Stripe Stablecoin Payments Expand to 101 Countries: Here’s Why It Matters

Stripe stablecoin payments are now live across 101 countries, giving businesses a new way to move money globally without traditional banking headaches. The payments giant is tackling crypto’s worst problems head-on—high costs, slow transfers and security worries—while making stablecoin adoption easier than ever. This comes after Stripe, the payments service provider acquired Bridge for $1.1 billion; the stablecoin payments platform, which some companies such as SpaceX used.

Also Read: Powell: Tariffs Will Generate Higher Inflation and Rising Unemployment

How Stripe’s Stablecoin Move Solves Crypto’s Biggest Pain Points

Cutting Costs and Wait Times

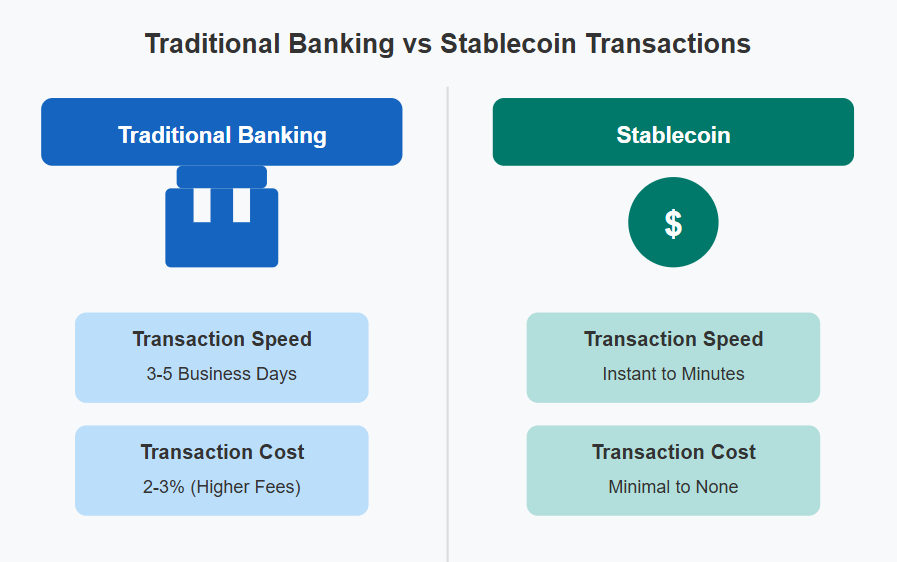

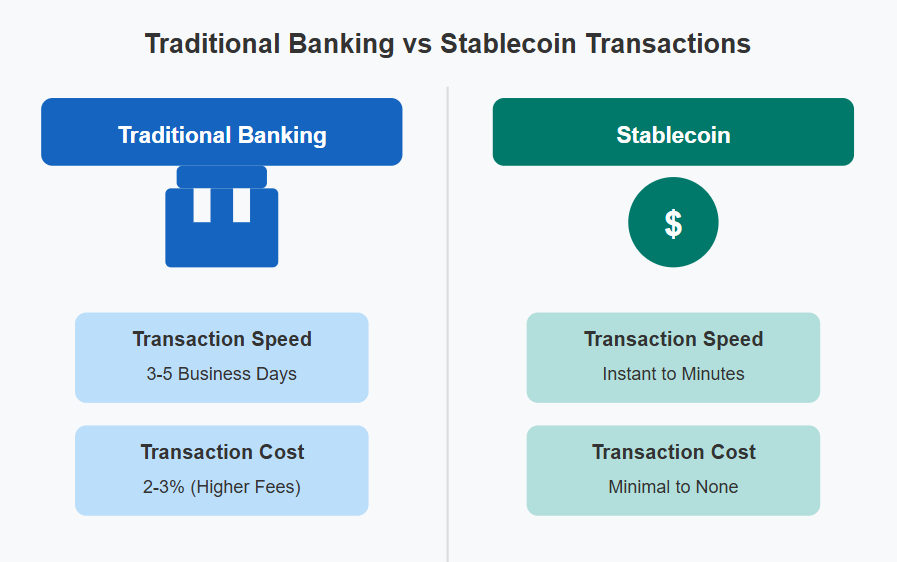

Businesses have long complained about crypto transaction fees that sometimes exceed the actual payment amounts. Stripe’s system slashes these costs dramatically while speeding up international transfers that normally take 3-5 business days down to minutes. Their stablecoin accounts currently support USDC and USDB, avoiding the wild price swings of other cryptocurrencies while maintaining dollar parity.

Smarter Fraud Protection

Alongside stablecoins, Stripe rolled out its Payments Foundation Model—AI tools trained on tens of billions of transactions to catch scams before they happen. Early tests show a 15-20% improvement in fraud detection rates compared to traditional systems. This directly addresses one of the biggest fears businesses have about adopting crypto payments.

Also Read: Bernstein Predicts The Future Of Bitcoin (BTC) And Its Corporate Deployment

Global Payments Made Simple

The new system allows firms to hold reserve stablecoin and swap back and forth between one currency and another without volatility.Multinational businesses can now maintain working capital in USD, EUR and GBP through unified accounts. As Stripe CEO Patrick Collison stated during the launch: “AI and stablecoins are reshaping the economic landscape. Our job is to make sure businesses benefit from them right away.”

The Adoption Boost

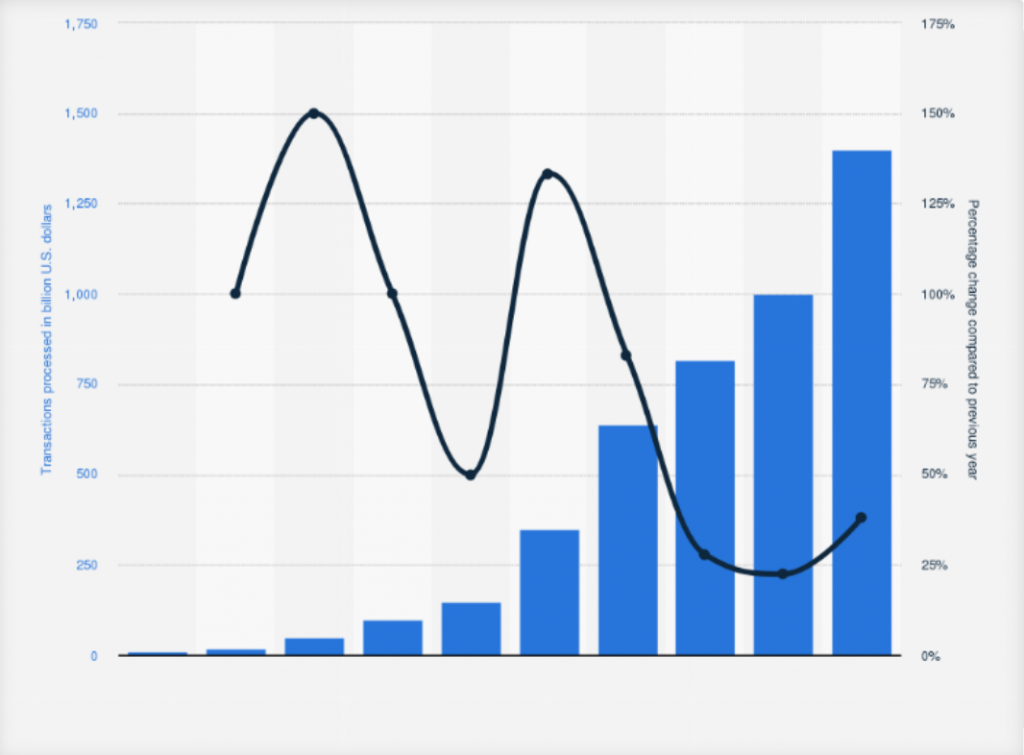

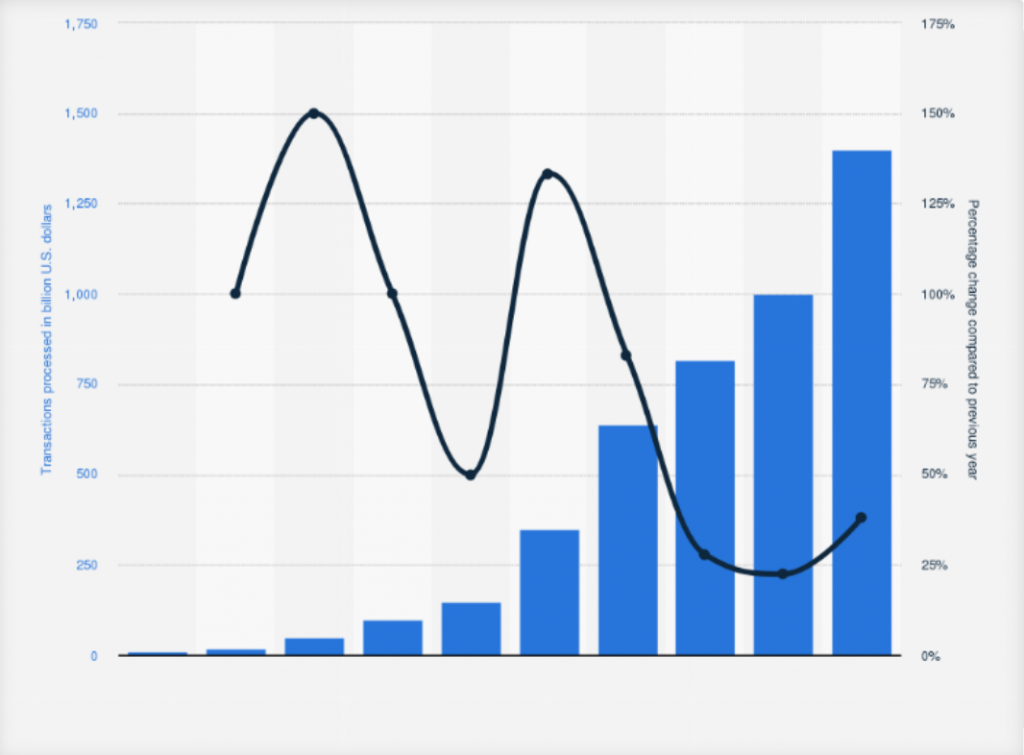

With Stripe processing $1.4 trillion last year—roughly 1.3% of global GDP—this move could push crypto payments into the mainstream. The company already counts major corporations among its users, and the expanded stablecoin support removes technical barriers that previously kept smaller businesses away.

Also Read: PEPE Whale Buys $4.36 Million Coins Amid 9.5% Rally: $0.00001 Next?

Read More

Cardano’s roadmap reveals $50 million liquidity push for stablecoins, DeFi and RWA

Stripe Stablecoin Payments Expand to 101 Countries: Here’s Why It Matters

Stripe stablecoin payments are now live across 101 countries, giving businesses a new way to move money globally without traditional banking headaches. The payments giant is tackling crypto’s worst problems head-on—high costs, slow transfers and security worries—while making stablecoin adoption easier than ever. This comes after Stripe, the payments service provider acquired Bridge for $1.1 billion; the stablecoin payments platform, which some companies such as SpaceX used.

Also Read: Powell: Tariffs Will Generate Higher Inflation and Rising Unemployment

How Stripe’s Stablecoin Move Solves Crypto’s Biggest Pain Points

Cutting Costs and Wait Times

Businesses have long complained about crypto transaction fees that sometimes exceed the actual payment amounts. Stripe’s system slashes these costs dramatically while speeding up international transfers that normally take 3-5 business days down to minutes. Their stablecoin accounts currently support USDC and USDB, avoiding the wild price swings of other cryptocurrencies while maintaining dollar parity.

Smarter Fraud Protection

Alongside stablecoins, Stripe rolled out its Payments Foundation Model—AI tools trained on tens of billions of transactions to catch scams before they happen. Early tests show a 15-20% improvement in fraud detection rates compared to traditional systems. This directly addresses one of the biggest fears businesses have about adopting crypto payments.

Also Read: Bernstein Predicts The Future Of Bitcoin (BTC) And Its Corporate Deployment

Global Payments Made Simple

The new system allows firms to hold reserve stablecoin and swap back and forth between one currency and another without volatility.Multinational businesses can now maintain working capital in USD, EUR and GBP through unified accounts. As Stripe CEO Patrick Collison stated during the launch: “AI and stablecoins are reshaping the economic landscape. Our job is to make sure businesses benefit from them right away.”

The Adoption Boost

With Stripe processing $1.4 trillion last year—roughly 1.3% of global GDP—this move could push crypto payments into the mainstream. The company already counts major corporations among its users, and the expanded stablecoin support removes technical barriers that previously kept smaller businesses away.

Also Read: PEPE Whale Buys $4.36 Million Coins Amid 9.5% Rally: $0.00001 Next?

Read More