$5,760,000,000 in Bitcoin Bought by Whales in Just Six Weeks Amid Crypto Market Correction: Santiment

Deep-pocketed Bitcoin investors are snapping up billions of dollars worth of BTC, according to analytics firm Santiment.

Santiment says on the social media platform X that Bitcoin whales are showing continued accumulation after purchasing more than $5.76 billion worth of BTC amid a marketwide correction.

“Bitcoin’s whales, specifically wallets that hold between 100-1,000 BTC, have accumulated 94,700 more coins in the last six weeks. As price uncertainty has shaken many traders out of crypto, key stakeholders are loading up.”

Fellow analytics firm Glassnode is echoing Santiment’s stance that investors are accumulating Bitcoin in the midst of market uncertainty.

Glassnode says that one on-chain metric that tracks the balance size and accumulation behavior of market participants is flashing green for Bitcoin.

“The Accumulation Trend Score (ATS) indicates a market shift back to accumulation, with the ATS reaching its maximum value of 1.0, signaling significant accumulation over the past month.”

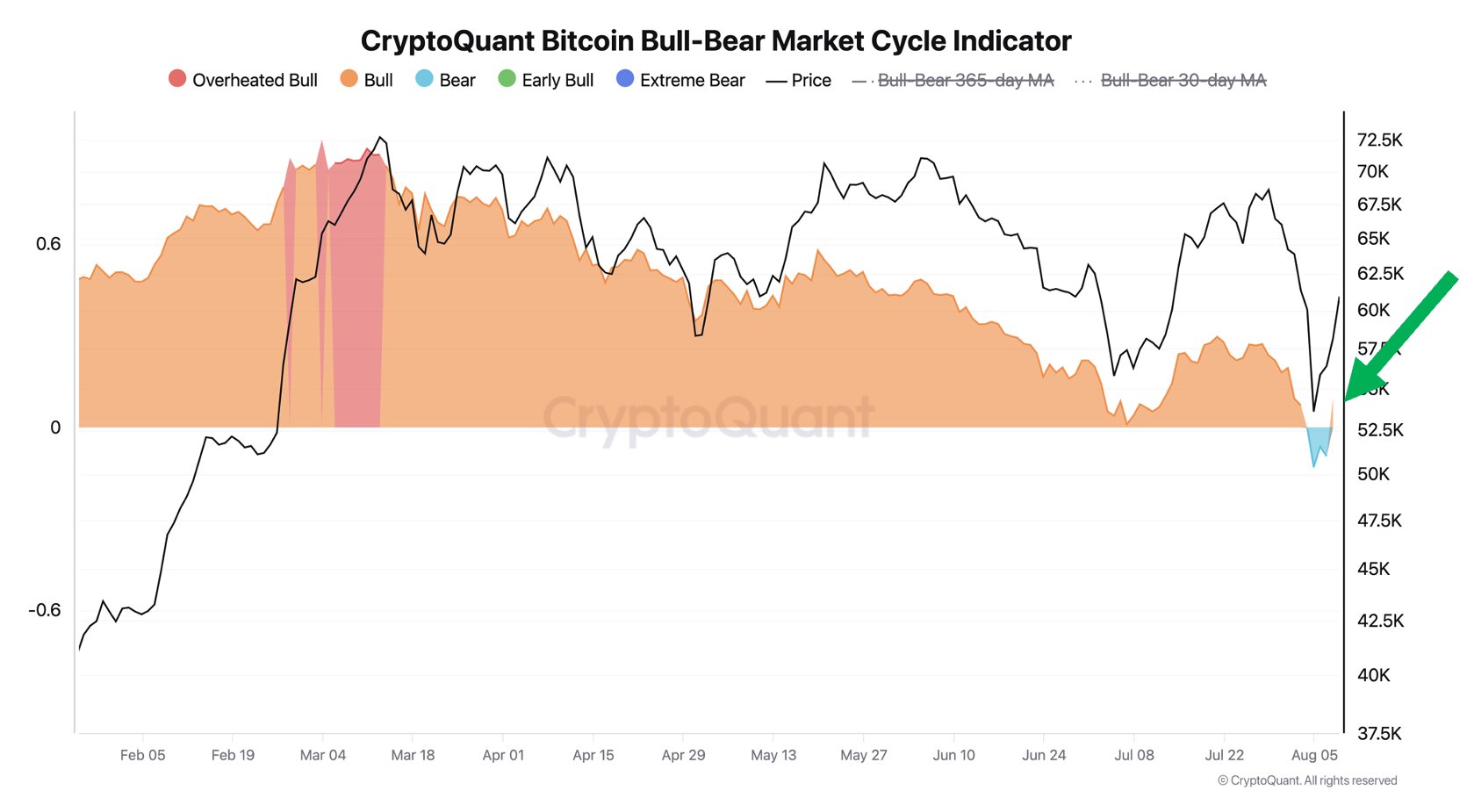

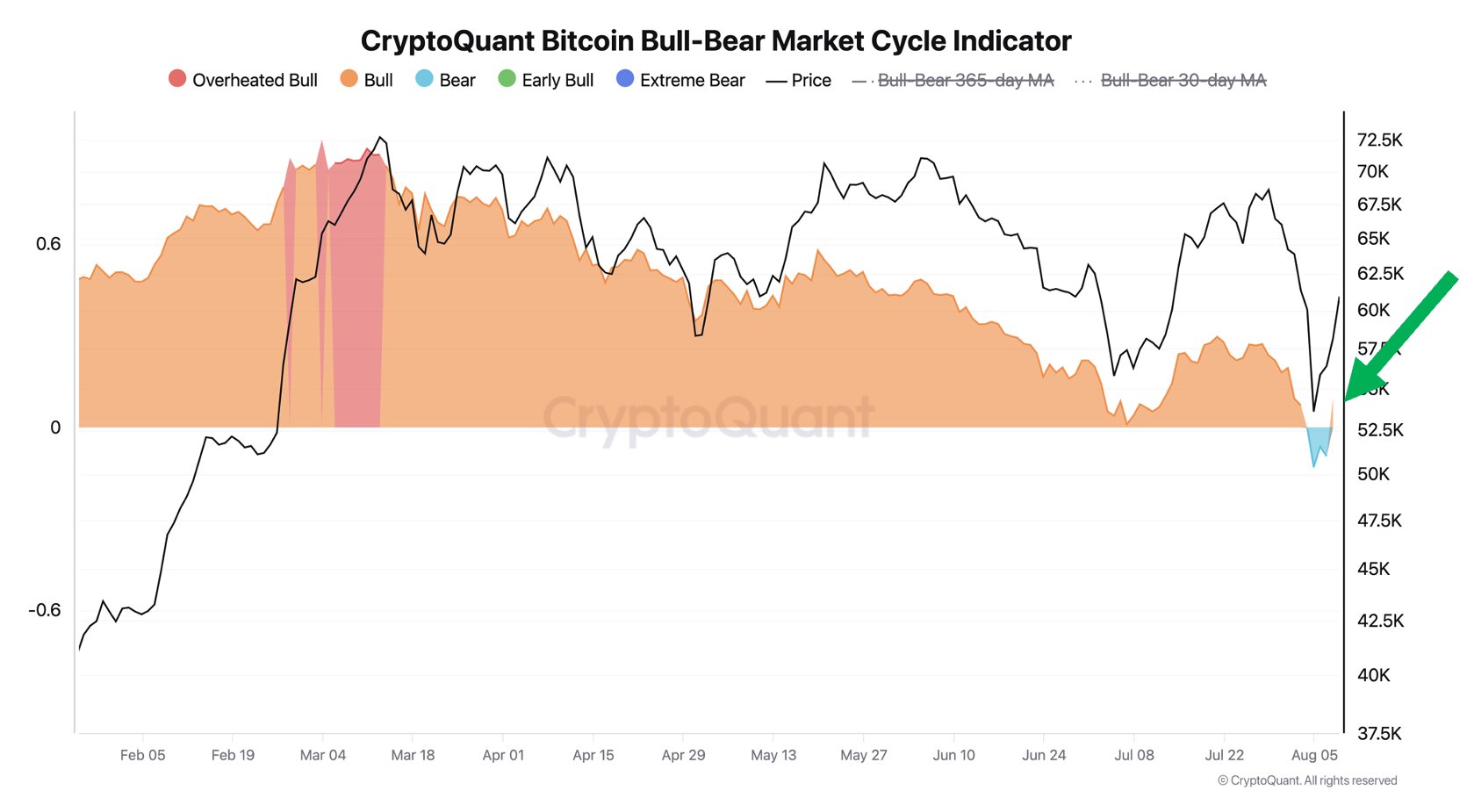

Earlier this month, the chief executive of analytics firm CryptoQuant said the Bitcoin bull-bear market cycle indicator, which tracks phases of investor sentiment, was back to bullish after briefly dipping into bear territory.

“Most Bitcoin on-chain cyclical indicators that were hovering near the borderline have now shifted back to signaling a bull market. BTC was discounted for only three days.”

At time of writing, Bitcoin is trading for $60,516, up over 4% on the day.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post $5,760,000,000 in Bitcoin Bought by Whales in Just Six Weeks Amid Crypto Market Correction: Santiment appeared first on The Daily Hodl.

$5,760,000,000 in Bitcoin Bought by Whales in Just Six Weeks Amid Crypto Market Correction: Santiment

Deep-pocketed Bitcoin investors are snapping up billions of dollars worth of BTC, according to analytics firm Santiment.

Santiment says on the social media platform X that Bitcoin whales are showing continued accumulation after purchasing more than $5.76 billion worth of BTC amid a marketwide correction.

“Bitcoin’s whales, specifically wallets that hold between 100-1,000 BTC, have accumulated 94,700 more coins in the last six weeks. As price uncertainty has shaken many traders out of crypto, key stakeholders are loading up.”

Fellow analytics firm Glassnode is echoing Santiment’s stance that investors are accumulating Bitcoin in the midst of market uncertainty.

Glassnode says that one on-chain metric that tracks the balance size and accumulation behavior of market participants is flashing green for Bitcoin.

“The Accumulation Trend Score (ATS) indicates a market shift back to accumulation, with the ATS reaching its maximum value of 1.0, signaling significant accumulation over the past month.”

Earlier this month, the chief executive of analytics firm CryptoQuant said the Bitcoin bull-bear market cycle indicator, which tracks phases of investor sentiment, was back to bullish after briefly dipping into bear territory.

“Most Bitcoin on-chain cyclical indicators that were hovering near the borderline have now shifted back to signaling a bull market. BTC was discounted for only three days.”

At time of writing, Bitcoin is trading for $60,516, up over 4% on the day.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post $5,760,000,000 in Bitcoin Bought by Whales in Just Six Weeks Amid Crypto Market Correction: Santiment appeared first on The Daily Hodl.