US Stock Market Crash: Should You Be Worried or Buy the Dip?

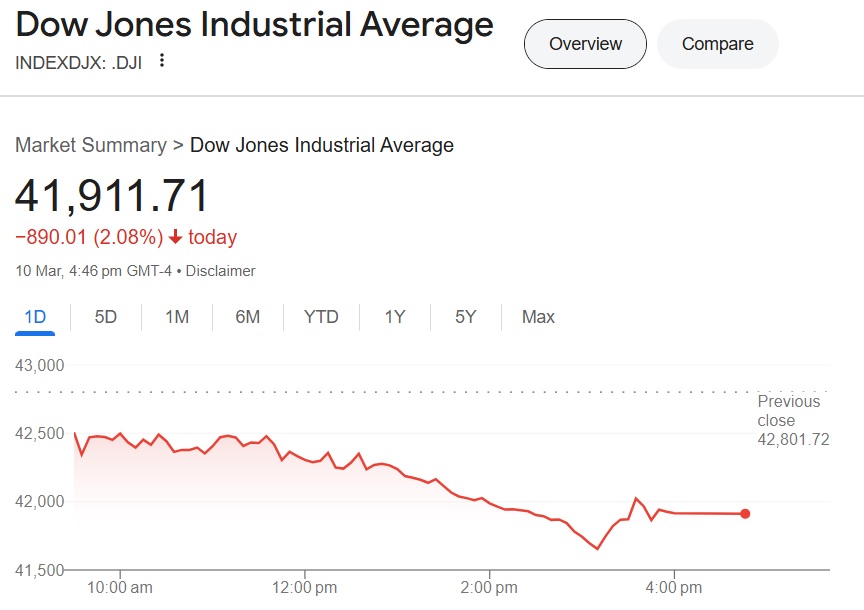

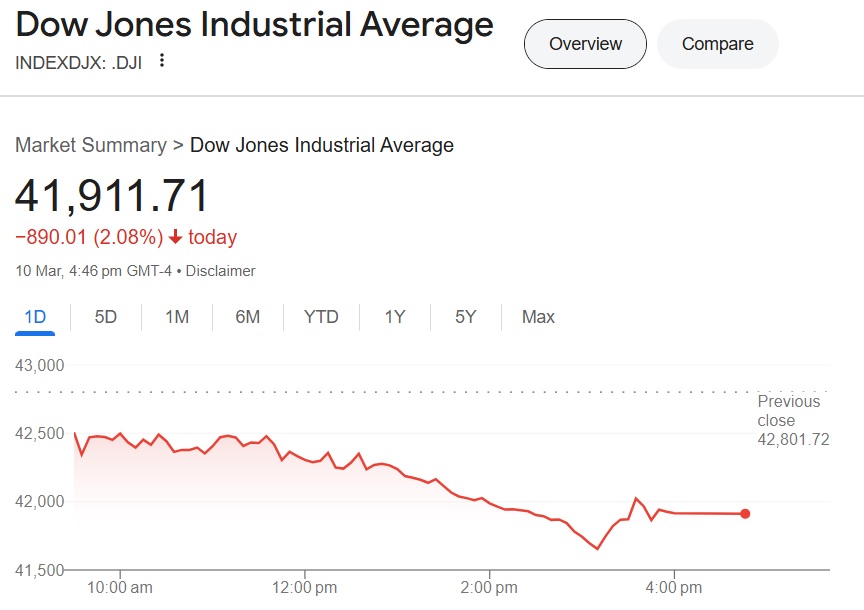

The US stock market saw the biggest crash on Monday since September 2022. Dow Jones plummeted 890 points while Nasdaq crashed 727 points. The S&P 500 index fell 155 points wiping away close to $1 trillion in value. At one point, the Dow Jones index was down close to 1,100 points in the day’s trade. The crash has shocked investors while fears of a recession and a prolonged downturn loom.

Also Read: Amazon: 3 Reasons AMZN is Smartest Stock to Buy Right Now

The stock market crash is making retail investors stay away from taking an entry position as equities are yet to bottom out. The ongoing trade wars have left a lasting impact on stocks making the markets a divided bag. Tesla shares plummeted 15% while Apple dipped close to 12%. Leading stocks are bleeding profusely turning the markets deep red with little to no signs of a recovery in sight.

Also Read: Tesla (TSLA) Wipes Away US Election Gains, Falls Another 15%

Should You Fear or Accumulate the Dip During the US Stock Market Crash?

Gina Bolvin, the President of Bolvin Wealth Management Group explained that the US stock market crash was a correction that was coming. Bolvin stressed that the markets will be up and running again and will reward investors who accumulated the dip. She revealed that when investors fear the market, it’s the best time to take an entry position.

Also Read: Top 3 Cryptocurrencies You Could Buy At A Discount Right Now

The analyst explained that the US stock market crash is a temporary blip before it enters the bullish phase. “We’ve gone from animal spirits to what are the odds of a recession,” said Bolvin to CNBC. “This is a headline-driven market; one that could change in an hour. Sit tight. Buckle up. We finally have the correction we were waiting for, and long-term investors will be rewarded again,” she said.

In conclusion, the US stock market could dust itself from the crash and turn bullish again, according to the analyst. Buying the dip is recommended as leading stocks are available at discounted prices.

Read More

Stock Market Should Continue Upward Till Year-End After Passing ‘Stress Test’: Fundstrat’s Tom Lee

US Stock Market Crash: Should You Be Worried or Buy the Dip?

The US stock market saw the biggest crash on Monday since September 2022. Dow Jones plummeted 890 points while Nasdaq crashed 727 points. The S&P 500 index fell 155 points wiping away close to $1 trillion in value. At one point, the Dow Jones index was down close to 1,100 points in the day’s trade. The crash has shocked investors while fears of a recession and a prolonged downturn loom.

Also Read: Amazon: 3 Reasons AMZN is Smartest Stock to Buy Right Now

The stock market crash is making retail investors stay away from taking an entry position as equities are yet to bottom out. The ongoing trade wars have left a lasting impact on stocks making the markets a divided bag. Tesla shares plummeted 15% while Apple dipped close to 12%. Leading stocks are bleeding profusely turning the markets deep red with little to no signs of a recovery in sight.

Also Read: Tesla (TSLA) Wipes Away US Election Gains, Falls Another 15%

Should You Fear or Accumulate the Dip During the US Stock Market Crash?

Gina Bolvin, the President of Bolvin Wealth Management Group explained that the US stock market crash was a correction that was coming. Bolvin stressed that the markets will be up and running again and will reward investors who accumulated the dip. She revealed that when investors fear the market, it’s the best time to take an entry position.

Also Read: Top 3 Cryptocurrencies You Could Buy At A Discount Right Now

The analyst explained that the US stock market crash is a temporary blip before it enters the bullish phase. “We’ve gone from animal spirits to what are the odds of a recession,” said Bolvin to CNBC. “This is a headline-driven market; one that could change in an hour. Sit tight. Buckle up. We finally have the correction we were waiting for, and long-term investors will be rewarded again,” she said.

In conclusion, the US stock market could dust itself from the crash and turn bullish again, according to the analyst. Buying the dip is recommended as leading stocks are available at discounted prices.

Read More