Bitcoin, Ethereum battles a ‘PVP Market’ Amidst Drying Spot Volumes

For all its improved market credibility since 2021, for major market cap tokens, and ‘degen’ traders frontrunning Bitcoin and Ethereum when any ETF news breaks out. Overall, the statistical narrative hasn’t changed: there is no new money in the market. It was a big part of the bull market in 2021, and it is likely going to play a part again in 2024–2025. Yet, for the time being, investors and traders should keep these things in mind, as in why Bitcoin and Ethereum are not manifesting fatter pockets in 2023.

But first, a Market Update—or the lack of it

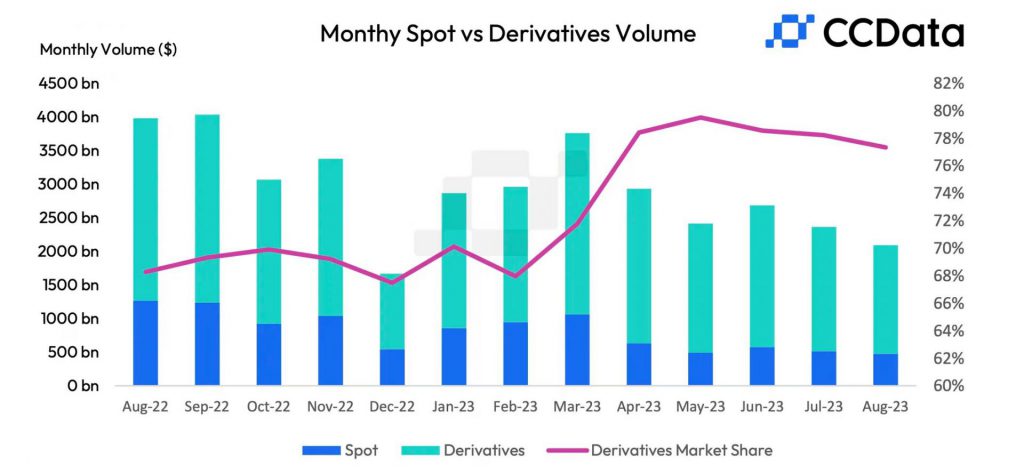

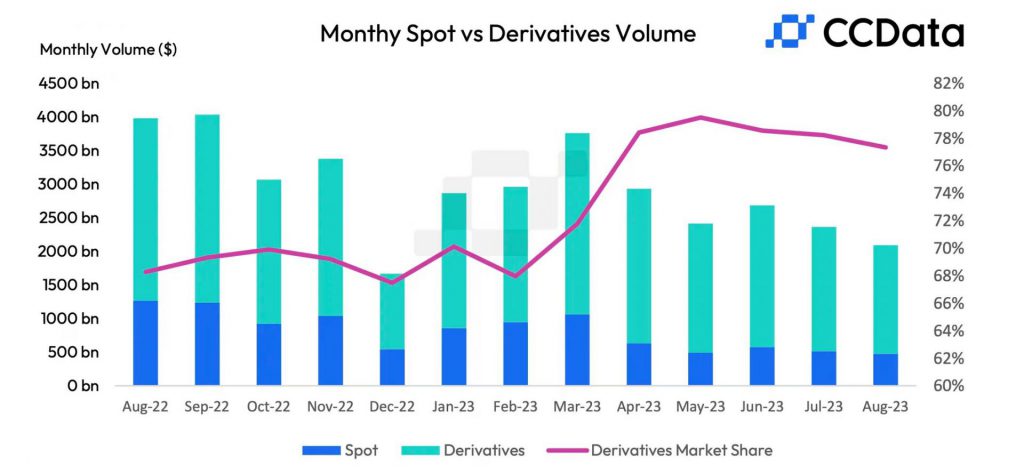

According to data released by CCdata, Trading activity in the cryptocurrency spot market reached its lowest point in over four years last month, continuing a period of subdued activity at digital asset trading desks. This lack of activity persisted despite the volatility triggered by Grayscale Investments’ legal victory against the U.S. Securities and Exchange Commission. After the initial euphoria, the market lacked conviction to continue on a bullish trend.

Specifically, the volume of spot trading on centralized exchanges saw a significant decline for the second consecutive month, dropping by 7.78% to $475 billion. This marked the lowest level since March 2019. Spot trading volume measures the total number of tokens exchanged during a given time frame.

In the derivatives market, trading volume decreased by over 12%, reaching its second-lowest point since 2021. The share of derivatives in overall market activity also shrank for the third month in a row, down to 77.3%. Additionally, the dollar value locked in open derivatives contracts experienced a notable drop of 19.5%, falling to $17.1 billion.

Also Read: Bitcoin: Two Years Ago Today, El Salvador Adopted BTC As Legal Tender

A PVP Market: How Does It Affect Bitcoin, Ethereum?

Now, if readers are paying keen attention to the market, they might have seen small-cap coins undergoing parabolic rises. CYBER, RLB (Rollbit), SUI, UNFI are to name a few. So, why are these assets recording new yearly highs on a weekly basis, while Bitcoin and Ethereum consolidate? because we are currently in a structural PVP market.

PVP or simply “player vs. player,” is a term used when the market volatility is coming from traders literally trading against each other on assets. While that is the case in general, when ‘new money’ is not coming in, any market value generated by newer, lower-cap assets is borrowed value. Most of the alts rallying over the past day have already dropped by 50% over the past few days. The lack of spot volumes and relative rise in derivatives is a sign that it is a PVP market.

How Traders and Investors Should Navigate Such Environment

One of the key formulas for making capital in an investment market is trading with the trend. Right now, there isn’t one that is definitive and directional. Bitcoin and Ethereum are chopping at range highs and range lows, and low-cap altcoins are essentially, pumping and dumping. During such a tumultuous period, the best bet would be to sit back and analyze good projects with high potential for the next bull run.

Also Read: 1750 Wallets Tied to Grayscale Bitcoin Trust Hold ~1000 BTC Each

Bitcoin, Ethereum battles a ‘PVP Market’ Amidst Drying Spot Volumes

For all its improved market credibility since 2021, for major market cap tokens, and ‘degen’ traders frontrunning Bitcoin and Ethereum when any ETF news breaks out. Overall, the statistical narrative hasn’t changed: there is no new money in the market. It was a big part of the bull market in 2021, and it is likely going to play a part again in 2024–2025. Yet, for the time being, investors and traders should keep these things in mind, as in why Bitcoin and Ethereum are not manifesting fatter pockets in 2023.

But first, a Market Update—or the lack of it

According to data released by CCdata, Trading activity in the cryptocurrency spot market reached its lowest point in over four years last month, continuing a period of subdued activity at digital asset trading desks. This lack of activity persisted despite the volatility triggered by Grayscale Investments’ legal victory against the U.S. Securities and Exchange Commission. After the initial euphoria, the market lacked conviction to continue on a bullish trend.

Specifically, the volume of spot trading on centralized exchanges saw a significant decline for the second consecutive month, dropping by 7.78% to $475 billion. This marked the lowest level since March 2019. Spot trading volume measures the total number of tokens exchanged during a given time frame.

In the derivatives market, trading volume decreased by over 12%, reaching its second-lowest point since 2021. The share of derivatives in overall market activity also shrank for the third month in a row, down to 77.3%. Additionally, the dollar value locked in open derivatives contracts experienced a notable drop of 19.5%, falling to $17.1 billion.

Also Read: Bitcoin: Two Years Ago Today, El Salvador Adopted BTC As Legal Tender

A PVP Market: How Does It Affect Bitcoin, Ethereum?

Now, if readers are paying keen attention to the market, they might have seen small-cap coins undergoing parabolic rises. CYBER, RLB (Rollbit), SUI, UNFI are to name a few. So, why are these assets recording new yearly highs on a weekly basis, while Bitcoin and Ethereum consolidate? because we are currently in a structural PVP market.

PVP or simply “player vs. player,” is a term used when the market volatility is coming from traders literally trading against each other on assets. While that is the case in general, when ‘new money’ is not coming in, any market value generated by newer, lower-cap assets is borrowed value. Most of the alts rallying over the past day have already dropped by 50% over the past few days. The lack of spot volumes and relative rise in derivatives is a sign that it is a PVP market.

How Traders and Investors Should Navigate Such Environment

One of the key formulas for making capital in an investment market is trading with the trend. Right now, there isn’t one that is definitive and directional. Bitcoin and Ethereum are chopping at range highs and range lows, and low-cap altcoins are essentially, pumping and dumping. During such a tumultuous period, the best bet would be to sit back and analyze good projects with high potential for the next bull run.

Also Read: 1750 Wallets Tied to Grayscale Bitcoin Trust Hold ~1000 BTC Each