XRP Price Prediction: Dips Below Key Support – Is a Deeper Correction Incoming for the Altcoin?

XRP has dropped sharply after its run to $3.25 and is now raising concerns of a deeper correction. As of now, it’s at $2.89, down 2% in the last 24 hours. This is a significant shift from the bull run that propelled XRP to multi-year highs.

The pullback follows heavy whale activity, most notably a $175 million transfer by Ripple co-founder Chris Larsen, according to recent blockchain data. This has sparked institutional repositioning or profit taking at the top.

Psychologically, the $3 level is a key battleground. XRP’s decline below this level has spooked bulls and opened the door for bears to take control. With market volatility increasing, traders are now looking to technicals for clues.

XRP/USD Key Technicals Now in Focus

On the technical front, XRP price prediction seems bearish as the 4-hour chart shows XRP trapped below a descending trendline and the 50-period SMA, which is at $3.08. These levels are now acting as resistance after the breakdown from $2.93.

- Multiple bearish candles, including an engulfing pattern

- RSI dipped into oversold (35.68) and bounced back to 40.16 (still below 50)

- Price is testing the $2.93-$2.94 zone, which was former support turned resistance

Unless XRP breaks above this zone with conviction, the bias is bearish. Watch for candlestick signals like a shooting star or bearish engulfing near resistance.

XRP/USD – Another Leg Down?

Short-term XRP can’t reclaim $3, so sellers are still in control. If price gets rejected again from $2.94-$3.08, the following support levels to watch are $2.73 and $2.61. These zones could be bounce opportunities, but only if momentum improves.

Trade Setup (Short Term Bias):

- Entry idea: Wait for rejection from $2.94

- Stop loss: Just above $3.08

- Targets: $2.73 and $2.61

- Invalidation: A clean close above $3.10 flips the outlook bullish

A break and hold above $3.08 would signal strength, potentially triggering a move toward $3.18 and $3.32.

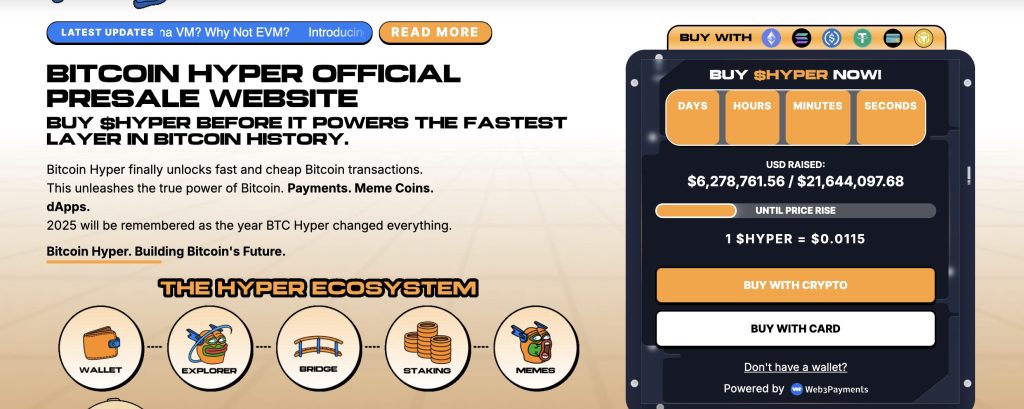

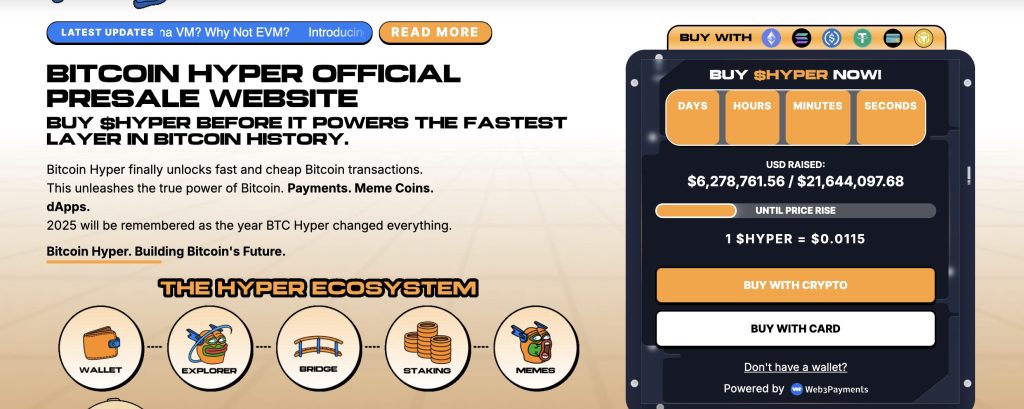

Bitcoin Hyper Presale Over $6.2M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first BTC-native Layer 2 powered by the Solana Virtual Machine (SVM), has raised over $6.2 million in its public presale, with $6,278,761 out of a $21,644,097 target. The token is priced at $0.0115, with the next price tier expected to be announced soon.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and a full rollout expected by Q1, $HYPER is gaining serious traction.

The post XRP Price Prediction: Dips Below Key Support – Is a Deeper Correction Incoming for the Altcoin? appeared first on Cryptonews.

XRP Price Prediction: Dips Below Key Support – Is a Deeper Correction Incoming for the Altcoin?

XRP has dropped sharply after its run to $3.25 and is now raising concerns of a deeper correction. As of now, it’s at $2.89, down 2% in the last 24 hours. This is a significant shift from the bull run that propelled XRP to multi-year highs.

The pullback follows heavy whale activity, most notably a $175 million transfer by Ripple co-founder Chris Larsen, according to recent blockchain data. This has sparked institutional repositioning or profit taking at the top.

Psychologically, the $3 level is a key battleground. XRP’s decline below this level has spooked bulls and opened the door for bears to take control. With market volatility increasing, traders are now looking to technicals for clues.

XRP/USD Key Technicals Now in Focus

On the technical front, XRP price prediction seems bearish as the 4-hour chart shows XRP trapped below a descending trendline and the 50-period SMA, which is at $3.08. These levels are now acting as resistance after the breakdown from $2.93.

- Multiple bearish candles, including an engulfing pattern

- RSI dipped into oversold (35.68) and bounced back to 40.16 (still below 50)

- Price is testing the $2.93-$2.94 zone, which was former support turned resistance

Unless XRP breaks above this zone with conviction, the bias is bearish. Watch for candlestick signals like a shooting star or bearish engulfing near resistance.

XRP/USD – Another Leg Down?

Short-term XRP can’t reclaim $3, so sellers are still in control. If price gets rejected again from $2.94-$3.08, the following support levels to watch are $2.73 and $2.61. These zones could be bounce opportunities, but only if momentum improves.

Trade Setup (Short Term Bias):

- Entry idea: Wait for rejection from $2.94

- Stop loss: Just above $3.08

- Targets: $2.73 and $2.61

- Invalidation: A clean close above $3.10 flips the outlook bullish

A break and hold above $3.08 would signal strength, potentially triggering a move toward $3.18 and $3.32.

Bitcoin Hyper Presale Over $6.2M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first BTC-native Layer 2 powered by the Solana Virtual Machine (SVM), has raised over $6.2 million in its public presale, with $6,278,761 out of a $21,644,097 target. The token is priced at $0.0115, with the next price tier expected to be announced soon.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and a full rollout expected by Q1, $HYPER is gaining serious traction.

The post XRP Price Prediction: Dips Below Key Support – Is a Deeper Correction Incoming for the Altcoin? appeared first on Cryptonews.