Tron Rises 24% Amid New Developments – Will The Uptrend Continue?

Tron (TRX) investors continue to feel bullish even as the market dips after certain on-chain developments help investor sentiment remain high. According to CoinGecko, the token has increased more than 24% since last week, a sign that investors on the platform have held TRX and accumulated to capture more gains.

Tron’s developments will help TRX hold against the downward trajectory the market has taken today. However, questions remain about whether the token will continue to go against the broader market or follow the dip.

Tron On-chain Developments Drive TRX Sky High

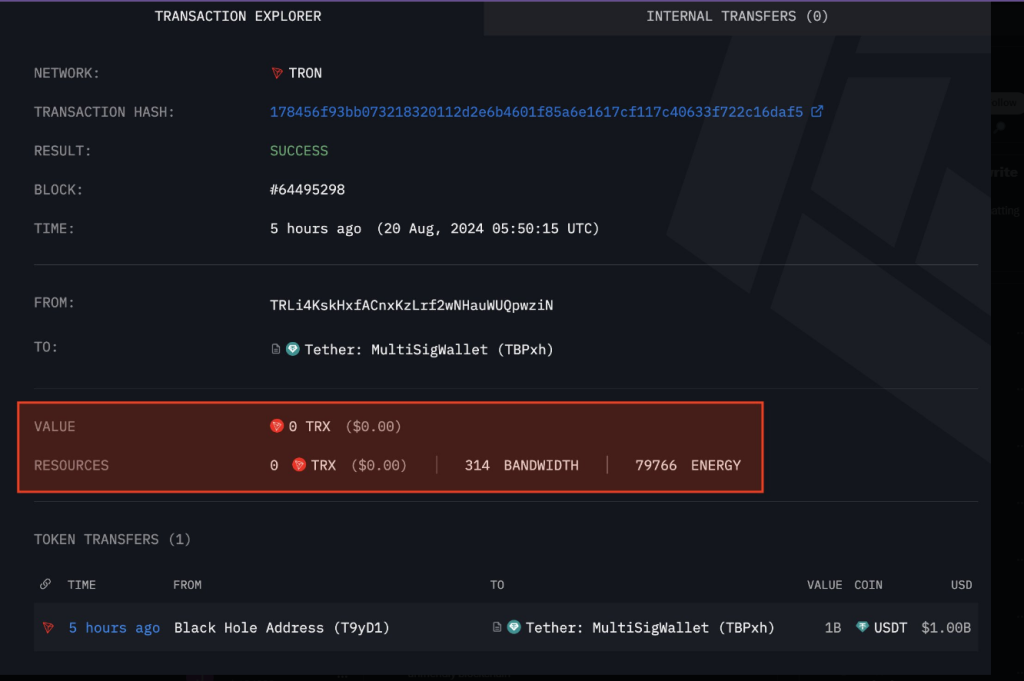

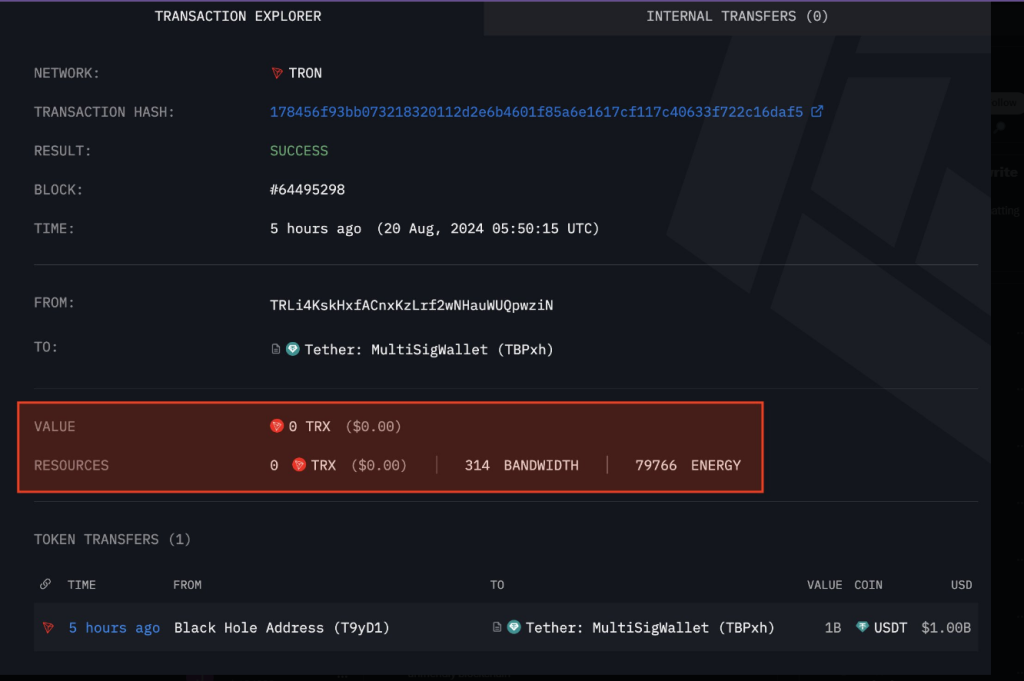

With Tron’s focus on stablecoin development made apparent by Tron founder Justin Sun last month, yesterday saw a big win for the platform as Tether minted over $1 billion USDT without paying any gas fees on the platform. This placed Tron in the crosshairs of critics as they questioned the “no gas fee” transaction with an individual pointing out that they are charged a dollar for a simple swap approval.

Our team is developing a new solution that enables gas-free stablecoin transfers. In other words, transfers can be made without paying any gas tokens, with the fees being entirely covered by the stablecoins themselves.

— H.E. Justin Sun 孙宇晨(hiring) (@justinsuntron) July 6, 2024

Despite this, Tron handled a third of Visa’s annual settlement volume while gaining over half a billion dollars in fees in as little as 3 months. This, according to Tron, makes it clear that “blockchain is more than just a buzzword.”

TODAY: $1B USDT minted on TRON

They paid $0.00 in fees.

Wow pic.twitter.com/NuNYRuj1Yc

— Arkham (@ArkhamIntel) August 20, 2024

TRX To Face Possible Downturn Soon?

The token’s current position is an awkward balance between the bulls attempting to break through the $0.1665 ceiling and the bears also attempting the reverse by eyeing the $0.1583 floor.

As it currently stands, TRX is on an untenable position as it forces the bulls to continue buying without regard to the token’s overall momentum. The relative strength index (RSI) supports this as it nears to push the limits of the bullish momentum, with a possible cool-down period in the next couple of days.

Accounting the market’s general momentum, we might see TRX stabilize on its current trading range between $0.1583 and $0.1665 in the short term. The RSI’s near maxed-out value indicates a possible retracement to the $0.1532 floor before opening the floodgates to the $0.1665.

This scenario is possible as TRX will eventually lose its current momentum to follow the consensus dip within the broader market. The dip, although bearish in some regards, will allow the bulls to rest before building up the momentum for bigger gains.

With improving macroeconomic conditions also supporting this bullish thesis, we might more gains as capital from private equity flows to more risky investment products like crypto. For now, monitoring the broader market will benefit investors as TRX moves to more sustainable levels.

Featured image from Zipmex, chart from TradingView

Read More

Crypto Bull Run: Probability Of Fed Rate Cuts In September Almost At 100%

Tron Rises 24% Amid New Developments – Will The Uptrend Continue?

Tron (TRX) investors continue to feel bullish even as the market dips after certain on-chain developments help investor sentiment remain high. According to CoinGecko, the token has increased more than 24% since last week, a sign that investors on the platform have held TRX and accumulated to capture more gains.

Tron’s developments will help TRX hold against the downward trajectory the market has taken today. However, questions remain about whether the token will continue to go against the broader market or follow the dip.

Tron On-chain Developments Drive TRX Sky High

With Tron’s focus on stablecoin development made apparent by Tron founder Justin Sun last month, yesterday saw a big win for the platform as Tether minted over $1 billion USDT without paying any gas fees on the platform. This placed Tron in the crosshairs of critics as they questioned the “no gas fee” transaction with an individual pointing out that they are charged a dollar for a simple swap approval.

Our team is developing a new solution that enables gas-free stablecoin transfers. In other words, transfers can be made without paying any gas tokens, with the fees being entirely covered by the stablecoins themselves.

— H.E. Justin Sun 孙宇晨(hiring) (@justinsuntron) July 6, 2024

Despite this, Tron handled a third of Visa’s annual settlement volume while gaining over half a billion dollars in fees in as little as 3 months. This, according to Tron, makes it clear that “blockchain is more than just a buzzword.”

TODAY: $1B USDT minted on TRON

They paid $0.00 in fees.

Wow pic.twitter.com/NuNYRuj1Yc

— Arkham (@ArkhamIntel) August 20, 2024

TRX To Face Possible Downturn Soon?

The token’s current position is an awkward balance between the bulls attempting to break through the $0.1665 ceiling and the bears also attempting the reverse by eyeing the $0.1583 floor.

As it currently stands, TRX is on an untenable position as it forces the bulls to continue buying without regard to the token’s overall momentum. The relative strength index (RSI) supports this as it nears to push the limits of the bullish momentum, with a possible cool-down period in the next couple of days.

Accounting the market’s general momentum, we might see TRX stabilize on its current trading range between $0.1583 and $0.1665 in the short term. The RSI’s near maxed-out value indicates a possible retracement to the $0.1532 floor before opening the floodgates to the $0.1665.

This scenario is possible as TRX will eventually lose its current momentum to follow the consensus dip within the broader market. The dip, although bearish in some regards, will allow the bulls to rest before building up the momentum for bigger gains.

With improving macroeconomic conditions also supporting this bullish thesis, we might more gains as capital from private equity flows to more risky investment products like crypto. For now, monitoring the broader market will benefit investors as TRX moves to more sustainable levels.

Featured image from Zipmex, chart from TradingView

Read More