XRP Battles to Hold $2.74 as Bearish Pressure Mounts

- XRP is defending $2.74, but both spot and futures CVD show strong sell dominance.

- Open Interest has been sliding, reflecting bearish sentiment among speculators.

- Only the drop in leverage offers relief—no major liquidation risk yet, but downside still looms.

Ripple’s XRP is hanging on to the $2.74 support level for now, but the mood across the broader market is shaky, and that could easily drag it into a deeper bearish phase.

For weeks, spot and futures taker CVD data have been flashing red, signaling sellers are firmly in control. What makes things more complicated is the fact that CME Open Interest recently hit a fresh record—normally a bullish sign—but so far, that optimism hasn’t shown up on the charts.

Analysts also pointed to the cost basis heatmap, which placed $2.8 as a major level to watch. If bulls can’t defend this zone, the road could open toward $2.4 next.

A Fragile Structure

On the 12-hour chart, the August low at $2.74 is the line in the sand. Lose it, and XRP risks sliding further down. The Money Flow Index (MFI) has been declining, underlining weakening demand, while structure on that timeframe leans bearish. Most indicators are pretty much agreeing with that outlook right now.

Adding to the pressure, Bitcoin’s recent dip under $110K has weighed on sentiment. If BTC stumbles further, it’s hard to see XRP holding strong in isolation.

Spot and Futures Point to Sell Pressure

Looking at the spot market, the taker CVD (90-day delta) has been negative since late July. During that same time, XRP kept failing to crack $3.4—a resistance level sitting just under July’s all-time high at $3.65.

That persistent negative CVD plus falling volume tells us this is a sell-dominant environment. Until that changes, buyers are unlikely to flip the trend back in their favor.

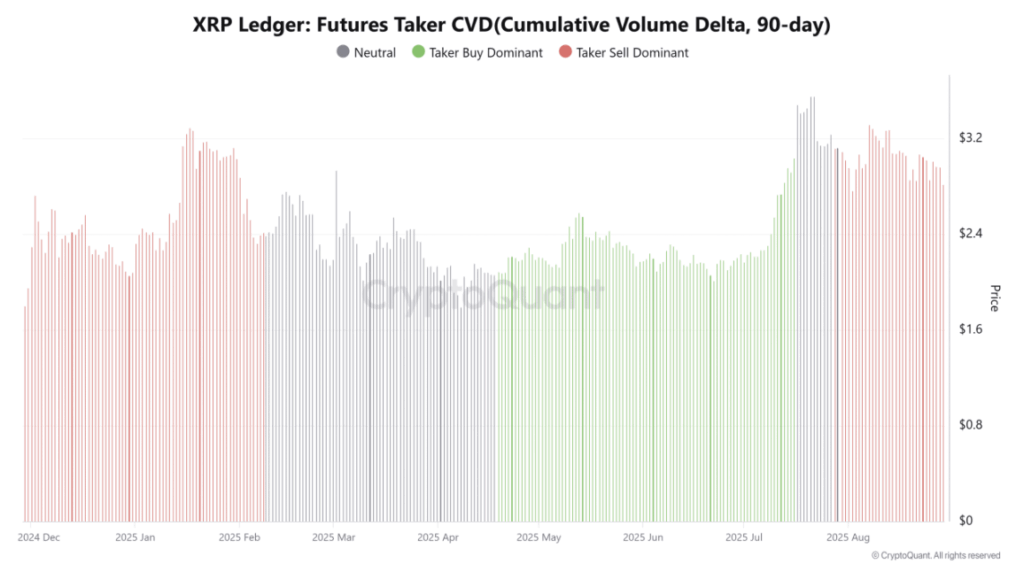

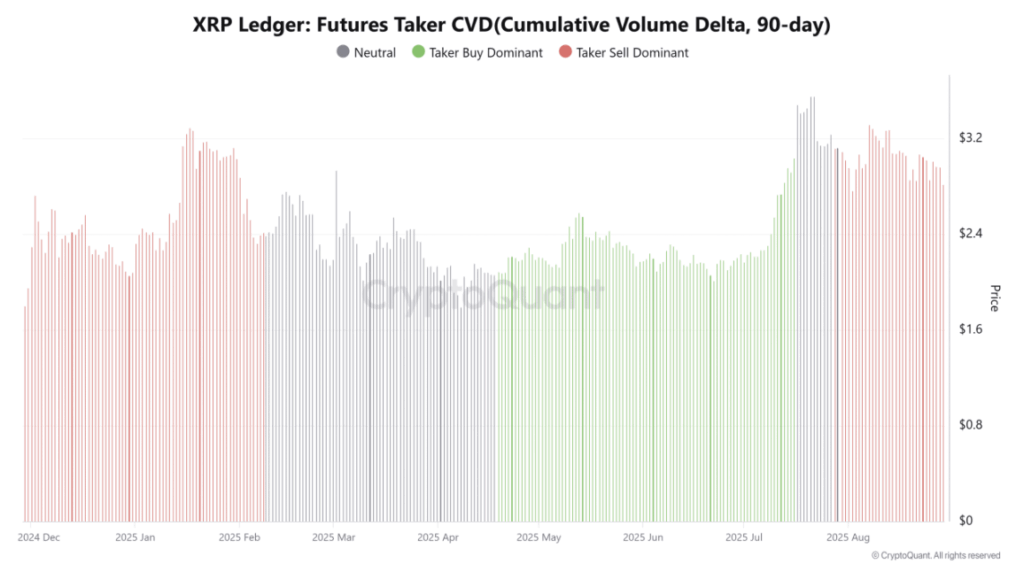

The futures market isn’t painting a prettier picture either. Taker CVD there has also been negative for weeks, and Open Interest has trended downward since the end of July. Over the last two weeks especially, OI has thinned out, suggesting traders are closing positions rather than betting on new upside.

One Slight Positive

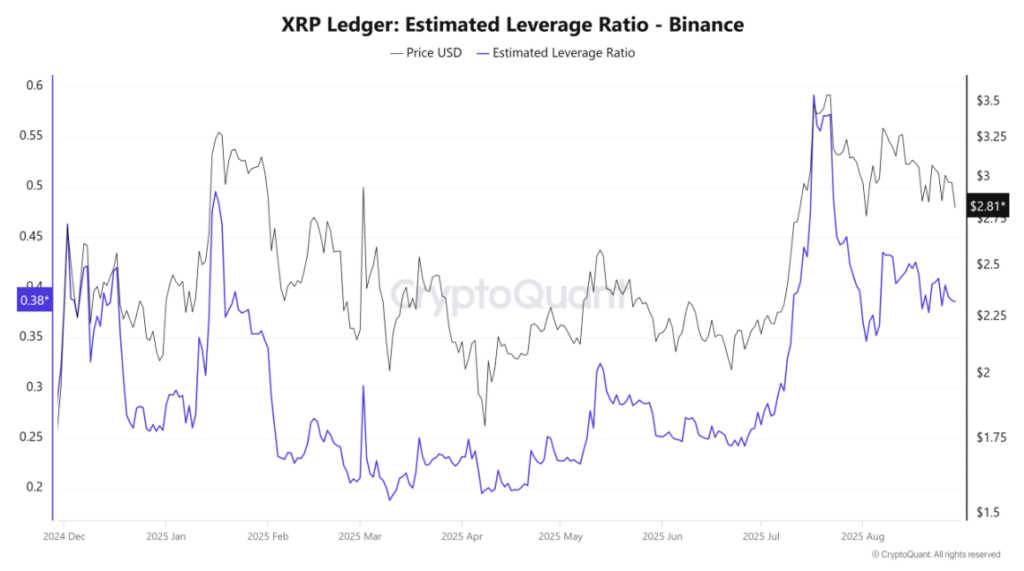

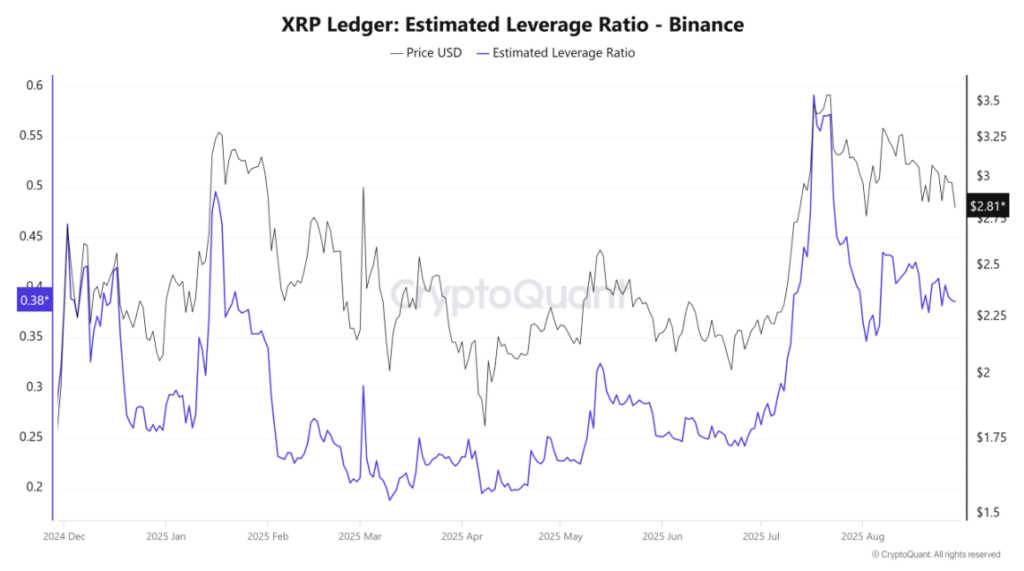

The Estimated Leverage Ratio (ELR) has been dropping, which at least means the market isn’t dangerously overleveraged. In plain words: even if things turn south, the odds of a massive liquidation cascade look low.

Still, the overall picture remains tilted bearish. As long as XRP stays above $2.74 and the backup support at $2.60, bulls can argue the structure isn’t completely broken. But if those levels give way, the sell-dominant phase could get uglier in a hurry.

The post XRP Battles to Hold $2.74 as Bearish Pressure Mounts first appeared on BlockNews.

XRP Battles to Hold $2.74 as Bearish Pressure Mounts

- XRP is defending $2.74, but both spot and futures CVD show strong sell dominance.

- Open Interest has been sliding, reflecting bearish sentiment among speculators.

- Only the drop in leverage offers relief—no major liquidation risk yet, but downside still looms.

Ripple’s XRP is hanging on to the $2.74 support level for now, but the mood across the broader market is shaky, and that could easily drag it into a deeper bearish phase.

For weeks, spot and futures taker CVD data have been flashing red, signaling sellers are firmly in control. What makes things more complicated is the fact that CME Open Interest recently hit a fresh record—normally a bullish sign—but so far, that optimism hasn’t shown up on the charts.

Analysts also pointed to the cost basis heatmap, which placed $2.8 as a major level to watch. If bulls can’t defend this zone, the road could open toward $2.4 next.

A Fragile Structure

On the 12-hour chart, the August low at $2.74 is the line in the sand. Lose it, and XRP risks sliding further down. The Money Flow Index (MFI) has been declining, underlining weakening demand, while structure on that timeframe leans bearish. Most indicators are pretty much agreeing with that outlook right now.

Adding to the pressure, Bitcoin’s recent dip under $110K has weighed on sentiment. If BTC stumbles further, it’s hard to see XRP holding strong in isolation.

Spot and Futures Point to Sell Pressure

Looking at the spot market, the taker CVD (90-day delta) has been negative since late July. During that same time, XRP kept failing to crack $3.4—a resistance level sitting just under July’s all-time high at $3.65.

That persistent negative CVD plus falling volume tells us this is a sell-dominant environment. Until that changes, buyers are unlikely to flip the trend back in their favor.

The futures market isn’t painting a prettier picture either. Taker CVD there has also been negative for weeks, and Open Interest has trended downward since the end of July. Over the last two weeks especially, OI has thinned out, suggesting traders are closing positions rather than betting on new upside.

One Slight Positive

The Estimated Leverage Ratio (ELR) has been dropping, which at least means the market isn’t dangerously overleveraged. In plain words: even if things turn south, the odds of a massive liquidation cascade look low.

Still, the overall picture remains tilted bearish. As long as XRP stays above $2.74 and the backup support at $2.60, bulls can argue the structure isn’t completely broken. But if those levels give way, the sell-dominant phase could get uglier in a hurry.

The post XRP Battles to Hold $2.74 as Bearish Pressure Mounts first appeared on BlockNews.