Stablecoin Activity Shoots Up: Investors Looking To Buy Bitcoin?

On-chain data shows the stablecoins have seen a spike in Active Addresses recently, something that may turn out to be bullish for Bitcoin.

Stablecoins Active Addresses & Volume Have Jumped

In a new post on X, the market intelligence platform IntoTheBlock has talked about the latest trend in the Active Addresses for the various stablecoins in the sector.

The “Active Addresses” here refers to an on-chain metric that keeps track of the total number of addresses becoming involved in transactions on the blockchain every day. The indicator accounts for both senders and receivers.

When the value of this metric goes up, it means the number of users participating in transfers on the blockchain is on the rise. Such a trend suggests the interest in the asset is increasing.

On the other hand, the indicator witnessing a decline implies investors may be paying lower attention to the cryptocurrency as not many of them are becoming active on the network.

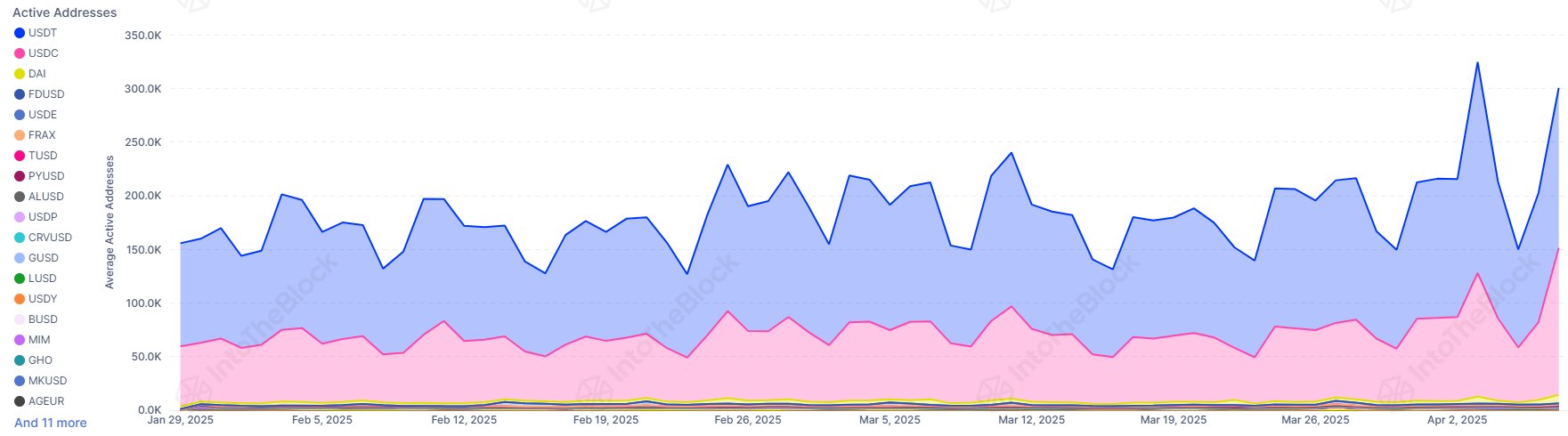

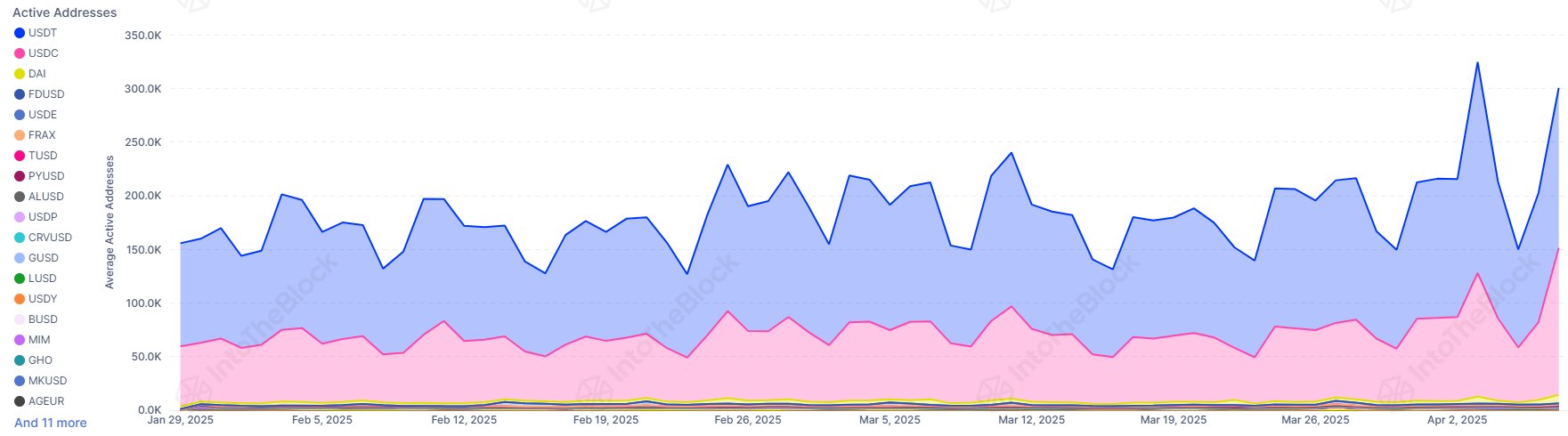

Now, here is the chart shared by the analytics firm that shows the trend in the Active Addresses for the different stablecoins over the last few months:

As is visible in the above graph, the Active Addresses has recently observed a sharp increase for the stablecoins, especially USDT and USDC, the two largest tokens of this class.

According to IntoTheBlock, the indicator has now crossed above the 300,000 mark. At the same time as this spike, the Transaction Volume has also registered an uptick, reaching a value of $72 billion.

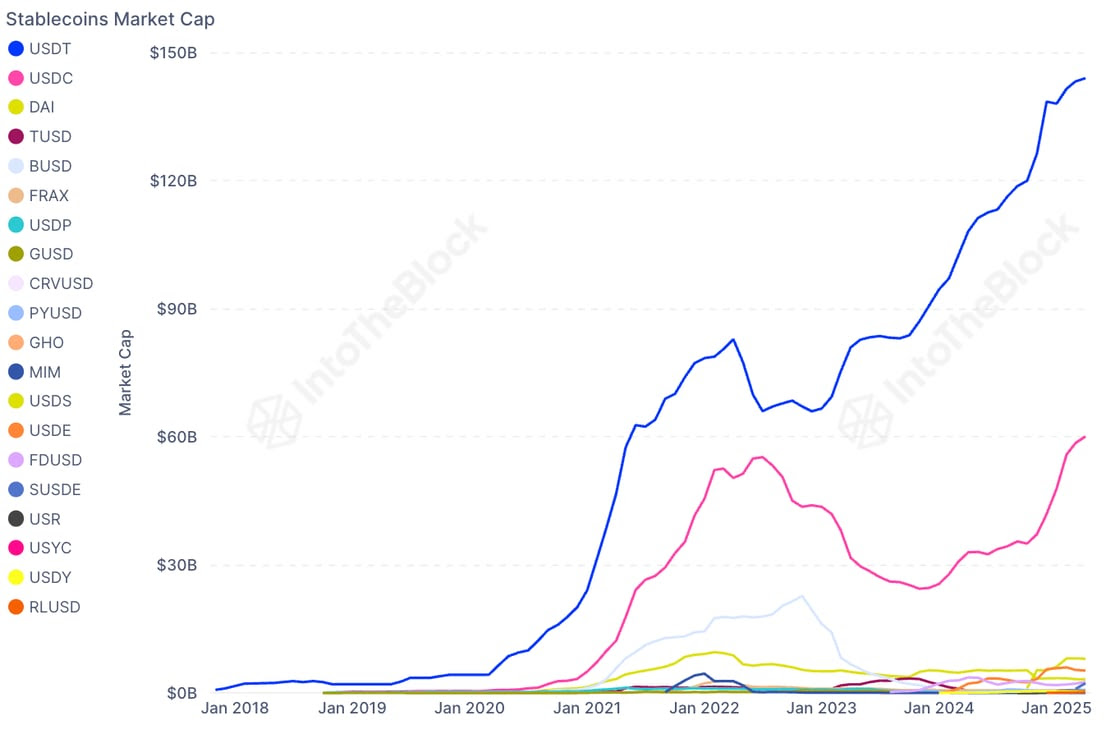

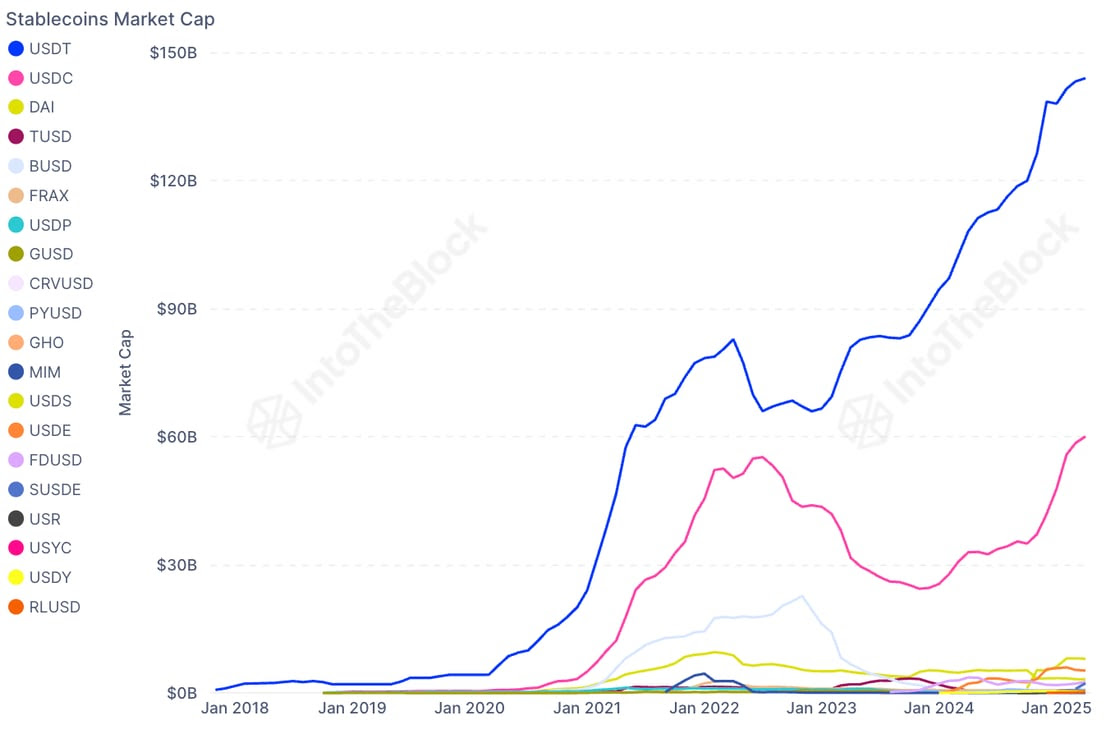

These two aren’t the only stablecoin-related metrics that have surged recently, as the analytics firm has pointed out in another X post that the total market cap of these fiat-tied tokens has set a new record.

Thus, it would appear that these assets have not only been enjoying an uptick in activity, but also fresh capital inflows. This trend could hold implications for Bitcoin and other cryptocurrencies.

Generally, investors store their capital in the form of stables whenever they want to avoid the volatility associated with BTC and company. These holders are probable to return back to the volatile side eventually, however, as if they wanted to stay away from the sector entirely, they would have just gone with fiat.

As such, the market cap of the stablecoins may be looked at as dry powder waiting on the sidelines for Bitcoin and other coins. With activity related to these coins shooting up recently, it’s possible that the transactions are related to investors swapping their stables to buy the market dip.

That said, there also exists the scenario where the reverse is true; the transactions correspond to investors buying into the stables as they look to exit from the volatile cryptocurrencies.

Bitcoin Price

Bitcoin appears to have retraced some of its latest recovery as its price is back at $77,300.

Read More

Bitcoin Price Analysis: Is BTC’s Consolidation Phase Nearing Its End?

Stablecoin Activity Shoots Up: Investors Looking To Buy Bitcoin?

On-chain data shows the stablecoins have seen a spike in Active Addresses recently, something that may turn out to be bullish for Bitcoin.

Stablecoins Active Addresses & Volume Have Jumped

In a new post on X, the market intelligence platform IntoTheBlock has talked about the latest trend in the Active Addresses for the various stablecoins in the sector.

The “Active Addresses” here refers to an on-chain metric that keeps track of the total number of addresses becoming involved in transactions on the blockchain every day. The indicator accounts for both senders and receivers.

When the value of this metric goes up, it means the number of users participating in transfers on the blockchain is on the rise. Such a trend suggests the interest in the asset is increasing.

On the other hand, the indicator witnessing a decline implies investors may be paying lower attention to the cryptocurrency as not many of them are becoming active on the network.

Now, here is the chart shared by the analytics firm that shows the trend in the Active Addresses for the different stablecoins over the last few months:

As is visible in the above graph, the Active Addresses has recently observed a sharp increase for the stablecoins, especially USDT and USDC, the two largest tokens of this class.

According to IntoTheBlock, the indicator has now crossed above the 300,000 mark. At the same time as this spike, the Transaction Volume has also registered an uptick, reaching a value of $72 billion.

These two aren’t the only stablecoin-related metrics that have surged recently, as the analytics firm has pointed out in another X post that the total market cap of these fiat-tied tokens has set a new record.

Thus, it would appear that these assets have not only been enjoying an uptick in activity, but also fresh capital inflows. This trend could hold implications for Bitcoin and other cryptocurrencies.

Generally, investors store their capital in the form of stables whenever they want to avoid the volatility associated with BTC and company. These holders are probable to return back to the volatile side eventually, however, as if they wanted to stay away from the sector entirely, they would have just gone with fiat.

As such, the market cap of the stablecoins may be looked at as dry powder waiting on the sidelines for Bitcoin and other coins. With activity related to these coins shooting up recently, it’s possible that the transactions are related to investors swapping their stables to buy the market dip.

That said, there also exists the scenario where the reverse is true; the transactions correspond to investors buying into the stables as they look to exit from the volatile cryptocurrencies.

Bitcoin Price

Bitcoin appears to have retraced some of its latest recovery as its price is back at $77,300.

Read More