XRP Futures Volume Skyrockets Past 200%

- XRP futures volume surged over 200% to $12.4B, surpassing Solana’s.

- Bull flag breakout points to a $4.50 target by September or October.

- Heavy long positioning could mean sharp gains—or a quick reversal if momentum fades.

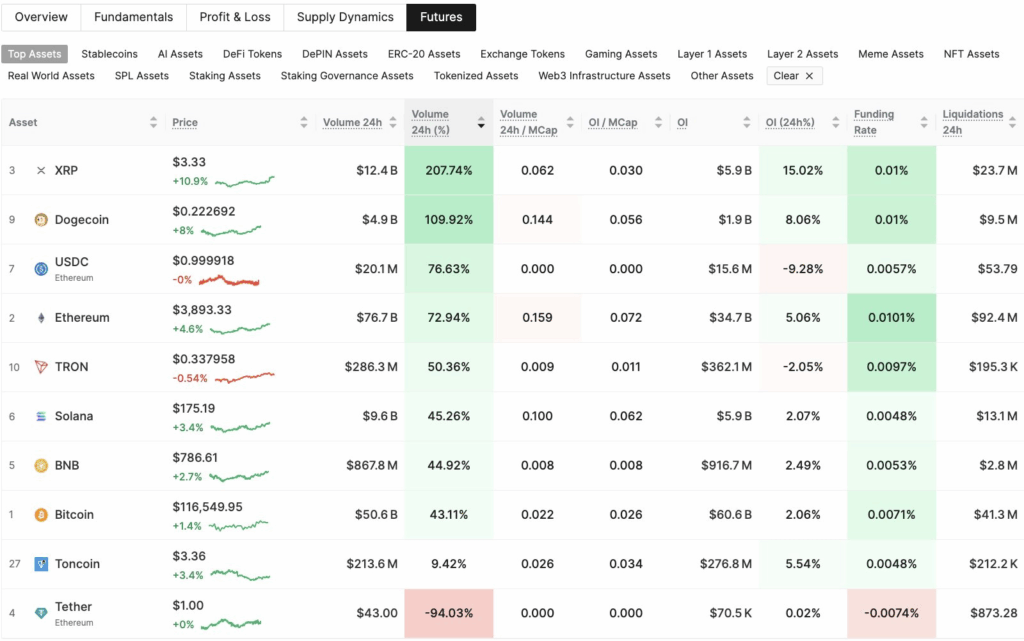

XRP’s derivatives market just lit up, with futures trading volume exploding by more than 200% in the past 24 hours, hitting roughly $12.4 billion. That’s not only a sharp jump, it’s enough to push XRP ahead of Solana’s $9.6 billion in the same period, based on Glassnode data. The timing isn’t random—this surge comes right after Ripple and the U.S. SEC agreed to drop their legal appeals, closing the chapter on a years-long courtroom battle that had been hanging over the token’s head. With open interest also climbing 15% to around $5 billion, traders are clearly piling in fast.

Traders Lean Bullish, But Risks Remain

The futures market isn’t just heating up; it’s skewing heavily bullish. Funding rates are in the green at about 0.01%, hinting that most positions are long and expecting more upside. But there’s a flip side—Glassnode warns that this kind of over-leveraged enthusiasm can backfire if price momentum stalls. On the spot market, a huge cluster of supply sits in the $2.80–$2.82 range, with more than 1.7 billion tokens bought there. That zone could act as a major line in the sand if XRP dips, as many holders in profit might defend their buys.

Bull Flag Breakout Targets $4.50

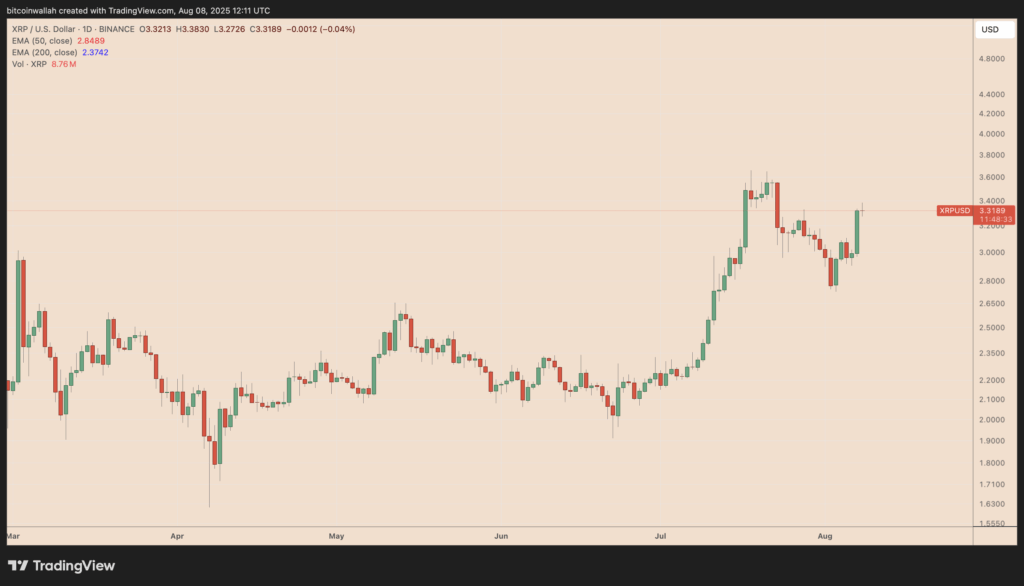

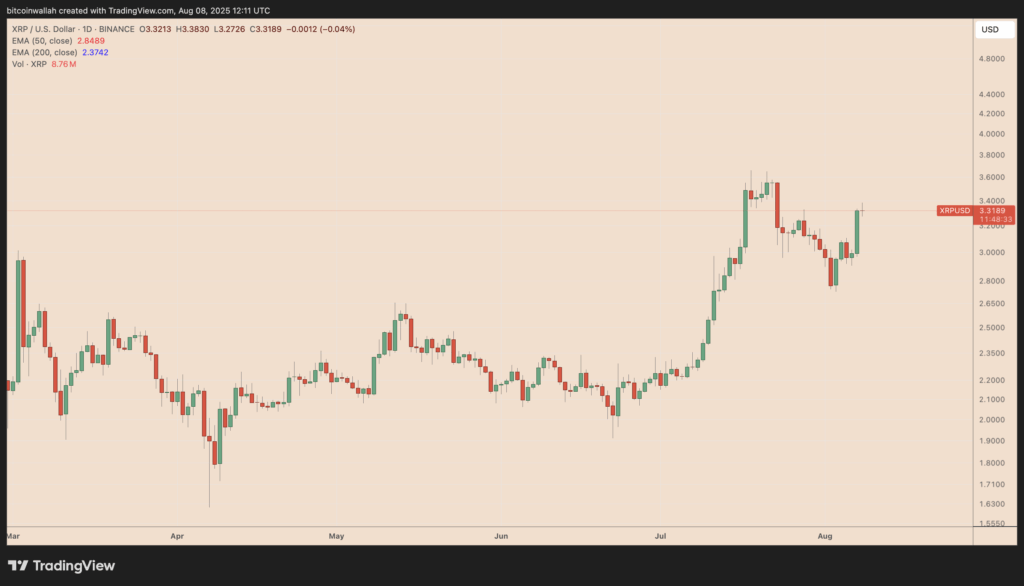

From a charting perspective, XRP has broken out of a bull flag formation, with the breakout supported by rising volume—always a good sign for confirmation. In technical terms, the measured move from this pattern suggests a push toward $4.50, which is roughly a 35% gain from where the price sits now. Analysts believe this could play out by September or October, especially if macro winds turn favorable. A Federal Reserve rate cut in September would be a prime catalyst for risk assets like XRP to attract even more capital.

Analysts See Higher Price Potential

That $4.50 target isn’t a lone wolf prediction. Traders like Mikybull Crypto have their sights higher, forecasting a run to $5–$8 by year-end 2025, while others, like Dom, see a path toward double digits.

Whether or not XRP gets there, the sudden surge in futures activity and strong technical setup suggest that the token’s next big move could come sooner rather than later—though traders might want to keep an eye on leverage before the wave turns.

The post XRP Futures Volume Skyrockets Past 200% first appeared on BlockNews.

XRP Futures Volume Skyrockets Past 200%

- XRP futures volume surged over 200% to $12.4B, surpassing Solana’s.

- Bull flag breakout points to a $4.50 target by September or October.

- Heavy long positioning could mean sharp gains—or a quick reversal if momentum fades.

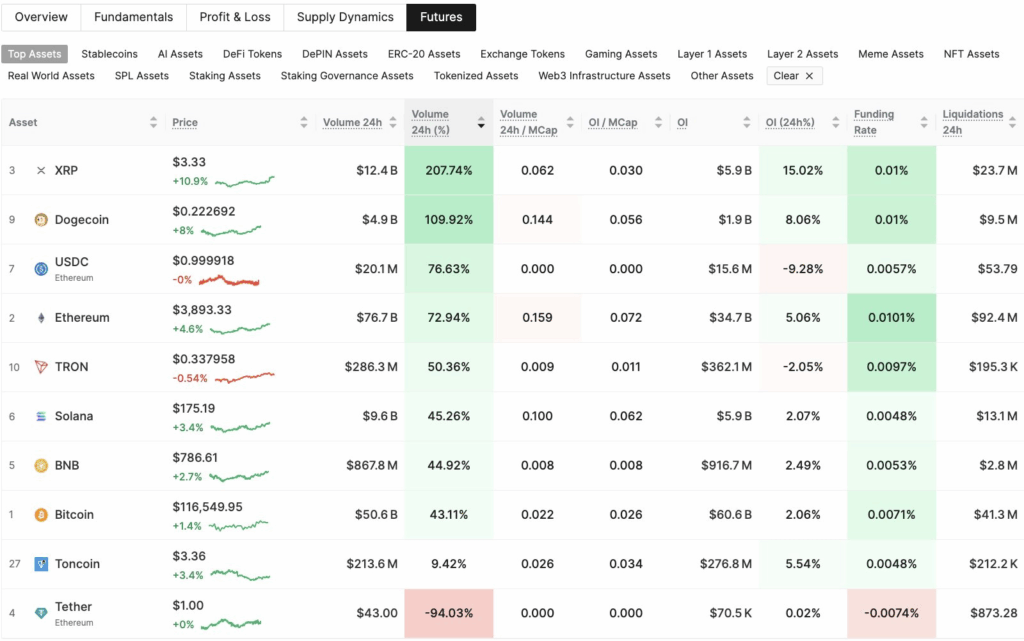

XRP’s derivatives market just lit up, with futures trading volume exploding by more than 200% in the past 24 hours, hitting roughly $12.4 billion. That’s not only a sharp jump, it’s enough to push XRP ahead of Solana’s $9.6 billion in the same period, based on Glassnode data. The timing isn’t random—this surge comes right after Ripple and the U.S. SEC agreed to drop their legal appeals, closing the chapter on a years-long courtroom battle that had been hanging over the token’s head. With open interest also climbing 15% to around $5 billion, traders are clearly piling in fast.

Traders Lean Bullish, But Risks Remain

The futures market isn’t just heating up; it’s skewing heavily bullish. Funding rates are in the green at about 0.01%, hinting that most positions are long and expecting more upside. But there’s a flip side—Glassnode warns that this kind of over-leveraged enthusiasm can backfire if price momentum stalls. On the spot market, a huge cluster of supply sits in the $2.80–$2.82 range, with more than 1.7 billion tokens bought there. That zone could act as a major line in the sand if XRP dips, as many holders in profit might defend their buys.

Bull Flag Breakout Targets $4.50

From a charting perspective, XRP has broken out of a bull flag formation, with the breakout supported by rising volume—always a good sign for confirmation. In technical terms, the measured move from this pattern suggests a push toward $4.50, which is roughly a 35% gain from where the price sits now. Analysts believe this could play out by September or October, especially if macro winds turn favorable. A Federal Reserve rate cut in September would be a prime catalyst for risk assets like XRP to attract even more capital.

Analysts See Higher Price Potential

That $4.50 target isn’t a lone wolf prediction. Traders like Mikybull Crypto have their sights higher, forecasting a run to $5–$8 by year-end 2025, while others, like Dom, see a path toward double digits.

Whether or not XRP gets there, the sudden surge in futures activity and strong technical setup suggest that the token’s next big move could come sooner rather than later—though traders might want to keep an eye on leverage before the wave turns.

The post XRP Futures Volume Skyrockets Past 200% first appeared on BlockNews.