Best Presales to Buy as Bitcoin ETF Inflows Resume Suggesting Bullish Momentum

A total of 22,000 Bitcoin option contracts expired on March 21 with a notional value of $1.83B.

The put/call ratio was 0.84, which means there were more call buyers than put option buyers, suggesting a short-term bullish sentiment.

The maximum pain was around $85K, while $BTC is currently trading around $84,300.

Max pain, for those unaware, is the level where option sellers experience the least losses. This also suggests a small upward move.

However, the larger picture for Bitcoin is more or less sideways. The short-term Implied Volatility (IV) has fallen below 50%.

This implies that market participants aren’t expecting large price moves on either side, and the price may stabilize around the $85K mark for a while.

However, as we’ll highlight below, there are several reasons to be bullish on $BTC, which also makes this the perfect time to invest in the best crypto presales.

A Bitcoin Rally Is Just Around the Corner

Analysts have predicted that the FED might announce fresh rate cuts in April in the direction of Trump after economic upheaval caused by the tariff war.

This could prove to be a great catalyst in pushing $BTC prices above $85K.

What’s more, the influx of funds in Bitcoin ETFs has also picked up, recording a cumulative net inflow of $166M in the last five sessions.

Amid this, BlackRock’s IBIT recorded a net inflow of $172M in just a single day.

Increasing ETF investments suggest that investors are accumulating BTC after a significant correction from its all-time high of $110K.

Technical Analysis of Bitcoin Comes Bearing Fruits

Even better, a deep dive into the technical analysis of Bitcoin’s chart reveals a handful of positive signs.

- For starters, $BTC is bouncing off the 50 EMA (Exponential Moving Average) on the weekly chart.

- Both the 50 & 200 EMAs are sloping upwards, which is another strong bullish signal.

- In addition to the 50 EMA, the current bounce is also occurring from the 50% Fibonacci level. This simply means $BTC has had a healthy amount of correction and is now continuing its longer-term bullish trend.

To put it simply, Bitcoin is trading in a discounted zone. Although the OG crypto presents a fantastic risk-to-reward opportunity here, the following presales could easily match (and even eclipse) $BTC’s gains.

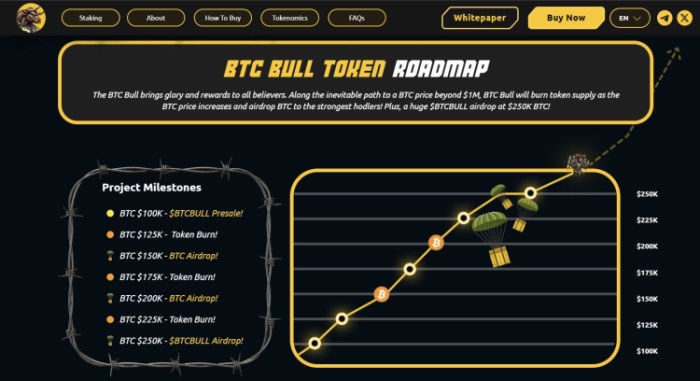

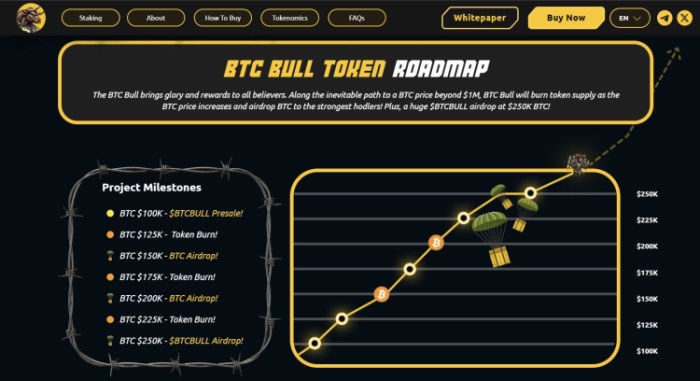

1. BTC Bull Token ($BTCBULL) – Best Crypto Presale to Buy Right Now

Combined with increased institutional buying and a promising technical chart, several signs are pointing toward an upcoming Bitcoin rally.

If you wish to make the most of the next $BTC run, consider investing in BTC Bull Token ($BTCBULL) – one of the best altcoins on the market right now.

It stands out by being the ONLY crypto to offer free (and real) $BTC to token holders who buy and hold $BTCBULL in Best Wallet.

The aforementioned Bitcoin giveaways will take place as and when $BTC surges past a new milestone figure (such as $150K, $200K, and $250K) for the very first time.

Additionally, the project’s roadmap also includes periodic burn events. Essentially, at every $25K mark ($125K, $150K, $175K, and so on), the developers will shave off a part of the total $BTCBULL supply.

As you might have already guessed, this will contract supply and ultimately boost BTC Bull Token’s price.

The best part is that $BTCBULL is currently in presale ($3.9M+ raised), meaning prices are at their lowest. You can buy each token for just $0.002425.

Need help with the purchase process? Check out our detailed guide on how to buy $BTCBULL.

2. Solaxy ($SOLX) – Solana Meme Coin with Real-World Use Case

Solana’s approximately 50% fall from its all-time high (ATH) in mid-January is concerning, especially when it has been dubbed the “Ethereum killer.”

In addition to a temporary drop in enthusiasm regarding meme coins, Solana’s inability to accommodate the growing number of investors on the network post $TRUMP and Pump.fun’s launch has been its biggest worry.

Solaxy ($SOLX), however, could be Solana’s knight in shining armor. After all, it plans to build the first-ever Layer 2 scaling protocol on Solana.

Solaxy’s plan to process Solana’s transactions on a sidechain would significantly reduce the burden on Solana’s primary network.

Additionally, Solaxy would process transactions in batches – rather than one by one. This would further reduce the overall costs required to operate on Solana.

All in all, Solaxy will solve Solana’s long-standing problems of scalability, congestion, and failed transactions.

Thanks to its revolutionary mission, Solaxy has attracted both retail investors and crypto whales. It is, in fact, one of the hottest cryptos going around, with over $27.5M in its purse at the time of writing.

1 $SOLX is currently available for only $0.001672, but hurry up because the price increases in just a few hours. Here’s how to buy Solaxy.

3. Lightchain AI ($LCAI) – Unique Crypto Presale Planning to Build Secure Blockchains

Lightchain AI ($LCAI) harnesses the power of artificial intelligence to develop smarter and more secure decentralized crypto exchanges.

A highlight of the project is the Artificial Intelligence Virtual Machine (AIVM), which has been masterfully designed to tackle AI tasks with maximum efficiency.

The good news keeps coming, as $LCAI token holders will also get a say in how the project moves forward.

The token is currently in presale, where it has amassed a whopping $18M so far. Such massive investor interest in an AI-crypto project is a telltale sign of this hybrid industry’s potential.

Also, because $LCAI is only selling for $0.007125 per token, it’s among the best cheap cryptos you can get your hands on right now.

Conclusion

Although the three cryptos above are certainly worth including in your portfolio, it’s worth remembering that no token is risk-free – largely due to the larger crypto market’s volatility and unpredictability.

You should, therefore, only invest an amount that doesn’t hurt your belly.

Also, we urge you to do your own research before investing. None of the above is a substitute for financial advice from a certified professional.

Read More

Oh Whale Launches Utility-Driven NFT Collection to Support Ocean Protection

Best Presales to Buy as Bitcoin ETF Inflows Resume Suggesting Bullish Momentum

A total of 22,000 Bitcoin option contracts expired on March 21 with a notional value of $1.83B.

The put/call ratio was 0.84, which means there were more call buyers than put option buyers, suggesting a short-term bullish sentiment.

The maximum pain was around $85K, while $BTC is currently trading around $84,300.

Max pain, for those unaware, is the level where option sellers experience the least losses. This also suggests a small upward move.

However, the larger picture for Bitcoin is more or less sideways. The short-term Implied Volatility (IV) has fallen below 50%.

This implies that market participants aren’t expecting large price moves on either side, and the price may stabilize around the $85K mark for a while.

However, as we’ll highlight below, there are several reasons to be bullish on $BTC, which also makes this the perfect time to invest in the best crypto presales.

A Bitcoin Rally Is Just Around the Corner

Analysts have predicted that the FED might announce fresh rate cuts in April in the direction of Trump after economic upheaval caused by the tariff war.

This could prove to be a great catalyst in pushing $BTC prices above $85K.

What’s more, the influx of funds in Bitcoin ETFs has also picked up, recording a cumulative net inflow of $166M in the last five sessions.

Amid this, BlackRock’s IBIT recorded a net inflow of $172M in just a single day.

Increasing ETF investments suggest that investors are accumulating BTC after a significant correction from its all-time high of $110K.

Technical Analysis of Bitcoin Comes Bearing Fruits

Even better, a deep dive into the technical analysis of Bitcoin’s chart reveals a handful of positive signs.

- For starters, $BTC is bouncing off the 50 EMA (Exponential Moving Average) on the weekly chart.

- Both the 50 & 200 EMAs are sloping upwards, which is another strong bullish signal.

- In addition to the 50 EMA, the current bounce is also occurring from the 50% Fibonacci level. This simply means $BTC has had a healthy amount of correction and is now continuing its longer-term bullish trend.

To put it simply, Bitcoin is trading in a discounted zone. Although the OG crypto presents a fantastic risk-to-reward opportunity here, the following presales could easily match (and even eclipse) $BTC’s gains.

1. BTC Bull Token ($BTCBULL) – Best Crypto Presale to Buy Right Now

Combined with increased institutional buying and a promising technical chart, several signs are pointing toward an upcoming Bitcoin rally.

If you wish to make the most of the next $BTC run, consider investing in BTC Bull Token ($BTCBULL) – one of the best altcoins on the market right now.

It stands out by being the ONLY crypto to offer free (and real) $BTC to token holders who buy and hold $BTCBULL in Best Wallet.

The aforementioned Bitcoin giveaways will take place as and when $BTC surges past a new milestone figure (such as $150K, $200K, and $250K) for the very first time.

Additionally, the project’s roadmap also includes periodic burn events. Essentially, at every $25K mark ($125K, $150K, $175K, and so on), the developers will shave off a part of the total $BTCBULL supply.

As you might have already guessed, this will contract supply and ultimately boost BTC Bull Token’s price.

The best part is that $BTCBULL is currently in presale ($3.9M+ raised), meaning prices are at their lowest. You can buy each token for just $0.002425.

Need help with the purchase process? Check out our detailed guide on how to buy $BTCBULL.

2. Solaxy ($SOLX) – Solana Meme Coin with Real-World Use Case

Solana’s approximately 50% fall from its all-time high (ATH) in mid-January is concerning, especially when it has been dubbed the “Ethereum killer.”

In addition to a temporary drop in enthusiasm regarding meme coins, Solana’s inability to accommodate the growing number of investors on the network post $TRUMP and Pump.fun’s launch has been its biggest worry.

Solaxy ($SOLX), however, could be Solana’s knight in shining armor. After all, it plans to build the first-ever Layer 2 scaling protocol on Solana.

Solaxy’s plan to process Solana’s transactions on a sidechain would significantly reduce the burden on Solana’s primary network.

Additionally, Solaxy would process transactions in batches – rather than one by one. This would further reduce the overall costs required to operate on Solana.

All in all, Solaxy will solve Solana’s long-standing problems of scalability, congestion, and failed transactions.

Thanks to its revolutionary mission, Solaxy has attracted both retail investors and crypto whales. It is, in fact, one of the hottest cryptos going around, with over $27.5M in its purse at the time of writing.

1 $SOLX is currently available for only $0.001672, but hurry up because the price increases in just a few hours. Here’s how to buy Solaxy.

3. Lightchain AI ($LCAI) – Unique Crypto Presale Planning to Build Secure Blockchains

Lightchain AI ($LCAI) harnesses the power of artificial intelligence to develop smarter and more secure decentralized crypto exchanges.

A highlight of the project is the Artificial Intelligence Virtual Machine (AIVM), which has been masterfully designed to tackle AI tasks with maximum efficiency.

The good news keeps coming, as $LCAI token holders will also get a say in how the project moves forward.

The token is currently in presale, where it has amassed a whopping $18M so far. Such massive investor interest in an AI-crypto project is a telltale sign of this hybrid industry’s potential.

Also, because $LCAI is only selling for $0.007125 per token, it’s among the best cheap cryptos you can get your hands on right now.

Conclusion

Although the three cryptos above are certainly worth including in your portfolio, it’s worth remembering that no token is risk-free – largely due to the larger crypto market’s volatility and unpredictability.

You should, therefore, only invest an amount that doesn’t hurt your belly.

Also, we urge you to do your own research before investing. None of the above is a substitute for financial advice from a certified professional.

Read More