Long Term Gold And Silver Price Forecast For 2025

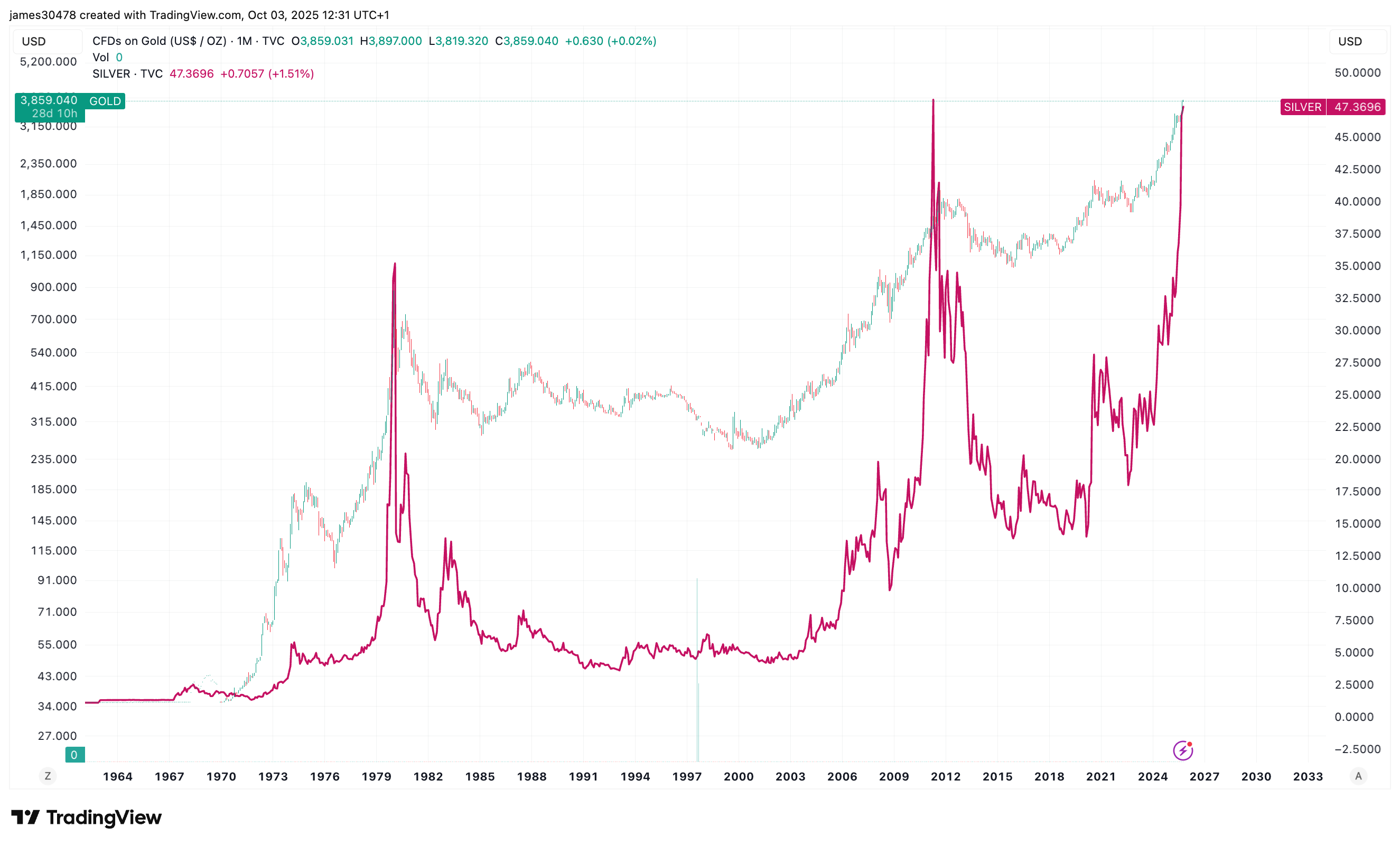

Gold and silver are two precious metals that have lately been making significant headlines in the market. As the US political narrative gains further momentum, the bolstering of the US dollar may further put pressure on gold and silver, influencing their prices by posing volatility. Here’s how both the assets may perform in the near future.

Also Read: DogWifHat (WIF) And Pepe Price Prediction For Mid-January 2025

Gold Price Forecast

Gold is currently sitting at $2652, up 3% in the last 24 hours. The latest forecast presented by Rashad Hajiyev, a reputed gold analyst, is that gold is still aiming for the high-value point and is currently forming a pattern that is similar to the one that was formed in December 2024, which ultimately helped gold rally 4% within a single week.

“Gold might be forming a pattern similar to that during early December, following which it rallied 4% within a single week…”

Gold might be forming a pattern similar to that during early December, following which it rallied 4% within a single week… pic.twitter.com/fZC5VEDLyY

— Rashad Hajiyev (@hajiyev_rashad) January 7, 2025

The long-term gold forecast includes the precious yellow metal currently trading within a multi-month contracting triangle. Per Hajiyev, the breakout move includes the yellow metal’s historic price hike to $2950 if the asset manages to break out well.

“Gold continues to trade within a multi-month contracting triangle. Measured move targets $2,950 upon breakout…”

Gold continues to trade withing a multi month contracting triangle. Measured move targets $2,950 upon breakout… pic.twitter.com/uXjBrxZvKS

— Rashad Hajiyev (@hajiyev_rashad) January 6, 2025

Also Read: Bitcoin Plummets Below $95K: Is Your Investment Safe?

XAG Price Forecast

The plethora of versatile industrial use cases of silver has lately been driving the asset’s price to new highs. Silver is currently sitting at $30 and is poised to go even higher as markets progress and deliver a gentle push to the asset in the long haul.

Per Hajiyev, Silver is currently trading within a three-month bullish wedge formation. If silver manages to soar past the aforementioned development, it can catapult the asset’s price to hit $36.50 in the near future.

“Silver has been trading within a 3-month bullish wedge formation. A measured move upon breakout targets $36.50…”

Silver has been trading within a 3-month bullish wedge formation. A measured move upon breakout targets $36.50… pic.twitter.com/N54t5V303K

— Rashad Hajiyev (@hajiyev_rashad) January 4, 2025

Also Read: Cryptocurrency Market Loses $622 Million: Why Is It Down Today?

Long Term Gold And Silver Price Forecast For 2025

Gold and silver are two precious metals that have lately been making significant headlines in the market. As the US political narrative gains further momentum, the bolstering of the US dollar may further put pressure on gold and silver, influencing their prices by posing volatility. Here’s how both the assets may perform in the near future.

Also Read: DogWifHat (WIF) And Pepe Price Prediction For Mid-January 2025

Gold Price Forecast

Gold is currently sitting at $2652, up 3% in the last 24 hours. The latest forecast presented by Rashad Hajiyev, a reputed gold analyst, is that gold is still aiming for the high-value point and is currently forming a pattern that is similar to the one that was formed in December 2024, which ultimately helped gold rally 4% within a single week.

“Gold might be forming a pattern similar to that during early December, following which it rallied 4% within a single week…”

Gold might be forming a pattern similar to that during early December, following which it rallied 4% within a single week… pic.twitter.com/fZC5VEDLyY

— Rashad Hajiyev (@hajiyev_rashad) January 7, 2025

The long-term gold forecast includes the precious yellow metal currently trading within a multi-month contracting triangle. Per Hajiyev, the breakout move includes the yellow metal’s historic price hike to $2950 if the asset manages to break out well.

“Gold continues to trade within a multi-month contracting triangle. Measured move targets $2,950 upon breakout…”

Gold continues to trade withing a multi month contracting triangle. Measured move targets $2,950 upon breakout… pic.twitter.com/uXjBrxZvKS

— Rashad Hajiyev (@hajiyev_rashad) January 6, 2025

Also Read: Bitcoin Plummets Below $95K: Is Your Investment Safe?

XAG Price Forecast

The plethora of versatile industrial use cases of silver has lately been driving the asset’s price to new highs. Silver is currently sitting at $30 and is poised to go even higher as markets progress and deliver a gentle push to the asset in the long haul.

Per Hajiyev, Silver is currently trading within a three-month bullish wedge formation. If silver manages to soar past the aforementioned development, it can catapult the asset’s price to hit $36.50 in the near future.

“Silver has been trading within a 3-month bullish wedge formation. A measured move upon breakout targets $36.50…”

Silver has been trading within a 3-month bullish wedge formation. A measured move upon breakout targets $36.50… pic.twitter.com/N54t5V303K

— Rashad Hajiyev (@hajiyev_rashad) January 4, 2025

Also Read: Cryptocurrency Market Loses $622 Million: Why Is It Down Today?