Celsius’s bankruptcy-induced liquidation plans could pressure overall crypto market: Kaiko

Bankrupt lender Celsius’s plan to liquidate its altcoins for Bitcoin (BTC) and Ethereum (ETH) could exert more pressure on the crypto market, according to a July 10 report from blockchain analytical firm Kaiko.

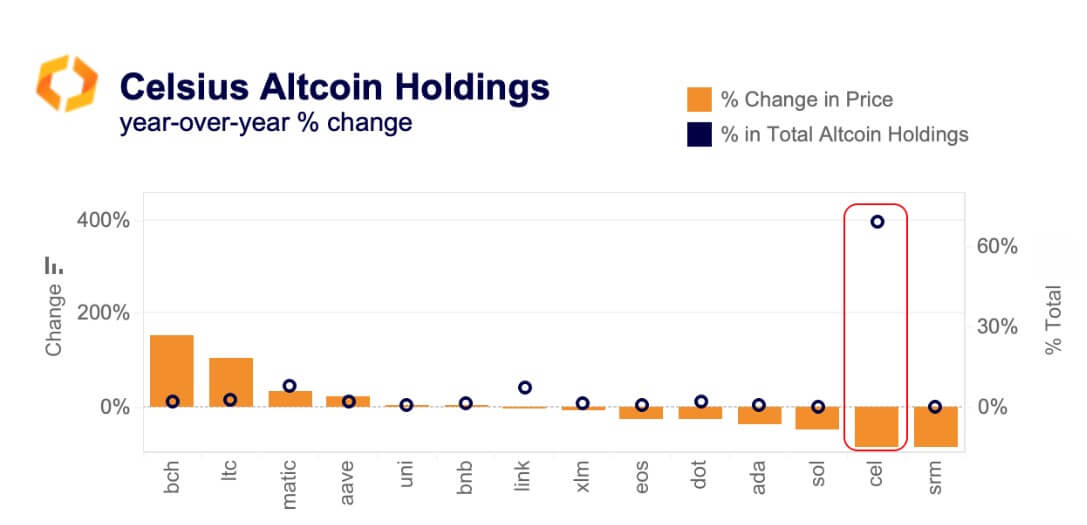

Kaiko noted that most altcoins held by Celsius had recorded significant drops, ranging from 6% to as high as 84%, in their liquidity over the past year.

“The aggregated market depth for Celsius’ altcoin holdings has declined by 40% since 2022, totalling around $90mn in early July.”

Per the chart below, only Litecoin (LTC), Bitcoin Cash (BCH), Polygon (MATIC), and Aave (AAVE) saw pronounced changes in their liquidity situations over the past year, while others mostly declined.

BCH and LTC, in particular, saw a surge in their liquidity situation after EDX, a crypto exchange backed by traditional financial institutions, enabled support in June.

The crypto company further noted that Celsius’s total altcoin holding exceeded $90 million, “which means it will be difficult for the company to liquidate without incurring high price slippage.” It added:

“More than 60% of altcoin market depth is concentrated on Binance and other off-shore exchanges while 30% is on U.S. exchanges.”

CEL token liquidity is almost non-existent

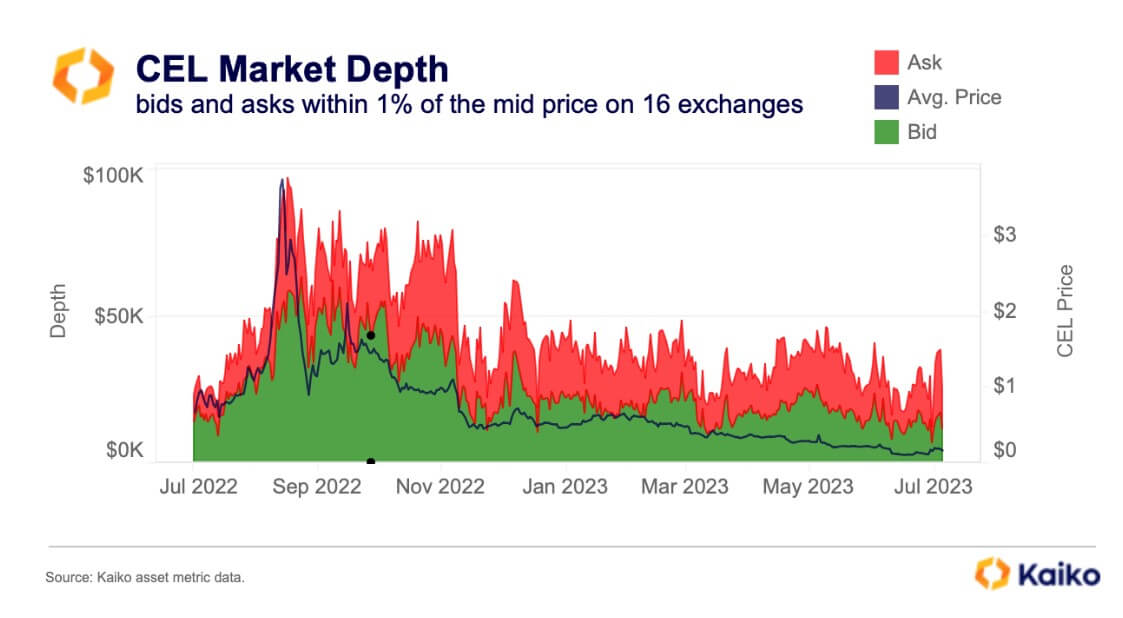

According to Kaiko, Celsius faces a problem as there is almost no liquidity for its most significant altcoin holding, CEL.

CEL is Celsius’s native token, accounting for nearly 65% of the bankrupt firm’s total altcoin holdings.

“There is virtually no liquidity for CEL as measured by market depth, which has collapsed to just $30k, concentrated mostly on OKX and Bybit.”

Since Celsius filed for bankruptcy, the lender’s native token has seen waned interest, with its value dropping to under $1 after peaking at over $8 in 2021, according to CryptoSlate’s data.

The post Celsius’s bankruptcy-induced liquidation plans could pressure overall crypto market: Kaiko appeared first on CryptoSlate.

Read More

TRUMP Crypto Effect: Which Is Worse, the Internal or External War?

Celsius’s bankruptcy-induced liquidation plans could pressure overall crypto market: Kaiko

Bankrupt lender Celsius’s plan to liquidate its altcoins for Bitcoin (BTC) and Ethereum (ETH) could exert more pressure on the crypto market, according to a July 10 report from blockchain analytical firm Kaiko.

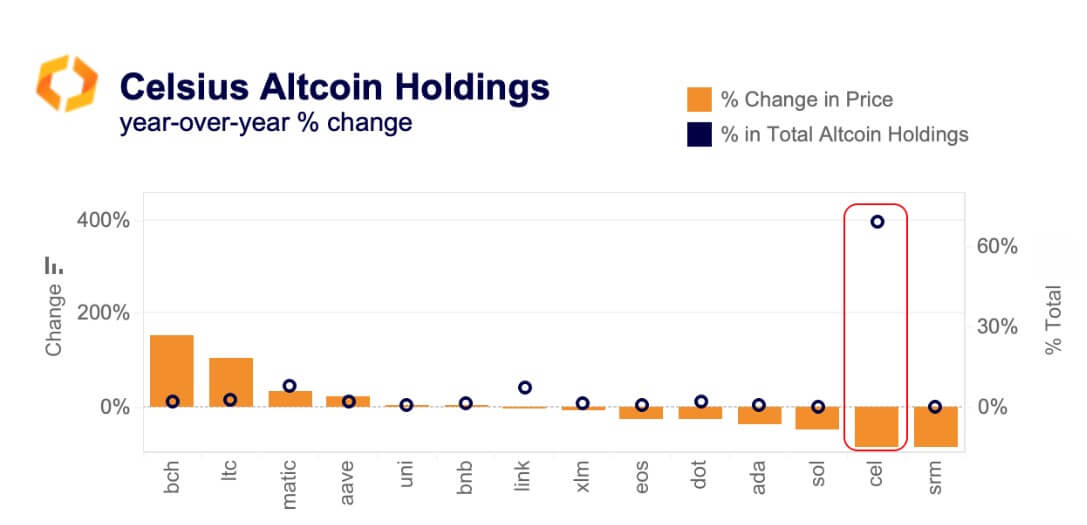

Kaiko noted that most altcoins held by Celsius had recorded significant drops, ranging from 6% to as high as 84%, in their liquidity over the past year.

“The aggregated market depth for Celsius’ altcoin holdings has declined by 40% since 2022, totalling around $90mn in early July.”

Per the chart below, only Litecoin (LTC), Bitcoin Cash (BCH), Polygon (MATIC), and Aave (AAVE) saw pronounced changes in their liquidity situations over the past year, while others mostly declined.

BCH and LTC, in particular, saw a surge in their liquidity situation after EDX, a crypto exchange backed by traditional financial institutions, enabled support in June.

The crypto company further noted that Celsius’s total altcoin holding exceeded $90 million, “which means it will be difficult for the company to liquidate without incurring high price slippage.” It added:

“More than 60% of altcoin market depth is concentrated on Binance and other off-shore exchanges while 30% is on U.S. exchanges.”

CEL token liquidity is almost non-existent

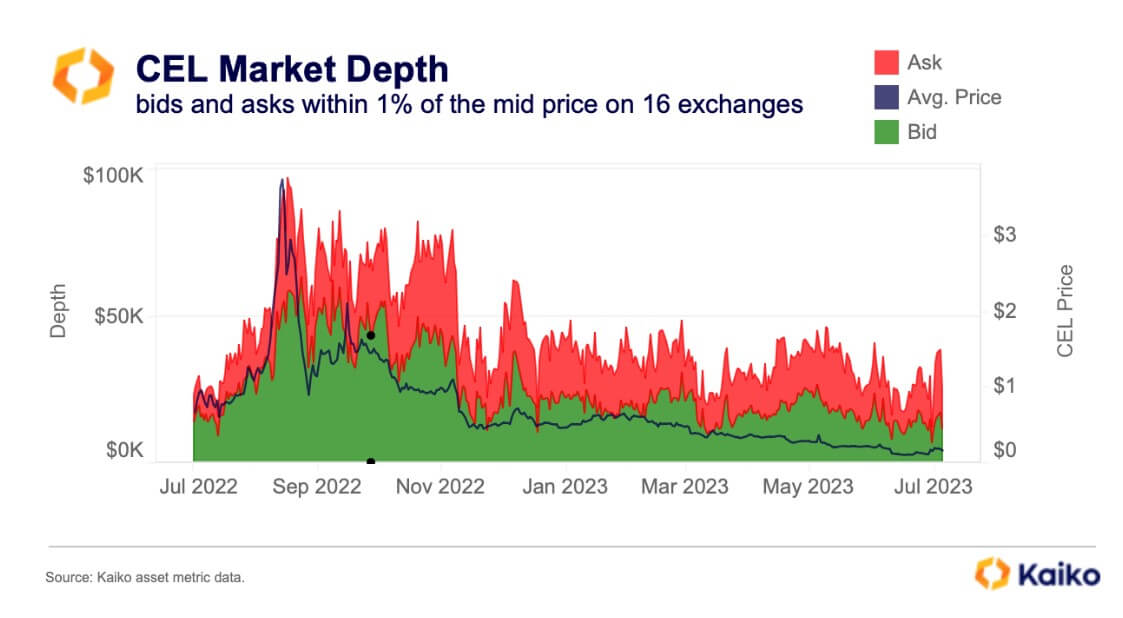

According to Kaiko, Celsius faces a problem as there is almost no liquidity for its most significant altcoin holding, CEL.

CEL is Celsius’s native token, accounting for nearly 65% of the bankrupt firm’s total altcoin holdings.

“There is virtually no liquidity for CEL as measured by market depth, which has collapsed to just $30k, concentrated mostly on OKX and Bybit.”

Since Celsius filed for bankruptcy, the lender’s native token has seen waned interest, with its value dropping to under $1 after peaking at over $8 in 2021, according to CryptoSlate’s data.

The post Celsius’s bankruptcy-induced liquidation plans could pressure overall crypto market: Kaiko appeared first on CryptoSlate.

Read More