Nvidia (NVDA) Jumps On Tariff Pause, US Shift: Is Stock $200 Bound?

Share:

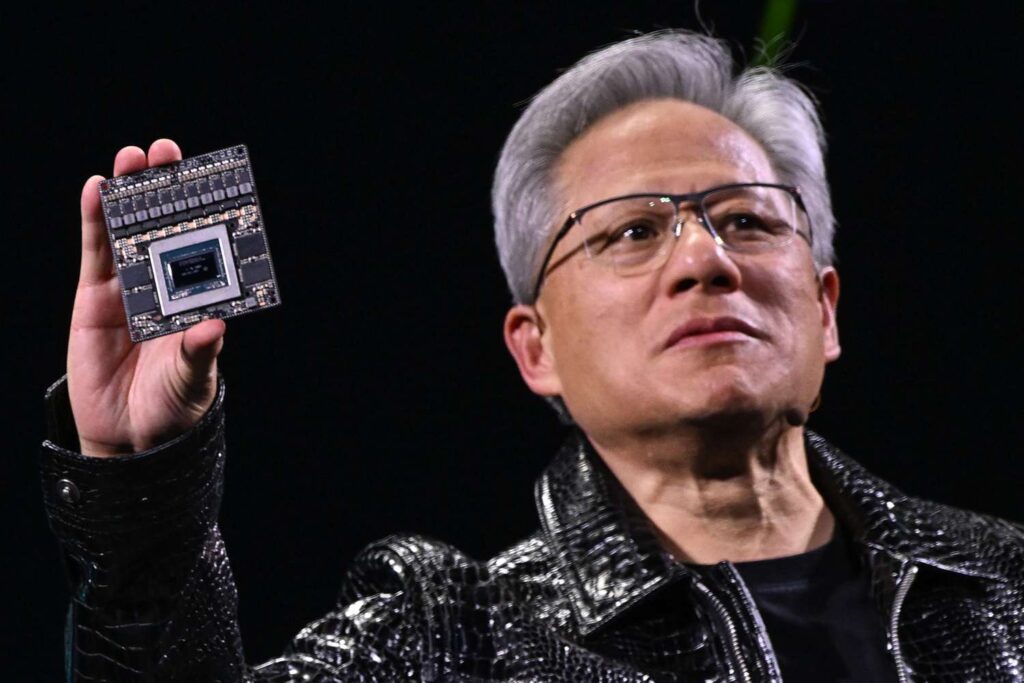

It has been a rather volatile year for the US stock market as a whole in 2025. Indeed, the country is facing increased economic uncertainty with aggressive economic policy defining a host industry. Some of the hardest hit have been big tech stocks, although one may be turning around. Indeed, Nvidia (NVDA) has jumped on a recent tariff pause and US shift, as traders ponder if shares are bound for $200 this year.

The company was a key part of the nation’s recent decision to pardon some tech industries from the United States Liberation Day tariff plan. Although the stock is down for Monday, it showed signs of life early. Moreover, the recent decision to invest heavily in the country could save it from continued volatility for the short-term future.

Also Read: Nvidia (NVDA) to Manufacture AI Supercomputers in US

Nvidia Set to Shift US Production as Stock Eyes Return to 2024 Levels

Nvidia (NVDA) is a far cry from the 174% jump it made throughout last year in 2025. Indeed, the AI chipmaker is down more than 20% year to date. However, it had shown signs of life as we approached the midpoint of the year. Moreover, over the last five days, the stock is up almost 13%.

The question is, just where does the company go from here as far as its investment sentiment? With Nvidia benefiting from a recent US tariff pause and shifting its manufacturing toward the country, the stock may just be bound for $200.

Also Read: Nvidia (NVDA) Citi Cuts Price Target to $150: Here’s Why

US President Donald Trump recently announced that the semiconductor industry is set to benefit from a tariff exemption. Although the inconsistent economic policy is still a cause of concern, the reprieve is helpful. Moreover, they doubled down on the United States, announcing that they are eyeing a $500 billion investment over the next four years.

All of that sounds incredibly promising, but the stock is still beholden to a struggling market. Macroeconomic factors abound, and the economic fragility is undeniable. Still, shares have a media price target of $175, according to CNN data. Moreover, its heightened projection sits at $235, showcasing upside of more than 113%.

If the market can turn things around, Nvidia is a strong contender to outperform its median target. Moreover, if the US economy can find a way to strengthen, its recent announcement should boost the stock toward the $200 mark.

Read More

Nvidia (NVDA) Jumps On Tariff Pause, US Shift: Is Stock $200 Bound?

Share:

It has been a rather volatile year for the US stock market as a whole in 2025. Indeed, the country is facing increased economic uncertainty with aggressive economic policy defining a host industry. Some of the hardest hit have been big tech stocks, although one may be turning around. Indeed, Nvidia (NVDA) has jumped on a recent tariff pause and US shift, as traders ponder if shares are bound for $200 this year.

The company was a key part of the nation’s recent decision to pardon some tech industries from the United States Liberation Day tariff plan. Although the stock is down for Monday, it showed signs of life early. Moreover, the recent decision to invest heavily in the country could save it from continued volatility for the short-term future.

Also Read: Nvidia (NVDA) to Manufacture AI Supercomputers in US

Nvidia Set to Shift US Production as Stock Eyes Return to 2024 Levels

Nvidia (NVDA) is a far cry from the 174% jump it made throughout last year in 2025. Indeed, the AI chipmaker is down more than 20% year to date. However, it had shown signs of life as we approached the midpoint of the year. Moreover, over the last five days, the stock is up almost 13%.

The question is, just where does the company go from here as far as its investment sentiment? With Nvidia benefiting from a recent US tariff pause and shifting its manufacturing toward the country, the stock may just be bound for $200.

Also Read: Nvidia (NVDA) Citi Cuts Price Target to $150: Here’s Why

US President Donald Trump recently announced that the semiconductor industry is set to benefit from a tariff exemption. Although the inconsistent economic policy is still a cause of concern, the reprieve is helpful. Moreover, they doubled down on the United States, announcing that they are eyeing a $500 billion investment over the next four years.

All of that sounds incredibly promising, but the stock is still beholden to a struggling market. Macroeconomic factors abound, and the economic fragility is undeniable. Still, shares have a media price target of $175, according to CNN data. Moreover, its heightened projection sits at $235, showcasing upside of more than 113%.

If the market can turn things around, Nvidia is a strong contender to outperform its median target. Moreover, if the US economy can find a way to strengthen, its recent announcement should boost the stock toward the $200 mark.

Read More