Digital Yuan’s Role in 38% of Global Trade Raises Eyebrows

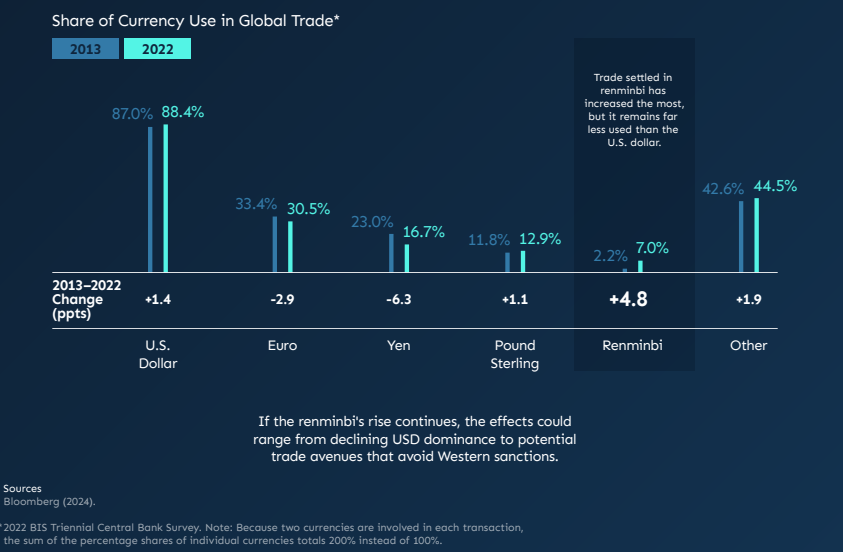

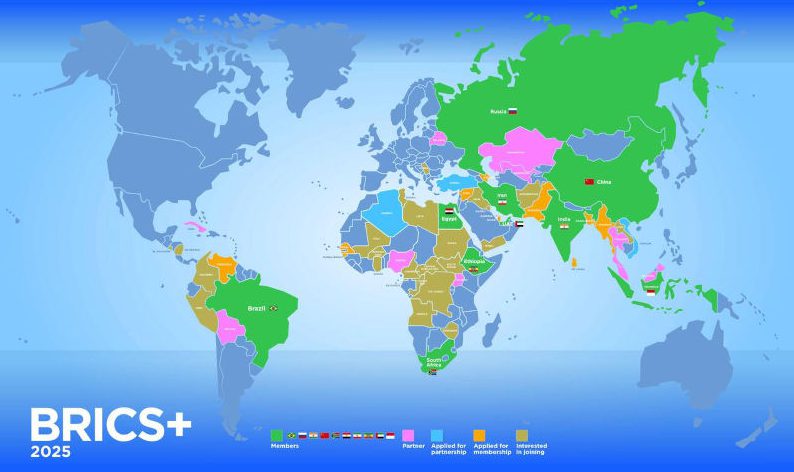

Digital yuan adoption has really surged as China’s Central Bank digital currency expands beyond domestic borders, and the e-CNY now facilitates cross-border payments across multiple nations. The digital yuan’s integration with BRICS payment systems represents a direct challenge to SWIFT‘s dominance, as Chinese Yuan transactions increasingly bypass traditional US dollar settlements in the global de-dollarization movement that’s gaining momentum right now.

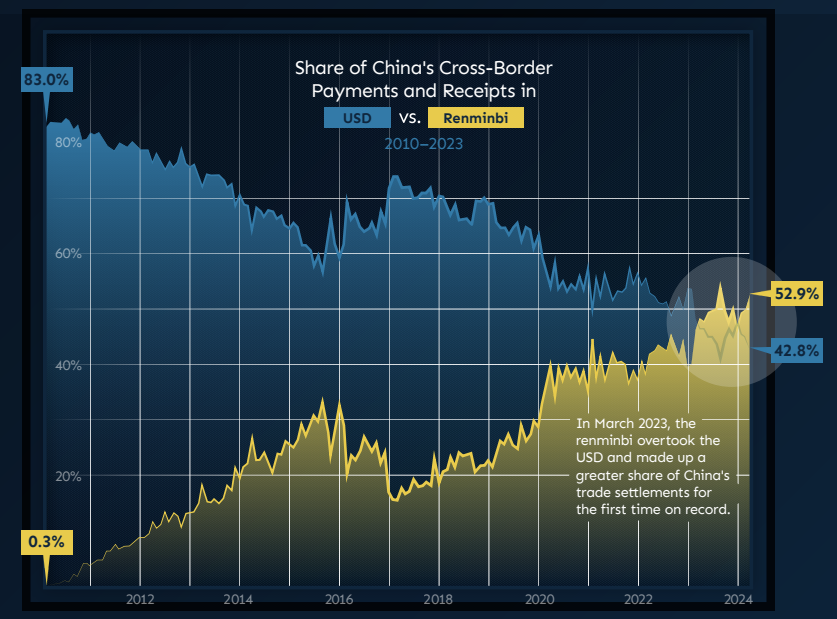

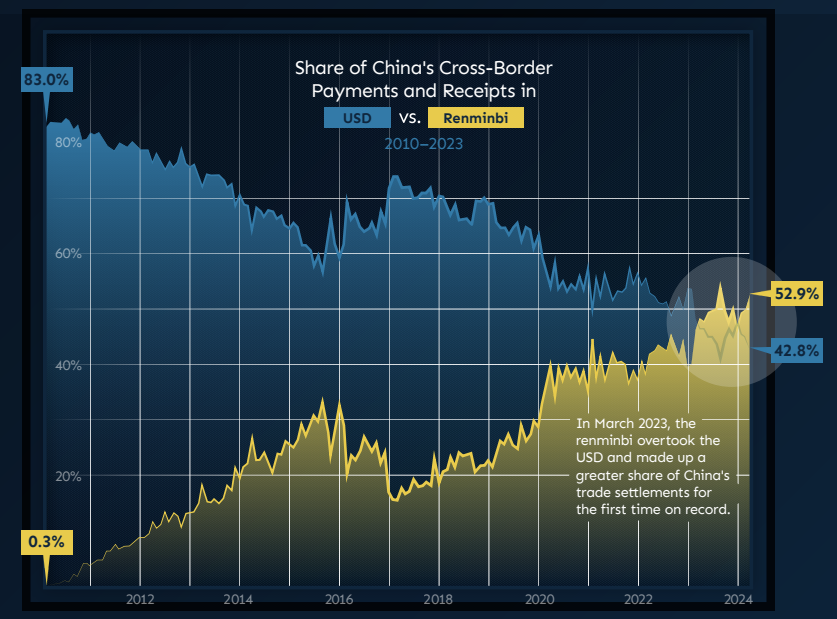

De-dollarization –

China’s Gradual Move Away From the U.S. Dollar – Source: hinrichfoundation

Also Read: Chinese Digital Yuan vs SWIFT: China’s 7-Second Payments Shake Up Global Finance

BRICS Alliance and SWIFT Shift Accelerate De-dollarization Push

The digital yuan has been connected with ASEAN member states and also six Middle East countries through China’s CBDC cross-border payment system. This expansion leverages the mBridge project technology, which was originally developed with the Bank for International Settlements, to create alternatives to SWIFT messaging systems that have dominated international finance for decades now.

Technology Drives Financial Revolution

De-dollarization –

China’s Gradual Move Away From the U.S. Dollar – Source: hinrichfoundation

The digital yuan is not only more secure than traditional banking, but it is also less expensive. Cross-border digital currencies make payments in minutes and they are cheaper than SWIFT by about three quarters. At present, CIPS manages $60 billion each day, helping Yuan benefit from technology, though US-based CHIPS has a much higher daily processing rate.

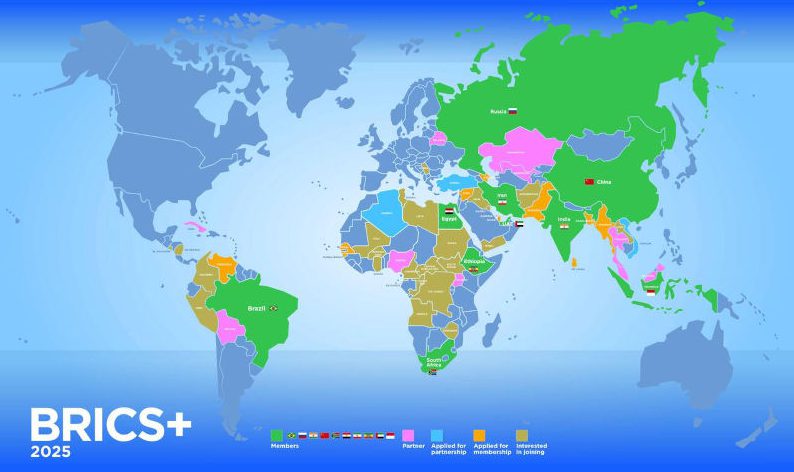

The leading BRICS countries have also joined in by making digital plans to reduce dependence on the dollar. Having the digital yuan means member countries can trade with each other without needing the US dollar or SWIFT which matters now more than ever.

Also Read: De-Dollarization: 5 Oil Giants Now Settling in Yuan, Not USD

Geopolitical Implications

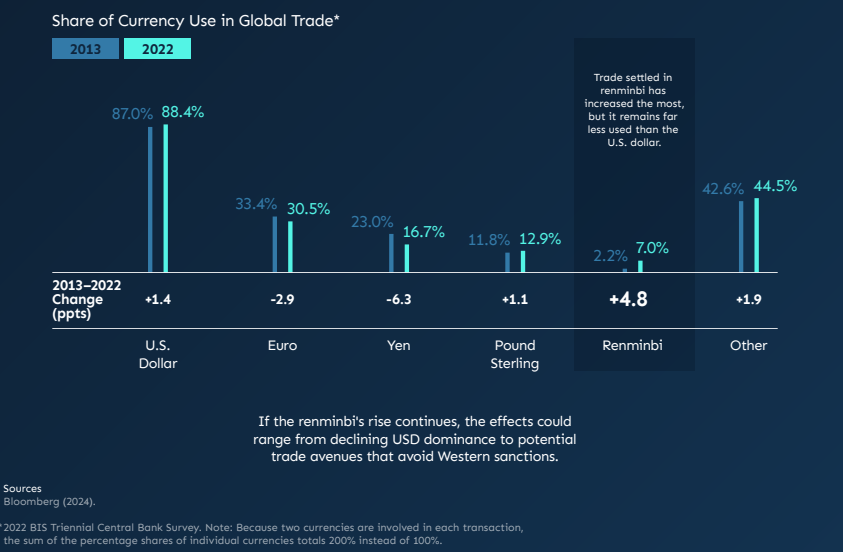

China’s digital yuan strategy centers on achieving “monetary sovereignty” and also reducing dependence on US financial systems. The Chinese Yuan’s internationalization through digital technology allows trading partners to avoid potential sanctions while maintaining economic autonomy. More than 80% of global trade still uses US dollars, which makes alternatives like the digital yuan increasingly attractive to BRICS alliance members seeking de-dollarization options.

The Bank for International Settlements withdrew from the mBridge project after it reached “minimum viable product” stage, and this coincided with BRICS Summit discussions about creating a “BRICS Bridge” based on similar technology. This timing suggests growing momentum for SWIFT alternatives powered by digital yuan infrastructure.

Also Read: Currency: E-Yuan is Here – How China’s CBDC Could Destroy the Dollar

Because of capital controls, many countries are still unable to loan in Chinese Yuan. However, right now, low interest rates in China encourage international borrowing. The digital yuan’s technology helps to chip away at the U.S. dollar’s global dominance, especially as BRICS countries consider other ways to cooperate.

Digital Yuan’s Role in 38% of Global Trade Raises Eyebrows

Digital yuan adoption has really surged as China’s Central Bank digital currency expands beyond domestic borders, and the e-CNY now facilitates cross-border payments across multiple nations. The digital yuan’s integration with BRICS payment systems represents a direct challenge to SWIFT‘s dominance, as Chinese Yuan transactions increasingly bypass traditional US dollar settlements in the global de-dollarization movement that’s gaining momentum right now.

De-dollarization –

China’s Gradual Move Away From the U.S. Dollar – Source: hinrichfoundation

Also Read: Chinese Digital Yuan vs SWIFT: China’s 7-Second Payments Shake Up Global Finance

BRICS Alliance and SWIFT Shift Accelerate De-dollarization Push

The digital yuan has been connected with ASEAN member states and also six Middle East countries through China’s CBDC cross-border payment system. This expansion leverages the mBridge project technology, which was originally developed with the Bank for International Settlements, to create alternatives to SWIFT messaging systems that have dominated international finance for decades now.

Technology Drives Financial Revolution

De-dollarization –

China’s Gradual Move Away From the U.S. Dollar – Source: hinrichfoundation

The digital yuan is not only more secure than traditional banking, but it is also less expensive. Cross-border digital currencies make payments in minutes and they are cheaper than SWIFT by about three quarters. At present, CIPS manages $60 billion each day, helping Yuan benefit from technology, though US-based CHIPS has a much higher daily processing rate.

The leading BRICS countries have also joined in by making digital plans to reduce dependence on the dollar. Having the digital yuan means member countries can trade with each other without needing the US dollar or SWIFT which matters now more than ever.

Also Read: De-Dollarization: 5 Oil Giants Now Settling in Yuan, Not USD

Geopolitical Implications

China’s digital yuan strategy centers on achieving “monetary sovereignty” and also reducing dependence on US financial systems. The Chinese Yuan’s internationalization through digital technology allows trading partners to avoid potential sanctions while maintaining economic autonomy. More than 80% of global trade still uses US dollars, which makes alternatives like the digital yuan increasingly attractive to BRICS alliance members seeking de-dollarization options.

The Bank for International Settlements withdrew from the mBridge project after it reached “minimum viable product” stage, and this coincided with BRICS Summit discussions about creating a “BRICS Bridge” based on similar technology. This timing suggests growing momentum for SWIFT alternatives powered by digital yuan infrastructure.

Also Read: Currency: E-Yuan is Here – How China’s CBDC Could Destroy the Dollar

Because of capital controls, many countries are still unable to loan in Chinese Yuan. However, right now, low interest rates in China encourage international borrowing. The digital yuan’s technology helps to chip away at the U.S. dollar’s global dominance, especially as BRICS countries consider other ways to cooperate.