$4.3B Bitcoin Options Expiry Flashes Caution Amid ATH, Bhutan Offloads Another 100 BTC

As Bitcoin BTC $115 951 24h volatility: 4.2% Market cap: $2.31 T Vol. 24h: $56.12 B reached a new all-time high of $118,000 earlier today, the $4.3 billion BTC options expiry signals a cautious bearish sentiment ahead.

While the spot market shows strength, the options market remains wary with subdued activity from institutional investors.

Meanwhile, the Royal Government of Bhutan continued its sell-off, offloading another 100 BTC today.

Bitcoin Options Put-Call Ratio Hints at Bearish Sentiment

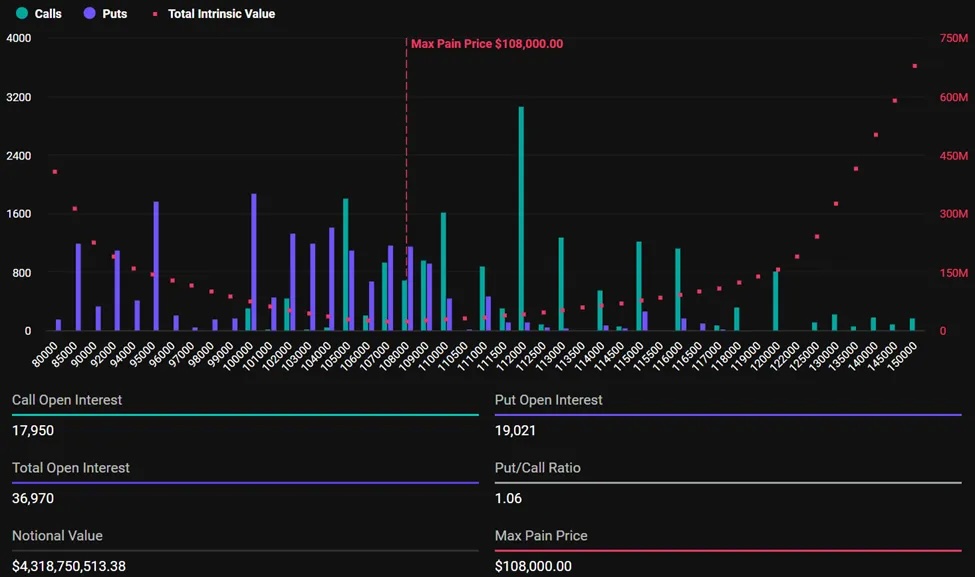

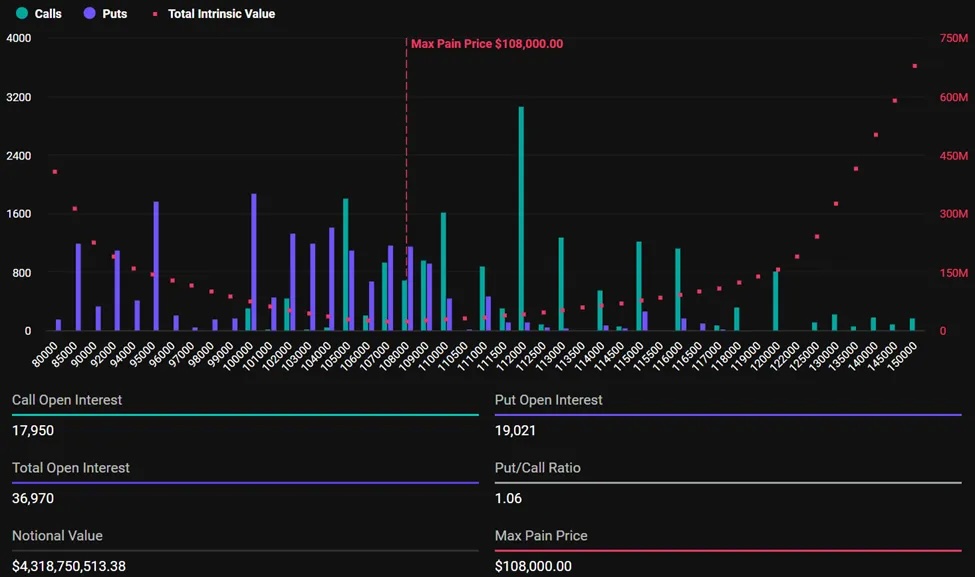

With BTC price approaching $120K, Bitcoin options expiring today have a notional value of $4.3 billion and total open interest of 36,970 contracts.

The maximum pain point, or the price level where option holders face the most losses, is currently at $108,000, according to Deribit data.

A key observation is the continued bearish bias in the options market. Similar to last week, today’s contracts show a Put-to-Call Ratio (PCR) above 1, standing at 1.06. A PCR above 1 indicates a higher volume of put (sell) options compared to call (buy) options, reflecting increased bearish sentiment among traders.

Bitcoin Options Expiry – Source: Deribit

Derivatives analytics platform Greeks.Live highlights significant options activity and cautious market sentiment, noting muted institutional involvement despite notable high-leverage positions.

July 11 Options Data]37,000 BTC options expiring with a Put Call Ratio of 1.05, a Maxpain point of $108,000 and a notional value of $4.3 billion.

240,000 ETH options expiring with a Put Call Ratio of 1.11, Maxpain point of $2,600 and notional value of $710 million.

The smell of… pic.twitter.com/s5bD7i3iNq— Greeks.live (@GreeksLive) July 11, 2025

In a recent update, the analytics platform noted that some traders are discussing 500x leverage positions, calling it suicidal in current market conditions.

Despite the elevated risks, new positions continue to be opened, with discussions of so-called “100% signal” trading strategies reflecting a combination of high conviction and high risk. Such aggressive leverage magnifies both potential gains and losses.

Bhutan Government Offloads Another 100 BTC

The Royal Government of Bhutan sees this Bitcoin price rally as a profit-booking opportunity.

Earlier today, the government transferred an additional 100.215 BTC, approximately $11.83 million, to Binance, according to blockchain analytics firm Arkham Intelligence. This comes just a day after the Bhutan Government purchased 213 BTC.

Over the past year, Bhutan has offloaded a total of 2,262 BTC, valued at around $200.46 million, across six separate batches, with an average selling price of $88,612 per Bitcoin.

Despite these sales, the country still holds a significant reserve of 11,611 BTC, currently valued at approximately $1.37 billion.

The Royal Government of #Bhutan deposited another 100.215 $BTC($11.83M) to #Binance 20 minutes ago.

In the past year, #Bhutan has sold 2,262 $BTC ($200.46M) across 6 batches at an average price of $88,612 and still holds 11,611 $BTC($1.37B).

The #German government sold all… pic.twitter.com/3xq94RXMWD

— Lookonchain (@lookonchain) July 11, 2025

The post $4.3B Bitcoin Options Expiry Flashes Caution Amid ATH, Bhutan Offloads Another 100 BTC appeared first on Coinspeaker.

Read More

Analyst Says Bitcoin Bear Market Has Started, Predicts 50% Crash To $61,000

$4.3B Bitcoin Options Expiry Flashes Caution Amid ATH, Bhutan Offloads Another 100 BTC

As Bitcoin BTC $115 951 24h volatility: 4.2% Market cap: $2.31 T Vol. 24h: $56.12 B reached a new all-time high of $118,000 earlier today, the $4.3 billion BTC options expiry signals a cautious bearish sentiment ahead.

While the spot market shows strength, the options market remains wary with subdued activity from institutional investors.

Meanwhile, the Royal Government of Bhutan continued its sell-off, offloading another 100 BTC today.

Bitcoin Options Put-Call Ratio Hints at Bearish Sentiment

With BTC price approaching $120K, Bitcoin options expiring today have a notional value of $4.3 billion and total open interest of 36,970 contracts.

The maximum pain point, or the price level where option holders face the most losses, is currently at $108,000, according to Deribit data.

A key observation is the continued bearish bias in the options market. Similar to last week, today’s contracts show a Put-to-Call Ratio (PCR) above 1, standing at 1.06. A PCR above 1 indicates a higher volume of put (sell) options compared to call (buy) options, reflecting increased bearish sentiment among traders.

Bitcoin Options Expiry – Source: Deribit

Derivatives analytics platform Greeks.Live highlights significant options activity and cautious market sentiment, noting muted institutional involvement despite notable high-leverage positions.

July 11 Options Data]37,000 BTC options expiring with a Put Call Ratio of 1.05, a Maxpain point of $108,000 and a notional value of $4.3 billion.

240,000 ETH options expiring with a Put Call Ratio of 1.11, Maxpain point of $2,600 and notional value of $710 million.

The smell of… pic.twitter.com/s5bD7i3iNq— Greeks.live (@GreeksLive) July 11, 2025

In a recent update, the analytics platform noted that some traders are discussing 500x leverage positions, calling it suicidal in current market conditions.

Despite the elevated risks, new positions continue to be opened, with discussions of so-called “100% signal” trading strategies reflecting a combination of high conviction and high risk. Such aggressive leverage magnifies both potential gains and losses.

Bhutan Government Offloads Another 100 BTC

The Royal Government of Bhutan sees this Bitcoin price rally as a profit-booking opportunity.

Earlier today, the government transferred an additional 100.215 BTC, approximately $11.83 million, to Binance, according to blockchain analytics firm Arkham Intelligence. This comes just a day after the Bhutan Government purchased 213 BTC.

Over the past year, Bhutan has offloaded a total of 2,262 BTC, valued at around $200.46 million, across six separate batches, with an average selling price of $88,612 per Bitcoin.

Despite these sales, the country still holds a significant reserve of 11,611 BTC, currently valued at approximately $1.37 billion.

The Royal Government of #Bhutan deposited another 100.215 $BTC($11.83M) to #Binance 20 minutes ago.

In the past year, #Bhutan has sold 2,262 $BTC ($200.46M) across 6 batches at an average price of $88,612 and still holds 11,611 $BTC($1.37B).

The #German government sold all… pic.twitter.com/3xq94RXMWD

— Lookonchain (@lookonchain) July 11, 2025

The post $4.3B Bitcoin Options Expiry Flashes Caution Amid ATH, Bhutan Offloads Another 100 BTC appeared first on Coinspeaker.

Read More