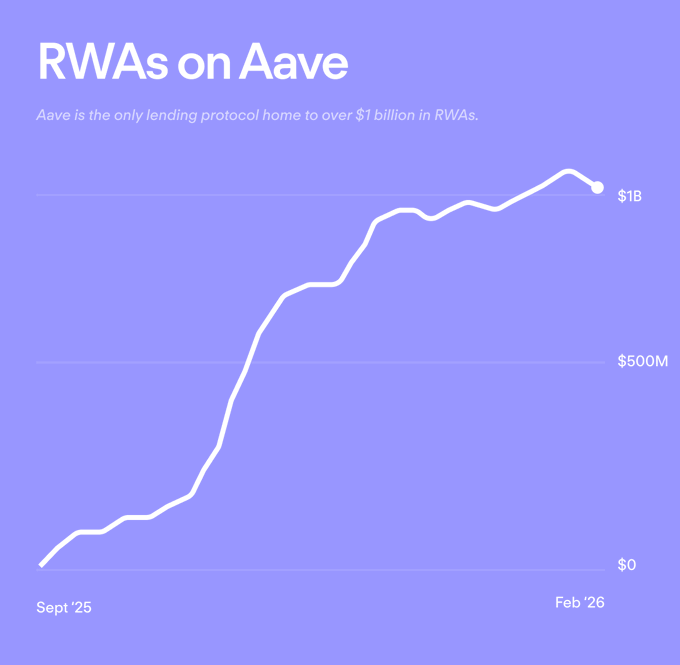

Aave Becomes First Lending Protocol to Cross $1 Billion in RWAs

Share:

Aave surpasses $1 billion in tokenized real-world asset (RWA) deposits, becoming the first decentralized lending platform to achieve this milestone. The protocol generates $8-10 million in monthly revenue, driven by stablecoin lending, while RWAs grow 13.5% market-wide despite a downturn in the broader crypto market.

- Aave crossed $1 billion in tokenized real-world asset deposits.

- Protocol generates $8–10 million monthly revenue with rising stablecoin lending.

- RWAs grew 13.5% market-wide despite a broader crypto market downturn.

Aave has made history in decentralized finance. The protocol has officially surpassed $1 billion in tokenized real-world asset (RWA) deposits, becoming the first decentralized lending platform to reach this milestone.

Source: X

Real-world assets, or RWAs, include tokenized versions of U.S. Treasury bills, private credit, bonds, and other yield-generating financial products. These assets allow investors to earn returns on-chain while being backed by traditional financial instruments.

Why This Matters for DeFi

The growth of RWAs shows that decentralized finance is expanding beyond crypto-native tokens. Instead of only lending and borrowing …

Read The Full Article Aave Becomes First Lending Protocol to Cross $1 Billion in RWAs On Coin Edition.

Read More

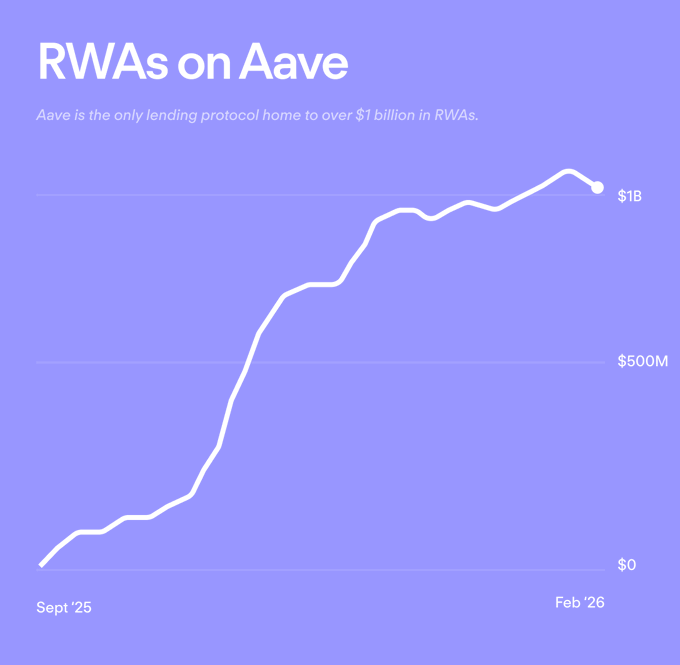

Aave Becomes First Lending Protocol to Cross $1 Billion in RWAs

Share:

Aave surpasses $1 billion in tokenized real-world asset (RWA) deposits, becoming the first decentralized lending platform to achieve this milestone. The protocol generates $8-10 million in monthly revenue, driven by stablecoin lending, while RWAs grow 13.5% market-wide despite a downturn in the broader crypto market.

- Aave crossed $1 billion in tokenized real-world asset deposits.

- Protocol generates $8–10 million monthly revenue with rising stablecoin lending.

- RWAs grew 13.5% market-wide despite a broader crypto market downturn.

Aave has made history in decentralized finance. The protocol has officially surpassed $1 billion in tokenized real-world asset (RWA) deposits, becoming the first decentralized lending platform to reach this milestone.

Source: X

Real-world assets, or RWAs, include tokenized versions of U.S. Treasury bills, private credit, bonds, and other yield-generating financial products. These assets allow investors to earn returns on-chain while being backed by traditional financial instruments.

Why This Matters for DeFi

The growth of RWAs shows that decentralized finance is expanding beyond crypto-native tokens. Instead of only lending and borrowing …

Read The Full Article Aave Becomes First Lending Protocol to Cross $1 Billion in RWAs On Coin Edition.

Read More