Polkadot’s 6% Drop Triggered by Institutional Selling? Here is What’s Really Happening

- DOT fell 6% in 24 hours due to institutional selling.

- Resistance sits at $4.15; fragile support at $3.90.

- Broader market gained, making DOT’s drop asset-specific rather than market-wide.

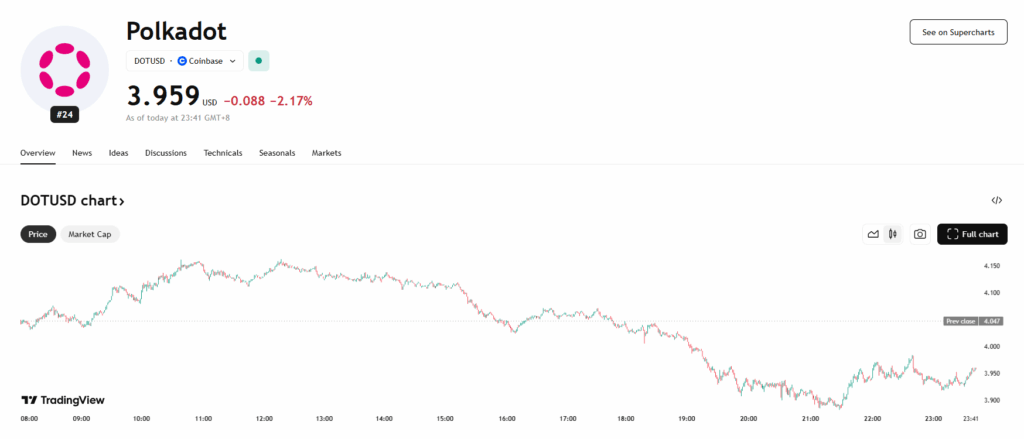

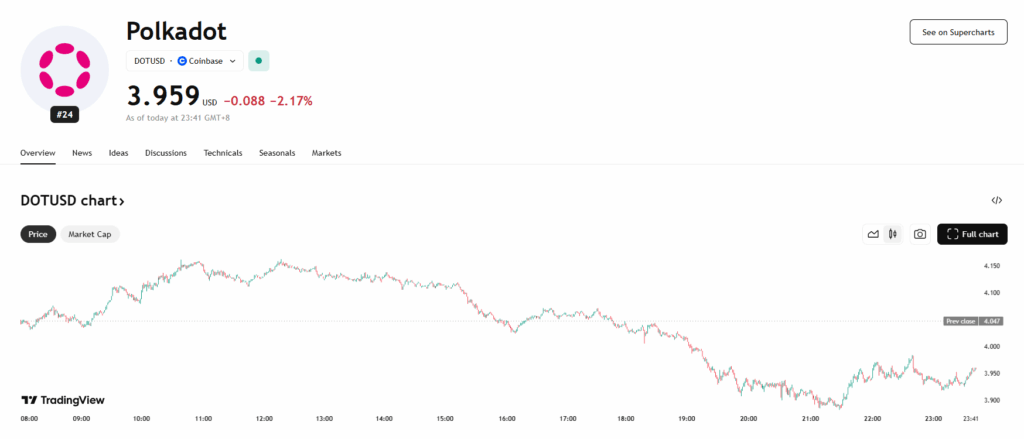

Polkadot’s DOT saw a sharp reversal over the past 24 hours, erasing earlier gains and closing in negative territory. Between August 10 at 12:00 and August 11 at 11:00, the token fell from $4.15 to $3.91, marking a 6% decline on strong selling volume. CoinDesk Research’s technical model points to institutional liquidations as the primary driver behind the move, with heavy order flow pushing prices through multiple support levels.

Market Context and Divergence

Interestingly, DOT’s decline came while the broader crypto market was edging higher—the CoinDesk 20 Index was up 0.5% over the same period. This divergence highlights DOT’s unique selling pressure and suggests that the drop was less about macro sentiment and more about asset-specific positioning by large holders.

Technical Breakdown

- Trading range: $0.24 spread between $3.91 and $4.15, indicating 6% volatility.

- Volume spike: Final-hour decline saw 4.96M tokens traded, signaling institutional unloading.

- Resistance: Firmly set at $4.15 after an aborted rally attempt.

- Support: Weak near $3.90, with risk of breakdown if pressure continues.

- Trend: Formation of lower highs confirms a deteriorating structure.

- Intraday selling bursts: Multiple 11:15–11:30 intervals logged over 300,000 in volume, intensifying the downward push.

Outlook

With resistance now clearly established at $4.15 and support just barely holding at $3.90, DOT could be at risk of further downside if selling volume persists. A decisive break below $3.90 would likely shift short-term sentiment more firmly bearish, while any rebound would need to retest and break $4.15 to signal recovery momentum.

The post Polkadot’s 6% Drop Triggered by Institutional Selling? Here is What’s Really Happening first appeared on BlockNews.

Polkadot’s 6% Drop Triggered by Institutional Selling? Here is What’s Really Happening

- DOT fell 6% in 24 hours due to institutional selling.

- Resistance sits at $4.15; fragile support at $3.90.

- Broader market gained, making DOT’s drop asset-specific rather than market-wide.

Polkadot’s DOT saw a sharp reversal over the past 24 hours, erasing earlier gains and closing in negative territory. Between August 10 at 12:00 and August 11 at 11:00, the token fell from $4.15 to $3.91, marking a 6% decline on strong selling volume. CoinDesk Research’s technical model points to institutional liquidations as the primary driver behind the move, with heavy order flow pushing prices through multiple support levels.

Market Context and Divergence

Interestingly, DOT’s decline came while the broader crypto market was edging higher—the CoinDesk 20 Index was up 0.5% over the same period. This divergence highlights DOT’s unique selling pressure and suggests that the drop was less about macro sentiment and more about asset-specific positioning by large holders.

Technical Breakdown

- Trading range: $0.24 spread between $3.91 and $4.15, indicating 6% volatility.

- Volume spike: Final-hour decline saw 4.96M tokens traded, signaling institutional unloading.

- Resistance: Firmly set at $4.15 after an aborted rally attempt.

- Support: Weak near $3.90, with risk of breakdown if pressure continues.

- Trend: Formation of lower highs confirms a deteriorating structure.

- Intraday selling bursts: Multiple 11:15–11:30 intervals logged over 300,000 in volume, intensifying the downward push.

Outlook

With resistance now clearly established at $4.15 and support just barely holding at $3.90, DOT could be at risk of further downside if selling volume persists. A decisive break below $3.90 would likely shift short-term sentiment more firmly bearish, while any rebound would need to retest and break $4.15 to signal recovery momentum.

The post Polkadot’s 6% Drop Triggered by Institutional Selling? Here is What’s Really Happening first appeared on BlockNews.