De-dollarization: SCO Nations Shift 92% of Trade Away from U.S. Dollar

Share:

De-dollarization is accelerating dramatically right now as Shanghai Cooperation Organization members are reducing their United States dollar dependency in international trade. SCO nations have also successfully implemented currency substitution strategies, with Russia reporting that national currencies now account for over 92% of trade settlements with fellow member states, and this marks a historic shift away from dollar-dominated global commerce.

Russian President Vladimir Putin stated:

“Our countries are increasing the use of national currencies in mutual settlements. For example, their share in Russia’s commercial transactions with members of the organization has already exceeded 92% in the first four months of this year.”

Also Read: De-Dollarization: 9 Countries Ditch the US Dollar

How SCO Nations, BRICS, and Currency Substitution Are Driving De-dollarization Trends

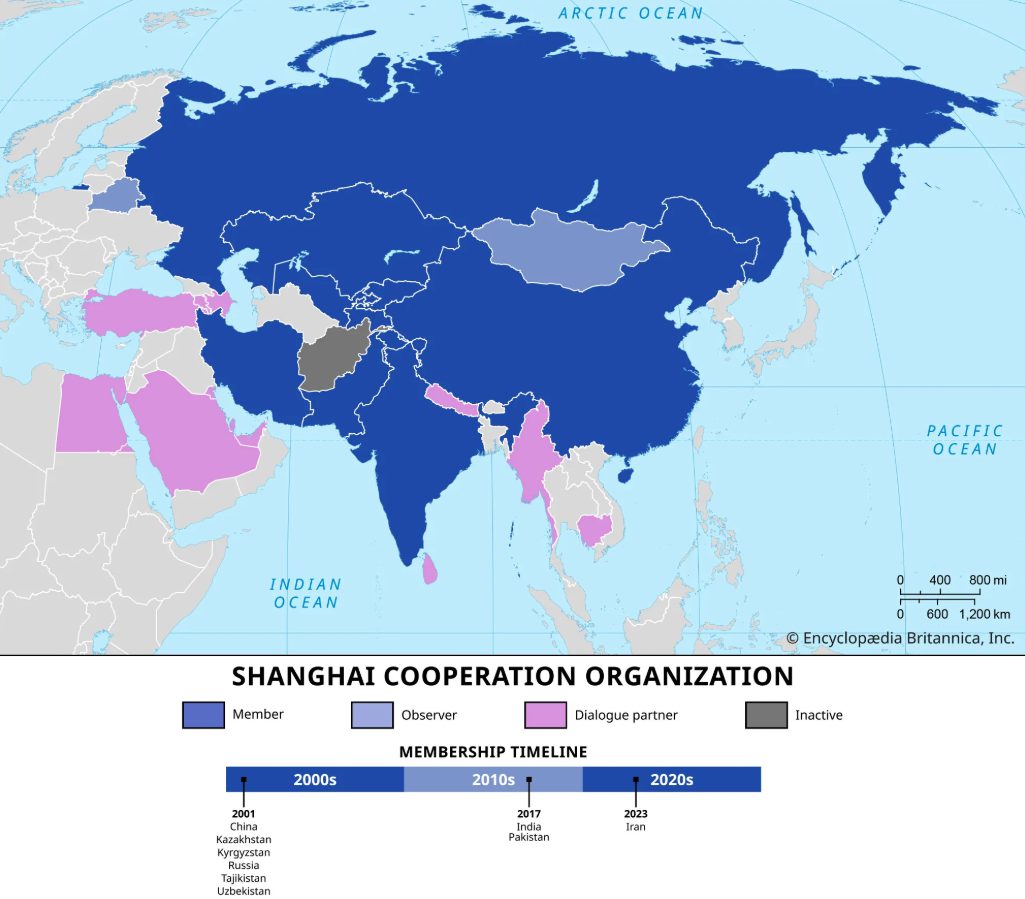

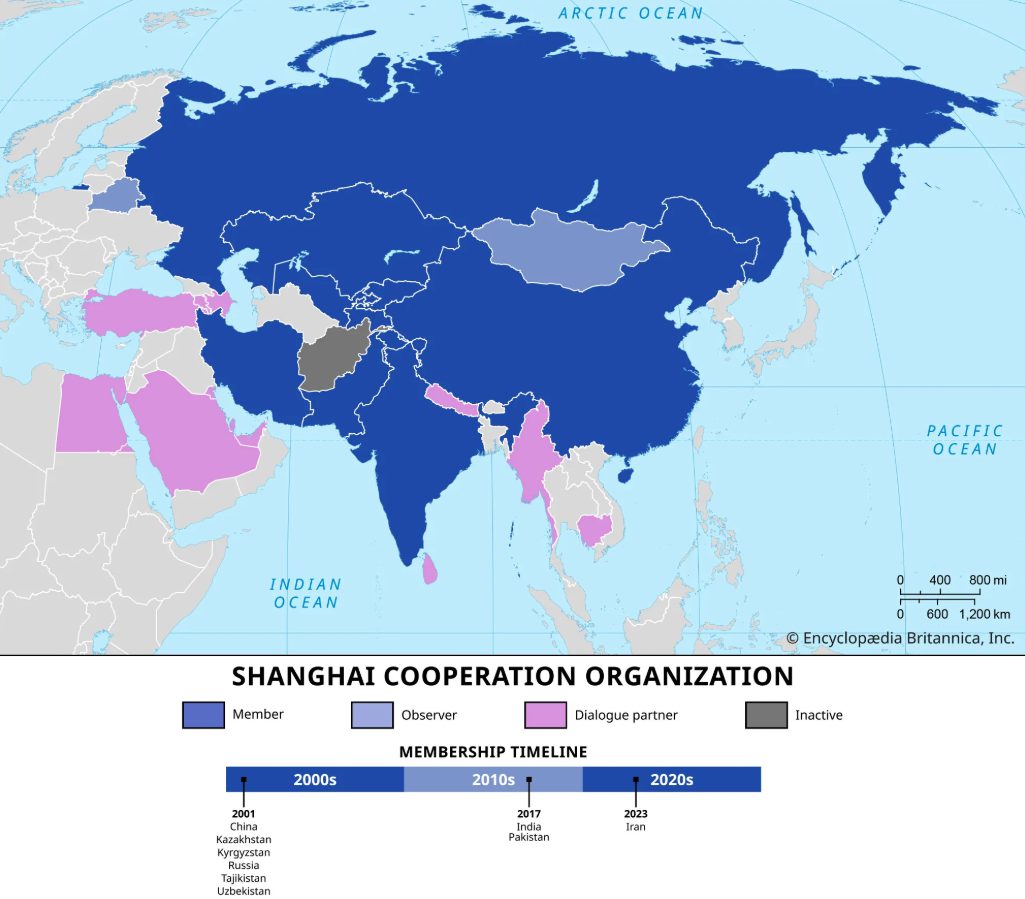

The Shanghai Cooperation Organization’s coordinated approach to de-dollarization represents a fundamental shift in global financial architecture right now. This massive economic bloc, which encompasses China, Russia, India, Pakistan, Iran, Kazakhstan, Kyrgyzstan, Tajikistan, and also Uzbekistan, controls approximately 42% of the world’s population and represents significant economic power that’s driving currency substitution initiatives across the region.

Putin also noted the broader economic success of SCO nations:

“The average GDP growth of the member countries of our organization last year amounted to more than 5%, industrial production to 4.5%, while the inflation rate is only 2.4%. At the same time, Russia’s trade with the SCO states has increased by a quarter.”

Also Read: 50 Countries Eye De-Dollarization & Reduce US Dollar Dependency

SCO’s Strategic De-dollarization Implementation

The de-dollarization movement within SCO represents more than just statistical changes—it also reflects systematic policy coordination among member nations at the time of writing. Putin emphasized Russia’s commitment to expanding non-dollar payment mechanisms, and he’s proposing an independent SCO settlement system that would further reduce United States dollar dependency.

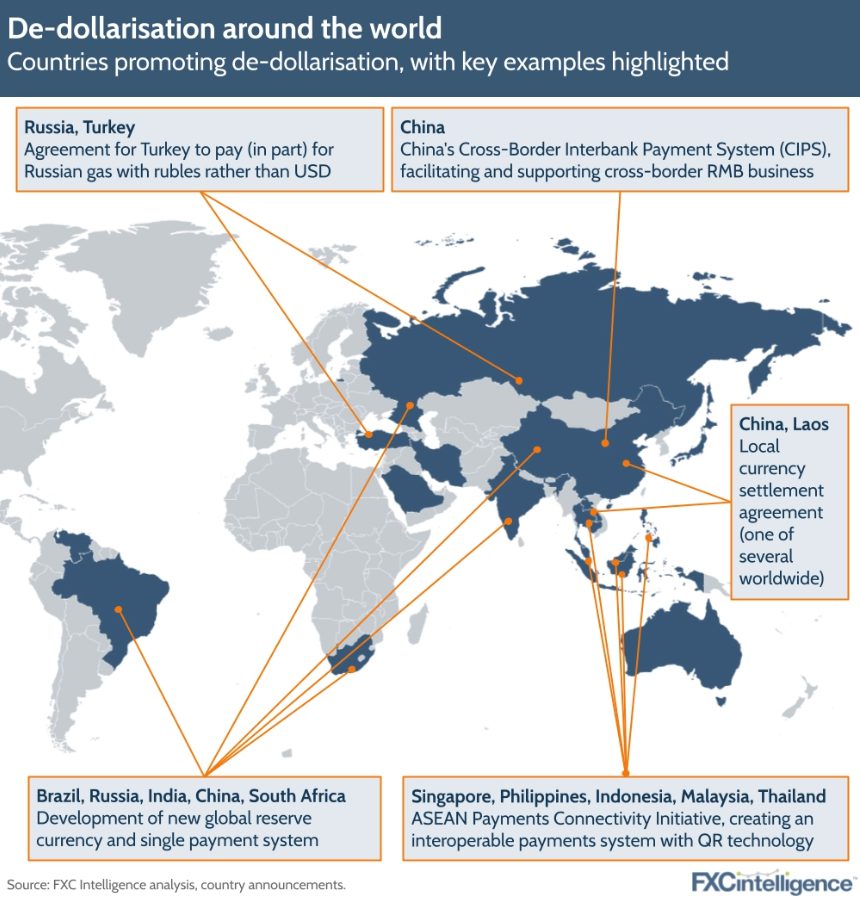

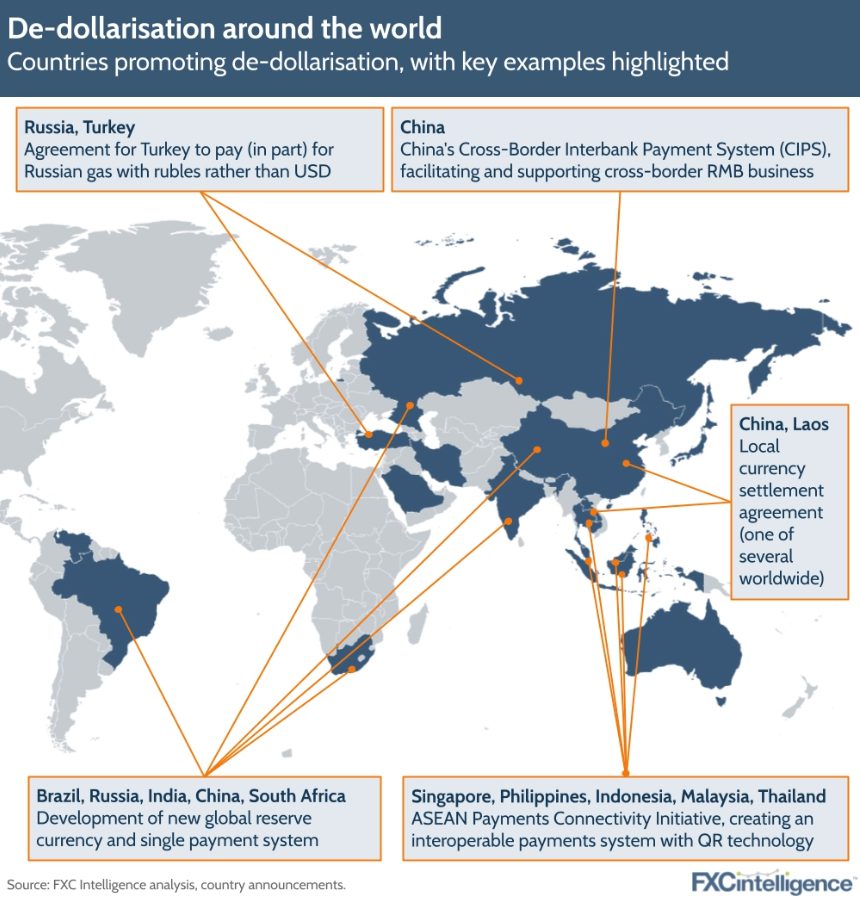

BRICS nations are working closely with SCO countries to implement currency substitution across multiple economic sectors right now. China’s yuan has emerged as a primary alternative currency, while bilateral trade agreements are increasingly favoring national currencies over traditional dollar-denominated transactions, and this trend is gaining momentum.

Also Read: De-Dollarization: 6 Global Alliances Race to Ditch the US Dollar

BRICS and Currency Substitution Drive Global Change

The coordination between SCO nations and also BRICS members amplifies de-dollarization effects globally. These interconnected economic blocs represent countries that are seeking financial sovereignty through currency substitution, and they’re reducing exposure to United States dollar volatility and potential sanctions.

Putin highlighted the strategic importance of this transition:

“Regular meetings of economy and finance ministers and governors of central banks made a weighty contribution to the development of trade and investment in the SCO.”

Oil-producing nations that were traditionally tied to petrodollar systems are now exploring alternatives. Saudi Arabia’s openness to yuan-denominated oil transactions with China exemplifies how even traditional dollar allies are considering currency substitution options right now.

Also Read: De-dollarization Surges—This Major Economy Drops the U.S. Dollar

Since almost all of the trade settlements within the SCO avoid the dollar, this achievement shows that large-scale de-dollarization works well. This action by leading economies is now challenging the United States dollar’s long-standing place in global trade and it may play a major role in reshaping financial systems over the next few decades.

De-dollarization: SCO Nations Shift 92% of Trade Away from U.S. Dollar

Share:

De-dollarization is accelerating dramatically right now as Shanghai Cooperation Organization members are reducing their United States dollar dependency in international trade. SCO nations have also successfully implemented currency substitution strategies, with Russia reporting that national currencies now account for over 92% of trade settlements with fellow member states, and this marks a historic shift away from dollar-dominated global commerce.

Russian President Vladimir Putin stated:

“Our countries are increasing the use of national currencies in mutual settlements. For example, their share in Russia’s commercial transactions with members of the organization has already exceeded 92% in the first four months of this year.”

Also Read: De-Dollarization: 9 Countries Ditch the US Dollar

How SCO Nations, BRICS, and Currency Substitution Are Driving De-dollarization Trends

The Shanghai Cooperation Organization’s coordinated approach to de-dollarization represents a fundamental shift in global financial architecture right now. This massive economic bloc, which encompasses China, Russia, India, Pakistan, Iran, Kazakhstan, Kyrgyzstan, Tajikistan, and also Uzbekistan, controls approximately 42% of the world’s population and represents significant economic power that’s driving currency substitution initiatives across the region.

Putin also noted the broader economic success of SCO nations:

“The average GDP growth of the member countries of our organization last year amounted to more than 5%, industrial production to 4.5%, while the inflation rate is only 2.4%. At the same time, Russia’s trade with the SCO states has increased by a quarter.”

Also Read: 50 Countries Eye De-Dollarization & Reduce US Dollar Dependency

SCO’s Strategic De-dollarization Implementation

The de-dollarization movement within SCO represents more than just statistical changes—it also reflects systematic policy coordination among member nations at the time of writing. Putin emphasized Russia’s commitment to expanding non-dollar payment mechanisms, and he’s proposing an independent SCO settlement system that would further reduce United States dollar dependency.

BRICS nations are working closely with SCO countries to implement currency substitution across multiple economic sectors right now. China’s yuan has emerged as a primary alternative currency, while bilateral trade agreements are increasingly favoring national currencies over traditional dollar-denominated transactions, and this trend is gaining momentum.

Also Read: De-Dollarization: 6 Global Alliances Race to Ditch the US Dollar

BRICS and Currency Substitution Drive Global Change

The coordination between SCO nations and also BRICS members amplifies de-dollarization effects globally. These interconnected economic blocs represent countries that are seeking financial sovereignty through currency substitution, and they’re reducing exposure to United States dollar volatility and potential sanctions.

Putin highlighted the strategic importance of this transition:

“Regular meetings of economy and finance ministers and governors of central banks made a weighty contribution to the development of trade and investment in the SCO.”

Oil-producing nations that were traditionally tied to petrodollar systems are now exploring alternatives. Saudi Arabia’s openness to yuan-denominated oil transactions with China exemplifies how even traditional dollar allies are considering currency substitution options right now.

Also Read: De-dollarization Surges—This Major Economy Drops the U.S. Dollar

Since almost all of the trade settlements within the SCO avoid the dollar, this achievement shows that large-scale de-dollarization works well. This action by leading economies is now challenging the United States dollar’s long-standing place in global trade and it may play a major role in reshaping financial systems over the next few decades.