SoFi Stock Price Prediction

Share:

- SoFi Technologies Inc: An Introduction

- SoFi’s Origin and Operations

- Vision and Growth of SoFi

- SoFi Stock Price Prediction: Price History

- SoFi Stock Price Prediction: Price Analysis

- What is SoFi Technologies Inc.?SoFi Stock Price Prediction

- SoFi Stock Price Prediction 2024

- SoFi Stock Price Prediction 2025

- SoFi Stock Price Prediction 2030

- Conclusion

- FAQ

SoFi Technologies Inc: An Introduction

The financial sector is getting evolved. Particularly, in the recent few years, several outstanding projects have revolutionized this sector. SoFi Technologies Inc. is categorized among the respective platforms. The worldwide financial space is advancing from conventional banking services to digital ones.

SoFi Technologies plays a significant role in this. The platform offers online services related to banking. The chief focus of the platform is to give preference to the user experience in addition to offering customized and suitable financial solutions to deal with the latest consumers. The platform is determined to carry out digital transformation, paving the way for redefining the banking landscape and personal finance online.

SoFi has an exclusive approach to financial management that combines the latest technology as well as consumer-centric design. This is focused on offering an intuitive experience for empowering customers to take complete control of their future in the financial world. The prioritization of user satisfaction and the endeavors to advance conventional banking models enable SoFi Technologies to establish exclusive standards. Nonetheless, the stock of SoFi has experienced a sharp slump in recent times. The platform is attempting to elevate its stocks above the crucial price hurdles.

SoFi’s Origin and Operations

SoFi Technologies Inc was founded back in 2011’s February. The full form of SoFi is Social Finance. The platform has witnessed enormous growth since its commencement as just a loan refinancing company for students. The firm made great progress to turn into a great platform providing financial services. With an innovative approach dealing with lending, investing, and banking, SoFi Technologies plays the role of a prominent fintech company operating in America.

It is also known as a digital platform offering digital banking with its headquarters based in San Francisco. It provides a broad array of services related to finance. These services take into account auto and student loan refinancing, banking services, investment options, credit cards, mortgages, and personal loans. It is accessible through desktop platforms and mobile apps. SoFi focuses on fulfilling a lot of requirements of the consumers. The SoFi Money account of the platform enables consumers to matchlessly administer their finances.

With it, they can leverage zero account charges, cashback rewards, and high-interest rates. The powerful budgeting instruments, responsive consumer support, and intuitive app guarantee that the customers have comprehensive control over their financial futures with convenience. The reports point out that SoFi has remained successful in attracting numerous consumers who are eager to be a part of the fintech revolution.

Vision and Growth of SoFi

SoFi’s founders envisioned the establishment of a company that would provide more economic substitutive options for the people pursuing financial support in terms of education. The pilot loan project of Sofi was conducted at Stanford University. The respective program marked the start of the platform’s vision. In that program, 40 alumni offered loans of up to $2M to approximately one hundred students. In this way, the $20,000 was given to each student on average.

Following that, in 2012’s September, the platform effectively collected $77.2M via a funding round. After that, on the 2nd of October of the next year, the platform declared that it had obtained up to $500M in terms of equity and debt for financing and refinancing the student loans. The funds contained up to $90M worth of equity while nearly $151M worth of debt. In addition to this, $200M was given by the bank members. the remaining amount was provided by community investors and alumni.

A few years after, in 2019’s September, the company obtained the Inglewood-based SoFi Stadium in California for twenty years. The respective contract with the Los Angeles Chargers and Los Angeles Rams of the NFL is worth an extraordinary $30M yearly. It sets an exclusive record within the case of naming rights in sports.

In 2020’s April, the company extended its reach with the acquisition of Galileo (a payments company based in Salt Lake City) for up to $1.2B worth in cash and stock. Then the platform went public. This was done as a result of a merger contract with a special purpose acquisition company (SPAC) in 2021. After the public listing, the cumulative valuation of SoFi elevated by more than 12%.

In the year 2022’s January, another significant development took place when the OCC granted a national bank charter to SoFi. A month after that, the firm spent $22.3M to purchase Golden Pacific Bancorp (the platform that owns Sacramento-based Golden Pacific Bank). With the respective Acquisition, SoFi can keep loans to meet investment needs rather than exporting them to outside investors.

The respective thing further solidifies the platform’s status in the financial space. Firstly, SoFi implemented an exclusive lending model that was funded by alumni to connect recent graduates and students with institutional and alumni investors via loan funds that were school-centered. This approach guaranteed that investors received a financial return and borrowers gained decreased interest rates in comparison with those that the federal government offered.

To decrease defaults, the platform systematically aimed at low-risk graduates and students. Over time, SoFi enlarged its product package to include personal loans, mortgages, and mortgage refinancing. Hence, the firm left the alumni-funded model and adopted a non-conventional underwriting approach.

This exclusive strategy gave preference to lending instead of financially responsible people. Apart from the respective services, the platform now offers cash management accounts as well as an investment forum that features both robo-advisor and brokerage services. This further solidifies its status within the industry as this could help increase the stock market performance of SoFi.

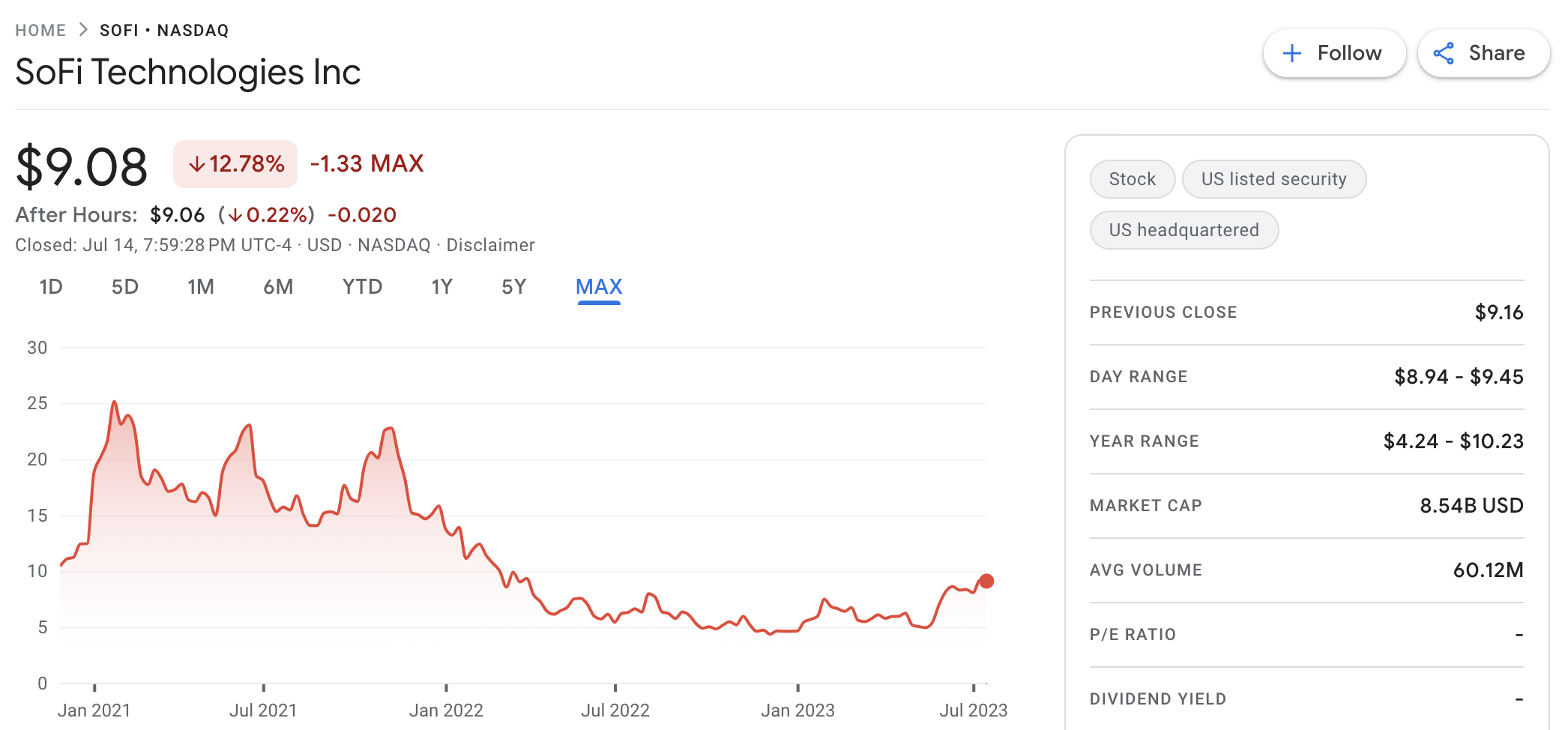

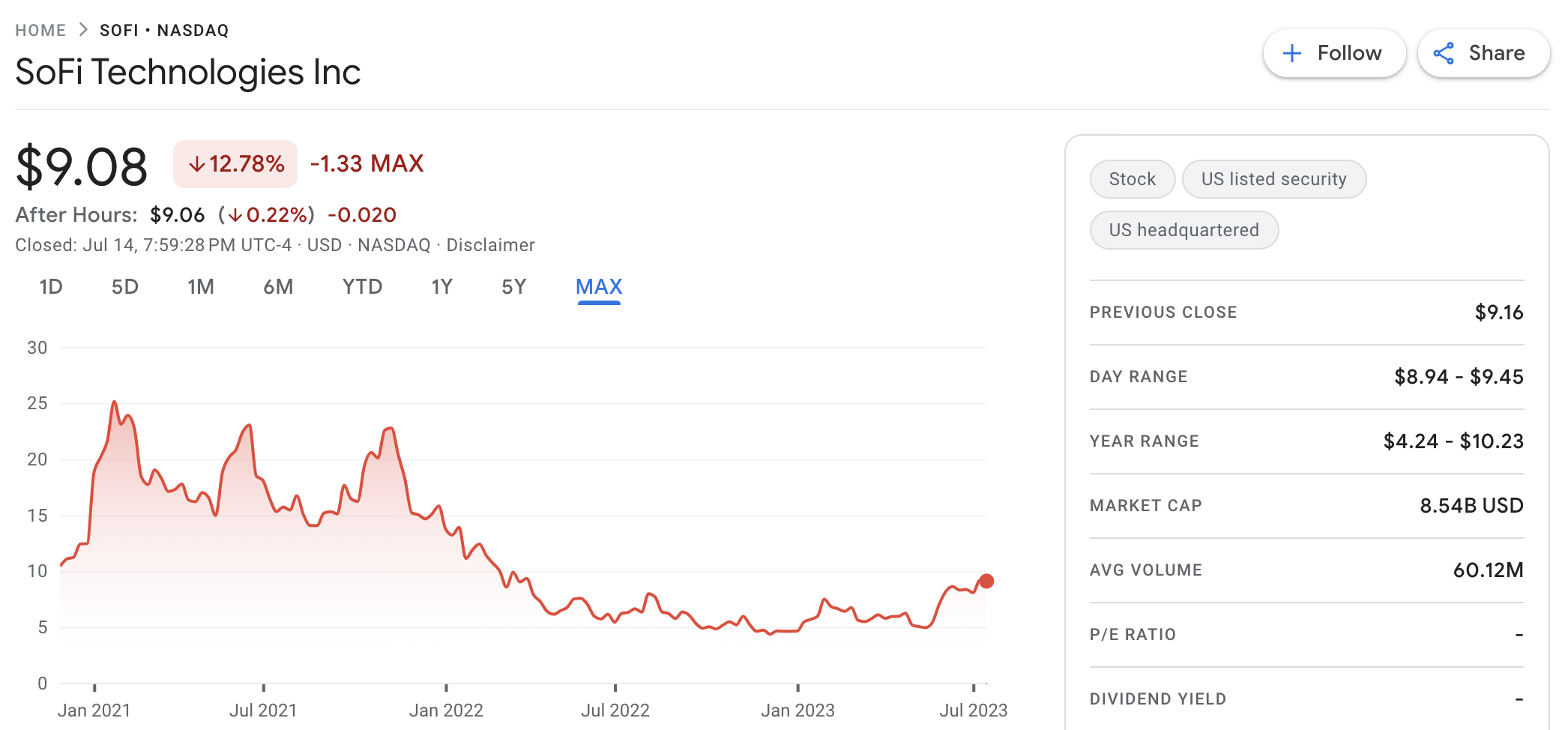

SoFi Stock Price Prediction: Price History

Financial modeling plays a significant role in the stock market and SoFi Technologies Inc. has witnessed considerable evolution in this genre. Financial technology has progressed to a great extent because of such projects. Along with this, the services like digital banking, peer-to-peer lending, and robo-advisory have revolutionized the financial space in addition to facilitating the common masses with fewer expenses and more benefits. SoFi’s online lending and personal finance have been categorized among the top platforms.

The historical data regarding SoFi’s stock points out that it went live on the 1st of June in 2021. The platform was then listed on Nasdaq with “SOFI” as its ticker symbol. The platform’s earliest valuation was nearly $9B. Its stock started trading at $22.65 on each share. After that, SoFi issued its initial earnings report while operating as a public firm on the 28th of June. The platform witnessed resilient results in the 1st quarter of 2021 with up to $216M in net revenue.

This displayed a huge year-on-year increase of approximately 151%. Then on the 12th of August, the earnings of the 2nd quarter pointed out that its revenue had a remarkable valuation of almost $237M in its revenue with a 101% year-on-year upsurge. Nonetheless, on January 14, 2022, the stock price of SOFI declined to $13.09. This showed a great drop of more than 40% since the price level of up to $22.76 which was witnessed on 15th November of 2021.

During the next months, the pandemic COVID-19 and other macroeconomic factors pushed the stock value of SOFI. As a result of that, the price even slumped below $5 in November 2022. During the beginning of the current year, the stock of SoFi remained to fluctuate around the above-mentioned price level. At the moment, SoFi’s stock price is standing at $5.02.

SoFi Stock Price Prediction: Price Analysis

Stock market trends, price fluctuations, and the economic indicators disclosed in the historical statistics of SoFi stock assist in market analysis. The price fluctuations witnessed by SOFI signify the market sentiment. The price analysis as well as the technical indicators make it easy to get an overall idea about the growth potential, long-term outlook, and even short-term outlook of stocks.

The fundamental analysis of SoFi stock brings to front that the current price of each stock share is $5.02. The current market capitalization of SoFi stocks is $4,460,073,761. Additionally, the latest 24-hour trading volume of SoFi stocks is nearly $44,765,945. The recent 24-hour high price level of SoFi stocks is placed at $5.2199. However, the recent 24-hour low price level is standing at $4.925.

The technical market analysis techniques bring to the front some significant things in line with analysts’ opinions. The sentiment analysis of SoFi stocks indicates that the current sentiment is bearish. On the other hand, the risk assessment says that the fear and greed index is placed at 39, showing “Fear.” An optimistic indicator says that SoFi stocks witnessed 16 days of positive development in the recent thirty days.

According to this, the stock value of SOFI experienced 53% progressive development over the last month. The volatility of the SoFi stocks has been nearly 6.52% during the previous 30 days. The 14-Day RSI of SOFI is currently placed at 48.32. SoFi’s 200-Day simple moving average (SMA) is now standing at $5.87. Nevertheless, the 50-Day SMA of the SoFi stocks points toward the $6.11 spot.

What is SoFi Technologies Inc.?SoFi Stock Price Prediction

Stock price forecast greatly relies on historical price movements and price analysis. Apart from that, the broad economic factors and the market trends also play a crucial role in this respect. Although price predictions are not meant to offer precise results about future price trends, they can provide an overview of the market scenario. Market prediction models are utilized for this procedure.

While keeping in view the stock analysis, market volatility, and the current condition of the stock market, it is disclosed that the SoFi stocks have a great potential to grow in value over the upcoming years. In addition to the increase in the stock valuation, investor sentiment about SoFi stocks will also spike with time.

SoFi Stock Price Prediction 2024

As an investment platform, SoFi Technologies Inc. has been effective in enduring the previous hard winds in the financial market. Its algorithmic trading has been quite facilitating for consumers. The use of artificial intelligence in finance is beneficial to perform financial forecasting. In the case of SoFi, the stock prices will reach $8.10 on average in the current year. However, favorable market conditions can even further elevate the price. As a result of this, the stock price of SOFI can even touch $11.90 this year.

SoFi Stock Price Prediction 2025

In quantitative finance, investment trends are very important in having a general idea about future price movements. Performing price predictions with the use of artificial intelligence in finance necessitates analysts to keep in view the market volatility. This factor can lead to positive results in the case of supportive indications.

The price prediction for SoFi stocks brings to the front that the possible average value will be nearly $14.90 by the year 2025. Also, some additional advancements are to be seen in the protocol of SoFi Technologies Inc. On the other hand, the increasing traction of the platform can also contribute to a substantial increase in price. Hence, the maximum price of the SoFi stocks is predicted to be around $26.80 by 2025.

SoFi Stock Price Prediction 2030

The long-term price outlook of the SoFi stocks is quite optimistic. It means that, due to the combination of a lot of factors contributing to the position of SoFi within the market, the platform’s valuation will spike in the coming years. A great role in this respect will be played by the increasing user base of the platform. By the year 2030, the price of SoFi stocks is predicted to reach $62 on average. On the other hand, the maximum price is expected to touch the price level of up to $80.

Conclusion

In line with the aforementioned historical data, analysis, as well as price forecasts, it is shown that SoFi stocks can offer a good investment option for the long term. Investors should keep an eye on the trading algorithms. They are advised to be proficient in risk management. While doing an investment, market volatility should be kept in mind. Investors should adopt adequate investment strategies for proper asset management. Suitable trading strategies and guidance from the experts can be beneficial in this respect. However, people who are not experienced and reluctant in making risky decisions should not consider this investment option.

FAQ

What is SoFi Technologies Inc.?

SoFi Technologies Inc., short for Social Finance, is a prominent fintech company based in San Francisco that started as a student loan refinancing platform in 2011. It now offers a wide range of financial services including personal and student loans, auto loan refinancing, mortgages, investing, and banking services, all accessible via desktop and mobile platforms.

How has SoFi’s stock price performed historically?

Since going public on June 1, 2021, with the ticker symbol SOFI, the stock opened at $22.65 per share. Despite initial gains, the stock price faced volatility, dropping to below $5 in November 2022 due to various macroeconomic factors and the COVID-19 pandemic.

What are the main financial services offered by SoFi?

SoFi offers a broad spectrum of financial services such as personal and student loan refinancing, mortgages, auto loans, investing solutions, and digital banking services. Their SoFi Money account provides features like zero account fees, cashback rewards, and high interest rates on savings.

What unique features does SoFi provide to its customers?

SoFi distinguishes itself by offering user-focused services that enhance financial management through technology and design. This includes powerful budgeting tools, responsive customer support, and an intuitive app that allows users to comprehensively manage their finances with ease.

Can you explain the significance of SoFi’s national bank charter?

In January 2022, SoFi was granted a national bank charter by the OCC, which allowed them to retain loans on their balance sheet rather than selling them to outside investors. This charter is a pivotal enhancement to their business model, allowing greater control over financial operations.

What are SoFi’s stock price predictions for the coming years?

According to various analyses, SoFi’s stock is expected to average around $8.10 in 2023 and could rise up to $11.90 under favorable conditions. By 2025, the stock price might average $14.90, with potential peaks around $26.80, and by 2030, it could reach an average of $62, possibly going up to $80.

What strategic acquisitions has SoFi made to expand its services?

In April 2020, SoFi acquired Galileo, a payments company, for approximately $1.2 billion. This acquisition is part of a broader strategy to integrate comprehensive payment systems into their financial services, enhancing their service offering.

What should potential investors consider before investing in SoFi stocks?

Potential investors should be aware of market volatility and the speculative nature of stock investments. They are advised to use effective risk management strategies and possibly seek expert advice. It’s also recommended to keep an updated on SoFi’s trading algorithms and market performance trends to make informed decisions.

SoFi Stock Price Prediction

Share:

- SoFi Technologies Inc: An Introduction

- SoFi’s Origin and Operations

- Vision and Growth of SoFi

- SoFi Stock Price Prediction: Price History

- SoFi Stock Price Prediction: Price Analysis

- What is SoFi Technologies Inc.?SoFi Stock Price Prediction

- SoFi Stock Price Prediction 2024

- SoFi Stock Price Prediction 2025

- SoFi Stock Price Prediction 2030

- Conclusion

- FAQ

SoFi Technologies Inc: An Introduction

The financial sector is getting evolved. Particularly, in the recent few years, several outstanding projects have revolutionized this sector. SoFi Technologies Inc. is categorized among the respective platforms. The worldwide financial space is advancing from conventional banking services to digital ones.

SoFi Technologies plays a significant role in this. The platform offers online services related to banking. The chief focus of the platform is to give preference to the user experience in addition to offering customized and suitable financial solutions to deal with the latest consumers. The platform is determined to carry out digital transformation, paving the way for redefining the banking landscape and personal finance online.

SoFi has an exclusive approach to financial management that combines the latest technology as well as consumer-centric design. This is focused on offering an intuitive experience for empowering customers to take complete control of their future in the financial world. The prioritization of user satisfaction and the endeavors to advance conventional banking models enable SoFi Technologies to establish exclusive standards. Nonetheless, the stock of SoFi has experienced a sharp slump in recent times. The platform is attempting to elevate its stocks above the crucial price hurdles.

SoFi’s Origin and Operations

SoFi Technologies Inc was founded back in 2011’s February. The full form of SoFi is Social Finance. The platform has witnessed enormous growth since its commencement as just a loan refinancing company for students. The firm made great progress to turn into a great platform providing financial services. With an innovative approach dealing with lending, investing, and banking, SoFi Technologies plays the role of a prominent fintech company operating in America.

It is also known as a digital platform offering digital banking with its headquarters based in San Francisco. It provides a broad array of services related to finance. These services take into account auto and student loan refinancing, banking services, investment options, credit cards, mortgages, and personal loans. It is accessible through desktop platforms and mobile apps. SoFi focuses on fulfilling a lot of requirements of the consumers. The SoFi Money account of the platform enables consumers to matchlessly administer their finances.

With it, they can leverage zero account charges, cashback rewards, and high-interest rates. The powerful budgeting instruments, responsive consumer support, and intuitive app guarantee that the customers have comprehensive control over their financial futures with convenience. The reports point out that SoFi has remained successful in attracting numerous consumers who are eager to be a part of the fintech revolution.

Vision and Growth of SoFi

SoFi’s founders envisioned the establishment of a company that would provide more economic substitutive options for the people pursuing financial support in terms of education. The pilot loan project of Sofi was conducted at Stanford University. The respective program marked the start of the platform’s vision. In that program, 40 alumni offered loans of up to $2M to approximately one hundred students. In this way, the $20,000 was given to each student on average.

Following that, in 2012’s September, the platform effectively collected $77.2M via a funding round. After that, on the 2nd of October of the next year, the platform declared that it had obtained up to $500M in terms of equity and debt for financing and refinancing the student loans. The funds contained up to $90M worth of equity while nearly $151M worth of debt. In addition to this, $200M was given by the bank members. the remaining amount was provided by community investors and alumni.

A few years after, in 2019’s September, the company obtained the Inglewood-based SoFi Stadium in California for twenty years. The respective contract with the Los Angeles Chargers and Los Angeles Rams of the NFL is worth an extraordinary $30M yearly. It sets an exclusive record within the case of naming rights in sports.

In 2020’s April, the company extended its reach with the acquisition of Galileo (a payments company based in Salt Lake City) for up to $1.2B worth in cash and stock. Then the platform went public. This was done as a result of a merger contract with a special purpose acquisition company (SPAC) in 2021. After the public listing, the cumulative valuation of SoFi elevated by more than 12%.

In the year 2022’s January, another significant development took place when the OCC granted a national bank charter to SoFi. A month after that, the firm spent $22.3M to purchase Golden Pacific Bancorp (the platform that owns Sacramento-based Golden Pacific Bank). With the respective Acquisition, SoFi can keep loans to meet investment needs rather than exporting them to outside investors.

The respective thing further solidifies the platform’s status in the financial space. Firstly, SoFi implemented an exclusive lending model that was funded by alumni to connect recent graduates and students with institutional and alumni investors via loan funds that were school-centered. This approach guaranteed that investors received a financial return and borrowers gained decreased interest rates in comparison with those that the federal government offered.

To decrease defaults, the platform systematically aimed at low-risk graduates and students. Over time, SoFi enlarged its product package to include personal loans, mortgages, and mortgage refinancing. Hence, the firm left the alumni-funded model and adopted a non-conventional underwriting approach.

This exclusive strategy gave preference to lending instead of financially responsible people. Apart from the respective services, the platform now offers cash management accounts as well as an investment forum that features both robo-advisor and brokerage services. This further solidifies its status within the industry as this could help increase the stock market performance of SoFi.

SoFi Stock Price Prediction: Price History

Financial modeling plays a significant role in the stock market and SoFi Technologies Inc. has witnessed considerable evolution in this genre. Financial technology has progressed to a great extent because of such projects. Along with this, the services like digital banking, peer-to-peer lending, and robo-advisory have revolutionized the financial space in addition to facilitating the common masses with fewer expenses and more benefits. SoFi’s online lending and personal finance have been categorized among the top platforms.

The historical data regarding SoFi’s stock points out that it went live on the 1st of June in 2021. The platform was then listed on Nasdaq with “SOFI” as its ticker symbol. The platform’s earliest valuation was nearly $9B. Its stock started trading at $22.65 on each share. After that, SoFi issued its initial earnings report while operating as a public firm on the 28th of June. The platform witnessed resilient results in the 1st quarter of 2021 with up to $216M in net revenue.

This displayed a huge year-on-year increase of approximately 151%. Then on the 12th of August, the earnings of the 2nd quarter pointed out that its revenue had a remarkable valuation of almost $237M in its revenue with a 101% year-on-year upsurge. Nonetheless, on January 14, 2022, the stock price of SOFI declined to $13.09. This showed a great drop of more than 40% since the price level of up to $22.76 which was witnessed on 15th November of 2021.

During the next months, the pandemic COVID-19 and other macroeconomic factors pushed the stock value of SOFI. As a result of that, the price even slumped below $5 in November 2022. During the beginning of the current year, the stock of SoFi remained to fluctuate around the above-mentioned price level. At the moment, SoFi’s stock price is standing at $5.02.

SoFi Stock Price Prediction: Price Analysis

Stock market trends, price fluctuations, and the economic indicators disclosed in the historical statistics of SoFi stock assist in market analysis. The price fluctuations witnessed by SOFI signify the market sentiment. The price analysis as well as the technical indicators make it easy to get an overall idea about the growth potential, long-term outlook, and even short-term outlook of stocks.

The fundamental analysis of SoFi stock brings to front that the current price of each stock share is $5.02. The current market capitalization of SoFi stocks is $4,460,073,761. Additionally, the latest 24-hour trading volume of SoFi stocks is nearly $44,765,945. The recent 24-hour high price level of SoFi stocks is placed at $5.2199. However, the recent 24-hour low price level is standing at $4.925.

The technical market analysis techniques bring to the front some significant things in line with analysts’ opinions. The sentiment analysis of SoFi stocks indicates that the current sentiment is bearish. On the other hand, the risk assessment says that the fear and greed index is placed at 39, showing “Fear.” An optimistic indicator says that SoFi stocks witnessed 16 days of positive development in the recent thirty days.

According to this, the stock value of SOFI experienced 53% progressive development over the last month. The volatility of the SoFi stocks has been nearly 6.52% during the previous 30 days. The 14-Day RSI of SOFI is currently placed at 48.32. SoFi’s 200-Day simple moving average (SMA) is now standing at $5.87. Nevertheless, the 50-Day SMA of the SoFi stocks points toward the $6.11 spot.

What is SoFi Technologies Inc.?SoFi Stock Price Prediction

Stock price forecast greatly relies on historical price movements and price analysis. Apart from that, the broad economic factors and the market trends also play a crucial role in this respect. Although price predictions are not meant to offer precise results about future price trends, they can provide an overview of the market scenario. Market prediction models are utilized for this procedure.

While keeping in view the stock analysis, market volatility, and the current condition of the stock market, it is disclosed that the SoFi stocks have a great potential to grow in value over the upcoming years. In addition to the increase in the stock valuation, investor sentiment about SoFi stocks will also spike with time.

SoFi Stock Price Prediction 2024

As an investment platform, SoFi Technologies Inc. has been effective in enduring the previous hard winds in the financial market. Its algorithmic trading has been quite facilitating for consumers. The use of artificial intelligence in finance is beneficial to perform financial forecasting. In the case of SoFi, the stock prices will reach $8.10 on average in the current year. However, favorable market conditions can even further elevate the price. As a result of this, the stock price of SOFI can even touch $11.90 this year.

SoFi Stock Price Prediction 2025

In quantitative finance, investment trends are very important in having a general idea about future price movements. Performing price predictions with the use of artificial intelligence in finance necessitates analysts to keep in view the market volatility. This factor can lead to positive results in the case of supportive indications.

The price prediction for SoFi stocks brings to the front that the possible average value will be nearly $14.90 by the year 2025. Also, some additional advancements are to be seen in the protocol of SoFi Technologies Inc. On the other hand, the increasing traction of the platform can also contribute to a substantial increase in price. Hence, the maximum price of the SoFi stocks is predicted to be around $26.80 by 2025.

SoFi Stock Price Prediction 2030

The long-term price outlook of the SoFi stocks is quite optimistic. It means that, due to the combination of a lot of factors contributing to the position of SoFi within the market, the platform’s valuation will spike in the coming years. A great role in this respect will be played by the increasing user base of the platform. By the year 2030, the price of SoFi stocks is predicted to reach $62 on average. On the other hand, the maximum price is expected to touch the price level of up to $80.

Conclusion

In line with the aforementioned historical data, analysis, as well as price forecasts, it is shown that SoFi stocks can offer a good investment option for the long term. Investors should keep an eye on the trading algorithms. They are advised to be proficient in risk management. While doing an investment, market volatility should be kept in mind. Investors should adopt adequate investment strategies for proper asset management. Suitable trading strategies and guidance from the experts can be beneficial in this respect. However, people who are not experienced and reluctant in making risky decisions should not consider this investment option.

FAQ

What is SoFi Technologies Inc.?

SoFi Technologies Inc., short for Social Finance, is a prominent fintech company based in San Francisco that started as a student loan refinancing platform in 2011. It now offers a wide range of financial services including personal and student loans, auto loan refinancing, mortgages, investing, and banking services, all accessible via desktop and mobile platforms.

How has SoFi’s stock price performed historically?

Since going public on June 1, 2021, with the ticker symbol SOFI, the stock opened at $22.65 per share. Despite initial gains, the stock price faced volatility, dropping to below $5 in November 2022 due to various macroeconomic factors and the COVID-19 pandemic.

What are the main financial services offered by SoFi?

SoFi offers a broad spectrum of financial services such as personal and student loan refinancing, mortgages, auto loans, investing solutions, and digital banking services. Their SoFi Money account provides features like zero account fees, cashback rewards, and high interest rates on savings.

What unique features does SoFi provide to its customers?

SoFi distinguishes itself by offering user-focused services that enhance financial management through technology and design. This includes powerful budgeting tools, responsive customer support, and an intuitive app that allows users to comprehensively manage their finances with ease.

Can you explain the significance of SoFi’s national bank charter?

In January 2022, SoFi was granted a national bank charter by the OCC, which allowed them to retain loans on their balance sheet rather than selling them to outside investors. This charter is a pivotal enhancement to their business model, allowing greater control over financial operations.

What are SoFi’s stock price predictions for the coming years?

According to various analyses, SoFi’s stock is expected to average around $8.10 in 2023 and could rise up to $11.90 under favorable conditions. By 2025, the stock price might average $14.90, with potential peaks around $26.80, and by 2030, it could reach an average of $62, possibly going up to $80.

What strategic acquisitions has SoFi made to expand its services?

In April 2020, SoFi acquired Galileo, a payments company, for approximately $1.2 billion. This acquisition is part of a broader strategy to integrate comprehensive payment systems into their financial services, enhancing their service offering.

What should potential investors consider before investing in SoFi stocks?

Potential investors should be aware of market volatility and the speculative nature of stock investments. They are advised to use effective risk management strategies and possibly seek expert advice. It’s also recommended to keep an updated on SoFi’s trading algorithms and market performance trends to make informed decisions.