BTC’s Realized Cap HODL Waves Has Surged By 80+%: On-Chain Data

- Glassnode tweeted that BTC’s Realized Cap HODL Waves have surged by more than 80%.

- This suggests a noteworthy transfer of wealth from long-standing Bitcoin holders to newer participants in the market.

- At press time, BTC was trading hands at $27,114.40 after a 0.98% price increase.

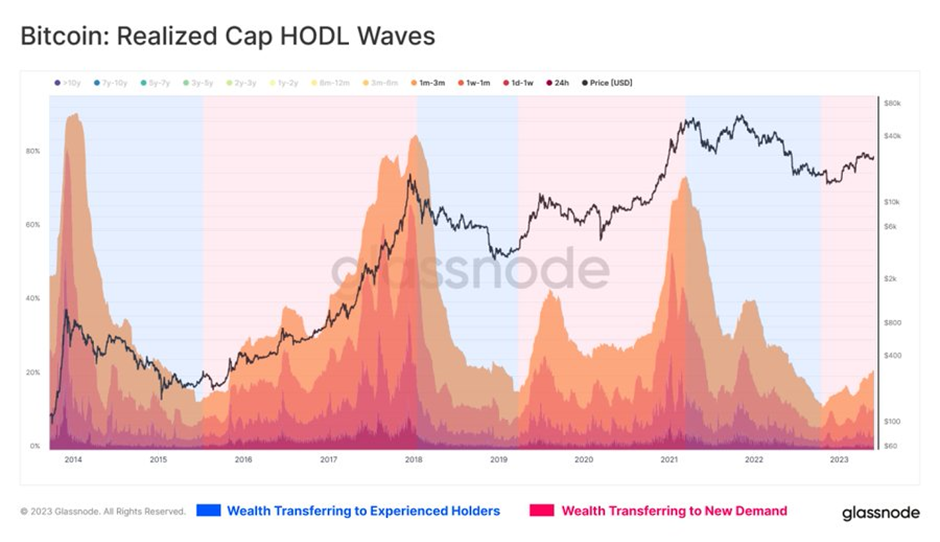

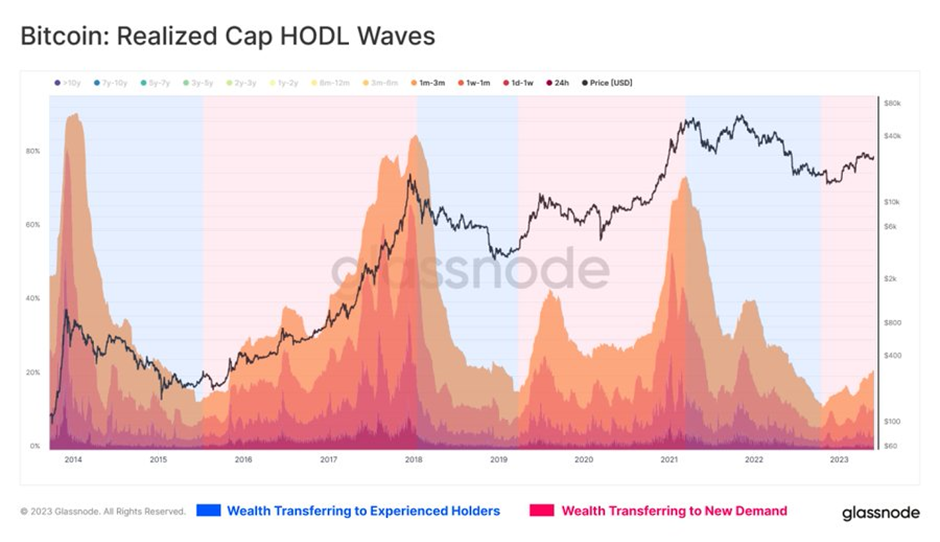

In a tweet posted yesterday, the on-chain analysis firm Glassnode noted that the 1d-3m Bitcoin (BTC) Realized Cap HODL Waves experienced a significant increase, rising from a cycle low of 11.5% to a current value of 21.4%. This meant that BTC’s Realized Cap HODL Waves experienced a more than 80% surge.

This observation indicated a noteworthy transfer of wealth from long-standing Bitcoin holders to newer participants in the market. Such a phenomenon is frequently observed during critical turning points in the market cycle.

In simpler terms, it suggests that experienced Bitcoin investors are selling their holdings, and a new wave of demand is emerging from newer investors who are acquiring BTC. This shift in ownership is a perfect example of the dynamic nature of the Bitcoin market and the continuous interplay between different…

The post BTC’s Realized Cap HODL Waves Has Surged By 80+%: On-Chain Data appeared first on Coin Edition.

BTC’s Realized Cap HODL Waves Has Surged By 80+%: On-Chain Data

- Glassnode tweeted that BTC’s Realized Cap HODL Waves have surged by more than 80%.

- This suggests a noteworthy transfer of wealth from long-standing Bitcoin holders to newer participants in the market.

- At press time, BTC was trading hands at $27,114.40 after a 0.98% price increase.

In a tweet posted yesterday, the on-chain analysis firm Glassnode noted that the 1d-3m Bitcoin (BTC) Realized Cap HODL Waves experienced a significant increase, rising from a cycle low of 11.5% to a current value of 21.4%. This meant that BTC’s Realized Cap HODL Waves experienced a more than 80% surge.

This observation indicated a noteworthy transfer of wealth from long-standing Bitcoin holders to newer participants in the market. Such a phenomenon is frequently observed during critical turning points in the market cycle.

In simpler terms, it suggests that experienced Bitcoin investors are selling their holdings, and a new wave of demand is emerging from newer investors who are acquiring BTC. This shift in ownership is a perfect example of the dynamic nature of the Bitcoin market and the continuous interplay between different…

The post BTC’s Realized Cap HODL Waves Has Surged By 80+%: On-Chain Data appeared first on Coin Edition.