Coinbase Acquires Cyprus Subsidiary of BUX: Report

Coinbase expanded its presence in Europe on Friday with the acquisition of BUX Europe Limited (BEU), a Cyprus-based subsidiary of BUX, according to a report by Finance Magnates.

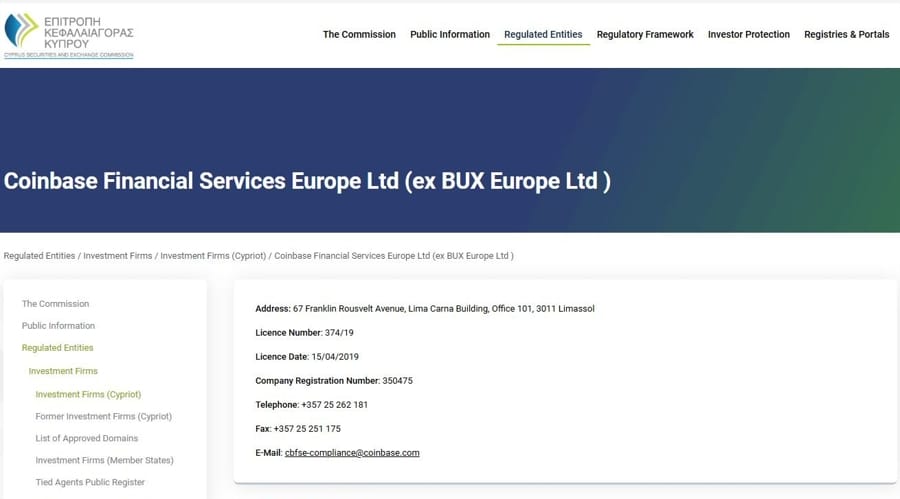

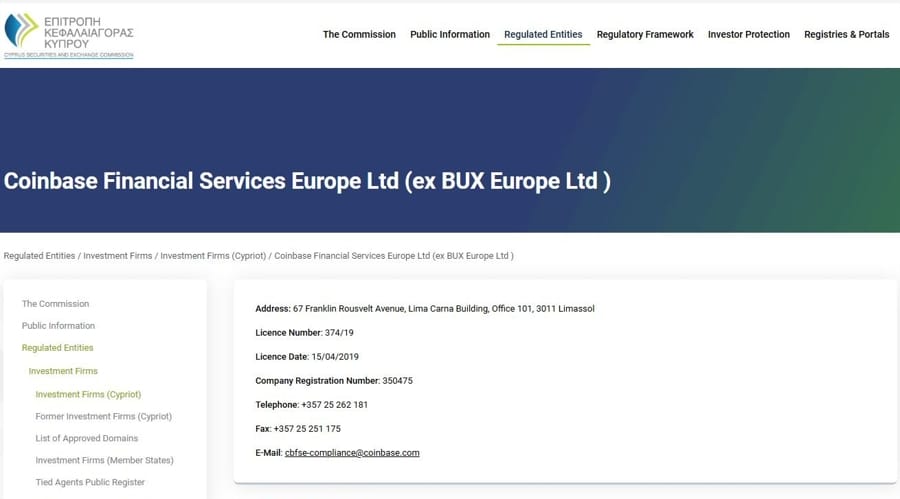

The rebranded entity, now called Coinbase Financial Services Europe, is listed on the Cyprus Securities and Exchange Commission (CySEC) registry, as shown in a screenshot shared by the publication.

Coinbase’s Strategic Expansion into Europe

The acquisition provides Coinbase with a Cyprus Investment Firm (CIF) license, a pivotal regulatory approval enabling the exchange to expand its operations across the EEA.

This license, granted by CySEC, allows Coinbase to offer financial products such as contracts for differences (CFDs) and passport its services across member states, giving the company an edge in navigating Europe’s fragmented crypto regulatory landscape.

Commenting on the sale, Yorick Naeff, CEO of BUX, stated, “We are pleased with the sale of our MiFID-licensed entity, BUX Europe Limited, to Coinbase, a globally recognized leader in the crypto industry.”

Europe: A Growing Opportunity for Coinbase

Europe’s regulatory environment has become increasingly favorable for cryptocurrency businesses following the introduction of the Markets in Crypto-Assets (MiCA) regulation.

This new framework offers greater predictability and structure for firms like Coinbase, allowing them to operate with confidence across the region.

By acquiring BUX’s Cypriot subsidiary, Coinbase signals its intent to solidify its market position and adapt to the evolving regulatory landscape.

Rise in M&A Activity Among Crypto Exchanges

Coinbase’s acquisition of BUX Europe Limited highlights a broader trend of mergers and acquisitions (M&A) in the cryptocurrency industry.

On Thursday, Binance, the world’s largest cryptocurrency exchange by trading volume, announced its approval from the Central Bank of Brazil to acquire Sim;paul, a licensed broker-dealer operating in Latin America.

This acquisition allows Binance to function as a locally licensed broker-dealer in Brazil, expanding its reach in the region.

The post Coinbase Acquires Cyprus Subsidiary of BUX: Report appeared first on Cryptonews.

Read More

US Senate to Grill Coinbase Exec on Crypto Tax Rules Next Week — Regulation Incoming?

Coinbase Acquires Cyprus Subsidiary of BUX: Report

Coinbase expanded its presence in Europe on Friday with the acquisition of BUX Europe Limited (BEU), a Cyprus-based subsidiary of BUX, according to a report by Finance Magnates.

The rebranded entity, now called Coinbase Financial Services Europe, is listed on the Cyprus Securities and Exchange Commission (CySEC) registry, as shown in a screenshot shared by the publication.

Coinbase’s Strategic Expansion into Europe

The acquisition provides Coinbase with a Cyprus Investment Firm (CIF) license, a pivotal regulatory approval enabling the exchange to expand its operations across the EEA.

This license, granted by CySEC, allows Coinbase to offer financial products such as contracts for differences (CFDs) and passport its services across member states, giving the company an edge in navigating Europe’s fragmented crypto regulatory landscape.

Commenting on the sale, Yorick Naeff, CEO of BUX, stated, “We are pleased with the sale of our MiFID-licensed entity, BUX Europe Limited, to Coinbase, a globally recognized leader in the crypto industry.”

Europe: A Growing Opportunity for Coinbase

Europe’s regulatory environment has become increasingly favorable for cryptocurrency businesses following the introduction of the Markets in Crypto-Assets (MiCA) regulation.

This new framework offers greater predictability and structure for firms like Coinbase, allowing them to operate with confidence across the region.

By acquiring BUX’s Cypriot subsidiary, Coinbase signals its intent to solidify its market position and adapt to the evolving regulatory landscape.

Rise in M&A Activity Among Crypto Exchanges

Coinbase’s acquisition of BUX Europe Limited highlights a broader trend of mergers and acquisitions (M&A) in the cryptocurrency industry.

On Thursday, Binance, the world’s largest cryptocurrency exchange by trading volume, announced its approval from the Central Bank of Brazil to acquire Sim;paul, a licensed broker-dealer operating in Latin America.

This acquisition allows Binance to function as a locally licensed broker-dealer in Brazil, expanding its reach in the region.

The post Coinbase Acquires Cyprus Subsidiary of BUX: Report appeared first on Cryptonews.

Read More