As Viral ETF Token Plummets 99%, This Other Bitcoin ETF Project Just Raised $1.3 Million – Next 100x Coin?

As market hype around the prospect of an imminent Bitcoin Spot ETF grows, so too has super-charged price action on DEX markets, but in a move shocking markets this morning, viral BTC ETF token has rug-pulled – leaving investors scrambling for alternative plays.

Recent months have seen a huge trend in explosive DEX-traded token moves, with countless moon-shots garnering significant attention, including the ever-popular APX, SAMBO Bot, Baby Meme, TIME, ROCKY and IO.

JUST IN: #SEC just met with #Grayscale for spot Bitcoin ETF listing, memo shows pic.twitter.com/yTVjS8ipwl

— Satoshi Club (@esatoshiclub) November 22, 2023

With markets scoped in on the news for any developments on the Bitcoin spot ETF front, it’s no surprise that a meme coin bearing the name ‘BTC ETF’ has undertaken rapid growth on DEX markets with little to no marketing.

But as is often true for DEX traded moon-shot tokens, all was not what it seemed, and a sinister rug-pull play awaited that has left 702 DEX traders penniless in the dust.

$ETF Rug Pull Analysis: As BTC ETF Token Capitulates – Were The Warning Signs Written on the Wall for 702 Penniless Traders?

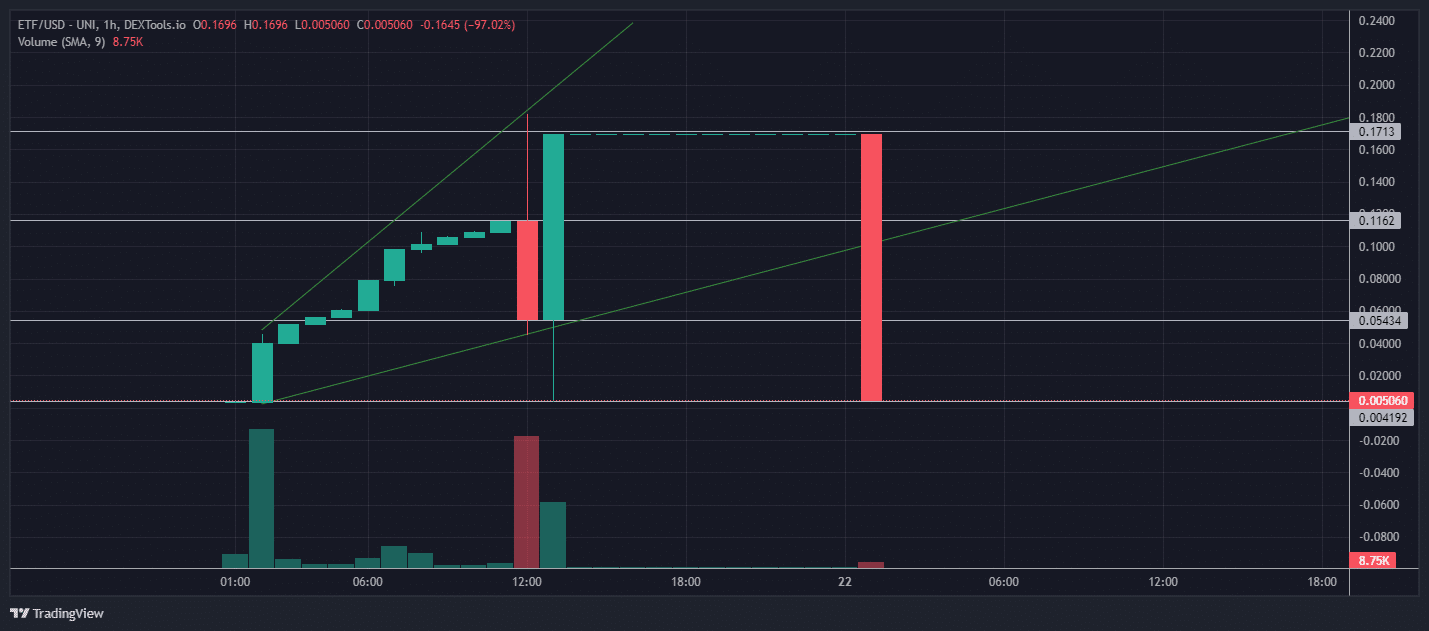

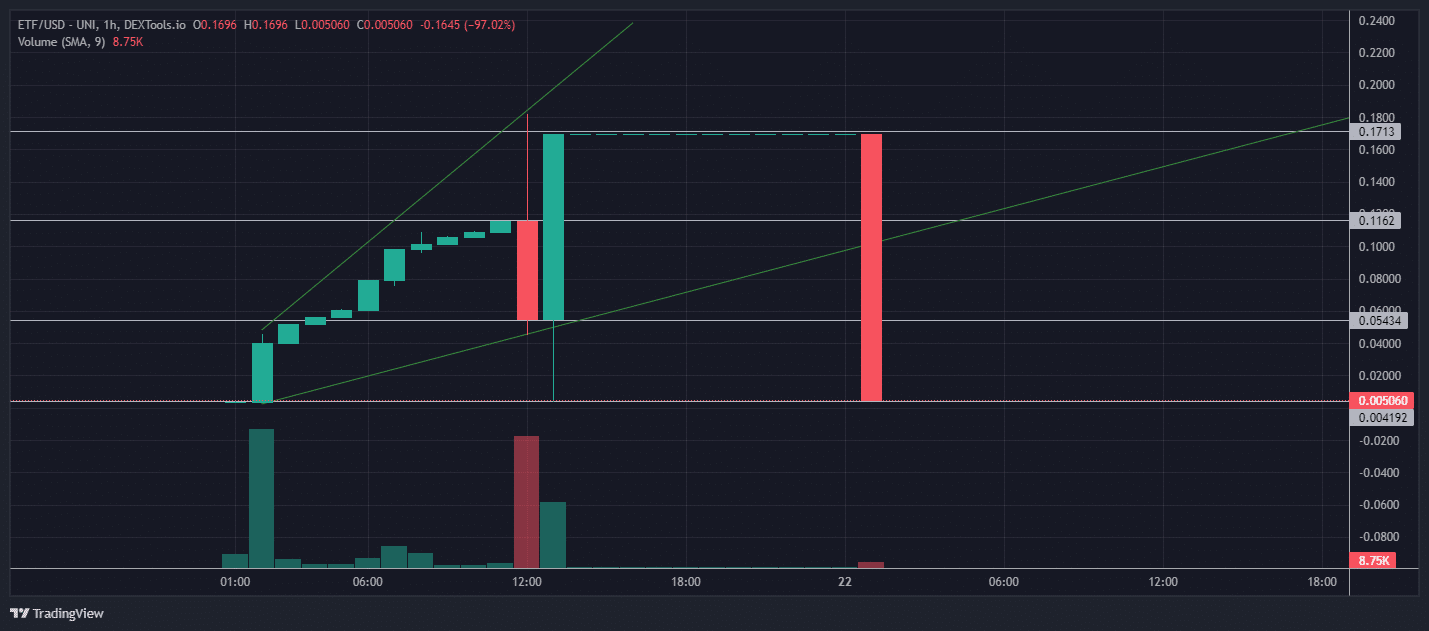

Following the thunderous crash, $ETF token is currently trading at a market price of $0.005060 (representing a 24-hour change of -95.29%).

This comes following a seemingly impressive run yesterday. which saw $ETF token launch to almost instantaneous success as the fresh-faced coin surged +850% in the first hour.

Lured in by the dramatic growth, $ETF token then posted a 9-hour sustained +194% rally move to resistance at $0.1162, however, this was stifled by a substantial -95% retracement move.

Mysteriously this dump like price action was quickly bought up by an influx of $371k in volume, as late stage traders raced into what now appeared to be a honeypot.

This left 702 bewildered holders trapped, with liquidity pulled at 14:00 on November 21, this was followed by a sweeping rug-pull 11-hours later – with price tumbling -95% in a complete scam.

But with BTC ETF token posting such dramatic growth, and 702 holders now penniless – with nothing but a few illiquid digital tokens as a memoire – were the warning signs written on the wall?

$ETF $***250k+*** buy volume detected

+ buy vol & 12.1x UP since VIP alert!

Traders 249

Buy vol $253.8k

Sec. risks:

(TG)

0x041badf25213e5f41cdf074d9dbf5cbb29d073d6

Details in TG: https://t.co/Udo7mVwBq5#ETF $gdx $grok $gup $bape $bart $kekec $mai pic.twitter.com/8Za0lbs2AN

— Crypto Rick | @GoldmineAlpha (@crypto_rick_gm) November 12, 2023

Perhaps the first warning sign emerges when you search the $ETF token address on Twitter, which reveals a prior token launch in early November – that undertook a ‘sensational run’ before vanishing for more than 10 days.

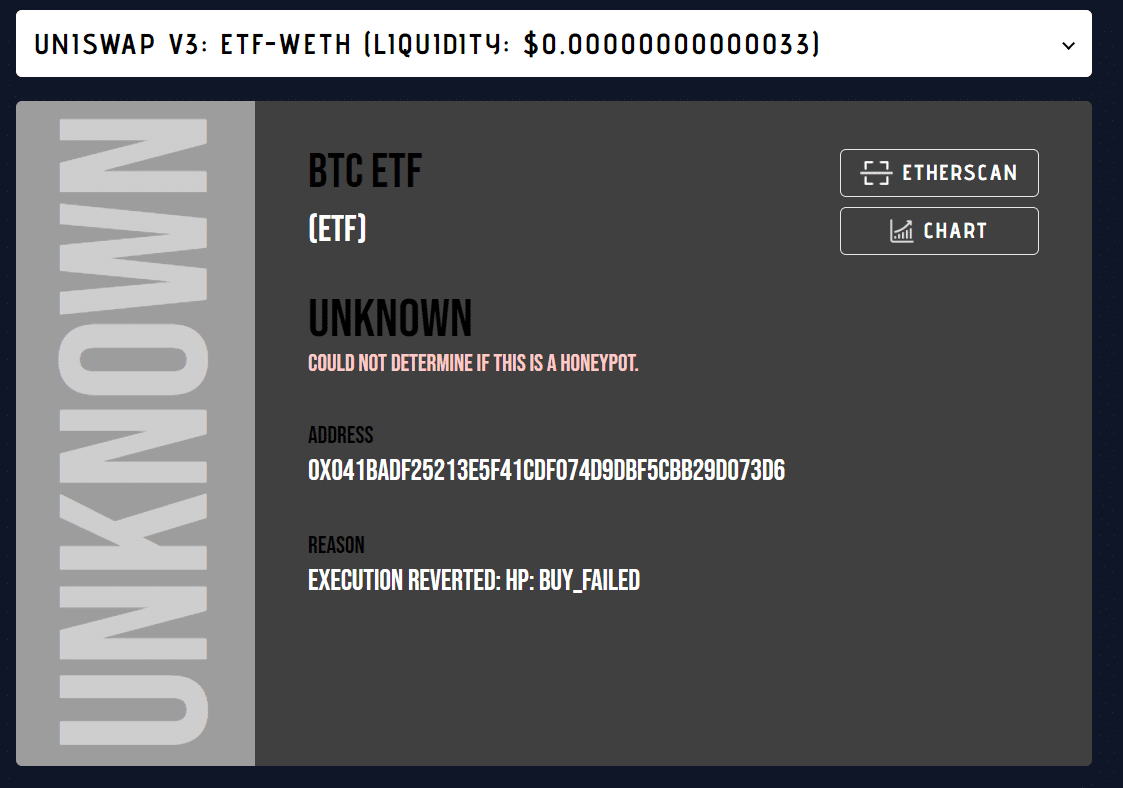

This suggests a token contract being reused or recycled, and quite coyly too, as $ETF goes undetected by DEXTools built in security audits.

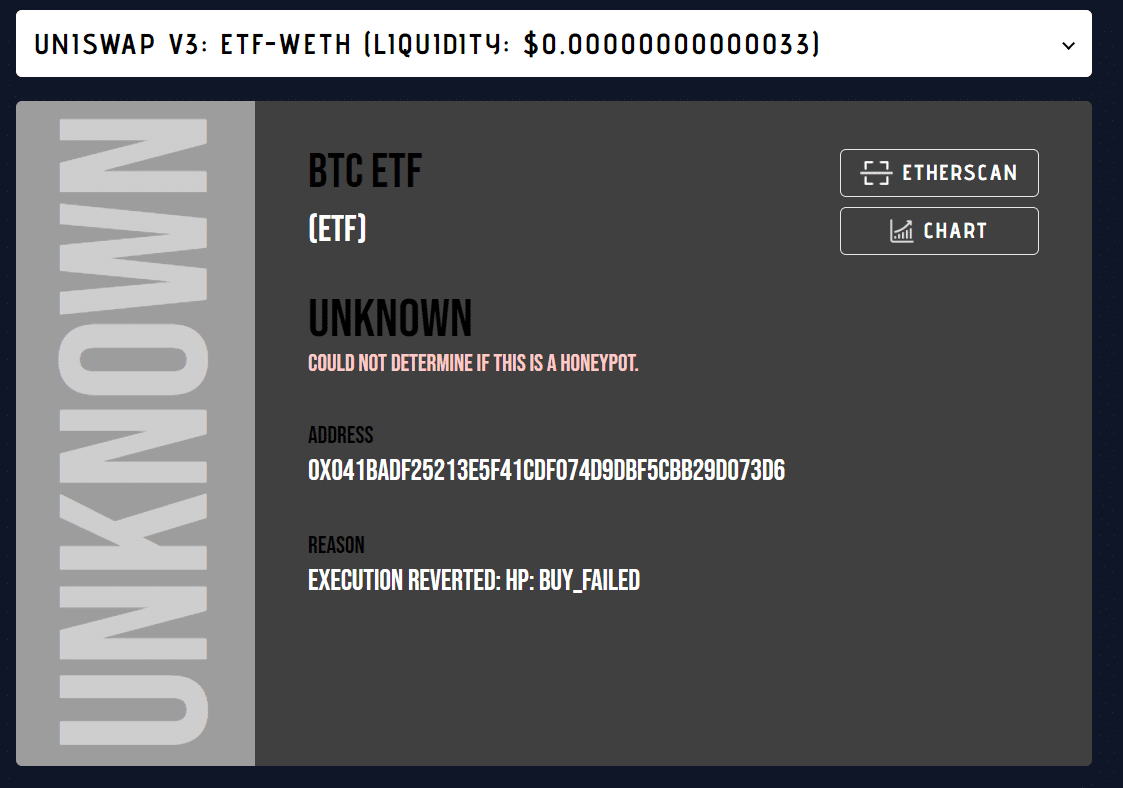

But further examination of the token contract with a Honeypot Detector begins to ring warning bells, with the token contract found to be faulty – leading to an illusive ‘unknown’ result.

However, the ability to edit buy functions alongside unlocked liquidity pools suggests this was a clear rug-pull risk from the start.

Despite the loss here, traders looking for a similar ETF-themed play backed by a fully security audited token contract and reputable development team need look no further than the Bitcoin ETF presale (that’s right; Bitcoin ETF – NOT – BTC ETF).

This BTC ETF Alternative Token Could Skyrocket Amid Bitcoin ETF Bullrun – Don’t Miss Out

A new Bitcoin alternative presale launched this week, offering eagle-eyed traders the opportunity to make it big on unfolding Bitcoin ETF rumors, without having to eat the $37,000 cost of becoming a wholecoiner.

Bitcoin ETF Token ($BTCETF) is currently trading at a market price of $0.0056 in funding round stage 1 with an alluring $1,333,692 raised in the opening weekend of presale.

Designed and built with skyrocket potential in mind, this promising token aims to bank big on market excitement surrounding the ongoing applications for Bitcoin spot ETFs.

Aiming for a hard-cap of $5m in presale funding, the early-stage of this emerging project’s presale offers investors a unique opportunity to get in during this early entry point, which could set the stage for life-changing gains.

#BitcoinETF introduces a 5% transaction burn tax, gradually reducing the #Token supply.

Targeting a 25% token burn as milestones are reached.

This strategy aims to reward holders and alleviate selling pressure with a deflationary approach. pic.twitter.com/UiheUjIZB8

— BTCETF_Token (@BTCETF_Token) November 22, 2023

Ride the ETF Rally with Ease: Bitcoin ETF Token is a Critical Component in Every BTC Trader’s Toolbox

Indeed, Bitcoin ETF isn’t simply a useless meme coin, beyond taking aim at the biggest narrative in crypto – BTCETF has a major utility: Bitcoin ETF news alerts.

The token’s dApp offers traders a live-feed of the latest Bitcoin spot ETF information and news, with sophisticated technology tracking applications real-time at the SEC, and high-speed bots monitoring social media for the latest breaking ETF news.

But a simple feed of Bitcoin spot ETF news only highlights a fraction of Bitcoin ETF token’s potential, with easy-access to real-time update alerts offering sharp traders the opportunity to make market-beating returns stress-free; being amongst the first to hear about privileged Bitcoin Spot ETF news.

This could enable traders to position themselves appropriately in seismic Bitcoin market movements, making Bitcoin ETF token a critical component in every BTC trader’s tool-box this Winter.

Surging Interest in Bitcoin Alternatives Leaves $BTCETF Poised to Outperform $ETF Token

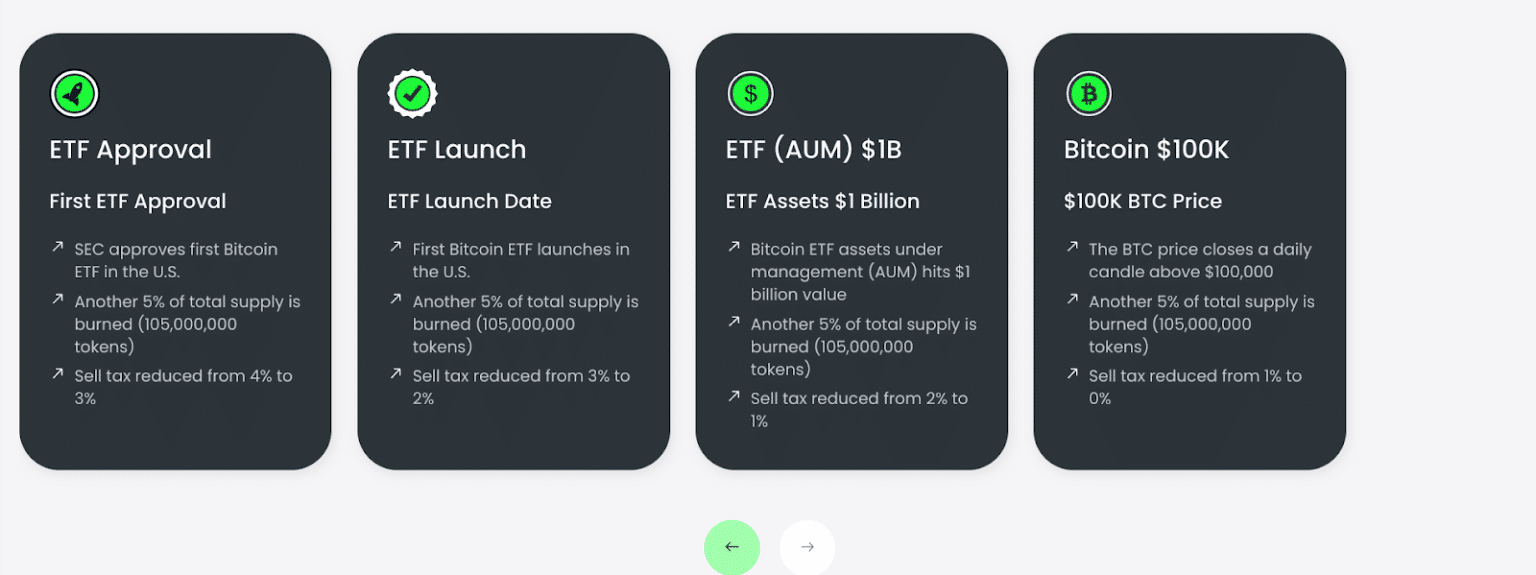

Project tokenomics are bolstered by ambitious plans for the incorporation of staking rewards that incentivise long-term holding, alongside a burn mechanism, which will enhance $BTCETF as a ‘digital gold’ alternative, by creating a deflationary mechanism in price.

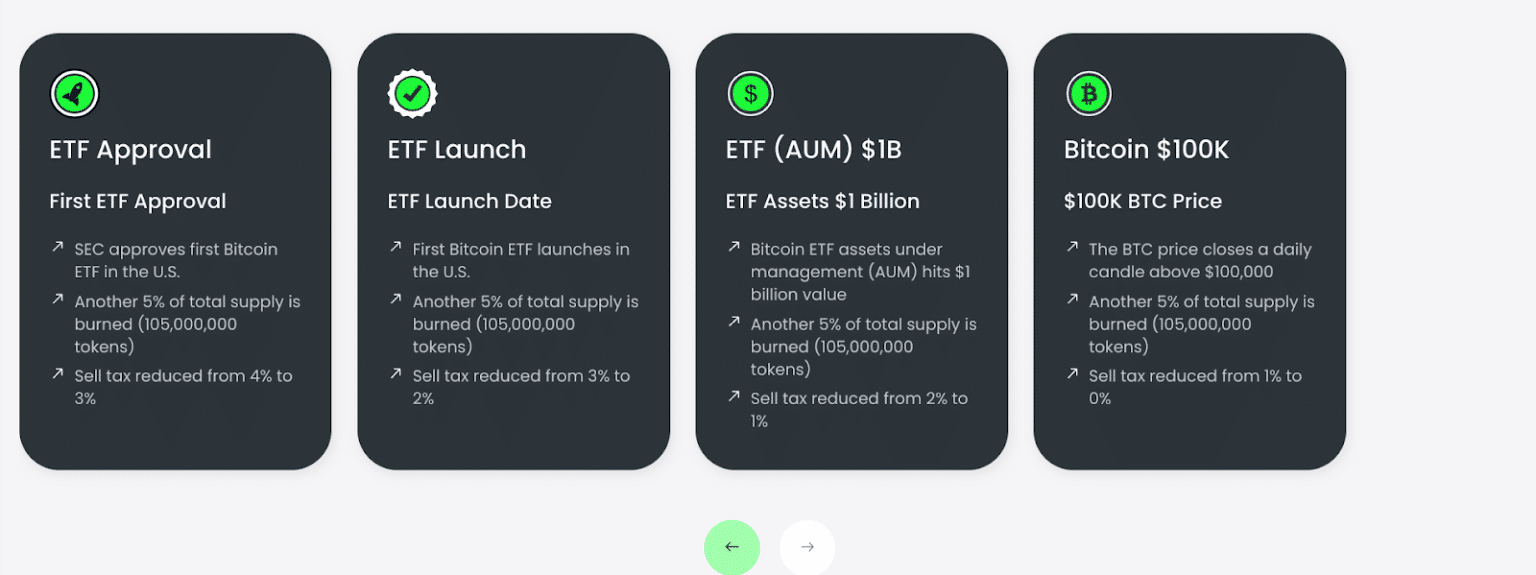

Set for stage 3 of the Bitcoin ETF project roadmap, an initial burn mechanism will be introduced amid a well-marketed DEX launch, imposing an initial 5% burn tax on transactions – this will be reduced by -1% each time a Bitcoin ETF news milestone is reached.

However, plans are afoot for a larger burn mechanism in stage 4, in a move that will see 25% of token supply burned overtime, this will be conducted in 5% burn intervals – with each supply-side reduction taking place as a Bitcoin ETF news milestone is met.

The milestones for the burn mechanism are as follows:

- Milestone 1 – $BTCETF Trading Volume hits $100m – burn tax on transactions reduced from 5% to 4%, and 5% of total supply is burned.

- Milestone 2 – First Bitcoin ETF is approved by SEC – burn tax on transactions is reduced from 4% to 3%, and a further 5% of total supply is burned.

- Milestone 3- First Bitcoin ETF launch date – burn tax on transactions is reduced from 3% to 2%, and a further 5% of total supply is burned.

- Milestone 4 – Bitcoin ETF assets under management (AUM) hits $1bn – burn tax on transactions is reduced from 2% to 1%, and a further 5% of total supply is burned.

- Milestone 5 – Bitcoin price hits $100k – burn tax on transactions is reduced from 1% to 0%, and a further 5% of total supply is burned.

This will create a gradual decrease in total supply, eventually leaving around 70% of BTCETF in circulation, with the supply side reduction inducing upside price growth.

And that is without considering the potential for token value accrual driven by demand from traders for access to the ETF news dApp and the ever-present demand for Bitcoin alternatives.

Indeed, 2023 has seen explosive growth in Bitcoin related tokens – with markets showing a real appetite for BRC-20 ordinal tokens, Bitcoin Cloud Mining, and Bitcoin derivatives.

So don’t miss your chance to get in early ahead of the next major Bitcoin rally leg – connect with the project on X (Twitter) and Telegram for more details.

Buy Bitcoin ETF Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post As Viral ETF Token Plummets 99%, This Other Bitcoin ETF Project Just Raised $1.3 Million – Next 100x Coin? appeared first on Cryptonews.

As Viral ETF Token Plummets 99%, This Other Bitcoin ETF Project Just Raised $1.3 Million – Next 100x Coin?

As market hype around the prospect of an imminent Bitcoin Spot ETF grows, so too has super-charged price action on DEX markets, but in a move shocking markets this morning, viral BTC ETF token has rug-pulled – leaving investors scrambling for alternative plays.

Recent months have seen a huge trend in explosive DEX-traded token moves, with countless moon-shots garnering significant attention, including the ever-popular APX, SAMBO Bot, Baby Meme, TIME, ROCKY and IO.

JUST IN: #SEC just met with #Grayscale for spot Bitcoin ETF listing, memo shows pic.twitter.com/yTVjS8ipwl

— Satoshi Club (@esatoshiclub) November 22, 2023

With markets scoped in on the news for any developments on the Bitcoin spot ETF front, it’s no surprise that a meme coin bearing the name ‘BTC ETF’ has undertaken rapid growth on DEX markets with little to no marketing.

But as is often true for DEX traded moon-shot tokens, all was not what it seemed, and a sinister rug-pull play awaited that has left 702 DEX traders penniless in the dust.

$ETF Rug Pull Analysis: As BTC ETF Token Capitulates – Were The Warning Signs Written on the Wall for 702 Penniless Traders?

Following the thunderous crash, $ETF token is currently trading at a market price of $0.005060 (representing a 24-hour change of -95.29%).

This comes following a seemingly impressive run yesterday. which saw $ETF token launch to almost instantaneous success as the fresh-faced coin surged +850% in the first hour.

Lured in by the dramatic growth, $ETF token then posted a 9-hour sustained +194% rally move to resistance at $0.1162, however, this was stifled by a substantial -95% retracement move.

Mysteriously this dump like price action was quickly bought up by an influx of $371k in volume, as late stage traders raced into what now appeared to be a honeypot.

This left 702 bewildered holders trapped, with liquidity pulled at 14:00 on November 21, this was followed by a sweeping rug-pull 11-hours later – with price tumbling -95% in a complete scam.

But with BTC ETF token posting such dramatic growth, and 702 holders now penniless – with nothing but a few illiquid digital tokens as a memoire – were the warning signs written on the wall?

$ETF $***250k+*** buy volume detected

+ buy vol & 12.1x UP since VIP alert!

Traders 249

Buy vol $253.8k

Sec. risks:

(TG)

0x041badf25213e5f41cdf074d9dbf5cbb29d073d6

Details in TG: https://t.co/Udo7mVwBq5#ETF $gdx $grok $gup $bape $bart $kekec $mai pic.twitter.com/8Za0lbs2AN

— Crypto Rick | @GoldmineAlpha (@crypto_rick_gm) November 12, 2023

Perhaps the first warning sign emerges when you search the $ETF token address on Twitter, which reveals a prior token launch in early November – that undertook a ‘sensational run’ before vanishing for more than 10 days.

This suggests a token contract being reused or recycled, and quite coyly too, as $ETF goes undetected by DEXTools built in security audits.

But further examination of the token contract with a Honeypot Detector begins to ring warning bells, with the token contract found to be faulty – leading to an illusive ‘unknown’ result.

However, the ability to edit buy functions alongside unlocked liquidity pools suggests this was a clear rug-pull risk from the start.

Despite the loss here, traders looking for a similar ETF-themed play backed by a fully security audited token contract and reputable development team need look no further than the Bitcoin ETF presale (that’s right; Bitcoin ETF – NOT – BTC ETF).

This BTC ETF Alternative Token Could Skyrocket Amid Bitcoin ETF Bullrun – Don’t Miss Out

A new Bitcoin alternative presale launched this week, offering eagle-eyed traders the opportunity to make it big on unfolding Bitcoin ETF rumors, without having to eat the $37,000 cost of becoming a wholecoiner.

Bitcoin ETF Token ($BTCETF) is currently trading at a market price of $0.0056 in funding round stage 1 with an alluring $1,333,692 raised in the opening weekend of presale.

Designed and built with skyrocket potential in mind, this promising token aims to bank big on market excitement surrounding the ongoing applications for Bitcoin spot ETFs.

Aiming for a hard-cap of $5m in presale funding, the early-stage of this emerging project’s presale offers investors a unique opportunity to get in during this early entry point, which could set the stage for life-changing gains.

#BitcoinETF introduces a 5% transaction burn tax, gradually reducing the #Token supply.

Targeting a 25% token burn as milestones are reached.

This strategy aims to reward holders and alleviate selling pressure with a deflationary approach. pic.twitter.com/UiheUjIZB8

— BTCETF_Token (@BTCETF_Token) November 22, 2023

Ride the ETF Rally with Ease: Bitcoin ETF Token is a Critical Component in Every BTC Trader’s Toolbox

Indeed, Bitcoin ETF isn’t simply a useless meme coin, beyond taking aim at the biggest narrative in crypto – BTCETF has a major utility: Bitcoin ETF news alerts.

The token’s dApp offers traders a live-feed of the latest Bitcoin spot ETF information and news, with sophisticated technology tracking applications real-time at the SEC, and high-speed bots monitoring social media for the latest breaking ETF news.

But a simple feed of Bitcoin spot ETF news only highlights a fraction of Bitcoin ETF token’s potential, with easy-access to real-time update alerts offering sharp traders the opportunity to make market-beating returns stress-free; being amongst the first to hear about privileged Bitcoin Spot ETF news.

This could enable traders to position themselves appropriately in seismic Bitcoin market movements, making Bitcoin ETF token a critical component in every BTC trader’s tool-box this Winter.

Surging Interest in Bitcoin Alternatives Leaves $BTCETF Poised to Outperform $ETF Token

Project tokenomics are bolstered by ambitious plans for the incorporation of staking rewards that incentivise long-term holding, alongside a burn mechanism, which will enhance $BTCETF as a ‘digital gold’ alternative, by creating a deflationary mechanism in price.

Set for stage 3 of the Bitcoin ETF project roadmap, an initial burn mechanism will be introduced amid a well-marketed DEX launch, imposing an initial 5% burn tax on transactions – this will be reduced by -1% each time a Bitcoin ETF news milestone is reached.

However, plans are afoot for a larger burn mechanism in stage 4, in a move that will see 25% of token supply burned overtime, this will be conducted in 5% burn intervals – with each supply-side reduction taking place as a Bitcoin ETF news milestone is met.

The milestones for the burn mechanism are as follows:

- Milestone 1 – $BTCETF Trading Volume hits $100m – burn tax on transactions reduced from 5% to 4%, and 5% of total supply is burned.

- Milestone 2 – First Bitcoin ETF is approved by SEC – burn tax on transactions is reduced from 4% to 3%, and a further 5% of total supply is burned.

- Milestone 3- First Bitcoin ETF launch date – burn tax on transactions is reduced from 3% to 2%, and a further 5% of total supply is burned.

- Milestone 4 – Bitcoin ETF assets under management (AUM) hits $1bn – burn tax on transactions is reduced from 2% to 1%, and a further 5% of total supply is burned.

- Milestone 5 – Bitcoin price hits $100k – burn tax on transactions is reduced from 1% to 0%, and a further 5% of total supply is burned.

This will create a gradual decrease in total supply, eventually leaving around 70% of BTCETF in circulation, with the supply side reduction inducing upside price growth.

And that is without considering the potential for token value accrual driven by demand from traders for access to the ETF news dApp and the ever-present demand for Bitcoin alternatives.

Indeed, 2023 has seen explosive growth in Bitcoin related tokens – with markets showing a real appetite for BRC-20 ordinal tokens, Bitcoin Cloud Mining, and Bitcoin derivatives.

So don’t miss your chance to get in early ahead of the next major Bitcoin rally leg – connect with the project on X (Twitter) and Telegram for more details.

Buy Bitcoin ETF Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post As Viral ETF Token Plummets 99%, This Other Bitcoin ETF Project Just Raised $1.3 Million – Next 100x Coin? appeared first on Cryptonews.