Palantir Stock Crashes 12%: Goldman Sachs Predicts What’s Next for PLTR

Palantir stock crash shocked investors Tuesday as shares dropped 12% despite strong Q1 earnings report and raised guidance. The AI software company posted 39% revenue growth to $884 million, but international growth decline and high valuation concerns weighed heavily on investor sentiment.

Also Read: 5 AI Stocks That Could Outperform Palantir in 2025

Understanding Palantir’s Market Volatility: From AI Growth to International Setbacks

Impressive Domestic Results vs. International Weakness

The Palantir stock crash came despite U.S. revenue growing 55% and U.S. commercial segment surging 71%. However, global sales declined 10% year-over-year, raising concerns about the company’s overall growth trajectory.

CEO Alex Karp stated:

“You don’t have to buy our shares. We’re happy. We’re going to partner with the world’s best people and we’re going to dominate. You can be along for the ride or you don’t have to be.”

During the earnings call, Karp added:

“Palantir is on fire. The reality of what’s going on is that this is an unvarnished cacophony — the combination of 20 years of investment and a massive cultural shift in the U.S. which is generating numbers.”

Also Read: Why Palantir’s AI Platform Is Gaining Traction Among Government Agencies

Goldman Sachs View on Palantir Stock Crash

Goldman Sachs analyst Gabriela Borges explained:

“In our view, the stock reaction is a smaller beat vs. prior quarters (4 quarter average of 4%) and elevated expectations given outperformance/valuation into the print (+67% over 1m and 2.2x EV/sales/growth vs. peers at 0.5x).”

Borges maintains that Palantir is “well positioned to continue to deliver best-in-class growth,” but advised caution for investors considering buying the dip:

“Our positive view of Palantir’s growth is balanced by longer term ecosystem risks (the industry moving from peak custom to more off the shelf adoption) and the stock’s premium valuation.”

Wall Street’s Divided Opinion After Palantir Stock Crash

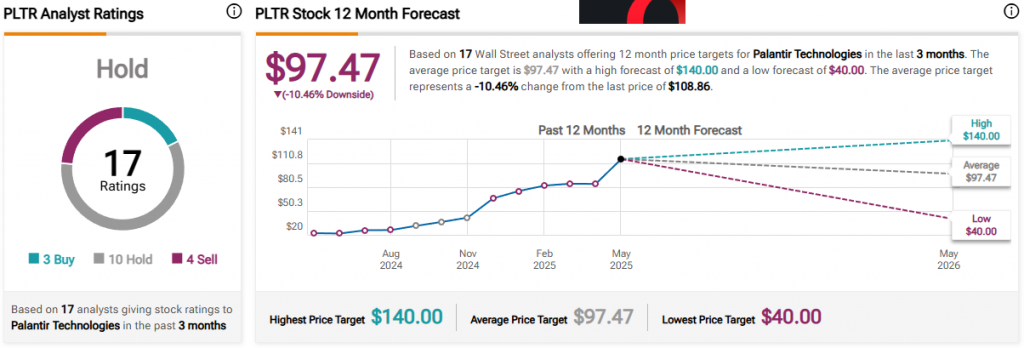

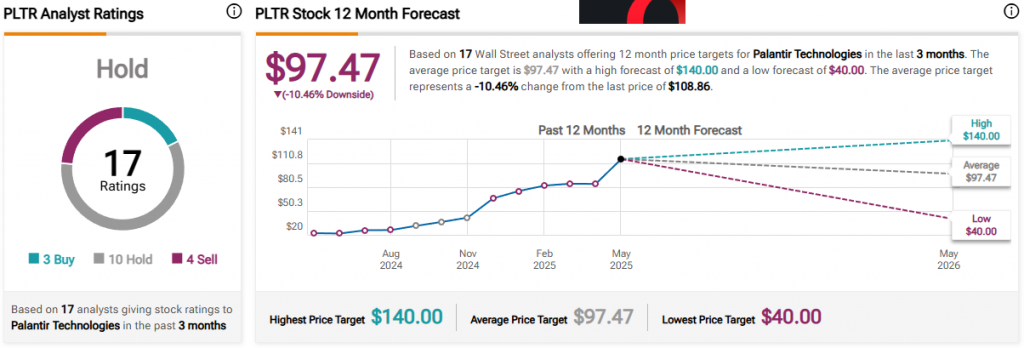

Among 17 analysts, Palantir has just 3 Buy ratings, with 10 Hold and 4 Sell recommendations. The average price target of $89.17 suggests continued valuation concerns.

William Blair analyst Louie DiPalma said:

“The company’s high software multiple makes it vulnerable to compression as revenue growth slows.”

Despite the Palantir stock crash, the company raised its full-year revenue guidance to between $3.89 billion and $3.90 billion, demonstrating confidence in its domestic growth offsetting international challenges.

Also Read: Tech Stocks Face Pressure as Trump’s Tariff Plans Rattle Markets

Read More

TRX Flips DOGE While TRON Races #8 Fueled by USDT Volume, IPO Momentum

Palantir Stock Crashes 12%: Goldman Sachs Predicts What’s Next for PLTR

Palantir stock crash shocked investors Tuesday as shares dropped 12% despite strong Q1 earnings report and raised guidance. The AI software company posted 39% revenue growth to $884 million, but international growth decline and high valuation concerns weighed heavily on investor sentiment.

Also Read: 5 AI Stocks That Could Outperform Palantir in 2025

Understanding Palantir’s Market Volatility: From AI Growth to International Setbacks

Impressive Domestic Results vs. International Weakness

The Palantir stock crash came despite U.S. revenue growing 55% and U.S. commercial segment surging 71%. However, global sales declined 10% year-over-year, raising concerns about the company’s overall growth trajectory.

CEO Alex Karp stated:

“You don’t have to buy our shares. We’re happy. We’re going to partner with the world’s best people and we’re going to dominate. You can be along for the ride or you don’t have to be.”

During the earnings call, Karp added:

“Palantir is on fire. The reality of what’s going on is that this is an unvarnished cacophony — the combination of 20 years of investment and a massive cultural shift in the U.S. which is generating numbers.”

Also Read: Why Palantir’s AI Platform Is Gaining Traction Among Government Agencies

Goldman Sachs View on Palantir Stock Crash

Goldman Sachs analyst Gabriela Borges explained:

“In our view, the stock reaction is a smaller beat vs. prior quarters (4 quarter average of 4%) and elevated expectations given outperformance/valuation into the print (+67% over 1m and 2.2x EV/sales/growth vs. peers at 0.5x).”

Borges maintains that Palantir is “well positioned to continue to deliver best-in-class growth,” but advised caution for investors considering buying the dip:

“Our positive view of Palantir’s growth is balanced by longer term ecosystem risks (the industry moving from peak custom to more off the shelf adoption) and the stock’s premium valuation.”

Wall Street’s Divided Opinion After Palantir Stock Crash

Among 17 analysts, Palantir has just 3 Buy ratings, with 10 Hold and 4 Sell recommendations. The average price target of $89.17 suggests continued valuation concerns.

William Blair analyst Louie DiPalma said:

“The company’s high software multiple makes it vulnerable to compression as revenue growth slows.”

Despite the Palantir stock crash, the company raised its full-year revenue guidance to between $3.89 billion and $3.90 billion, demonstrating confidence in its domestic growth offsetting international challenges.

Also Read: Tech Stocks Face Pressure as Trump’s Tariff Plans Rattle Markets

Read More