Taurus Launches the ‘First Private Smart Contract for Stablecoins’

Share:

Taurus, a Swiss digital asset infrastructure provider backed by Deutsche Bank, State Street, and Credit Suisse, has announced the deployment of what it calls “the first private stablecoin contract.”

The press release noted a difference between this offer and legacy stablecoins. The former, it argues, combines the zero-knowledge proofs’ confidentiality and key compliance elements. Therefore, it provides confidentiality, untraceability, and anonymity while allowing access to parties such as issuers, regulators, and law enforcement.

Hence, only these authorized parties can read the encrypted balances and transfers. “This prevents unauthorized parties from monitoring wallets, reverse-engineering investment strategies, or physically targeting high-value users,” the team says.

Moreover, the team has built the stablecoin contract atop the zero‑knowledge Layer-2 Aztec Network. According to Arnaud Schenk, Executive Director of the Aztec Network board, enforced transparency of public blockchains hampers the real-world adoption of stablecoins worldwide.

“Practical adoption for payroll, intra-company transfers, or day-to-day payments simply can’t happen if every transaction remains visible to all and immutably inscribed on a widely available ledger,” Schenk says.

Taurus’ novel stablecoin contract supports USDC’s core features. Notably, these include centralized, admin-controlled mint and burn, as well as the pause and unpause capabilities. This allows for transfers to be halted should the need arise.

Other key features include address blacklisting to “enforce sanctions and other compliance needs,” and events logging for a verifiable audit trail.

All this allows financial institutions to issue stablecoins in payment or treasury applications while ensuring privacy and regulatory observability, the announcement argues.

Taurus Makes “Major Step Forward for Stablecoins”

The team notes that the private stablecoin contract complements their open-source private security token. Taurus launched this token in February 2025. The announcement describes it as a confidential token standard for debt and equity tokenization, which allows financial institutions to issue tokenized versions of financial instruments on public blockchains while maintaining privacy.

This latest move “marks a major step forward for stablecoins,” said JP Aumasson, Chief Security Officer at Taurus. “We showed that it’s possible to protect the privacy and security of stablecoin users while retaining the features of industry-standard stablecoins. This addresses concerns that we’ve repeatedly heard from banks looking at issuing stablecoins, central banks, and regulators.”

Moreover, Taurus’ latest launch follows the news of the US Senate passing the GENIUS Act in mid-June. The Guiding and Establishing National Innovation for US Stablecoins Act requires issuers to fully back their stablecoins with US dollars, makes licensing dependent on the total market capitalization of their digital assets, provides safeguards for consumers (who would be paid first in the event of a bankruptcy), and tightens rules to prevent money laundering and terror financing.

On Wednesday, Senator Cynthia Lummis urged US lawmakers to advance both the GENIUS Act and broader crypto market structure asap. “I’m not saying combine them, but they both need to pass this year,” she said.

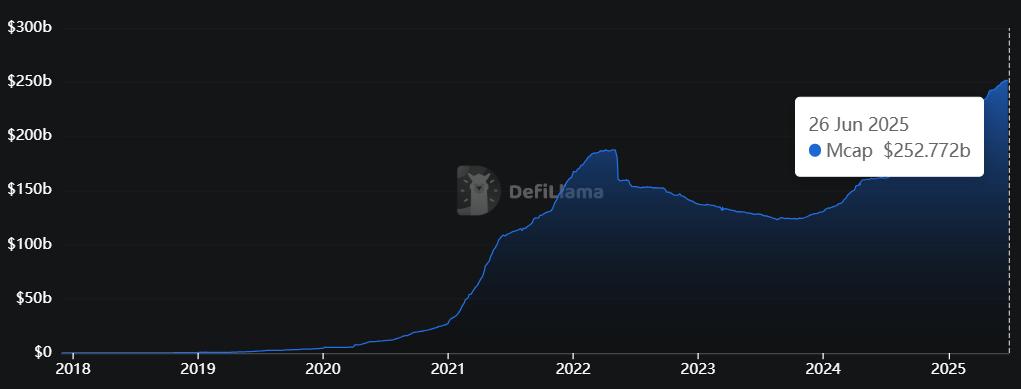

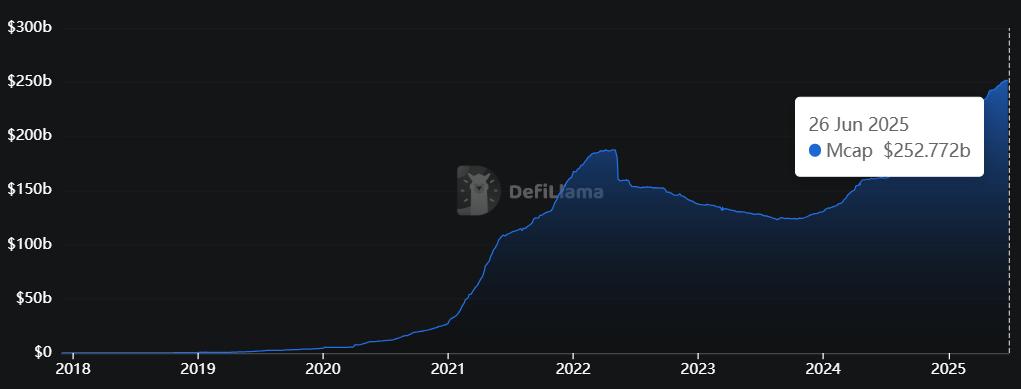

Moreover, Taurus noted that stablecoin supply has surpassed $250 billion with a 1,200% increase since 2020.

Taurus “expects the total stablecoin supply to reach $1 trillion-$2 trillion by 2030 as demand increases across institutional and consumer markets, pushed by favorable regulation,” it concluded.

The post Taurus Launches the ‘First Private Smart Contract for Stablecoins’ appeared first on Cryptonews.

Taurus Launches the ‘First Private Smart Contract for Stablecoins’

Share:

Taurus, a Swiss digital asset infrastructure provider backed by Deutsche Bank, State Street, and Credit Suisse, has announced the deployment of what it calls “the first private stablecoin contract.”

The press release noted a difference between this offer and legacy stablecoins. The former, it argues, combines the zero-knowledge proofs’ confidentiality and key compliance elements. Therefore, it provides confidentiality, untraceability, and anonymity while allowing access to parties such as issuers, regulators, and law enforcement.

Hence, only these authorized parties can read the encrypted balances and transfers. “This prevents unauthorized parties from monitoring wallets, reverse-engineering investment strategies, or physically targeting high-value users,” the team says.

Moreover, the team has built the stablecoin contract atop the zero‑knowledge Layer-2 Aztec Network. According to Arnaud Schenk, Executive Director of the Aztec Network board, enforced transparency of public blockchains hampers the real-world adoption of stablecoins worldwide.

“Practical adoption for payroll, intra-company transfers, or day-to-day payments simply can’t happen if every transaction remains visible to all and immutably inscribed on a widely available ledger,” Schenk says.

Taurus’ novel stablecoin contract supports USDC’s core features. Notably, these include centralized, admin-controlled mint and burn, as well as the pause and unpause capabilities. This allows for transfers to be halted should the need arise.

Other key features include address blacklisting to “enforce sanctions and other compliance needs,” and events logging for a verifiable audit trail.

All this allows financial institutions to issue stablecoins in payment or treasury applications while ensuring privacy and regulatory observability, the announcement argues.

Taurus Makes “Major Step Forward for Stablecoins”

The team notes that the private stablecoin contract complements their open-source private security token. Taurus launched this token in February 2025. The announcement describes it as a confidential token standard for debt and equity tokenization, which allows financial institutions to issue tokenized versions of financial instruments on public blockchains while maintaining privacy.

This latest move “marks a major step forward for stablecoins,” said JP Aumasson, Chief Security Officer at Taurus. “We showed that it’s possible to protect the privacy and security of stablecoin users while retaining the features of industry-standard stablecoins. This addresses concerns that we’ve repeatedly heard from banks looking at issuing stablecoins, central banks, and regulators.”

Moreover, Taurus’ latest launch follows the news of the US Senate passing the GENIUS Act in mid-June. The Guiding and Establishing National Innovation for US Stablecoins Act requires issuers to fully back their stablecoins with US dollars, makes licensing dependent on the total market capitalization of their digital assets, provides safeguards for consumers (who would be paid first in the event of a bankruptcy), and tightens rules to prevent money laundering and terror financing.

On Wednesday, Senator Cynthia Lummis urged US lawmakers to advance both the GENIUS Act and broader crypto market structure asap. “I’m not saying combine them, but they both need to pass this year,” she said.

Moreover, Taurus noted that stablecoin supply has surpassed $250 billion with a 1,200% increase since 2020.

Taurus “expects the total stablecoin supply to reach $1 trillion-$2 trillion by 2030 as demand increases across institutional and consumer markets, pushed by favorable regulation,” it concluded.

The post Taurus Launches the ‘First Private Smart Contract for Stablecoins’ appeared first on Cryptonews.