Weekly Web3, Blockchain, and Crypto Analysis

The post Weekly Web3, Blockchain, and Crypto Analysis appeared first on Coinpedia Fintech News

This analysis report, backed by quality data, covers the major developments the Web3, Blockchain and Crypto sector has experienced this week.

1. Breaking News This Week

- Paypal Expands International Transfers with PYUSD to USD Conversions

PayPal’s recent announcement allows users in the United States to engage in international money transfers using the PYUSD stablecoin. This expansion broadens the spectrum of global payment options available to US users, facilitating smoother transactions with friends and family overseas through currency conversion.

- Pyth Network Introduces New Price Feeds for W and USDB

Pyth Network, a notable price feed oracle and market data provider, has introduced fresh price feeds for two blockchain tokens: W and USDB. These newly integrated feeds are now accessible across approximately 50 blockchains that have integrated Pyth, enhancing the availability and accuracy of market data for users.

- Paradigm in Talks to Rise $750-$850 Million for New Crypto Fund

Paradigm, a prominent crypto venture capital firm co-founded by Fred Ehrsam and Matt Huang, is reportedly in discussion with investors to rise between $750 million and $850 million for a new crypto fund. This initiative aims to capitalise on increasing institutional interest in the crypto space following a lull in VC investing.

- Binance to Shut Down Bitcoin NFT Marketplace

Binance, a leading cryptocurrency exchange, has announced its decision to close its Bitcoin NFT marketplace, ceasing support for traders and deposits starting April 18. Users are required to withdraw their NFTs by May 18, marking the end of Binance’s brief venture into the realm of Bitcoin collectibles.

- Ripple Plans to Launch 1:1 USD-Pegged Stablecoin

Ripple, a prominent provider for enterprise blockchain and crypto solutions, has unveiled plans to introduce a stablecoin pegged 1:1 to the US dollar (USD). Backed by a reserve of US dollar deposits, short-term US government treasuries, and other cash equivalents, this stablecoin aims to provide stability and reliability in transactions.

- Coinbase Partners with Lightspark for Lightning Network Implementation

Coinbase, the largest crypto exchange in the United States, has selected Lightspark as its partner to spearhead the implementation of Bitcoin’s lightning network. Led by PayPal co-founder David Marcus, Lightspark’s expertise will aid in enhancing transaction scalability and efficiency within Coinbase’s platform.

- CrowdSwap Launches First Decentralised Crypto ETF

CrowdSwap has introduced the Bull Run dETF, marking the debut of the first decentralised crypto exchange-trading fund ever. Comprising ten digital assets, including Bitcoin and Ether, this innovative fund offers investors a diversified portfolio while maintaining decentralised and secure processes amidst a growing market for such products.

- US Authorities Possibly Selling More Bitcoin

Reports suggest that US authorities may be considering selling additional portions of the nation’s significant Bitcoin stash, potentially impacting the crypto market. With approximately 2000 BTC recently transferred from the government’s holdings to Coinbase, concerns arise regarding the implications of increased sell pressure on market dynamics.

- Argentina Requires Local Crypto Firms to Register with Regulatory Body

The Argentine government has mandated all local crypto firms to register with the newly established Registry of Virtual Asset Service Providers. Failure to comply could result in cessation of operations, aligning with recommendations from the Financial Action Task Force as Argentina aims to regulate its crypto sector more comprehensively.

- OFAC Tightens Grip on Russian Individuals and Entities in Virtual Assets

The Office of Foreign Assets Control has intensified enforcement efforts targeting individuals and entities operating within Russia’s financial services and technology sectors, particularly those involved in virtual assets. This crackdown aims to curb activities facilitating evasion of US sanctions, tightening regulatory oversight in this domain.

- Grayscale Unveils Grayscale Dynamic Income Fund

Grayscale, a leading institutional crypto asset management firm, has introduced its first actively managed investment product, the Grayscale Dynamic Income Fund (GDIF). This new fund focuses on optimising income through staking rewards associated with proof-of-stake crypto assets, offering investors exposure to innovative yield-generating strategies.

- Prisma Finance Hacker Claims “Whitehat Rescue” of Stolen Funds

The hacker responsible for the $11.6 million theft from Prisma Finance has asserted that the exploit was a ‘Whitehat Rescue’ attempt. Seeking guidance on how to return the funds, the hacker characterises their actions as an endeavour to identify and rectify security vulnerabilities in the DeFi protocol, emphasising ethical intent.

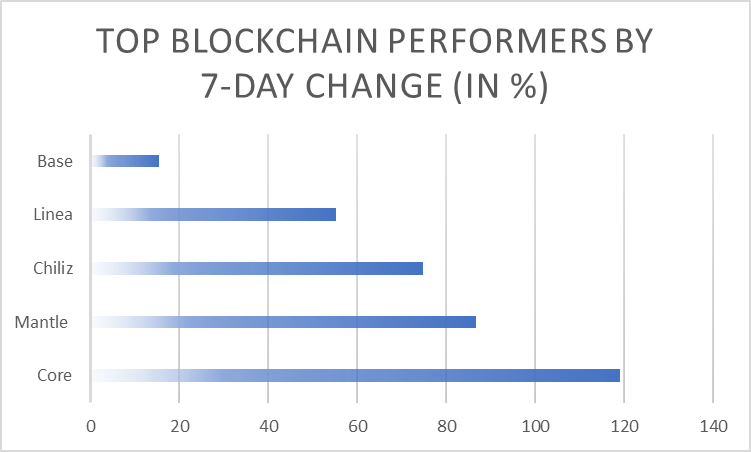

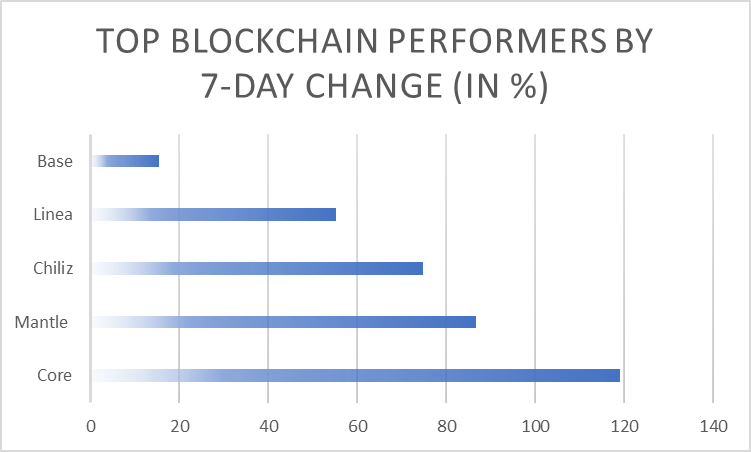

2. Blockchain Performance

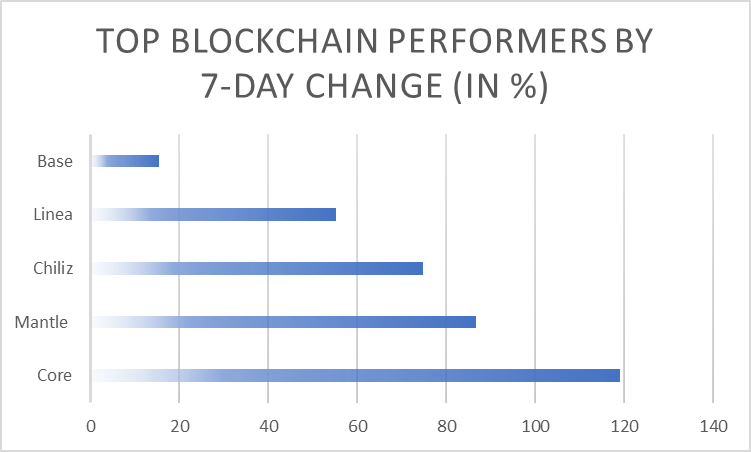

In this section, we will analyse two factors primarily: the top-performing blockchains based solely on their 7-day change and the top performers among the top five blockchains with the highest TVL.

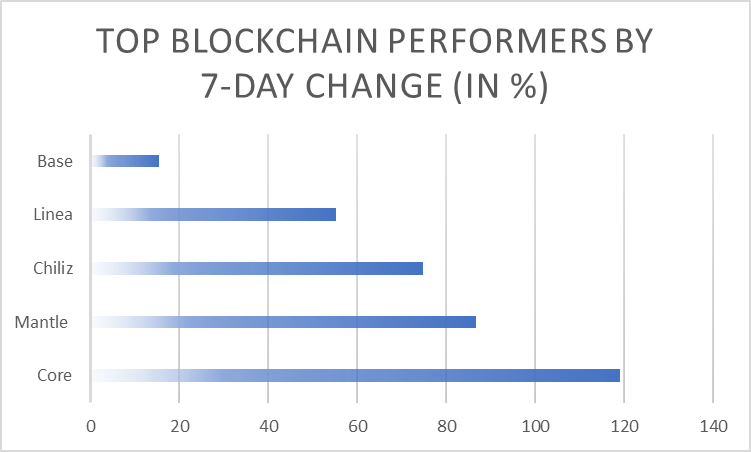

2.1. Top Blockchain Performers by 7-Day Change

This week’s top blockchain performers, based on their 7-day change, are Core, Mantle, Chiliz, Linea and Base.

| Blockchain | 7-Day Change (in %) | TVL |

| Core | +119.1% | $12,855,537 |

| Mantle | +86.7% | $509,090,713 |

| Chiliz | +74.7% | $157,104 |

| Linea | +55.1% | $148,219,099 |

| Base | +15.3% | $1,271,647,515 |

Among blockchains, this week, Core led with a remarkable 119.1% increase, followed closely by Mantle at 86.7% and Chiliz at 74.7%. Linea showed a substantial 55.1% rise, while Base recorded a modest 15.3% growth.

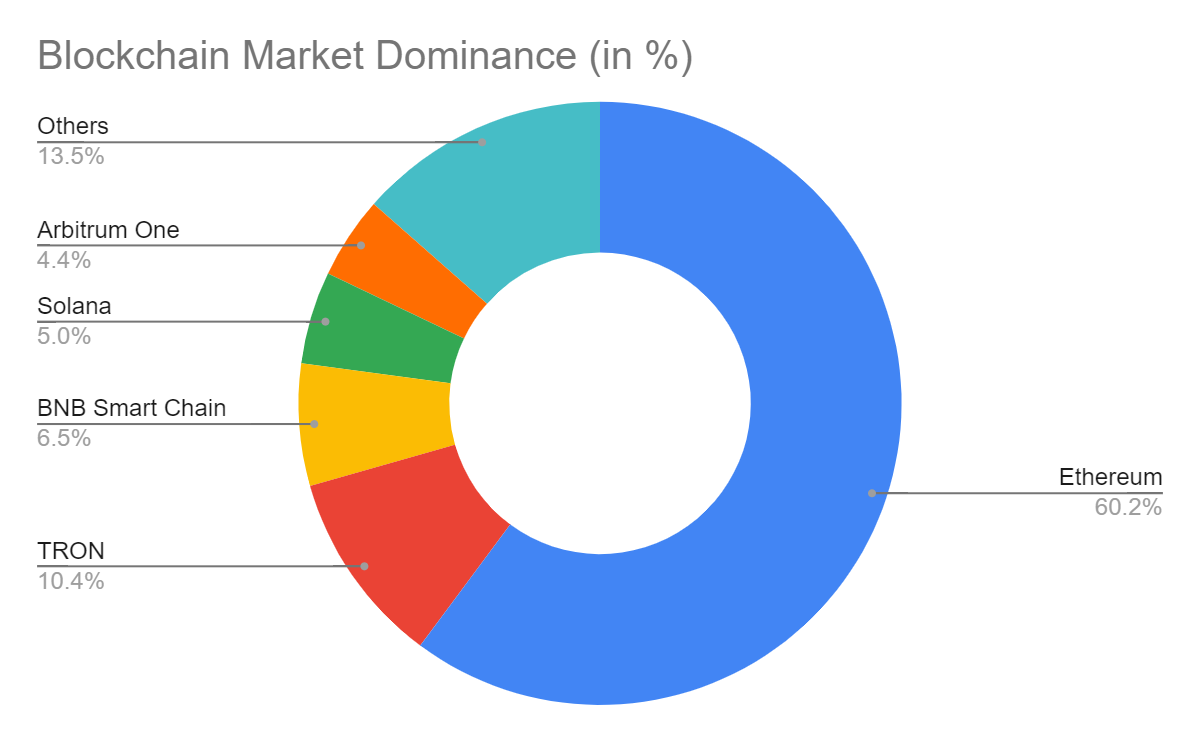

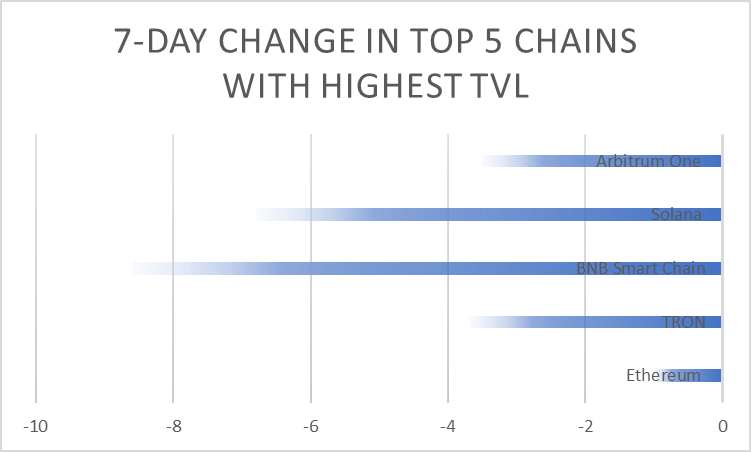

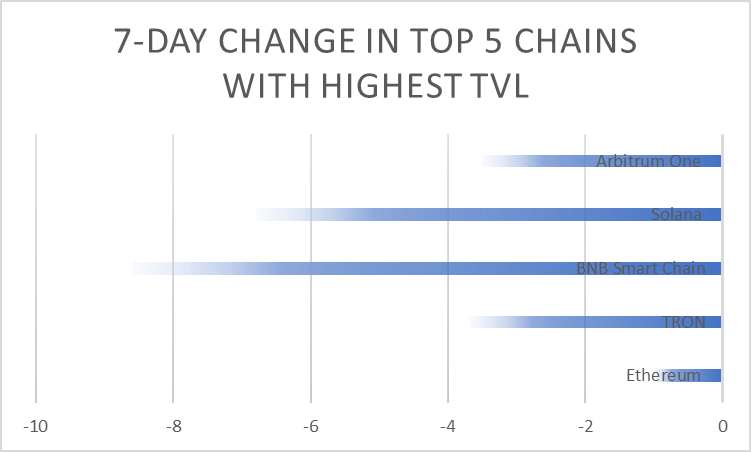

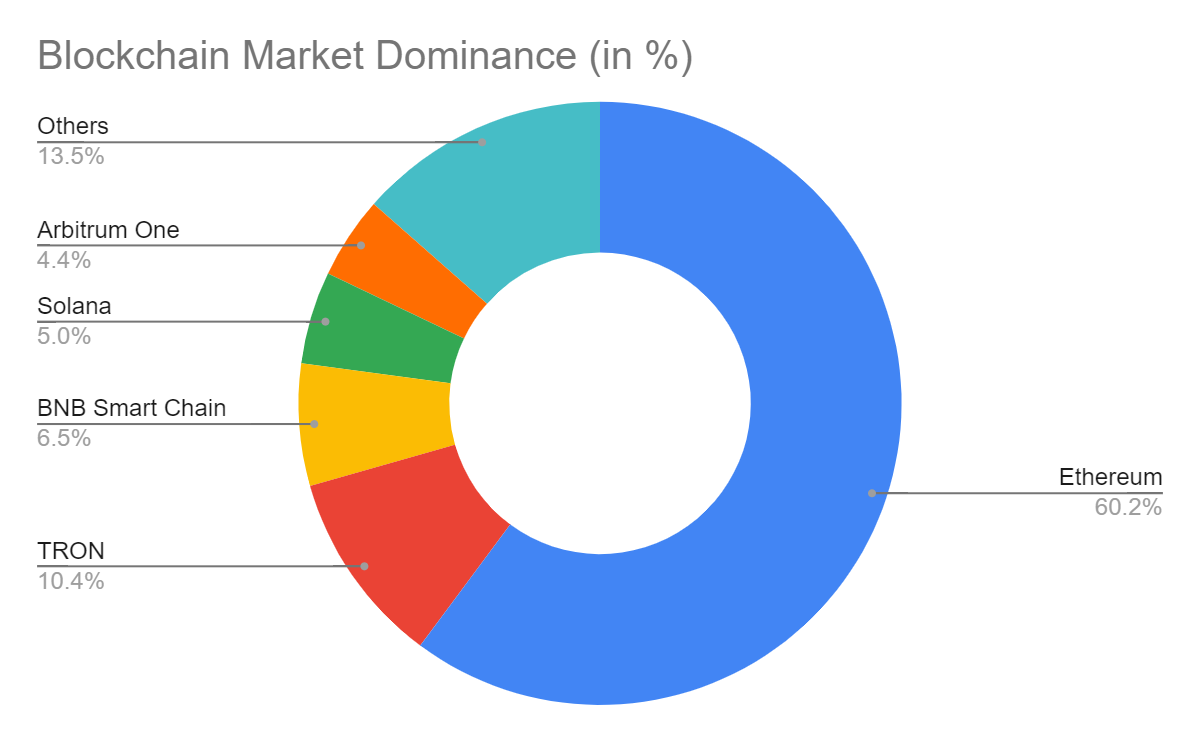

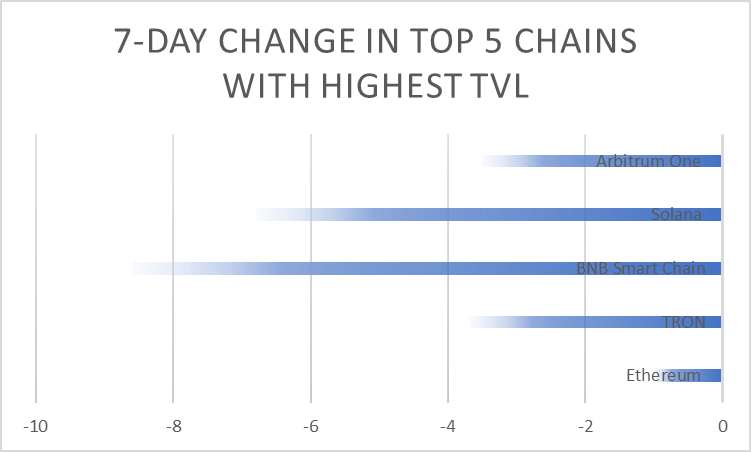

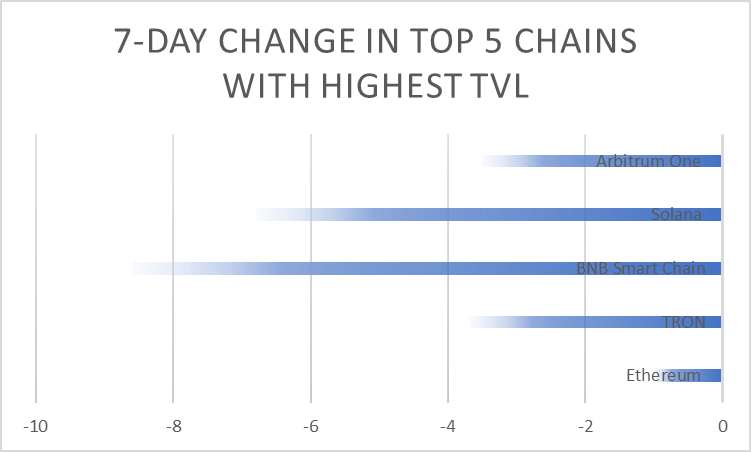

2.2. Top Performers: 7-Day Change in Top 5 Blockchains with Highest TVL

Ethereum, TRON, BNB Smart Chain, Solana, and Arbitrum One are the top five blockchains in the market on the basis of TVL and market dominance. Let’s see how the top five blockchains have performed this week, using 7-day TVL change.

| Blockchain | 7d Change (in %) | Dominance (in %) | TVL (in Billion) |

| Ethereum | -1.0% | 60.16% | $55,340,901,436 |

| TRON | -3.7% | 10.42% | $9,584,107,166 |

| BNB Smart Chain | -8.6% | 6.54% | $6,015,949,320 |

| Solana | -6.8% | 4.97% | $4,569,571,906 |

| Arbitrum One | -3.5% | 4.41% | $4,055,436,444 |

| Others | 13.5% |

This week, BNB Smart Chain experienced the most significant decline at -8.6%, followed by Solana at -6.8%, Tron at -3.7%, Arbitrum One at -3.5%, and Ethereum at -1.0%. All the top five blockchains saw negative trends, suggesting potential market volatility or shifts in sentiment.

3. Crypto Market Analysis

The crypto 7-day price change and dominance analysis and top gains and losers analysis are the two prime areas of the crypto market analysis.

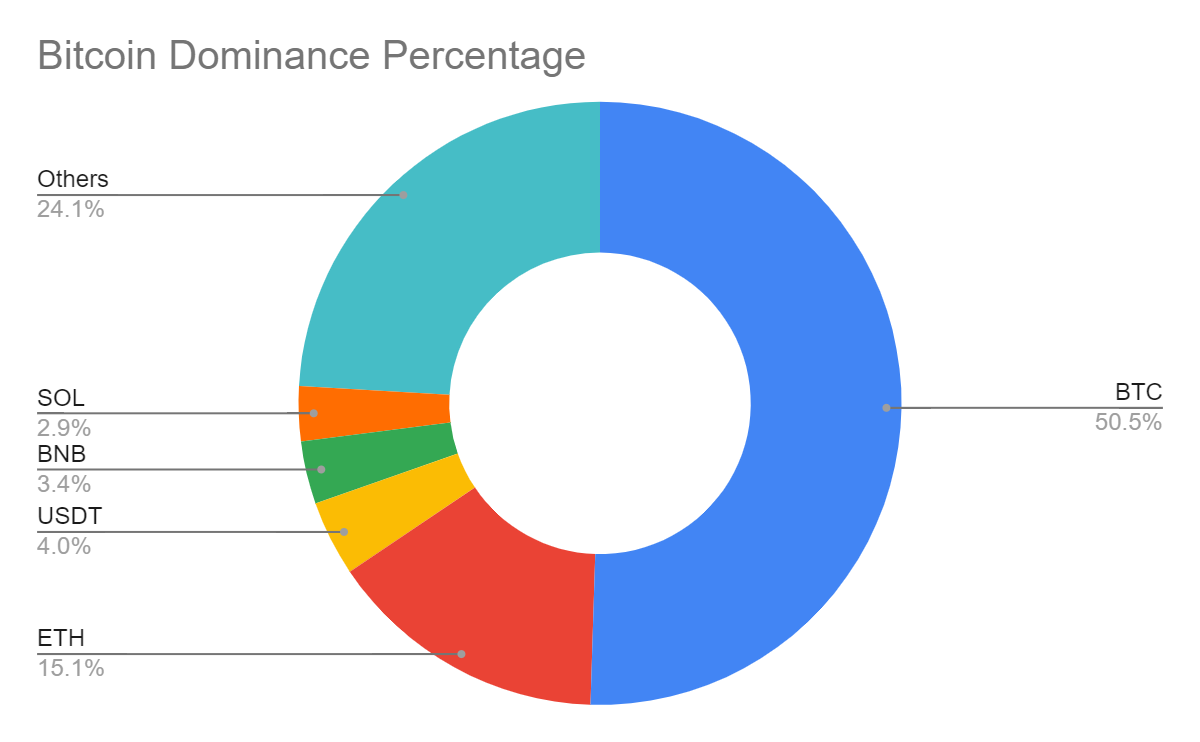

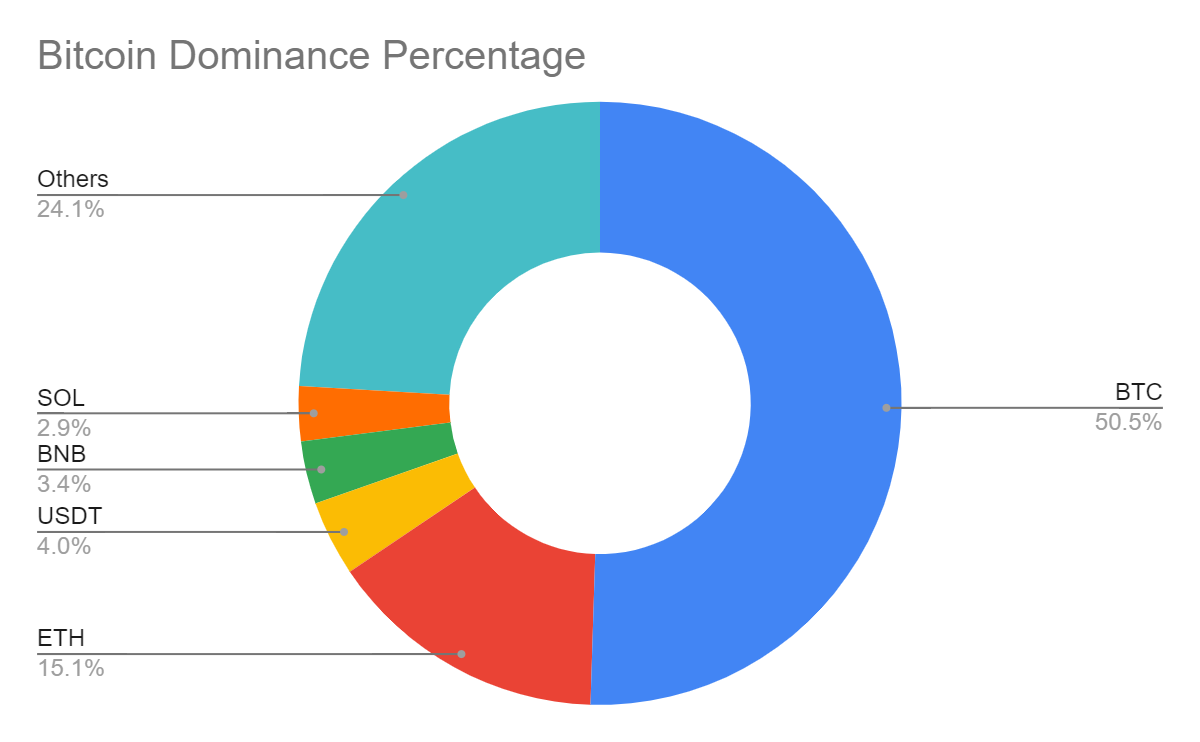

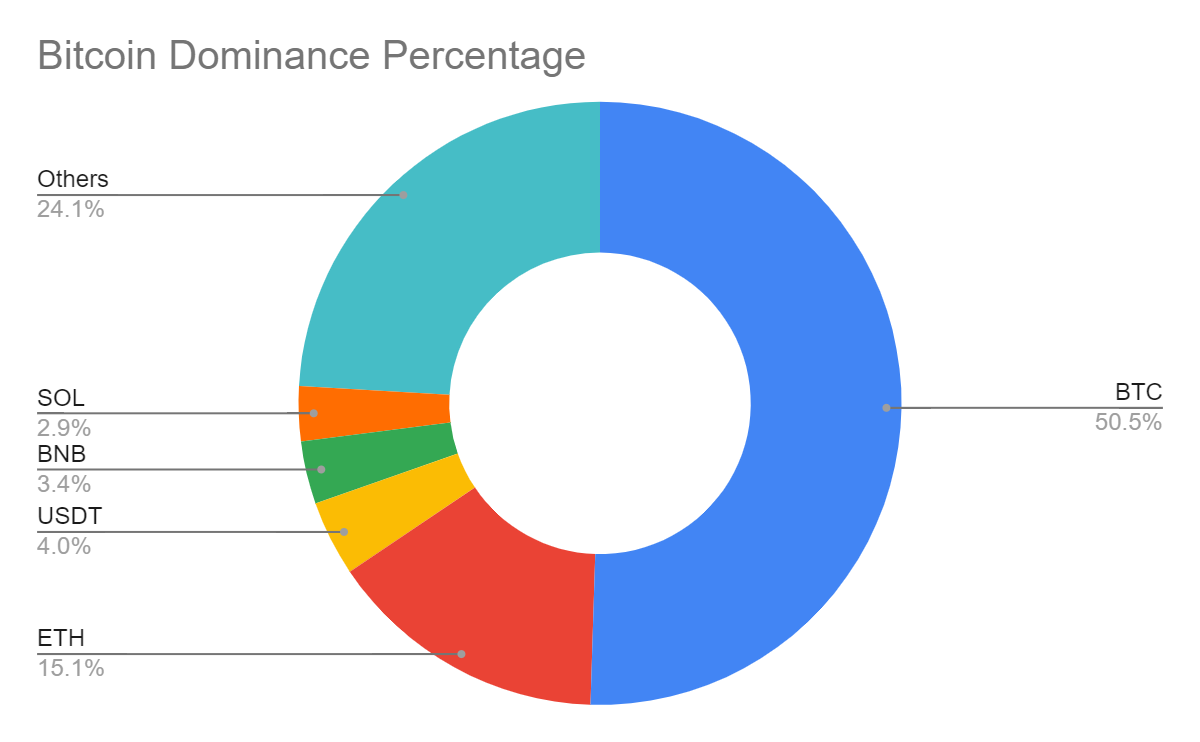

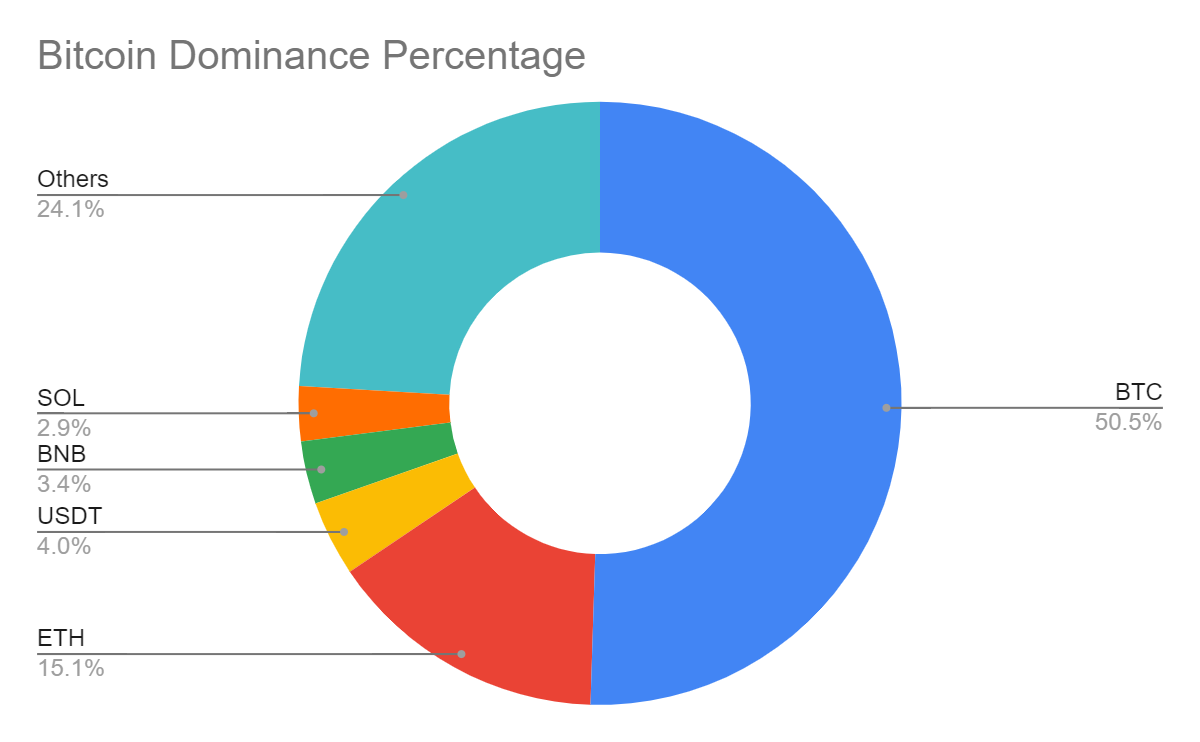

3.1. Crypto 7-D Price Change and Dominance Analysis

Bitcoin, Ethereum, Tether, BNB, and Solana are the top cryptocurrencies as per the market cap and dominance indices. Let’s analyse their seven-day price change.

| Cryptocurrency | Dominance Percentage | 7-D Change (in %) | Dominance Percentage | Price | Market Cap |

| BTC | 50.49% | -2.8% | 50.49% | $68,107.23 | $1,339,982,030,607 |

| ETH | 15.08% | -4.7% | 15.08% | $3,345.70 | $401,535,499,274 |

| USDT | 4.03% | +0.0% | 4.03% | $1.00 | $106,995,622,185 |

| BNB | 3.37% | -4.5% | 3.37% | $582.34 | $89,553,946,264 |

| SOL | 2.94% | -10.7% | 2.94% | $177.59 | $79,014,398,157 |

| Others | 24.08% |

Among the top cryptocurrencies, Solana exhibited the most significant decline with a -10.7% decrease, followed by Ethereum at -4.7%, and BNB at -4.5%. Bitcoin experienced a comparatively milder decline at -2.8%, while Tether remained stable with a +0.0% change.

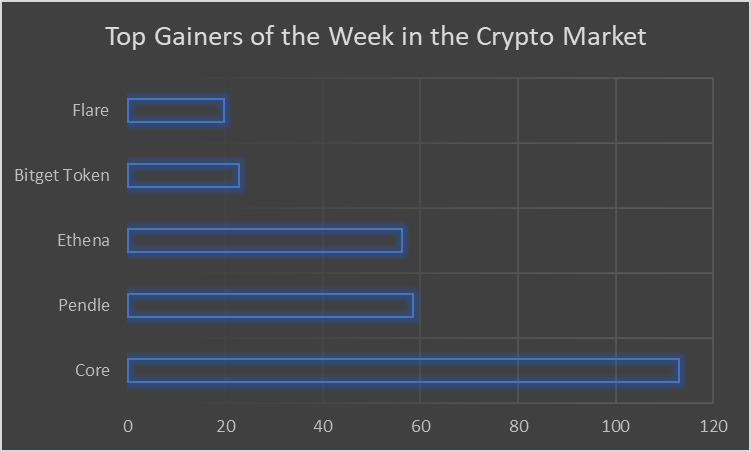

3.2. Top Gainers & Losers of the Week in Crypto Market

Here is the list of top gainers and top losers of the week in the cryptocurrency market. The analysis is made using the 7-day Gain and 7-day Lose indices.

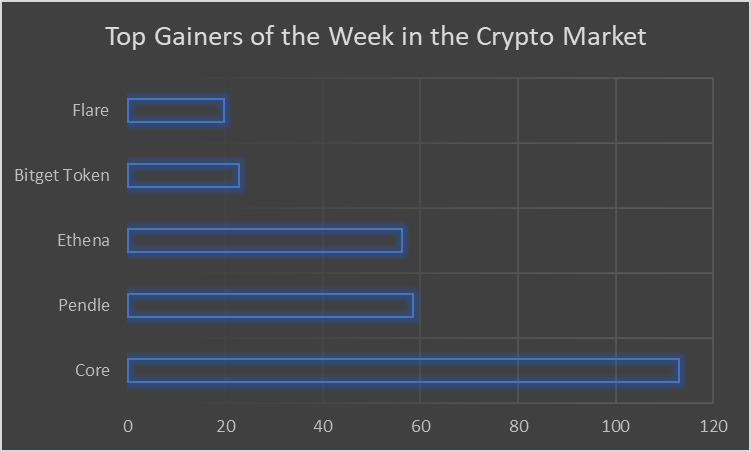

3.2.1. Top Gainers of the Week in Crypto

| Cryptocurrency | 7-Day Gain | Price |

| Core | +112.91% | $2.54 |

| Pendle | +58.57% | $7.07 |

| Ethena | +56.24% | $1.07 |

| Bitget Token | +22.78% | $1.29 |

| Flare | +19.77% | $0.04113 |

This week’s top cryptocurrency gainers include Core with a remarkable +112.91% increase, followed by Pendle at +58.87% and Ethena at +56.24%. Bitget Token and Flare also saw gains of +22.78% and +19.77% respectively.

3.2.2. Top Losers of the Week in Crypto

| Cryptocurrency | 7-Day Loss | Price |

| Wormhole | -28.11% | $0.9916 |

| dogwifhat | -26.27% | $3.34 |

| Conflux | -24.83% | $0.3616 |

| Axelar | -24.51% | $1.52 |

| Aptos | -22.16% | $13.25 |

This week’s top cryptocurrency losers include Wormhole with a significant loss of -28.11%, followed by dogwifhat at -26.27% and Conflux at -24.83%. Axelar and Aptos also experienced notable losses at -24.51% and -22.16% respectively.

3.3. Stablecoin Weekly Analysis

Tether, USDC, DAI, First Digital USD, and Ethena USDe are the top stablecoins in the market in terms of market capitalization. Let’s analyse their weekly performance using seven-day market capitalisation, market dominance and trading volume indices.

| Stablecoins | Market Dominance (7d) [in %] | Market Capitalisation (7d) | Trading Volume (7d) | Market Capitalisation |

| Tether | 70.36% | $106,688,966,459 | $49,954,604,763 | $106,887,238,660 |

| USDC | 21.74% | $32,959,702,182 | $14,453,026,413 | $32,947,808,359 |

| Dai | 3.33% | $5,056,208,757 | $783,578,952 | $5,058,072,602 |

| First Digital USD | 2.33% | $3,540,106,965 | $8,321,897,124 | $3,528,928,752 |

| Ethena USDe | 1.33% | $2,012,845,407 | $93,776,623 | $2,023,963,080 |

| Others | 0.91% |

Tether dominates the stablecoin market with 70.36% market dominance, followed by USDC at 21.74%. Dai holds 3.33%, while First Digital USD and Ethena USDe have 2.33% and 1.33% respectively. Tether’s significant lead reflects its widespread use and stability, while USDC’s strong position indicates growing adoption.

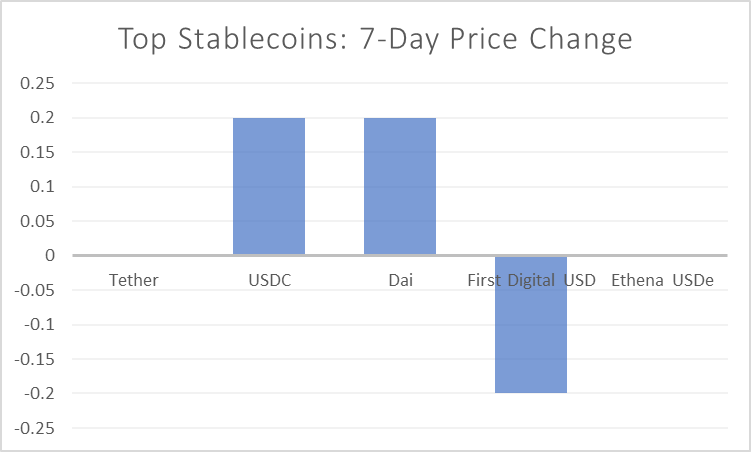

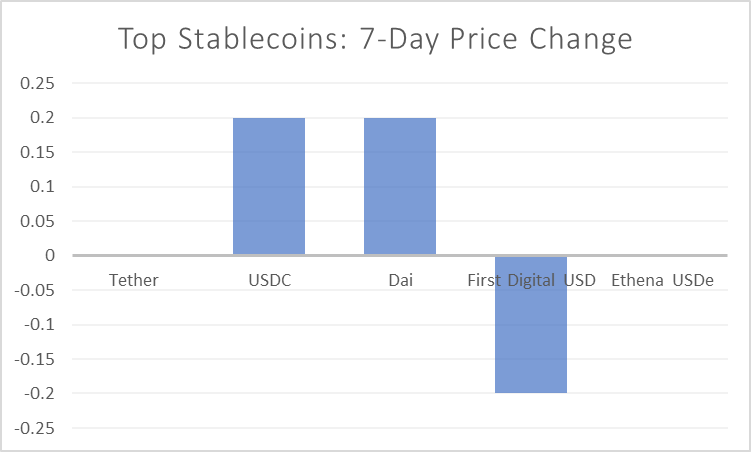

3.3.1. Stablecoin Weekly Price Analysis

Let’s analyse the weekly performance of the top stablecoins further using the seven-day price change index.

| Stablecoins | 7-Day Price Change (in %) | Price |

| Tether | +0.0% | $1.00 |

| USDC | +0.2% | $1.00 |

| Dai | +0.2% | $1.00 |

| First Digital USD | -0.2% | $1.00 |

| Ethena USDe | -0.0% | $1.00 |

Among the top stablecoins, Tether and Ethena USDe remained stable with no change, while USDC and Dai experienced a slight increase of +0.2%. Conversely, First Digital USD saw a minor decrease of -0.2%.

4. Bitcoin ETF Weekly Analysis

Bitcoin Futures ETFs and Bitcoin Spot ETFs should be analysed separately, in order to get the right picture of the Bitcoin ETF market, as they represent two different segments. Let’s start!

4.1. Bitcoin Futures ETF Weekly Analysis

ProShares (BITO), VanEck (XBTF), Valkyrie (BTF), Global X (BITS), and Ark/21 Shares (ARKA) are the top Bitcoin Future ETFs, as per the Asset Under Management index. Let’s use the price change percentage index to analyse these ETFs.

| Bitcoin Futures ETFs | Price Change (Gain/Loss) [in %] | Asset Under Management (in Billion) | Price |

| ProShares (BITO) | -1.73% | $598.78M | $29.51 |

| VanEck (XBTF) | +0.33% | $42.41M | $39.22 |

| Valkyrie (BTF) | -1.54% | $38.20M | $19.82 |

| Global X (BITS) | -1.54% | $26.10M | $66.29 |

| Ark/21 Shares (ARKA) | -1.64% | $8.01M | $64.88 |

ProShares (BITO) experienced the largest decline among top Bitcoin Futures ETFs at -1.73%, followed by Ark/21 Shares at -1.64%. Valkyrie (BTF) and Global X (BITS), both, saw a -1.54% decrease. Conversely, VanEck (XBTF) showed a modest gain of +0.33%.

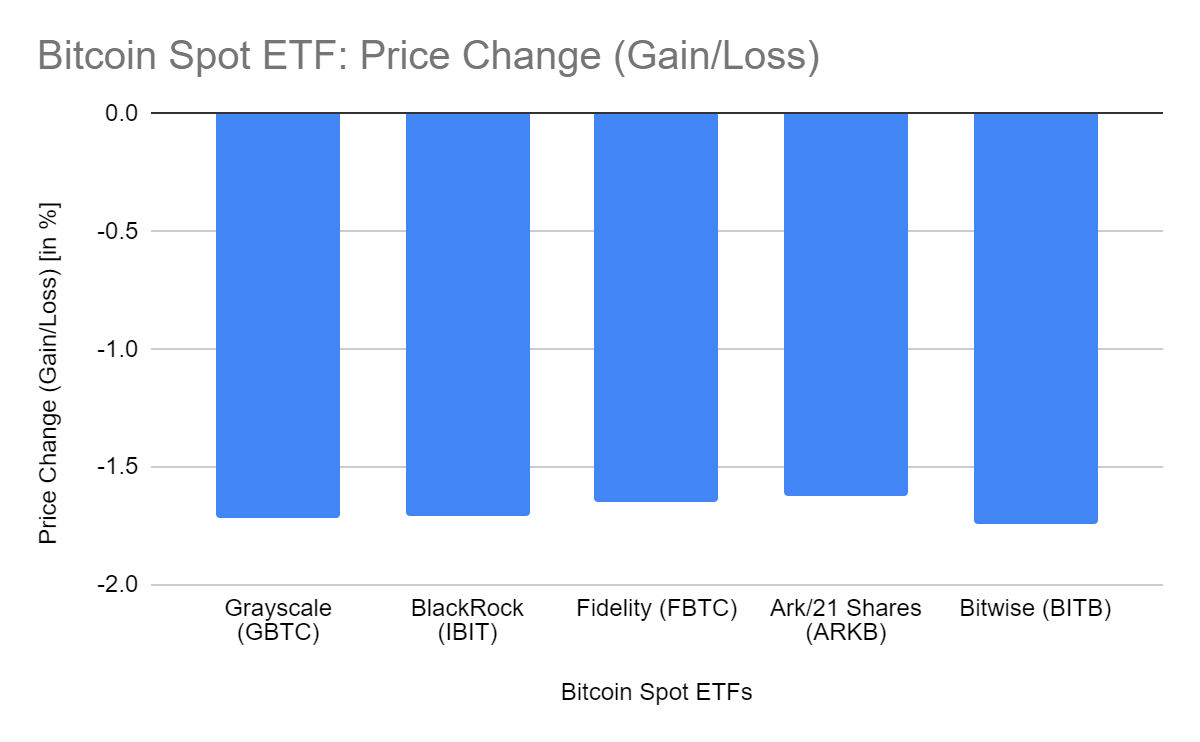

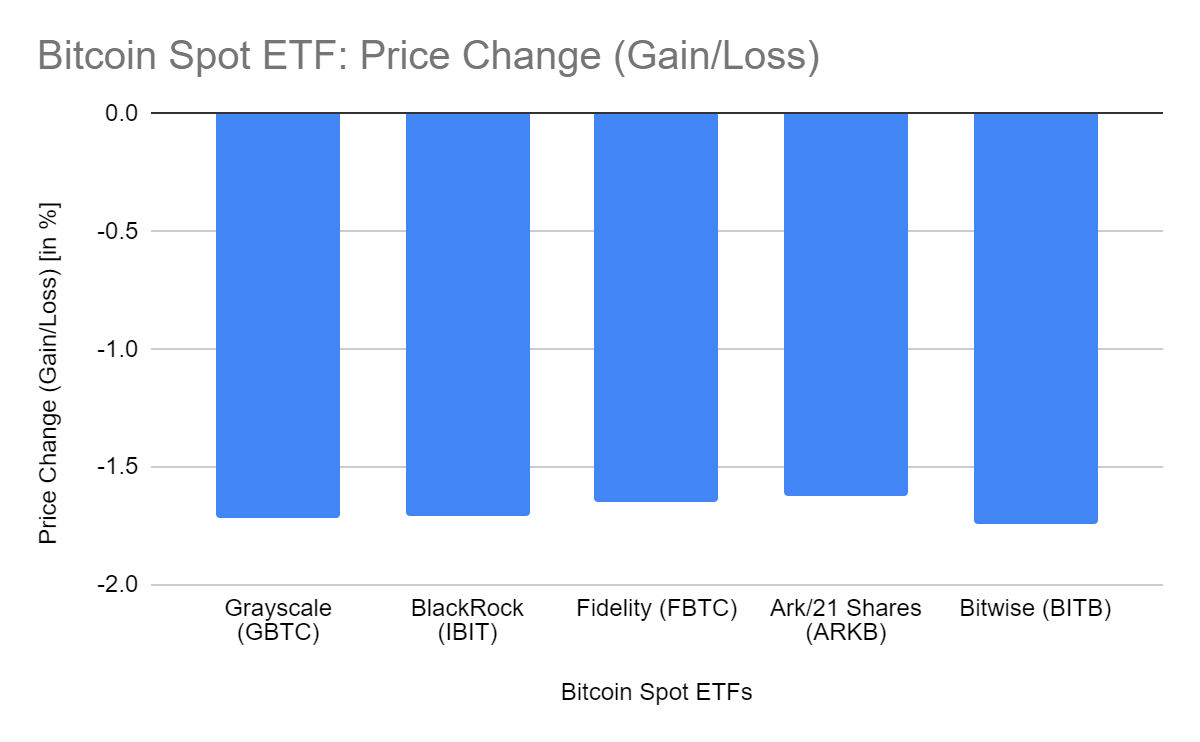

4.2. Bitcoin Spot ETF Weekly Analysis

Grayscale (GBTC), Blackrock (IBIT), Fidelity (FBTC), Ark/21 Shares (ARKB), and Bitwise (BITB) are the top Bitcoin Spot ETFs, as per the Asset Under Management index. Let’s analyse them using the price change index.

| Bitcoin Spot ETFs | Price Change (Gain/Loss) [in %] | Asset Under Management (in Billion) | Price |

| Grayscale (GBTC) | -1.72 | $24.33B | $59.99 |

| BlackRock (IBIT) | -1.71 | $17.24B | $38.41 |

| Fidelity (FBTC) | -1.65 | $9.90B | $58.94 |

| Ark/21 Shares (ARKB) | -1.62 | $2.85B | $67.43 |

| Bitwise (BITB) | -1.74 | $2.16B | $36.73 |

Among the top Bitcoin Spot ETFs, Bitwise (BITB) faced the largest decrease at -1.74%, followed closely by Grayscale (GBTC) and BlackRock (IBIT) at -1.72% and -1.71% respectively. Fidelity (FBTC) and Ark/21 Shares (ARKB) also experienced declines at -1.65% and -1.62%.

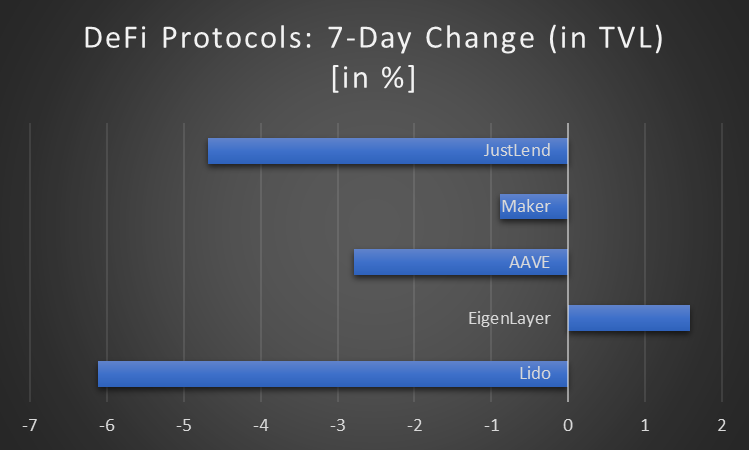

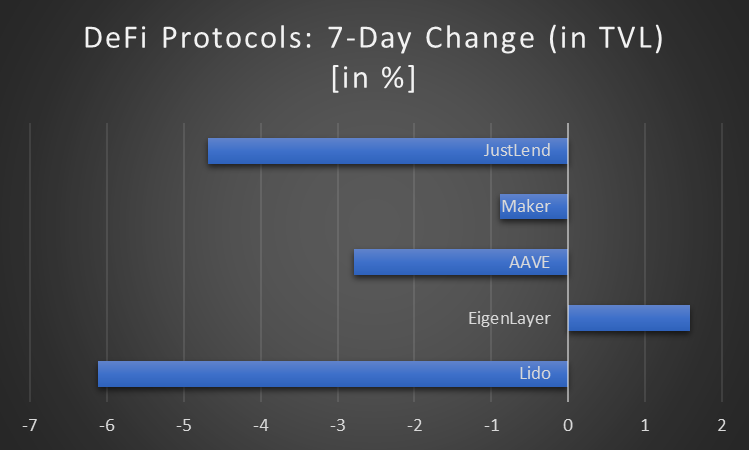

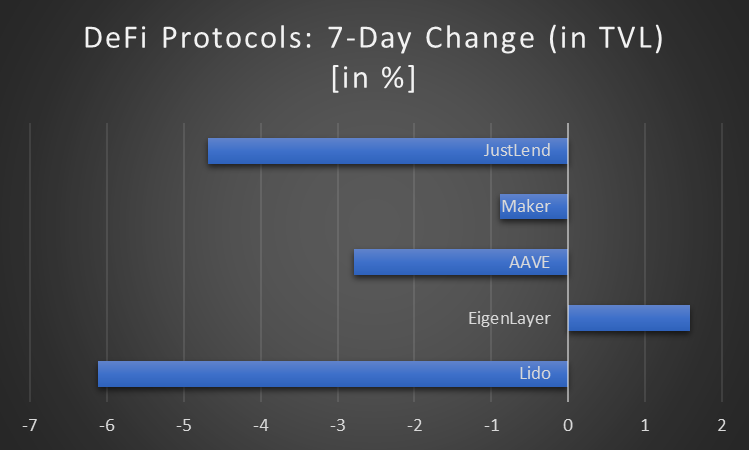

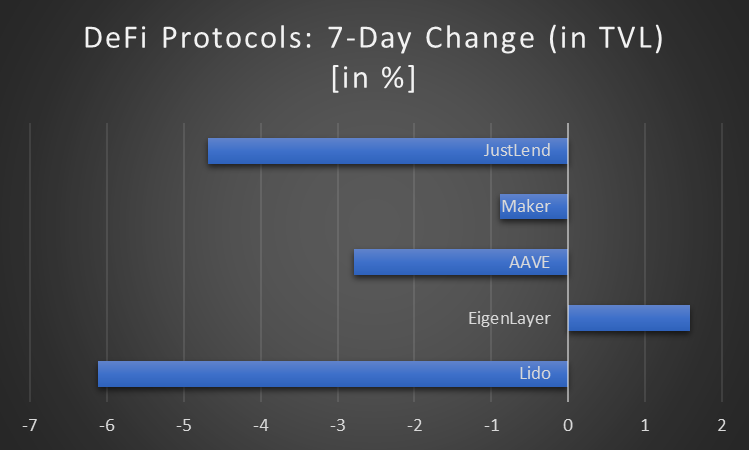

5. DeFi Market Weekly Status Analysis

Lido, EigenLayer, AAVE, Maker, JustLend are the five top DeFi protocols on the basis of TVL. Let’s analyse its weekly performance using the 7d Change index.

| DeFi Protocols | 7d Change (in Total Value Locked) [in %] | TVL |

| Lido | -6.11% | $32.054B |

| EigenLayer | +1.58% | $12.225B |

| AAVE | -2.79% | $10.911B |

| Maker | -0.88% | $8.534B |

| JustLend | -4.69% | $7.348B |

Among the top DeFi protocols, only EigenLayer exhibited an increase. It experienced an increase of +1.58%. Meanwhile, Lido saw a notable decline of -6.11%. JustLend and AAVE also experienced losses at -4.69% and -2.79% respectively. Notably, Maker also showed a decrease, but only a marginal loss of -0.88%.

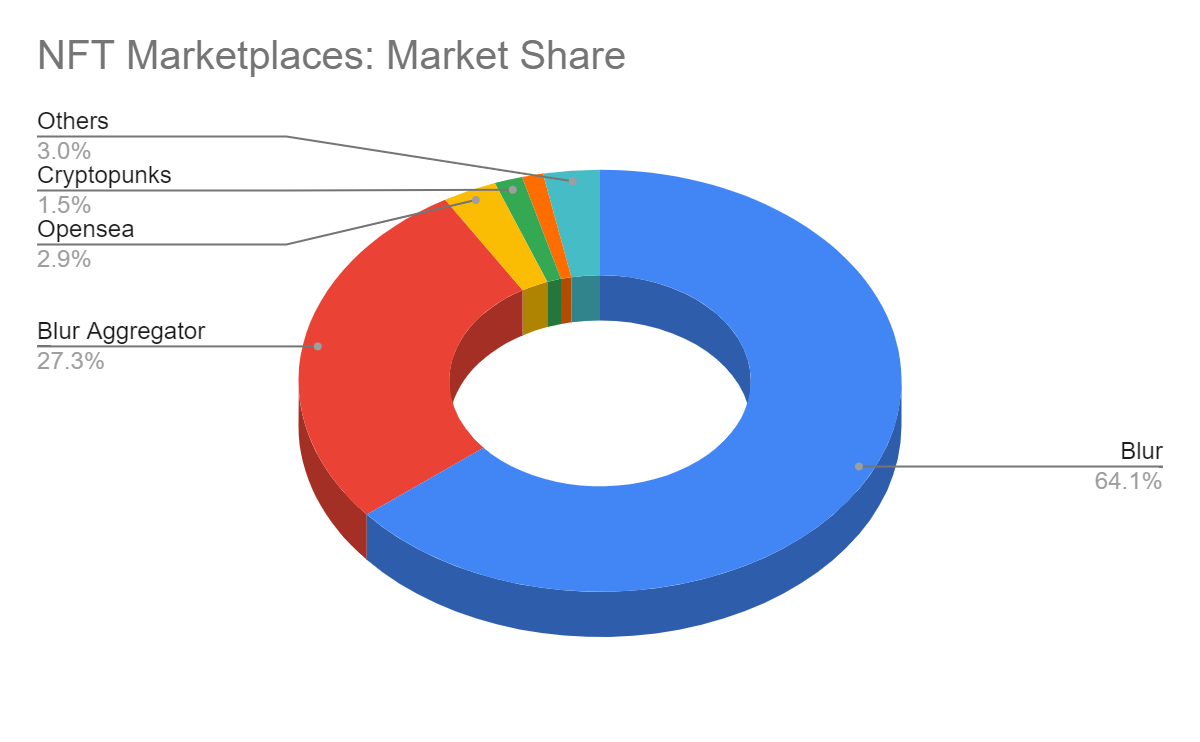

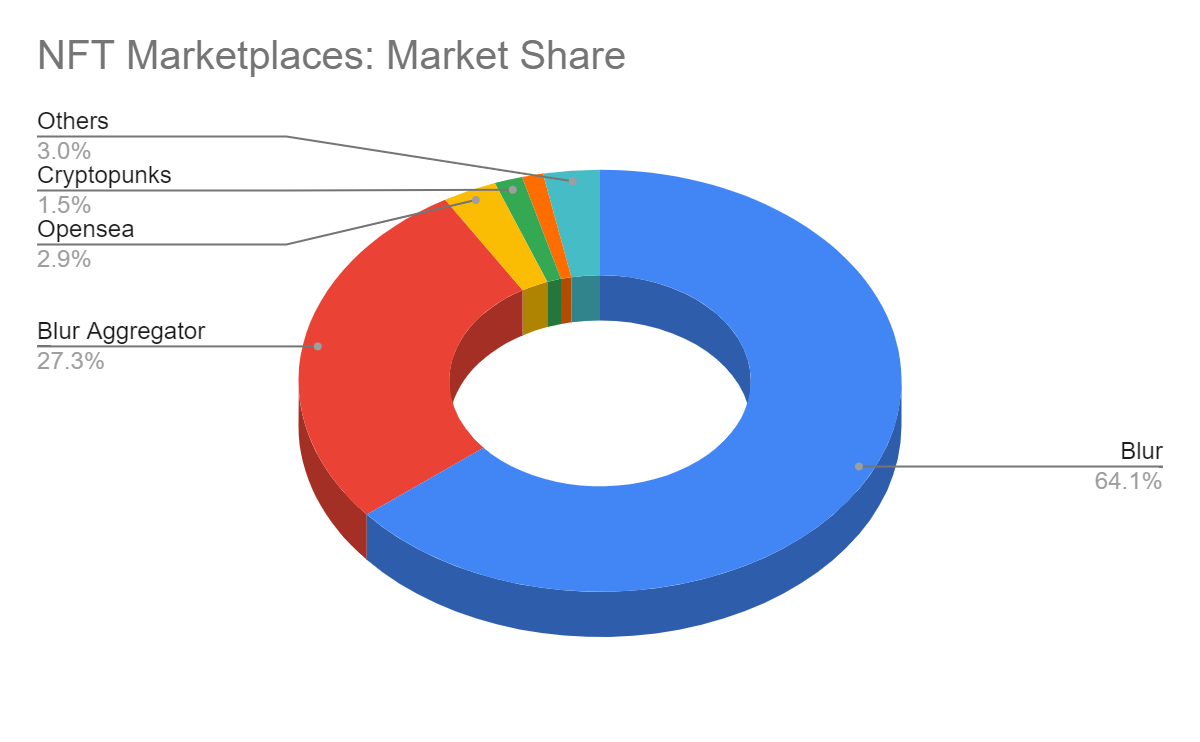

6. NFT Marketplace: A Basic Weekly Analysis

Blur, Blur Aggregator, Opensea, Cryptopunks, and X2Y2 are the top NFT marketplaces on the basis of market share. Let’s analyse them using the Volume Change (change of last 7d volume over the previous 7d volume) index.

| NFT Marketplaces | Market Share | Volume Change [Last 7 Day over the Previous 7 Day Volume] | 7-day Rolling Volume | 7-day Rolling Trades |

| Blur | 64.07% | -15.48% | 15003.54 | 23036 |

| Blur Aggregator | 27.34% | +1.44% | 7505.91 | 11717 |

| Opensea | 2.91% | -78.22% | 820.72 | 5718 |

| Cryptopunks | 1.51% | +11.89% | 771.05 | 16 |

| X2Y2 | 1.13% | +9.96% | 414.87 | 350 |

| Others | 3.04% |

Among the top NFT marketplaces, Cryptopunks and X2Y2 saw volume increase of +11.89% and +9.96% respectively, indicating heightened trading activity. Blur Aggregator showed a modest increase at +1.44%. However, Opensea experienced a significant decline of -78.22%, while Blur saw a comparatively modest decrease of -15.48%.

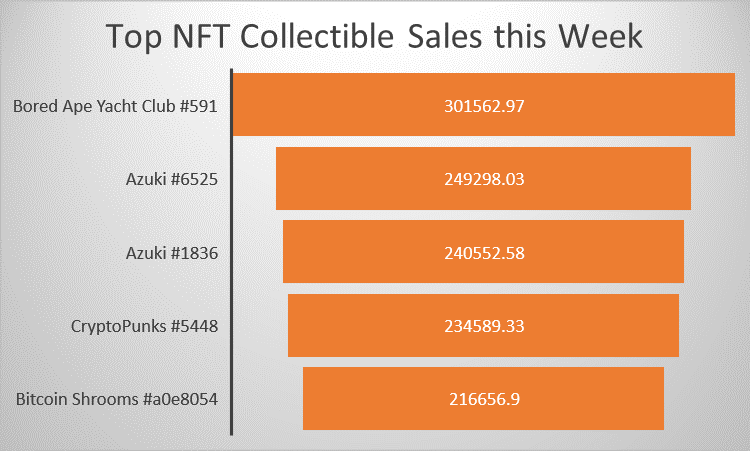

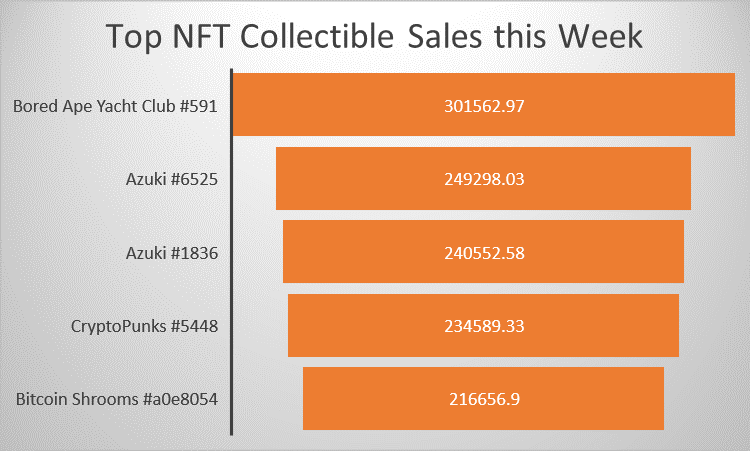

6.1. Top NFT Collectible Sales this Week

Bored Ape Yacht Club #591, Azuki #6525, Azuki #1836, CryptoPunks #5448, and Bitcoin Shrooms #a0e8054 are the top NFT collectable sales reported this week in the NFT market landscape.

| NFT Collectibles | Price (in USD) |

| Bored Ape Yacht Club #591 | $301,562.97 |

| Azuki #6525 | $249,298.03 |

| Azuki #1836 | $240,552.58 |

| CryptoPunks #5448 | $234,589.33 |

| Bitcoin Shrooms #a0e8054 | $216,656.90 |

This week’s top NFT collectibles sales showcase Bored Ape Yacht Club #591 leading at $301,562.97, followed by Azuki #6525 at $249,298.03 and Azuki #1836 at $240,552.58. CryptoPunks #5448 sold for $234,589.33, while Bitcoin Shrooms #a0e8054 fetched $216,656.90.

7. Web3 Weekly Funding Analysis

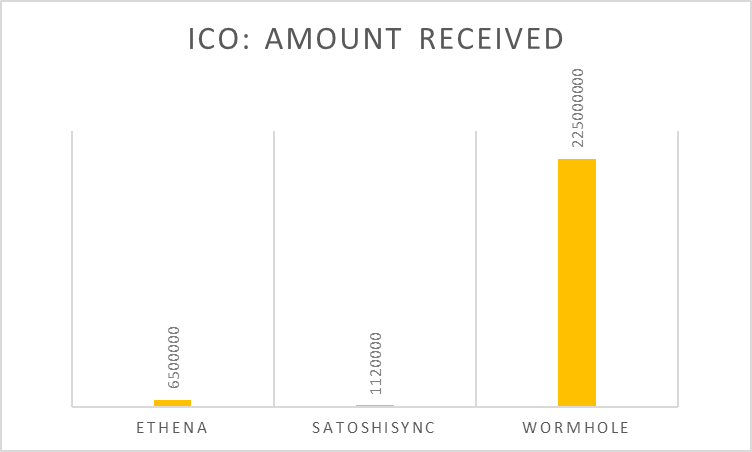

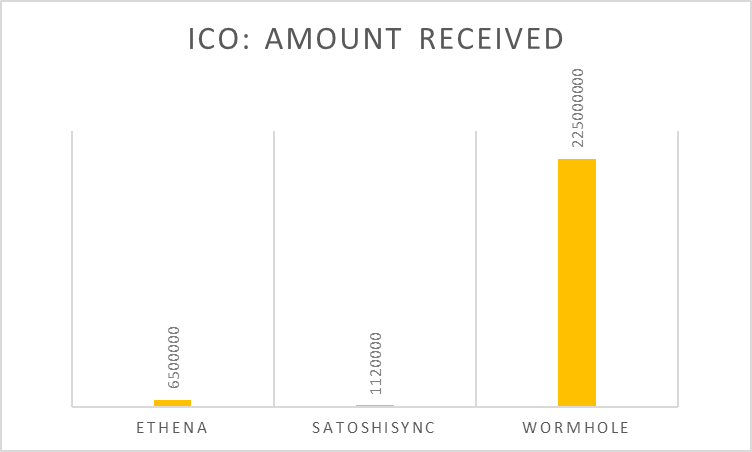

7.1. ICO Landscape: A Weekly Overview

Versus-X, Sensay, Ethena, BonusBlock, SatoshiSync, and Wormhole are the major ICOs that ended this week. Let’s analyse how much amount they have received.

| ICO | Received | Token Price | Fundraising Goal | Total Tokens | Token (Available for Sale) |

| Versus-X | N/A | $0.165 | $750,000 | 100,000,000 | N/A |

| Sensay | N/A | $0.001 | $800,000 | 10,000,000,000 | 20% |

| Ethena | $6,500,000 | N/A | 300,000,000 Tokens | 15,000,000,000 | N/A |

| BonusBlock | N/A | $0.25 | $100,000 | 100,000,000 | 15.8% |

| SatoshiSync | $1,120,000 | $0.013 | $300,000 | 1,000,000,000 | 13.5% |

| Wormhole | $225,000,000 | N/A | N/A | 10,000,000,000 | N/A |

Wormhole received the highest amount at $225,000,000, indicating significant investor interest and project potential. Ethena secured $6,500,000, reflecting a medium-scale project, while SatoshiSync received $1,120,000, suggesting a smaller-scale project.

8. Weekly Blockchain Hack Analysis

As of April 6, 2024, hackers have stolen a significant $7.77 billion. The majority, approximately $5.85 billion, targeted decentralised finance platforms. Another portion, roughly $2.83 billion, was taken from bridges connecting different blockchain networks.

Fortunately, no major hacks have been reported this month. However, late last month, the Web 3, Blockchain and Crypto ecosystem experienced three significant breaches. On March 29, 2024, Lava lost approximately $0.34 million to hackers. On the preceding day, March 26, 2024, Prisma Finance fell victim to hackers, losing $11.6 million. Also on March 26, 2024, Munchables was hacked using a storage slot exploit, resulting in a staggering $62.5 million loss, the largest reported this year.

Fortunately, the hackers returned the stolen Ether from the Munchables exploit. Additionally, the hackers behind the Prisma Finance theft claimed it was a ‘Whitehat Rescue’ effort. And, they sought guidance on returning the funds, describing their actions as aimed at identifying and fixing DeFi protocol security flaws, emphasising ethical intent.

Endnote

In this week’s comprehensive analysis of Web3, Blockchain and Crypto, we have brought out powerful insights, which can be used to stay-to-data about the market developments. As the landscape evolves, the strategic integration of technology and data-driven decision-making becomes paramount for stakeholders navigating the dynamic realms of decentralised technologies.

Weekly Web3, Blockchain, and Crypto Analysis

The post Weekly Web3, Blockchain, and Crypto Analysis appeared first on Coinpedia Fintech News

This analysis report, backed by quality data, covers the major developments the Web3, Blockchain and Crypto sector has experienced this week.

1. Breaking News This Week

- Paypal Expands International Transfers with PYUSD to USD Conversions

PayPal’s recent announcement allows users in the United States to engage in international money transfers using the PYUSD stablecoin. This expansion broadens the spectrum of global payment options available to US users, facilitating smoother transactions with friends and family overseas through currency conversion.

- Pyth Network Introduces New Price Feeds for W and USDB

Pyth Network, a notable price feed oracle and market data provider, has introduced fresh price feeds for two blockchain tokens: W and USDB. These newly integrated feeds are now accessible across approximately 50 blockchains that have integrated Pyth, enhancing the availability and accuracy of market data for users.

- Paradigm in Talks to Rise $750-$850 Million for New Crypto Fund

Paradigm, a prominent crypto venture capital firm co-founded by Fred Ehrsam and Matt Huang, is reportedly in discussion with investors to rise between $750 million and $850 million for a new crypto fund. This initiative aims to capitalise on increasing institutional interest in the crypto space following a lull in VC investing.

- Binance to Shut Down Bitcoin NFT Marketplace

Binance, a leading cryptocurrency exchange, has announced its decision to close its Bitcoin NFT marketplace, ceasing support for traders and deposits starting April 18. Users are required to withdraw their NFTs by May 18, marking the end of Binance’s brief venture into the realm of Bitcoin collectibles.

- Ripple Plans to Launch 1:1 USD-Pegged Stablecoin

Ripple, a prominent provider for enterprise blockchain and crypto solutions, has unveiled plans to introduce a stablecoin pegged 1:1 to the US dollar (USD). Backed by a reserve of US dollar deposits, short-term US government treasuries, and other cash equivalents, this stablecoin aims to provide stability and reliability in transactions.

- Coinbase Partners with Lightspark for Lightning Network Implementation

Coinbase, the largest crypto exchange in the United States, has selected Lightspark as its partner to spearhead the implementation of Bitcoin’s lightning network. Led by PayPal co-founder David Marcus, Lightspark’s expertise will aid in enhancing transaction scalability and efficiency within Coinbase’s platform.

- CrowdSwap Launches First Decentralised Crypto ETF

CrowdSwap has introduced the Bull Run dETF, marking the debut of the first decentralised crypto exchange-trading fund ever. Comprising ten digital assets, including Bitcoin and Ether, this innovative fund offers investors a diversified portfolio while maintaining decentralised and secure processes amidst a growing market for such products.

- US Authorities Possibly Selling More Bitcoin

Reports suggest that US authorities may be considering selling additional portions of the nation’s significant Bitcoin stash, potentially impacting the crypto market. With approximately 2000 BTC recently transferred from the government’s holdings to Coinbase, concerns arise regarding the implications of increased sell pressure on market dynamics.

- Argentina Requires Local Crypto Firms to Register with Regulatory Body

The Argentine government has mandated all local crypto firms to register with the newly established Registry of Virtual Asset Service Providers. Failure to comply could result in cessation of operations, aligning with recommendations from the Financial Action Task Force as Argentina aims to regulate its crypto sector more comprehensively.

- OFAC Tightens Grip on Russian Individuals and Entities in Virtual Assets

The Office of Foreign Assets Control has intensified enforcement efforts targeting individuals and entities operating within Russia’s financial services and technology sectors, particularly those involved in virtual assets. This crackdown aims to curb activities facilitating evasion of US sanctions, tightening regulatory oversight in this domain.

- Grayscale Unveils Grayscale Dynamic Income Fund

Grayscale, a leading institutional crypto asset management firm, has introduced its first actively managed investment product, the Grayscale Dynamic Income Fund (GDIF). This new fund focuses on optimising income through staking rewards associated with proof-of-stake crypto assets, offering investors exposure to innovative yield-generating strategies.

- Prisma Finance Hacker Claims “Whitehat Rescue” of Stolen Funds

The hacker responsible for the $11.6 million theft from Prisma Finance has asserted that the exploit was a ‘Whitehat Rescue’ attempt. Seeking guidance on how to return the funds, the hacker characterises their actions as an endeavour to identify and rectify security vulnerabilities in the DeFi protocol, emphasising ethical intent.

2. Blockchain Performance

In this section, we will analyse two factors primarily: the top-performing blockchains based solely on their 7-day change and the top performers among the top five blockchains with the highest TVL.

2.1. Top Blockchain Performers by 7-Day Change

This week’s top blockchain performers, based on their 7-day change, are Core, Mantle, Chiliz, Linea and Base.

| Blockchain | 7-Day Change (in %) | TVL |

| Core | +119.1% | $12,855,537 |

| Mantle | +86.7% | $509,090,713 |

| Chiliz | +74.7% | $157,104 |

| Linea | +55.1% | $148,219,099 |

| Base | +15.3% | $1,271,647,515 |

Among blockchains, this week, Core led with a remarkable 119.1% increase, followed closely by Mantle at 86.7% and Chiliz at 74.7%. Linea showed a substantial 55.1% rise, while Base recorded a modest 15.3% growth.

2.2. Top Performers: 7-Day Change in Top 5 Blockchains with Highest TVL

Ethereum, TRON, BNB Smart Chain, Solana, and Arbitrum One are the top five blockchains in the market on the basis of TVL and market dominance. Let’s see how the top five blockchains have performed this week, using 7-day TVL change.

| Blockchain | 7d Change (in %) | Dominance (in %) | TVL (in Billion) |

| Ethereum | -1.0% | 60.16% | $55,340,901,436 |

| TRON | -3.7% | 10.42% | $9,584,107,166 |

| BNB Smart Chain | -8.6% | 6.54% | $6,015,949,320 |

| Solana | -6.8% | 4.97% | $4,569,571,906 |

| Arbitrum One | -3.5% | 4.41% | $4,055,436,444 |

| Others | 13.5% |

This week, BNB Smart Chain experienced the most significant decline at -8.6%, followed by Solana at -6.8%, Tron at -3.7%, Arbitrum One at -3.5%, and Ethereum at -1.0%. All the top five blockchains saw negative trends, suggesting potential market volatility or shifts in sentiment.

3. Crypto Market Analysis

The crypto 7-day price change and dominance analysis and top gains and losers analysis are the two prime areas of the crypto market analysis.

3.1. Crypto 7-D Price Change and Dominance Analysis

Bitcoin, Ethereum, Tether, BNB, and Solana are the top cryptocurrencies as per the market cap and dominance indices. Let’s analyse their seven-day price change.

| Cryptocurrency | Dominance Percentage | 7-D Change (in %) | Dominance Percentage | Price | Market Cap |

| BTC | 50.49% | -2.8% | 50.49% | $68,107.23 | $1,339,982,030,607 |

| ETH | 15.08% | -4.7% | 15.08% | $3,345.70 | $401,535,499,274 |

| USDT | 4.03% | +0.0% | 4.03% | $1.00 | $106,995,622,185 |

| BNB | 3.37% | -4.5% | 3.37% | $582.34 | $89,553,946,264 |

| SOL | 2.94% | -10.7% | 2.94% | $177.59 | $79,014,398,157 |

| Others | 24.08% |

Among the top cryptocurrencies, Solana exhibited the most significant decline with a -10.7% decrease, followed by Ethereum at -4.7%, and BNB at -4.5%. Bitcoin experienced a comparatively milder decline at -2.8%, while Tether remained stable with a +0.0% change.

3.2. Top Gainers & Losers of the Week in Crypto Market

Here is the list of top gainers and top losers of the week in the cryptocurrency market. The analysis is made using the 7-day Gain and 7-day Lose indices.

3.2.1. Top Gainers of the Week in Crypto

| Cryptocurrency | 7-Day Gain | Price |

| Core | +112.91% | $2.54 |

| Pendle | +58.57% | $7.07 |

| Ethena | +56.24% | $1.07 |

| Bitget Token | +22.78% | $1.29 |

| Flare | +19.77% | $0.04113 |

This week’s top cryptocurrency gainers include Core with a remarkable +112.91% increase, followed by Pendle at +58.87% and Ethena at +56.24%. Bitget Token and Flare also saw gains of +22.78% and +19.77% respectively.

3.2.2. Top Losers of the Week in Crypto

| Cryptocurrency | 7-Day Loss | Price |

| Wormhole | -28.11% | $0.9916 |

| dogwifhat | -26.27% | $3.34 |

| Conflux | -24.83% | $0.3616 |

| Axelar | -24.51% | $1.52 |

| Aptos | -22.16% | $13.25 |

This week’s top cryptocurrency losers include Wormhole with a significant loss of -28.11%, followed by dogwifhat at -26.27% and Conflux at -24.83%. Axelar and Aptos also experienced notable losses at -24.51% and -22.16% respectively.

3.3. Stablecoin Weekly Analysis

Tether, USDC, DAI, First Digital USD, and Ethena USDe are the top stablecoins in the market in terms of market capitalization. Let’s analyse their weekly performance using seven-day market capitalisation, market dominance and trading volume indices.

| Stablecoins | Market Dominance (7d) [in %] | Market Capitalisation (7d) | Trading Volume (7d) | Market Capitalisation |

| Tether | 70.36% | $106,688,966,459 | $49,954,604,763 | $106,887,238,660 |

| USDC | 21.74% | $32,959,702,182 | $14,453,026,413 | $32,947,808,359 |

| Dai | 3.33% | $5,056,208,757 | $783,578,952 | $5,058,072,602 |

| First Digital USD | 2.33% | $3,540,106,965 | $8,321,897,124 | $3,528,928,752 |

| Ethena USDe | 1.33% | $2,012,845,407 | $93,776,623 | $2,023,963,080 |

| Others | 0.91% |

Tether dominates the stablecoin market with 70.36% market dominance, followed by USDC at 21.74%. Dai holds 3.33%, while First Digital USD and Ethena USDe have 2.33% and 1.33% respectively. Tether’s significant lead reflects its widespread use and stability, while USDC’s strong position indicates growing adoption.

3.3.1. Stablecoin Weekly Price Analysis

Let’s analyse the weekly performance of the top stablecoins further using the seven-day price change index.

| Stablecoins | 7-Day Price Change (in %) | Price |

| Tether | +0.0% | $1.00 |

| USDC | +0.2% | $1.00 |

| Dai | +0.2% | $1.00 |

| First Digital USD | -0.2% | $1.00 |

| Ethena USDe | -0.0% | $1.00 |

Among the top stablecoins, Tether and Ethena USDe remained stable with no change, while USDC and Dai experienced a slight increase of +0.2%. Conversely, First Digital USD saw a minor decrease of -0.2%.

4. Bitcoin ETF Weekly Analysis

Bitcoin Futures ETFs and Bitcoin Spot ETFs should be analysed separately, in order to get the right picture of the Bitcoin ETF market, as they represent two different segments. Let’s start!

4.1. Bitcoin Futures ETF Weekly Analysis

ProShares (BITO), VanEck (XBTF), Valkyrie (BTF), Global X (BITS), and Ark/21 Shares (ARKA) are the top Bitcoin Future ETFs, as per the Asset Under Management index. Let’s use the price change percentage index to analyse these ETFs.

| Bitcoin Futures ETFs | Price Change (Gain/Loss) [in %] | Asset Under Management (in Billion) | Price |

| ProShares (BITO) | -1.73% | $598.78M | $29.51 |

| VanEck (XBTF) | +0.33% | $42.41M | $39.22 |

| Valkyrie (BTF) | -1.54% | $38.20M | $19.82 |

| Global X (BITS) | -1.54% | $26.10M | $66.29 |

| Ark/21 Shares (ARKA) | -1.64% | $8.01M | $64.88 |

ProShares (BITO) experienced the largest decline among top Bitcoin Futures ETFs at -1.73%, followed by Ark/21 Shares at -1.64%. Valkyrie (BTF) and Global X (BITS), both, saw a -1.54% decrease. Conversely, VanEck (XBTF) showed a modest gain of +0.33%.

4.2. Bitcoin Spot ETF Weekly Analysis

Grayscale (GBTC), Blackrock (IBIT), Fidelity (FBTC), Ark/21 Shares (ARKB), and Bitwise (BITB) are the top Bitcoin Spot ETFs, as per the Asset Under Management index. Let’s analyse them using the price change index.

| Bitcoin Spot ETFs | Price Change (Gain/Loss) [in %] | Asset Under Management (in Billion) | Price |

| Grayscale (GBTC) | -1.72 | $24.33B | $59.99 |

| BlackRock (IBIT) | -1.71 | $17.24B | $38.41 |

| Fidelity (FBTC) | -1.65 | $9.90B | $58.94 |

| Ark/21 Shares (ARKB) | -1.62 | $2.85B | $67.43 |

| Bitwise (BITB) | -1.74 | $2.16B | $36.73 |

Among the top Bitcoin Spot ETFs, Bitwise (BITB) faced the largest decrease at -1.74%, followed closely by Grayscale (GBTC) and BlackRock (IBIT) at -1.72% and -1.71% respectively. Fidelity (FBTC) and Ark/21 Shares (ARKB) also experienced declines at -1.65% and -1.62%.

5. DeFi Market Weekly Status Analysis

Lido, EigenLayer, AAVE, Maker, JustLend are the five top DeFi protocols on the basis of TVL. Let’s analyse its weekly performance using the 7d Change index.

| DeFi Protocols | 7d Change (in Total Value Locked) [in %] | TVL |

| Lido | -6.11% | $32.054B |

| EigenLayer | +1.58% | $12.225B |

| AAVE | -2.79% | $10.911B |

| Maker | -0.88% | $8.534B |

| JustLend | -4.69% | $7.348B |

Among the top DeFi protocols, only EigenLayer exhibited an increase. It experienced an increase of +1.58%. Meanwhile, Lido saw a notable decline of -6.11%. JustLend and AAVE also experienced losses at -4.69% and -2.79% respectively. Notably, Maker also showed a decrease, but only a marginal loss of -0.88%.

6. NFT Marketplace: A Basic Weekly Analysis

Blur, Blur Aggregator, Opensea, Cryptopunks, and X2Y2 are the top NFT marketplaces on the basis of market share. Let’s analyse them using the Volume Change (change of last 7d volume over the previous 7d volume) index.

| NFT Marketplaces | Market Share | Volume Change [Last 7 Day over the Previous 7 Day Volume] | 7-day Rolling Volume | 7-day Rolling Trades |

| Blur | 64.07% | -15.48% | 15003.54 | 23036 |

| Blur Aggregator | 27.34% | +1.44% | 7505.91 | 11717 |

| Opensea | 2.91% | -78.22% | 820.72 | 5718 |

| Cryptopunks | 1.51% | +11.89% | 771.05 | 16 |

| X2Y2 | 1.13% | +9.96% | 414.87 | 350 |

| Others | 3.04% |

Among the top NFT marketplaces, Cryptopunks and X2Y2 saw volume increase of +11.89% and +9.96% respectively, indicating heightened trading activity. Blur Aggregator showed a modest increase at +1.44%. However, Opensea experienced a significant decline of -78.22%, while Blur saw a comparatively modest decrease of -15.48%.

6.1. Top NFT Collectible Sales this Week

Bored Ape Yacht Club #591, Azuki #6525, Azuki #1836, CryptoPunks #5448, and Bitcoin Shrooms #a0e8054 are the top NFT collectable sales reported this week in the NFT market landscape.

| NFT Collectibles | Price (in USD) |

| Bored Ape Yacht Club #591 | $301,562.97 |

| Azuki #6525 | $249,298.03 |

| Azuki #1836 | $240,552.58 |

| CryptoPunks #5448 | $234,589.33 |

| Bitcoin Shrooms #a0e8054 | $216,656.90 |

This week’s top NFT collectibles sales showcase Bored Ape Yacht Club #591 leading at $301,562.97, followed by Azuki #6525 at $249,298.03 and Azuki #1836 at $240,552.58. CryptoPunks #5448 sold for $234,589.33, while Bitcoin Shrooms #a0e8054 fetched $216,656.90.

7. Web3 Weekly Funding Analysis

7.1. ICO Landscape: A Weekly Overview

Versus-X, Sensay, Ethena, BonusBlock, SatoshiSync, and Wormhole are the major ICOs that ended this week. Let’s analyse how much amount they have received.

| ICO | Received | Token Price | Fundraising Goal | Total Tokens | Token (Available for Sale) |

| Versus-X | N/A | $0.165 | $750,000 | 100,000,000 | N/A |

| Sensay | N/A | $0.001 | $800,000 | 10,000,000,000 | 20% |

| Ethena | $6,500,000 | N/A | 300,000,000 Tokens | 15,000,000,000 | N/A |

| BonusBlock | N/A | $0.25 | $100,000 | 100,000,000 | 15.8% |

| SatoshiSync | $1,120,000 | $0.013 | $300,000 | 1,000,000,000 | 13.5% |

| Wormhole | $225,000,000 | N/A | N/A | 10,000,000,000 | N/A |

Wormhole received the highest amount at $225,000,000, indicating significant investor interest and project potential. Ethena secured $6,500,000, reflecting a medium-scale project, while SatoshiSync received $1,120,000, suggesting a smaller-scale project.

8. Weekly Blockchain Hack Analysis

As of April 6, 2024, hackers have stolen a significant $7.77 billion. The majority, approximately $5.85 billion, targeted decentralised finance platforms. Another portion, roughly $2.83 billion, was taken from bridges connecting different blockchain networks.

Fortunately, no major hacks have been reported this month. However, late last month, the Web 3, Blockchain and Crypto ecosystem experienced three significant breaches. On March 29, 2024, Lava lost approximately $0.34 million to hackers. On the preceding day, March 26, 2024, Prisma Finance fell victim to hackers, losing $11.6 million. Also on March 26, 2024, Munchables was hacked using a storage slot exploit, resulting in a staggering $62.5 million loss, the largest reported this year.

Fortunately, the hackers returned the stolen Ether from the Munchables exploit. Additionally, the hackers behind the Prisma Finance theft claimed it was a ‘Whitehat Rescue’ effort. And, they sought guidance on returning the funds, describing their actions as aimed at identifying and fixing DeFi protocol security flaws, emphasising ethical intent.

Endnote

In this week’s comprehensive analysis of Web3, Blockchain and Crypto, we have brought out powerful insights, which can be used to stay-to-data about the market developments. As the landscape evolves, the strategic integration of technology and data-driven decision-making becomes paramount for stakeholders navigating the dynamic realms of decentralised technologies.