Sui Network Gains Momentum: Can SUI Break $5.30 Resistance on Path to $7?

- SUI’s DEX volume hit $1.43B and TVL crossed $4.3B, showing strong on-chain momentum.

- Key resistance sits between $4.10–$5.30; clearing it could open the door to $7.

- Stablecoin dominance and liquidity milestones suggest growing adoption and conviction.

Sui (SUI) has been slipping just a little, trading around $3.59 after a 1% dip, but traders don’t seem too worried. If anything, the mood around SUI feels like anticipation — the kind of “quiet before the storm” vibe you see when a breakout might be close. On-chain data is buzzing, volumes are spiking, and analysts are hinting that $7 might not be too far away if the charts line up.

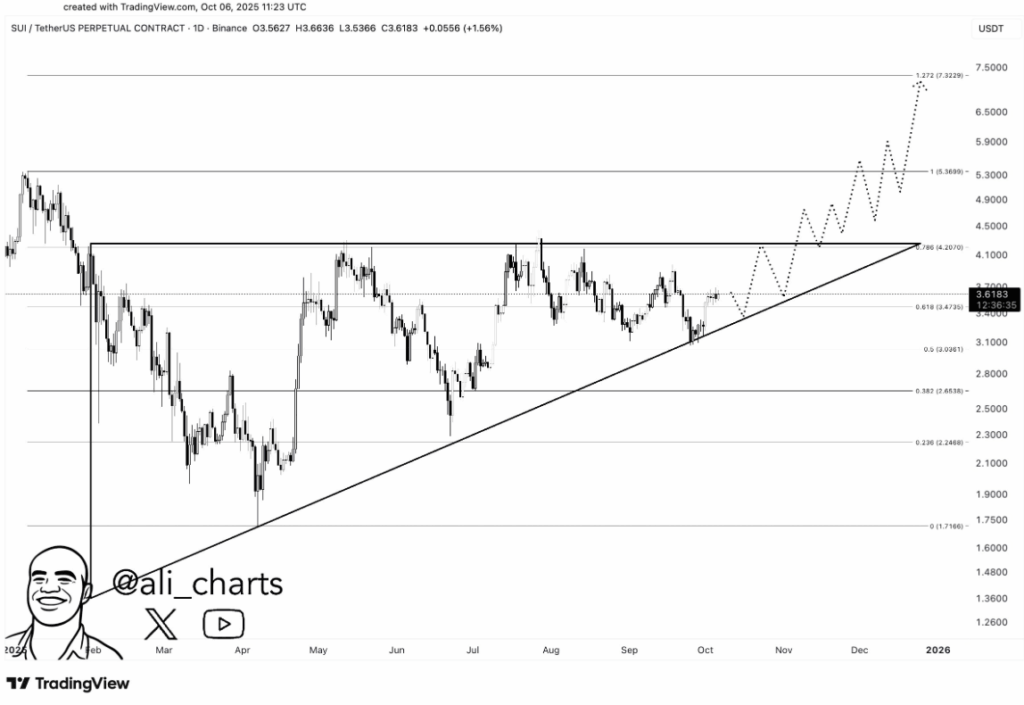

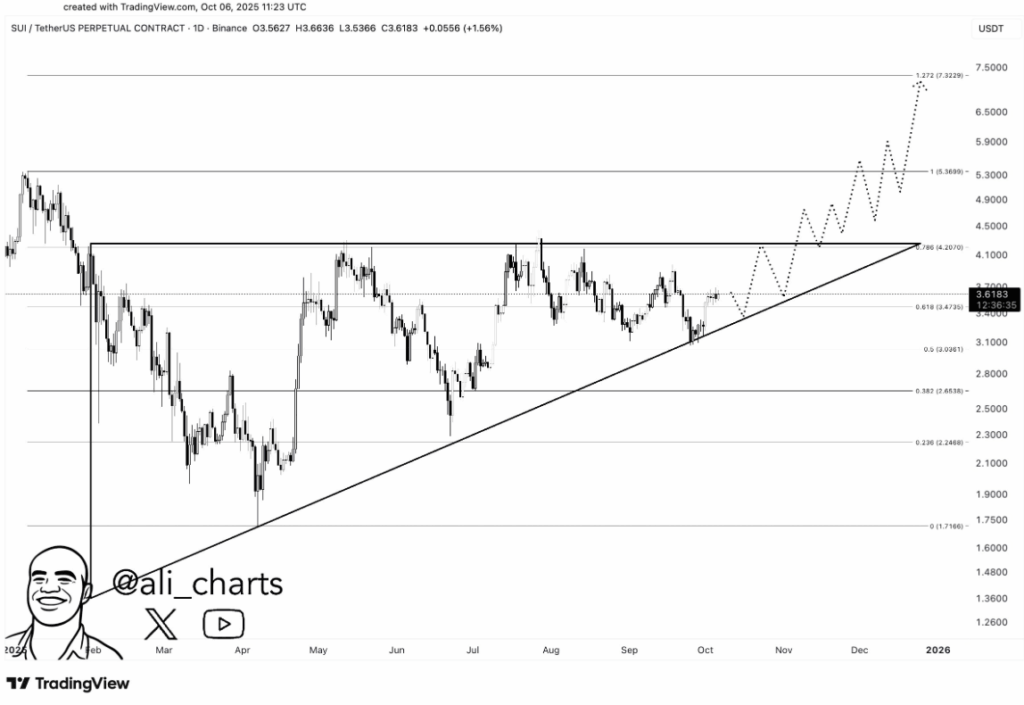

SUI Charts Hint at Fresh Upside

On the daily chart, SUI looks like it’s pushing toward the edge of a massive accumulation pattern that’s been in play since February. Earlier in the year, the token tapped $5.30 before pulling back, but analysts now think that same level might soon get tested again.

Ali Martinez, a well-followed analyst, pointed out that the ascending trendline has been a “prime accumulation zone,” mainly because it matches up with the 0.68 Fibonacci retracement level. In simple terms, this is where healthy reversals tend to happen. But for SUI to break free, it’ll have to clear that sticky $4.10 resistance, which has rejected moves higher at least three times already. If $4.10–$5.30 finally gives way, the Fibonacci projections put the next stop near $7, maybe even by 2026 if momentum holds.

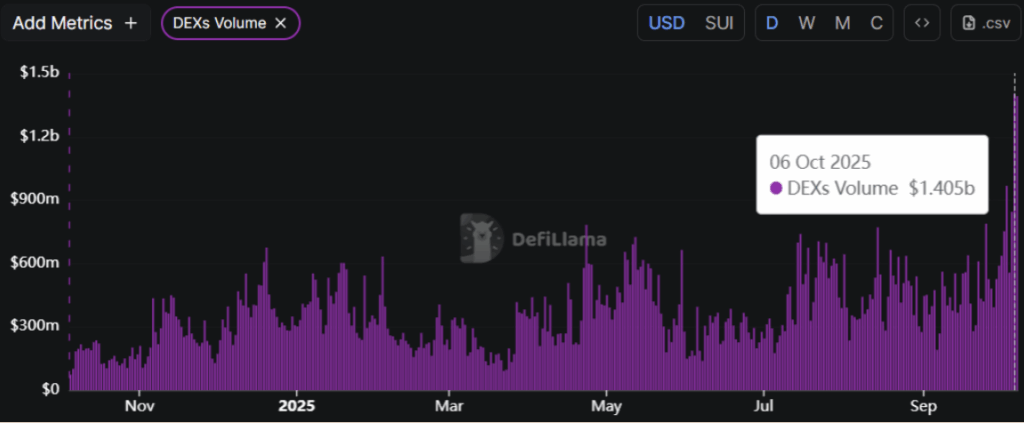

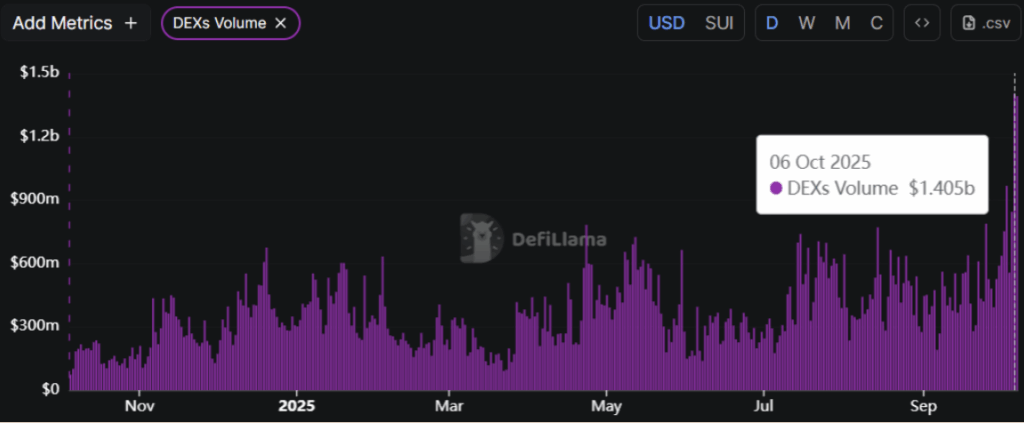

On-Chain Metrics Backing the Move

The hype isn’t just about chart patterns. On-chain numbers are flashing green too. According to DefiLlama, SUI’s daily DEX volume hit a fresh high at $1.43 billion, while perpetuals added another $160 million to the mix. Total Value Locked climbed to $2.60 billion, nearly matching bridged assets at $2.66 billion, and when you include staking, SUI’s aggregate TVL is now past $4.3 billion.

This kind of network growth suggests more than just short-term speculation. It shows money flowing into the ecosystem at scale, a sign that the fundamentals are helping fuel the breakout narrative.

Stablecoin Growth and Liquidity Gains

SUI has also overtaken Toncoin, Mantle, and Optimism in stablecoin market cap, reaching $921 million. That’s over $100 million more than TON, putting it firmly ahead in liquidity dominance. Swap volume has now crossed $16.25 billion — another milestone that hints at increasing adoption and stronger market conviction.

All signs point to a potential breakout if resistance levels finally crack. But until SUI clears the $4.10–$5.30 range with authority, traders will likely remain cautious. For now, consolidation is still in play, but the setup looks promising for that much-hyped move toward $7.

The post Sui Network Gains Momentum: Can SUI Break $5.30 Resistance on Path to $7? first appeared on BlockNews.

Read More

TRON Gains Momentum as TVL Hits $6.37B – Is a Breakout Coming?

Sui Network Gains Momentum: Can SUI Break $5.30 Resistance on Path to $7?

- SUI’s DEX volume hit $1.43B and TVL crossed $4.3B, showing strong on-chain momentum.

- Key resistance sits between $4.10–$5.30; clearing it could open the door to $7.

- Stablecoin dominance and liquidity milestones suggest growing adoption and conviction.

Sui (SUI) has been slipping just a little, trading around $3.59 after a 1% dip, but traders don’t seem too worried. If anything, the mood around SUI feels like anticipation — the kind of “quiet before the storm” vibe you see when a breakout might be close. On-chain data is buzzing, volumes are spiking, and analysts are hinting that $7 might not be too far away if the charts line up.

SUI Charts Hint at Fresh Upside

On the daily chart, SUI looks like it’s pushing toward the edge of a massive accumulation pattern that’s been in play since February. Earlier in the year, the token tapped $5.30 before pulling back, but analysts now think that same level might soon get tested again.

Ali Martinez, a well-followed analyst, pointed out that the ascending trendline has been a “prime accumulation zone,” mainly because it matches up with the 0.68 Fibonacci retracement level. In simple terms, this is where healthy reversals tend to happen. But for SUI to break free, it’ll have to clear that sticky $4.10 resistance, which has rejected moves higher at least three times already. If $4.10–$5.30 finally gives way, the Fibonacci projections put the next stop near $7, maybe even by 2026 if momentum holds.

On-Chain Metrics Backing the Move

The hype isn’t just about chart patterns. On-chain numbers are flashing green too. According to DefiLlama, SUI’s daily DEX volume hit a fresh high at $1.43 billion, while perpetuals added another $160 million to the mix. Total Value Locked climbed to $2.60 billion, nearly matching bridged assets at $2.66 billion, and when you include staking, SUI’s aggregate TVL is now past $4.3 billion.

This kind of network growth suggests more than just short-term speculation. It shows money flowing into the ecosystem at scale, a sign that the fundamentals are helping fuel the breakout narrative.

Stablecoin Growth and Liquidity Gains

SUI has also overtaken Toncoin, Mantle, and Optimism in stablecoin market cap, reaching $921 million. That’s over $100 million more than TON, putting it firmly ahead in liquidity dominance. Swap volume has now crossed $16.25 billion — another milestone that hints at increasing adoption and stronger market conviction.

All signs point to a potential breakout if resistance levels finally crack. But until SUI clears the $4.10–$5.30 range with authority, traders will likely remain cautious. For now, consolidation is still in play, but the setup looks promising for that much-hyped move toward $7.

The post Sui Network Gains Momentum: Can SUI Break $5.30 Resistance on Path to $7? first appeared on BlockNews.

Read More