Ethereum Targets $1,950 as Pectra Upgrade Boosts Market Momentum

- Ethereum’s price surges 5.22%, reaching $1,935 with strong market momentum.

- Analyst Ali identifies key $1,860 resistance, crucial for Ethereum’s next bullish move.

Ethereum’s price has increased by 5.22% in the last 24 hours, with the current price at $1,935. The cryptocurrency’s market capitalization reached $234 billion, reflecting its strong market position. Over the past day, Ethereum experienced a low of $1,789 and a high of $1,945, indicating robust price movement. This surge follows a notable rally, driven by positive market sentiment. Ethereum’s price climbed from below $1,850 to its current levels, signaling a bullish market trend. With this price increase, trading volume surged by 24.78%, reaching $20.28 billion, suggesting active market participation.

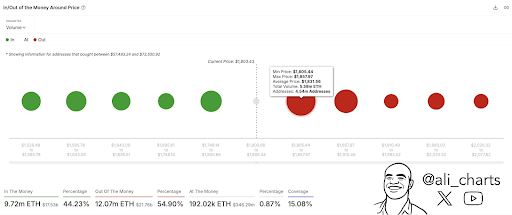

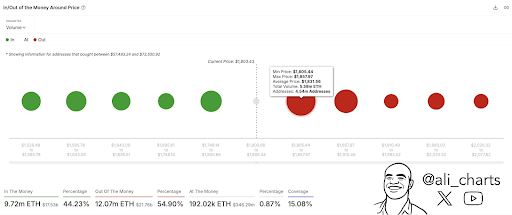

Analyst Ali Highlights Key $1,860 Resistance for Ethereum’s Next Move

Crypto analyst Ali pointed out that Ethereum is encountering significant resistance at the $1,860 mark, where 4.54 million wallets hold a total of 5.58 million ETH. This concentration of holdings suggests that many investors may be looking to sell or take profits at this critical price point.

Ethereum could trigger a strong bullish momentum if it breaks through this resistance. However, if the price fails to break through, it may result in a pullback. Ali emphasizes that overcoming this resistance is crucial for Ethereum to maintain its upward trajectory and avoid further consolidation.

Pectra Upgrade Goes Live with Major Enhancements

Ethereum’s Pectra upgrade was successfully deployed at epoch 364032, around 10:05 GMT. After several delays and testnet challenges, the upgrade introduces changes from eleven Ethereum Improvement Proposals (EIPs) to the mainnet. Pectra is Ethereum’s most ambitious upgrade since The Merge in August 2022, which transitioned the network from Proof-of-Work to Proof-of-Stake.

This upgrade follows the Dencun update in March 2024, which activated EIP-4844’s proto-danksharding, known as “blobspaces.” These changes are expected to improve Ethereum’s scalability and efficiency, paving the way for better network performance.

Ethereum Targets $$1,950 with Strong Bullish Momentum

Ethereum’s technical chart highlights key indicators that suggest continuing its bullish trend. The Bollinger Bands show Ethereum nearing the upper band, indicating increased volatility. If Ethereum surpasses this resistance, it could target the next price level around $1,950. The MACD, a key momentum indicator, shows a positive outlook, with the MACD line above the signal line, supporting the bullish trend.

The histogram also indicates growing bullish momentum, with a value of 5.81. On the downside, the key support level is near the lower Bollinger Band at $1,926. A break below this level could lead Ethereum to test the $1,900 mark. However, the strong momentum suggests that Ethereum’s most likely target in the short term could be the $1,950 range if the upward trend persists.

Read More

Can Ethereum Overcome Rising Supply and Weakened Demand? The Pectra Upgrade’s Role

Ethereum Targets $1,950 as Pectra Upgrade Boosts Market Momentum

- Ethereum’s price surges 5.22%, reaching $1,935 with strong market momentum.

- Analyst Ali identifies key $1,860 resistance, crucial for Ethereum’s next bullish move.

Ethereum’s price has increased by 5.22% in the last 24 hours, with the current price at $1,935. The cryptocurrency’s market capitalization reached $234 billion, reflecting its strong market position. Over the past day, Ethereum experienced a low of $1,789 and a high of $1,945, indicating robust price movement. This surge follows a notable rally, driven by positive market sentiment. Ethereum’s price climbed from below $1,850 to its current levels, signaling a bullish market trend. With this price increase, trading volume surged by 24.78%, reaching $20.28 billion, suggesting active market participation.

Analyst Ali Highlights Key $1,860 Resistance for Ethereum’s Next Move

Crypto analyst Ali pointed out that Ethereum is encountering significant resistance at the $1,860 mark, where 4.54 million wallets hold a total of 5.58 million ETH. This concentration of holdings suggests that many investors may be looking to sell or take profits at this critical price point.

Ethereum could trigger a strong bullish momentum if it breaks through this resistance. However, if the price fails to break through, it may result in a pullback. Ali emphasizes that overcoming this resistance is crucial for Ethereum to maintain its upward trajectory and avoid further consolidation.

Pectra Upgrade Goes Live with Major Enhancements

Ethereum’s Pectra upgrade was successfully deployed at epoch 364032, around 10:05 GMT. After several delays and testnet challenges, the upgrade introduces changes from eleven Ethereum Improvement Proposals (EIPs) to the mainnet. Pectra is Ethereum’s most ambitious upgrade since The Merge in August 2022, which transitioned the network from Proof-of-Work to Proof-of-Stake.

This upgrade follows the Dencun update in March 2024, which activated EIP-4844’s proto-danksharding, known as “blobspaces.” These changes are expected to improve Ethereum’s scalability and efficiency, paving the way for better network performance.

Ethereum Targets $$1,950 with Strong Bullish Momentum

Ethereum’s technical chart highlights key indicators that suggest continuing its bullish trend. The Bollinger Bands show Ethereum nearing the upper band, indicating increased volatility. If Ethereum surpasses this resistance, it could target the next price level around $1,950. The MACD, a key momentum indicator, shows a positive outlook, with the MACD line above the signal line, supporting the bullish trend.

The histogram also indicates growing bullish momentum, with a value of 5.81. On the downside, the key support level is near the lower Bollinger Band at $1,926. A break below this level could lead Ethereum to test the $1,900 mark. However, the strong momentum suggests that Ethereum’s most likely target in the short term could be the $1,950 range if the upward trend persists.

Read More