Crypto Trading Guide: How Top Traders Instantly Execute Alpha Calls for Profit

- Most traders lose profits due to slow execution, while pros use tools like Archer Bot to position in under 60 seconds.

- Verification and instant execution are key steps that separate consistent winners from late-entry chasers.

- Communities like TradeHero provide quality alpha calls, while Archer Bot ensures traders act fast with built-in risk management.

You’re scrolling through your favorite alpha group when someone drops a contract address. “This one’s about to moon,” they say. Your heart races—this could be the play that changes everything. But here’s where most new traders fail: they fumble around for 5-15 minutes trying to figure out how to actually buy the token, only to watch the opportunity slip away while they’re still navigating DEX interfaces.

The gap between seeing alpha and profiting from it isn’t about having better information—it’s about having better execution. The fastest traders go from alpha call to positioned in under 60 seconds. While others are still copying contract addresses and figuring out slippage settings, they’re already watching their positions pump.

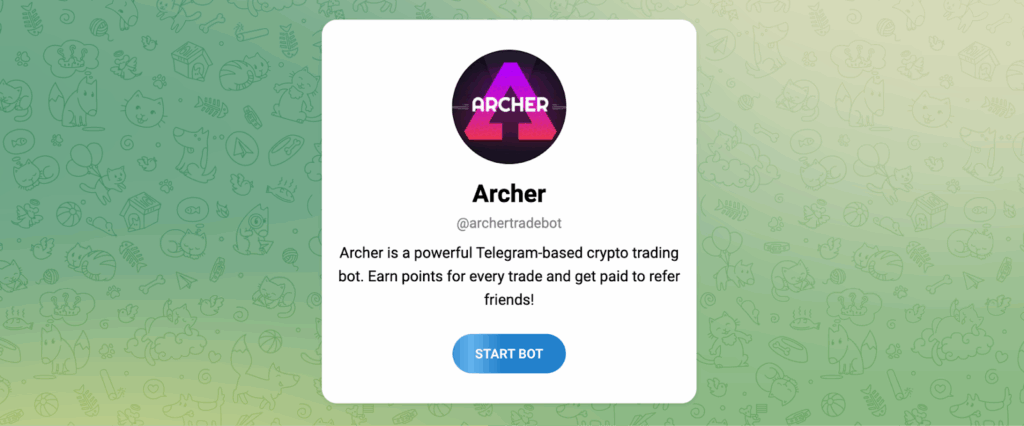

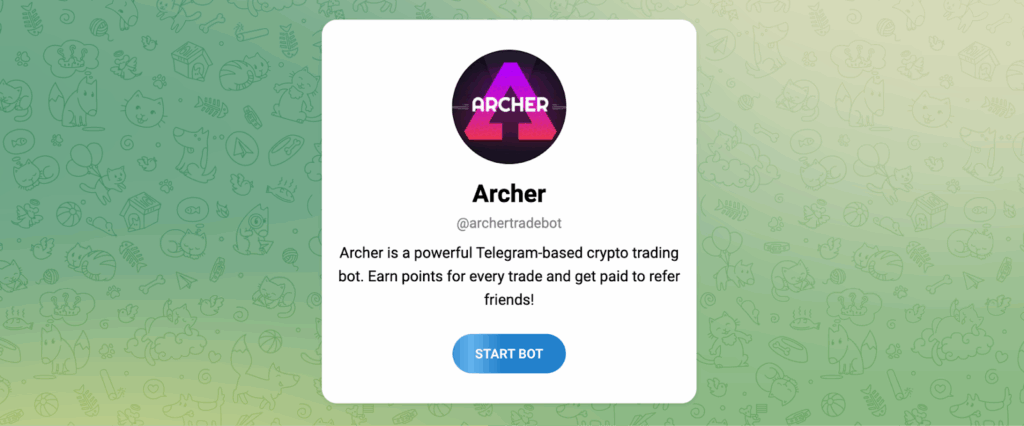

This is exactly why Archer Bot was built for alpha hunters who refuse to let execution delays kill their profits. From alpha discovery to instant positioning to live PNL tracking—all without ever leaving Telegram. Turn every alpha call into instant action → HERE

The Alpha-to-Profit Pipeline

Step 1: Alpha Discovery

The best opportunities come from tight-knit communities, alpha groups, and on-chain hunters who spot projects before they explode. Whether it’s a TradeHero community call, a developer announcement, or smart money wallet activity, you need to be plugged into quality information sources.

Real alpha usually comes with contract addresses, basic project information, and context about why the project matters. If someone’s just posting “this one’s going to moon” without details, skip it.

Step 2: Contract Address Verification

Always verify contract addresses through multiple sources—the project’s official Twitter, their website, or trusted community members. Scammers create fake tokens with similar names to trending projects, hoping to catch traders who don’t verify properly.

A few seconds of verification can save you from losing everything to a honeypot contract.

Step 3: Instant Execution

This is where traditional trading falls apart and smart traders pull ahead. While most people navigate to Uniswap, connect wallets, adjust slippage, and pray transactions go through, Archer Bot users simply paste the contract address into Telegram and execute instantly.

Archer Bot automatically handles all technical complexity—optimal slippage, MEV protection, and gas optimization—while you focus on getting positioned fast. Execute alpha calls in seconds, not minutes → HERE

Speed Advantage in Action

Traditional Execution (10 minutes)

Copy contract address → Open browser → Navigate to Uniswap or Jupiter → Connect wallet → Paste address → Wait for token info → Set slippage → Calculate position → Submit transaction → Wait for confirmation

By the time you’re positioned, early traders are taking profits.

Archer Bot Execution (30-60 seconds)

Copy contract address → Paste into Archer Bot → Confirm position size → Instantly positioned

This speed difference is often the difference between 10x gains and buying tops.

Live PNL and Risk Management

Archer Bot provides real-time profit and loss tracking directly in Telegram. No app switching or manual calculations—you see exactly how much your position is worth at any moment.

Automated Risk Management

Set automatic buy and sell levels to remove emotion from trading decisions:

- Take Profits: 25% at 2x, 50% at 5x automatically

- Automatic buys: Lock in buys on high-potential projects at specific price levels

- Ladder Selling: Lock in gains instantly while maintaining upside exposure

Professional traders swear by systematic risk management, and Archer Bot makes these techniques accessible to anyone. Get professional-grade risk management tools → HERE

The Community Advantage

The best alpha comes from being part of communities where serious traders share legitimate opportunities. Groups like TradeHero provide quality calls and thorough research, giving members access to opportunities before they hit mainstream channels.

When alpha gets called in quality communities, you’re not just getting a contract address—you’re getting context, analysis, and collective wisdom from experienced traders.

Connect with traders who consistently profit from alpha in the TradeHero community where members share researched opportunities and proven strategies. Join experienced alpha traders → HERE

Common Alpha Trading Mistakes

Execution Delays: Slow execution kills profits. Most traders enter during distribution phases when early buyers are selling.

Poor Risk Management: FOMO leads to oversized positions. Treat each alpha play as speculation, not investment.

Information Quality: Following low-quality sources that post random contracts instead of researched opportunities.

Emotional Trading: Letting greed override exit strategies or panic selling during normal volatility.

Building Your Alpha System

Information Sources

Develop relationships with quality alpha communities like TradeHero who learn to recognize legitimate opportunities versus pump schemes.

Execution Infrastructure

Have trading setup optimized before opportunities appear. Funds ready, Archer Bot configured, and clear rules about position sizing.

Continuous Learning

Study successful and failed trades to identify patterns. What alpha works for your risk tolerance? What timing leads to optimal entries?

Your Alpha Trading Blueprint

- Set up Archer Bot and practice with small positions

- Join quality communities like TradeHero

- Define position sizing and risk management rules

- Practice the workflow until it becomes automatic

- Maintain discipline around sizing and stops

- Study trades to improve decision-making

- Build relationships in alpha communities

- Refine execution speed and risk management

The Bottom Line

The gap between seeing alpha and profiting from it will only widen as more traders recognize the importance of execution speed. Alpha trading isn’t about having the best information—it’s about having the best execution when opportunities appear.

The combination of quality communities, instant execution tools, and disciplined risk management creates a system for consistently turning alpha calls into profits. Those who adapt early will capture opportunities that others can only watch slip away.

Ready to turn every alpha call into instant action? Archer Bot eliminates execution delays that cost traders thousands in missed opportunities. From contract address to positioned in seconds—all through Telegram. Start capturing alpha profits today → HERE

The post Crypto Trading Guide: How Top Traders Instantly Execute Alpha Calls for Profit first appeared on BlockNews.

Crypto Trading Guide: How Top Traders Instantly Execute Alpha Calls for Profit

- Most traders lose profits due to slow execution, while pros use tools like Archer Bot to position in under 60 seconds.

- Verification and instant execution are key steps that separate consistent winners from late-entry chasers.

- Communities like TradeHero provide quality alpha calls, while Archer Bot ensures traders act fast with built-in risk management.

You’re scrolling through your favorite alpha group when someone drops a contract address. “This one’s about to moon,” they say. Your heart races—this could be the play that changes everything. But here’s where most new traders fail: they fumble around for 5-15 minutes trying to figure out how to actually buy the token, only to watch the opportunity slip away while they’re still navigating DEX interfaces.

The gap between seeing alpha and profiting from it isn’t about having better information—it’s about having better execution. The fastest traders go from alpha call to positioned in under 60 seconds. While others are still copying contract addresses and figuring out slippage settings, they’re already watching their positions pump.

This is exactly why Archer Bot was built for alpha hunters who refuse to let execution delays kill their profits. From alpha discovery to instant positioning to live PNL tracking—all without ever leaving Telegram. Turn every alpha call into instant action → HERE

The Alpha-to-Profit Pipeline

Step 1: Alpha Discovery

The best opportunities come from tight-knit communities, alpha groups, and on-chain hunters who spot projects before they explode. Whether it’s a TradeHero community call, a developer announcement, or smart money wallet activity, you need to be plugged into quality information sources.

Real alpha usually comes with contract addresses, basic project information, and context about why the project matters. If someone’s just posting “this one’s going to moon” without details, skip it.

Step 2: Contract Address Verification

Always verify contract addresses through multiple sources—the project’s official Twitter, their website, or trusted community members. Scammers create fake tokens with similar names to trending projects, hoping to catch traders who don’t verify properly.

A few seconds of verification can save you from losing everything to a honeypot contract.

Step 3: Instant Execution

This is where traditional trading falls apart and smart traders pull ahead. While most people navigate to Uniswap, connect wallets, adjust slippage, and pray transactions go through, Archer Bot users simply paste the contract address into Telegram and execute instantly.

Archer Bot automatically handles all technical complexity—optimal slippage, MEV protection, and gas optimization—while you focus on getting positioned fast. Execute alpha calls in seconds, not minutes → HERE

Speed Advantage in Action

Traditional Execution (10 minutes)

Copy contract address → Open browser → Navigate to Uniswap or Jupiter → Connect wallet → Paste address → Wait for token info → Set slippage → Calculate position → Submit transaction → Wait for confirmation

By the time you’re positioned, early traders are taking profits.

Archer Bot Execution (30-60 seconds)

Copy contract address → Paste into Archer Bot → Confirm position size → Instantly positioned

This speed difference is often the difference between 10x gains and buying tops.

Live PNL and Risk Management

Archer Bot provides real-time profit and loss tracking directly in Telegram. No app switching or manual calculations—you see exactly how much your position is worth at any moment.

Automated Risk Management

Set automatic buy and sell levels to remove emotion from trading decisions:

- Take Profits: 25% at 2x, 50% at 5x automatically

- Automatic buys: Lock in buys on high-potential projects at specific price levels

- Ladder Selling: Lock in gains instantly while maintaining upside exposure

Professional traders swear by systematic risk management, and Archer Bot makes these techniques accessible to anyone. Get professional-grade risk management tools → HERE

The Community Advantage

The best alpha comes from being part of communities where serious traders share legitimate opportunities. Groups like TradeHero provide quality calls and thorough research, giving members access to opportunities before they hit mainstream channels.

When alpha gets called in quality communities, you’re not just getting a contract address—you’re getting context, analysis, and collective wisdom from experienced traders.

Connect with traders who consistently profit from alpha in the TradeHero community where members share researched opportunities and proven strategies. Join experienced alpha traders → HERE

Common Alpha Trading Mistakes

Execution Delays: Slow execution kills profits. Most traders enter during distribution phases when early buyers are selling.

Poor Risk Management: FOMO leads to oversized positions. Treat each alpha play as speculation, not investment.

Information Quality: Following low-quality sources that post random contracts instead of researched opportunities.

Emotional Trading: Letting greed override exit strategies or panic selling during normal volatility.

Building Your Alpha System

Information Sources

Develop relationships with quality alpha communities like TradeHero who learn to recognize legitimate opportunities versus pump schemes.

Execution Infrastructure

Have trading setup optimized before opportunities appear. Funds ready, Archer Bot configured, and clear rules about position sizing.

Continuous Learning

Study successful and failed trades to identify patterns. What alpha works for your risk tolerance? What timing leads to optimal entries?

Your Alpha Trading Blueprint

- Set up Archer Bot and practice with small positions

- Join quality communities like TradeHero

- Define position sizing and risk management rules

- Practice the workflow until it becomes automatic

- Maintain discipline around sizing and stops

- Study trades to improve decision-making

- Build relationships in alpha communities

- Refine execution speed and risk management

The Bottom Line

The gap between seeing alpha and profiting from it will only widen as more traders recognize the importance of execution speed. Alpha trading isn’t about having the best information—it’s about having the best execution when opportunities appear.

The combination of quality communities, instant execution tools, and disciplined risk management creates a system for consistently turning alpha calls into profits. Those who adapt early will capture opportunities that others can only watch slip away.

Ready to turn every alpha call into instant action? Archer Bot eliminates execution delays that cost traders thousands in missed opportunities. From contract address to positioned in seconds—all through Telegram. Start capturing alpha profits today → HERE

The post Crypto Trading Guide: How Top Traders Instantly Execute Alpha Calls for Profit first appeared on BlockNews.