Crypto to be Measured at Fair Value in US Under New FASB Rules – Here is the Bitcoin (BTC) Price Reacted

US companies that hold crypto will be required to record their tokens at the most up-to-date or “fair value”, according to the first set of crypto accounting rules issued by the US Financial Accounting Standards Board (FASB), and crypto prices are pushing higher as a result.

CRYPTO TO BE MEASURED AT FAIR VALUE UNDER NEW FASB RULES

— *Walter Bloomberg (@DeItaone) December 13, 2023

Previously, US companies holding crypto had to treat their assets the same as indefinite-lived intangible assets, meaning they could only record value gains if they sold the asset, while they would still have to record price drops, regardless of whether the assets had been sold.

Executives at major crypto-owning companies like Microstrategy had long criticized these accounting standards as unfair, arguing that they didn’t allow crypto-owning companies to fully reflect their healthier financial positions when sitting on substantial capital gains on their crypto holdings.

Some even went as far as to argue that crypto’s unfavorable accounting treatment in the US had been hurting its adoption by major companies and institutions.

FASB’s new crypto accounting rules, which it voted on back in September, are very much in line with what the crypto industry has been demanding and will allow companies like Microstrategy, Tesla and Block to capture the highs and lows of the crypto holdings.

That probably explains why crypto prices have been pushing higher in recent trade since the news of the FASB’s latest rule change hit the wires.

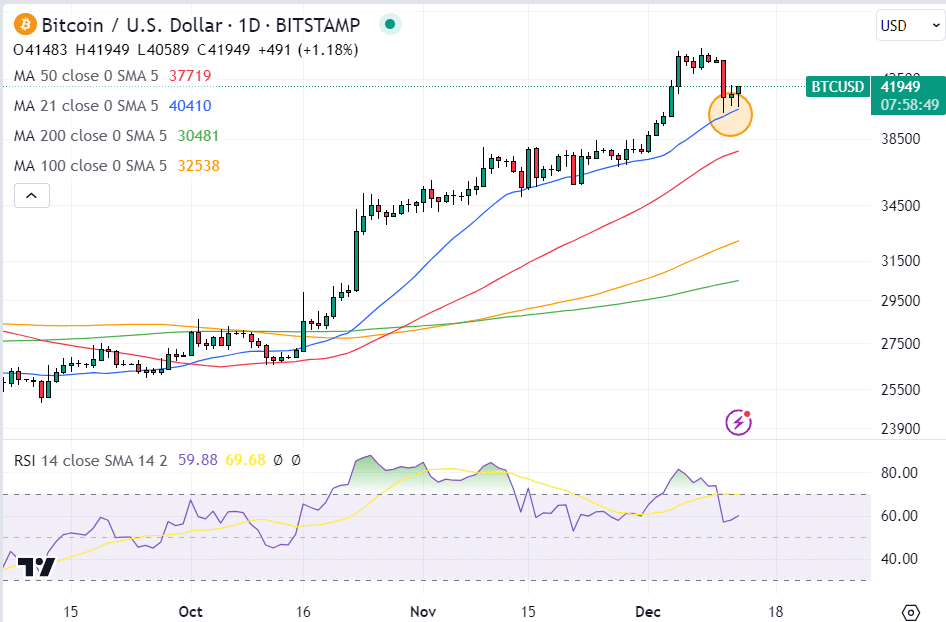

Bitcoin (BTC) was last trading near $41,900, having jumped about 1% from underneath $41,500 since the FASB news came out.

The world’s largest cryptocurrency has found strong support in the last few days above its 21-Day Moving Average (DMA), a sign that, despite a leverage flush out that has driven a more than 6% pull-back from last week’s yearly highs above $44,700s, bullish momentum remains very much intact.

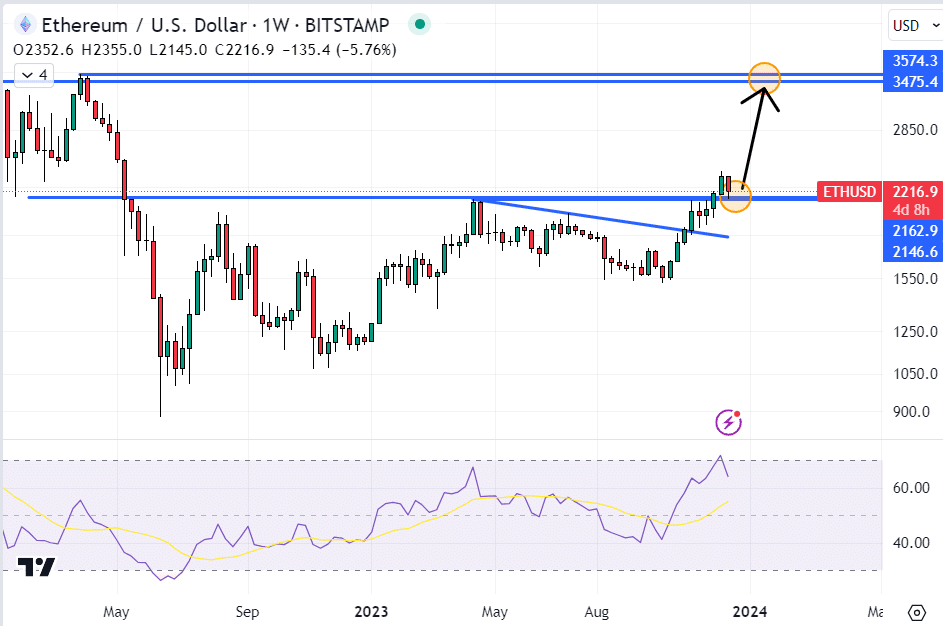

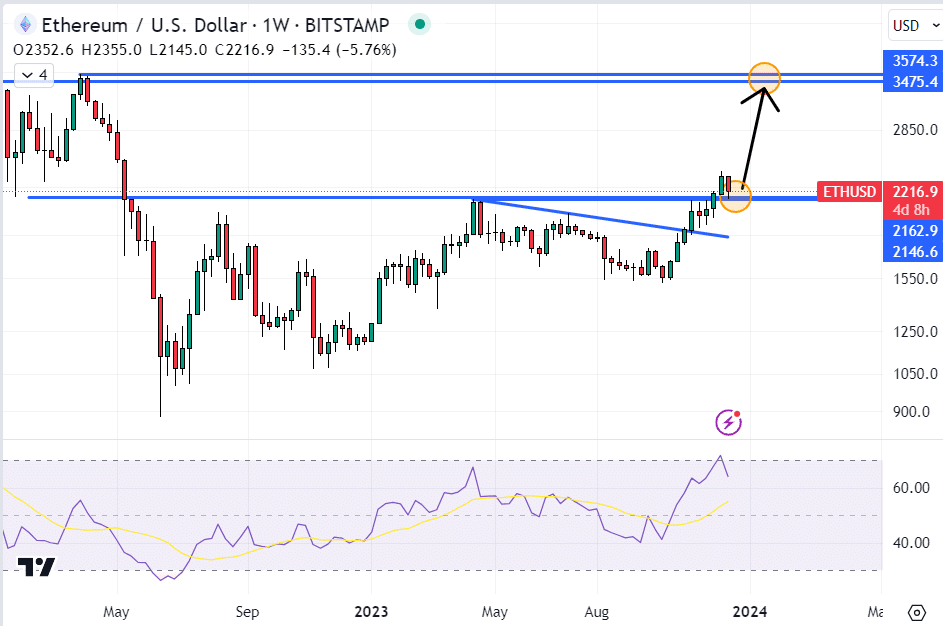

Ether (ETH), the world’s second-largest cryptocurrency by market capitalization rallied back above $2,200 on the news after finding strong support at key long-term support in the mid-$2,100s, a sign of a strong dip-buying mentality in a market where the bulls, on balance, remain in control.

All Eyes on the Fed

FASB’s new rules are clearly a net positive for the crypto market, as favorable accounting treatments will likely increase the willingness for US companies to hold crypto assets on their balance sheets.

But traders won’t have long to digest the news, with the release of the Fed’s latest policy announcement coming up in a few hours.

The Fed is expected to leave interest rates on hold at 5.25-5.5%, and will release its updated quarterly economic projections and “dot plot”, which summarizes the interest rate projections of its committee of policymakers.

Macro traders will closely scrutinize these new economic and interest rate projections, assessing the degree to which they support or push back against a recent increase in bets that the Fed will start cutting interest rates in early 2024.

The latest US jobs numbers released earlier this month pointed to a still robust labor market, which undermines the argument that the Fed will need to soon start cutting interest rates to support the economy.

Meanwhile, US inflation figures released earlier in the week suggested that while progress continues to be made on bringing headline inflation back to the Fed’s 2.0% goal, the battle remains far from won.

As a result, Fed Chair Jerome Powell will likely try to push back against the idea that the Fed will soon start aggressively cutting interest rates, and even that more rate hikes remain on the table.

But if the economic projections show a more pessimistic view for 2024 and interest rate projections point to more anticipated rate cuts next year that previously indicated, the market may continue “getting ahead of itself” regarding betting on a near-term dovish Fed pivot.

While crypto prices are likely to be volatile around the time of the release, expectations surrounding Fed policy are likely to remain a long-term tailwind for the crypto market.

That’s because the Fed’s interest rate hiking cycle is very likely now over, with the only question being the timing and speed of interest rate cuts.

Crypto has historically performed very well in times of easing financial conditions in the USA.

The post Crypto to be Measured at Fair Value in US Under New FASB Rules – Here is the Bitcoin (BTC) Price Reacted appeared first on Cryptonews.

Crypto to be Measured at Fair Value in US Under New FASB Rules – Here is the Bitcoin (BTC) Price Reacted

US companies that hold crypto will be required to record their tokens at the most up-to-date or “fair value”, according to the first set of crypto accounting rules issued by the US Financial Accounting Standards Board (FASB), and crypto prices are pushing higher as a result.

CRYPTO TO BE MEASURED AT FAIR VALUE UNDER NEW FASB RULES

— *Walter Bloomberg (@DeItaone) December 13, 2023

Previously, US companies holding crypto had to treat their assets the same as indefinite-lived intangible assets, meaning they could only record value gains if they sold the asset, while they would still have to record price drops, regardless of whether the assets had been sold.

Executives at major crypto-owning companies like Microstrategy had long criticized these accounting standards as unfair, arguing that they didn’t allow crypto-owning companies to fully reflect their healthier financial positions when sitting on substantial capital gains on their crypto holdings.

Some even went as far as to argue that crypto’s unfavorable accounting treatment in the US had been hurting its adoption by major companies and institutions.

FASB’s new crypto accounting rules, which it voted on back in September, are very much in line with what the crypto industry has been demanding and will allow companies like Microstrategy, Tesla and Block to capture the highs and lows of the crypto holdings.

That probably explains why crypto prices have been pushing higher in recent trade since the news of the FASB’s latest rule change hit the wires.

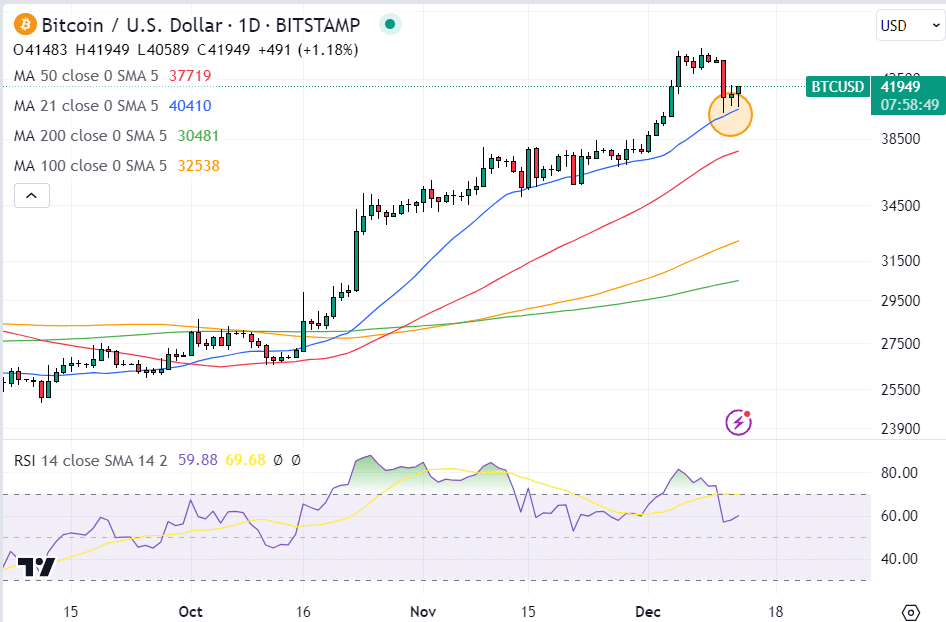

Bitcoin (BTC) was last trading near $41,900, having jumped about 1% from underneath $41,500 since the FASB news came out.

The world’s largest cryptocurrency has found strong support in the last few days above its 21-Day Moving Average (DMA), a sign that, despite a leverage flush out that has driven a more than 6% pull-back from last week’s yearly highs above $44,700s, bullish momentum remains very much intact.

Ether (ETH), the world’s second-largest cryptocurrency by market capitalization rallied back above $2,200 on the news after finding strong support at key long-term support in the mid-$2,100s, a sign of a strong dip-buying mentality in a market where the bulls, on balance, remain in control.

All Eyes on the Fed

FASB’s new rules are clearly a net positive for the crypto market, as favorable accounting treatments will likely increase the willingness for US companies to hold crypto assets on their balance sheets.

But traders won’t have long to digest the news, with the release of the Fed’s latest policy announcement coming up in a few hours.

The Fed is expected to leave interest rates on hold at 5.25-5.5%, and will release its updated quarterly economic projections and “dot plot”, which summarizes the interest rate projections of its committee of policymakers.

Macro traders will closely scrutinize these new economic and interest rate projections, assessing the degree to which they support or push back against a recent increase in bets that the Fed will start cutting interest rates in early 2024.

The latest US jobs numbers released earlier this month pointed to a still robust labor market, which undermines the argument that the Fed will need to soon start cutting interest rates to support the economy.

Meanwhile, US inflation figures released earlier in the week suggested that while progress continues to be made on bringing headline inflation back to the Fed’s 2.0% goal, the battle remains far from won.

As a result, Fed Chair Jerome Powell will likely try to push back against the idea that the Fed will soon start aggressively cutting interest rates, and even that more rate hikes remain on the table.

But if the economic projections show a more pessimistic view for 2024 and interest rate projections point to more anticipated rate cuts next year that previously indicated, the market may continue “getting ahead of itself” regarding betting on a near-term dovish Fed pivot.

While crypto prices are likely to be volatile around the time of the release, expectations surrounding Fed policy are likely to remain a long-term tailwind for the crypto market.

That’s because the Fed’s interest rate hiking cycle is very likely now over, with the only question being the timing and speed of interest rate cuts.

Crypto has historically performed very well in times of easing financial conditions in the USA.

The post Crypto to be Measured at Fair Value in US Under New FASB Rules – Here is the Bitcoin (BTC) Price Reacted appeared first on Cryptonews.