Warren Buffett’s $3 Billion Sell-Off: Time to Reevaluate Your Stock Portfolio?

Warren Buffett’s stock moves have grabbed market attention as his investment strategies in 2024 show major changes. Berkshire Hathaway’s latest SEC filing reveals three big stock portfolio reevaluation moves worth $3 billion. “The most important thing to do if you find yourself in a hole is to stop digging,” Buffett states, explaining these dramatic shifts in an increasingly uncertain market.

Also Read: Russia Legalizes Crypto Mining: How It Helps Evade Sanctions

Smart Investment Strategies 2024: Lessons from Warren Buffett’s Moves

1. Major Apple (AAPL) Stake Reduction

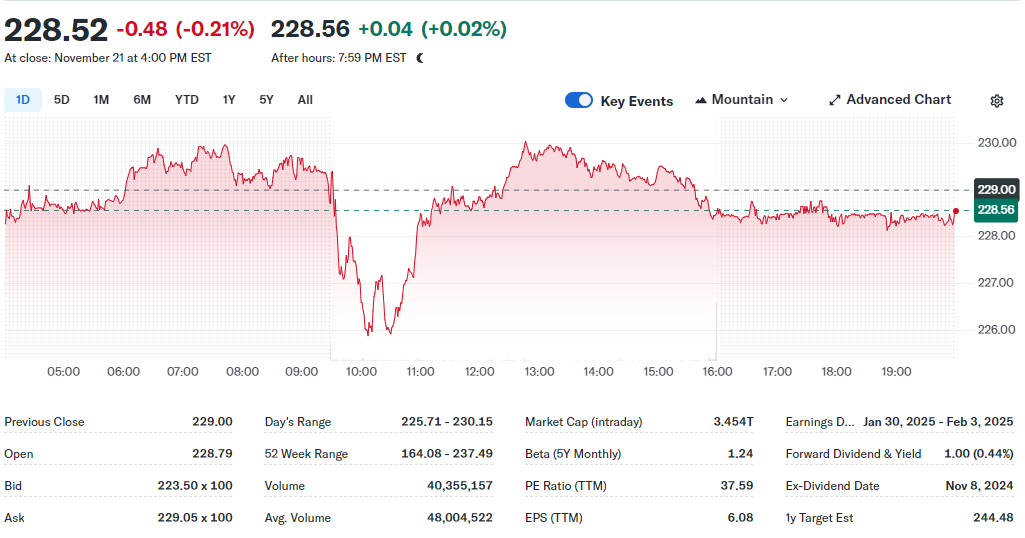

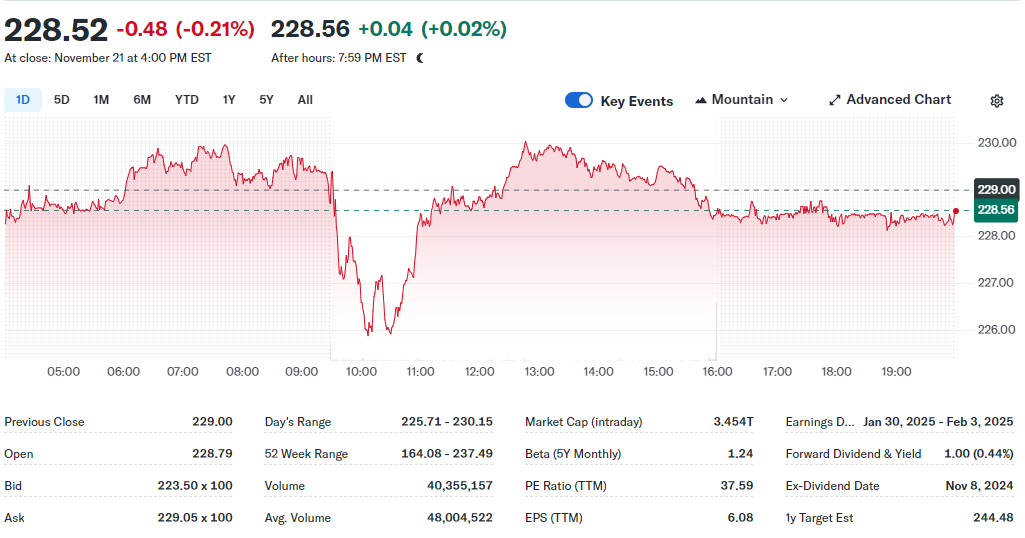

The biggest Warren Buffett stock change was cutting Apple (AAPL) holdings by two-thirds. Berkshire keeps 300 million shares from its $19.1 billion investment. Tax reasons drove this decision, as explained at May’s meeting. Despite the sale, Buffett’s investment strategies in 2024 still show faith in Apple CEO Tim Cook’s leadership. The move represents one of Berkshire’s largest position reductions in recent years.

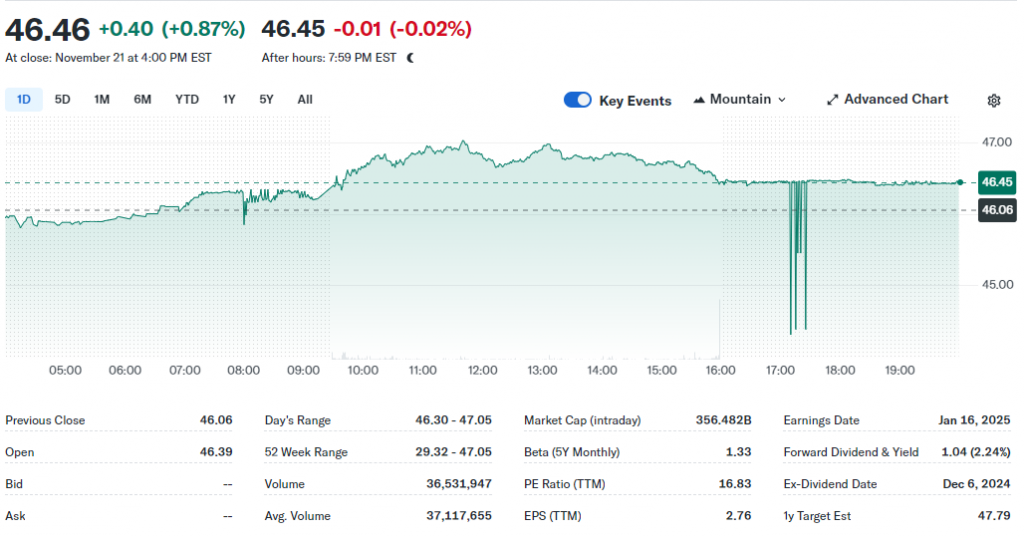

2. Bank of America (BAC) Exit

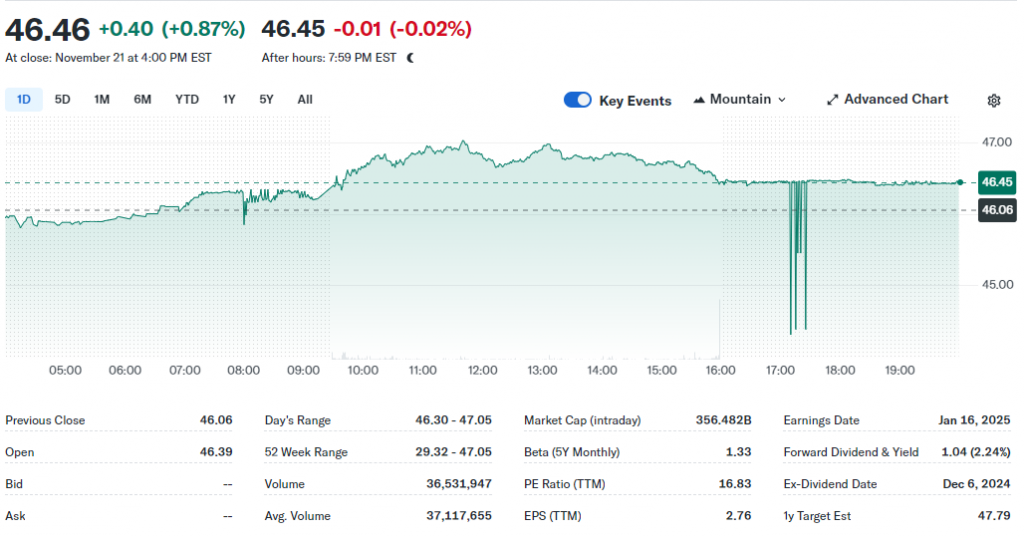

A second key stock portfolio reevaluation happened with Bank of America (BAC). Berkshire cut this position significantly, showing reduced confidence in the banking sector. “Risk comes from not knowing what you are doing,” Buffett reminds investors about such big changes. This exit marks a notable shift in Berkshire’s financial sector exposure.

Also Read: Shiba Inu: Can SHIB Hit $0.00005 By The End Of 2024?

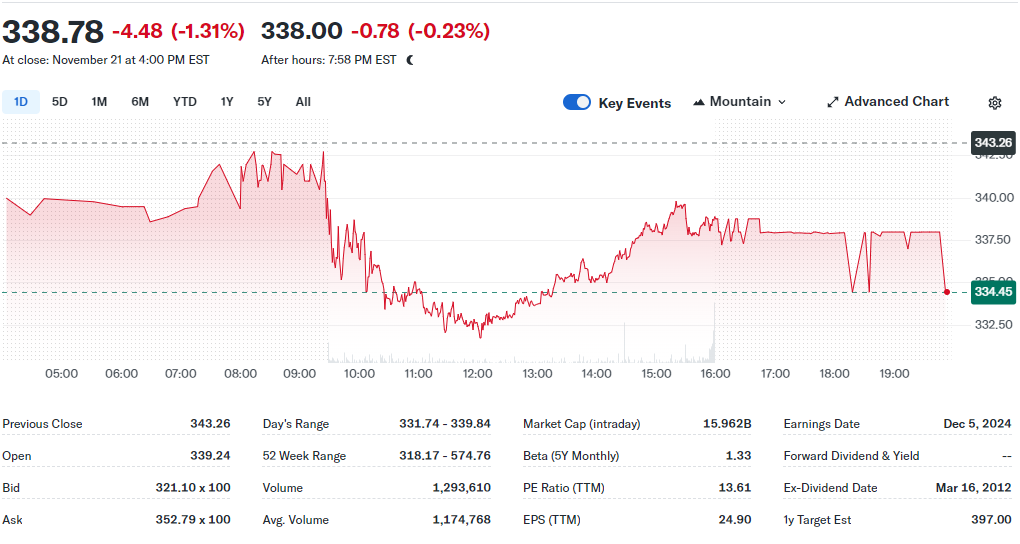

3. Ulta (ULTA) Beauty Reversal

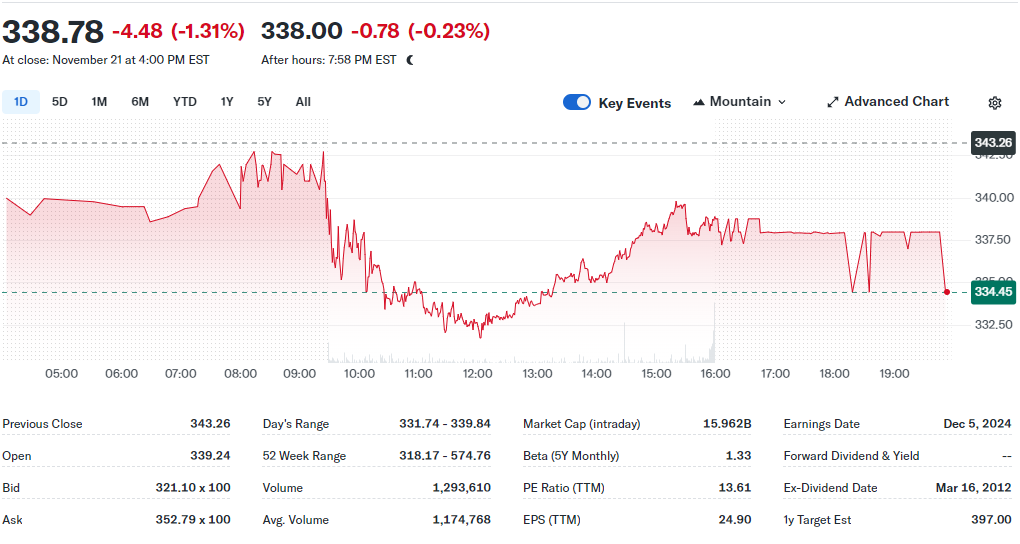

Berkshire fully sold its new Ulta Beauty (ULTA) stake. This quick stock portfolio reevaluation proves Buffett adjusts fast when markets shift. The rapid exit from this recent investment demonstrates Berkshire’s willingness to change course when circumstances demand.

Strategic Portfolio Balancing

While selling these positions, Berkshire bought new ones. They got 1.28 million Domino’s Pizza shares worth $550 million and added 400,000 Pool Corp shares. These choices match Buffett’s love for strong brands with “moats” that protect investment returns. The new positions reflect his continued faith in companies with strong market positions and sustainable competitive advantages.

Also Read: Ripple: AI Predicts How High Can XRP Spike Post Gensler’s Resignation

Read More

Banking Giant Goldman Sachs Adds One Asset to ‘Conviction Buy’ List After Raising Price Target: Report

Warren Buffett’s $3 Billion Sell-Off: Time to Reevaluate Your Stock Portfolio?

Warren Buffett’s stock moves have grabbed market attention as his investment strategies in 2024 show major changes. Berkshire Hathaway’s latest SEC filing reveals three big stock portfolio reevaluation moves worth $3 billion. “The most important thing to do if you find yourself in a hole is to stop digging,” Buffett states, explaining these dramatic shifts in an increasingly uncertain market.

Also Read: Russia Legalizes Crypto Mining: How It Helps Evade Sanctions

Smart Investment Strategies 2024: Lessons from Warren Buffett’s Moves

1. Major Apple (AAPL) Stake Reduction

The biggest Warren Buffett stock change was cutting Apple (AAPL) holdings by two-thirds. Berkshire keeps 300 million shares from its $19.1 billion investment. Tax reasons drove this decision, as explained at May’s meeting. Despite the sale, Buffett’s investment strategies in 2024 still show faith in Apple CEO Tim Cook’s leadership. The move represents one of Berkshire’s largest position reductions in recent years.

2. Bank of America (BAC) Exit

A second key stock portfolio reevaluation happened with Bank of America (BAC). Berkshire cut this position significantly, showing reduced confidence in the banking sector. “Risk comes from not knowing what you are doing,” Buffett reminds investors about such big changes. This exit marks a notable shift in Berkshire’s financial sector exposure.

Also Read: Shiba Inu: Can SHIB Hit $0.00005 By The End Of 2024?

3. Ulta (ULTA) Beauty Reversal

Berkshire fully sold its new Ulta Beauty (ULTA) stake. This quick stock portfolio reevaluation proves Buffett adjusts fast when markets shift. The rapid exit from this recent investment demonstrates Berkshire’s willingness to change course when circumstances demand.

Strategic Portfolio Balancing

While selling these positions, Berkshire bought new ones. They got 1.28 million Domino’s Pizza shares worth $550 million and added 400,000 Pool Corp shares. These choices match Buffett’s love for strong brands with “moats” that protect investment returns. The new positions reflect his continued faith in companies with strong market positions and sustainable competitive advantages.

Also Read: Ripple: AI Predicts How High Can XRP Spike Post Gensler’s Resignation

Read More