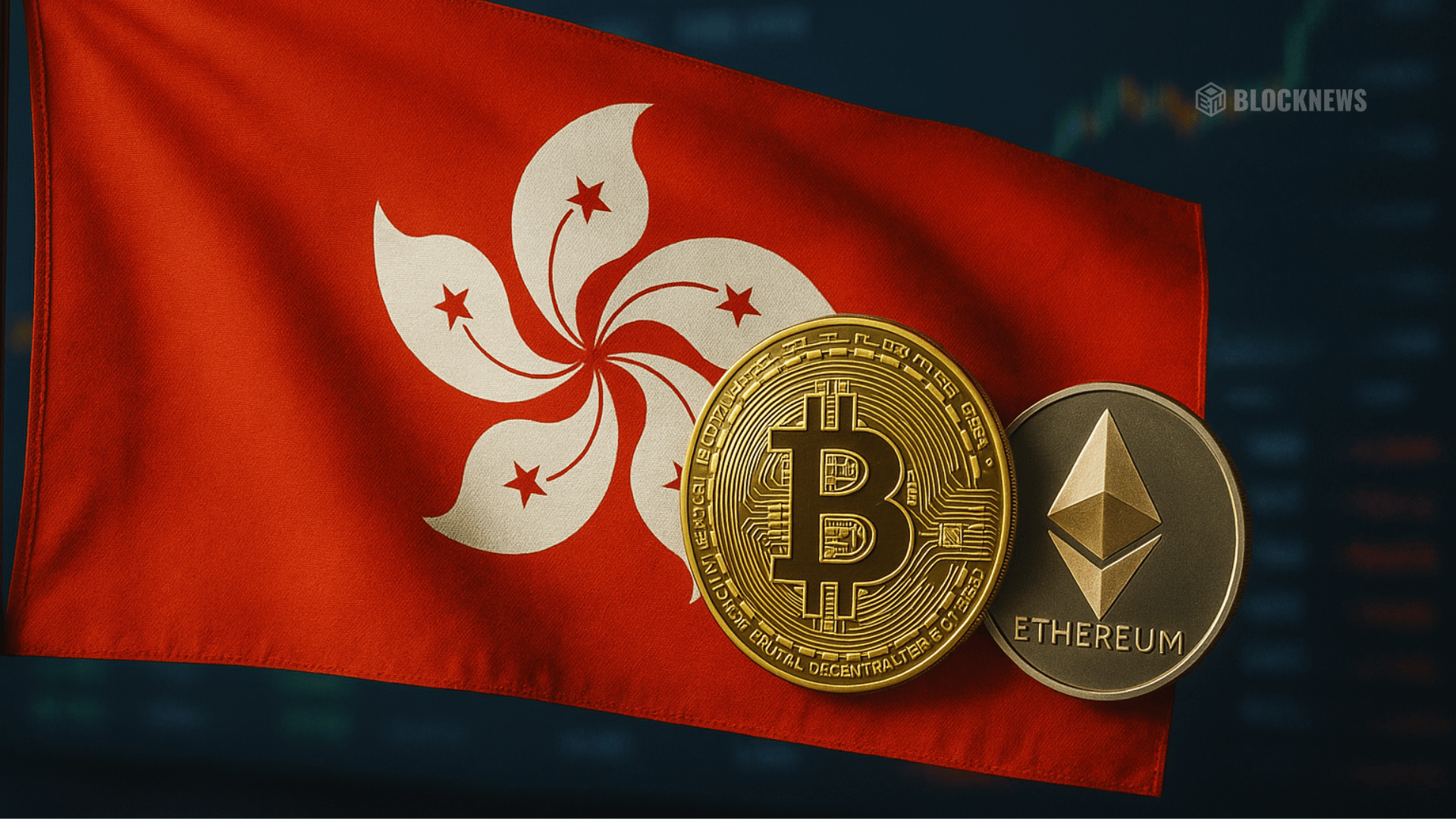

Hong Kong Proposes Softer Capital Rules for Banks Holding Crypto: Here Is What It Means

- HKMA proposes easing capital requirements for banks holding select crypto assets.

- Permissionless blockchain tokens may qualify if issuers meet strict risk controls.

- The move strengthens Hong Kong’s role as a global crypto hub while China maintains its ban.

The Hong Kong Monetary Authority (HKMA) has introduced draft guidance that could significantly ease capital requirements for banks holding crypto assets, according to a report from Caixin. The proposal marks another step in Hong Kong’s bid to position itself as a global crypto hub. The draft, known as module CRP-1, was circulated to the local banking sector and lays out how crypto should be classified under the Basel Committee’s global banking standards, set to take effect in early 2026.

Lower Requirements for Permissionless Blockchains

Under the draft, certain crypto assets built on permissionless blockchains could qualify for reduced capital requirements—provided their issuers adopt effective risk management and mitigation strategies. This framework reflects a shift from blanket risk treatment toward a more nuanced approach that considers governance and safeguards implemented by token issuers.

Strengthening Hong Kong’s Position as a Crypto Hub

The proposal aligns with Hong Kong’s broader push to attract crypto businesses through a licensing regime for exchanges and stablecoin issuers. By contrast, mainland China continues to enforce its ban on crypto trading and mining. The HKMA’s softer stance could help the city build on its role as a regulated yet innovation-friendly center for digital finance.

Regulatory Developments in Parallel

In August, the Securities and Futures Commission (SFC) rolled out updated rules requiring licensed crypto platforms to tighten custody measures for client assets. Together, these initiatives suggest Hong Kong is aiming to balance stricter investor protections with flexible capital treatment for banks, paving the way for greater institutional involvement in crypto markets.

The post Hong Kong Proposes Softer Capital Rules for Banks Holding Crypto: Here Is What It Means first appeared on BlockNews.

Read More

VanEck Plans Hyperliquid Staking ETF and European ETP: Here Is What Investors Should Know

Hong Kong Proposes Softer Capital Rules for Banks Holding Crypto: Here Is What It Means

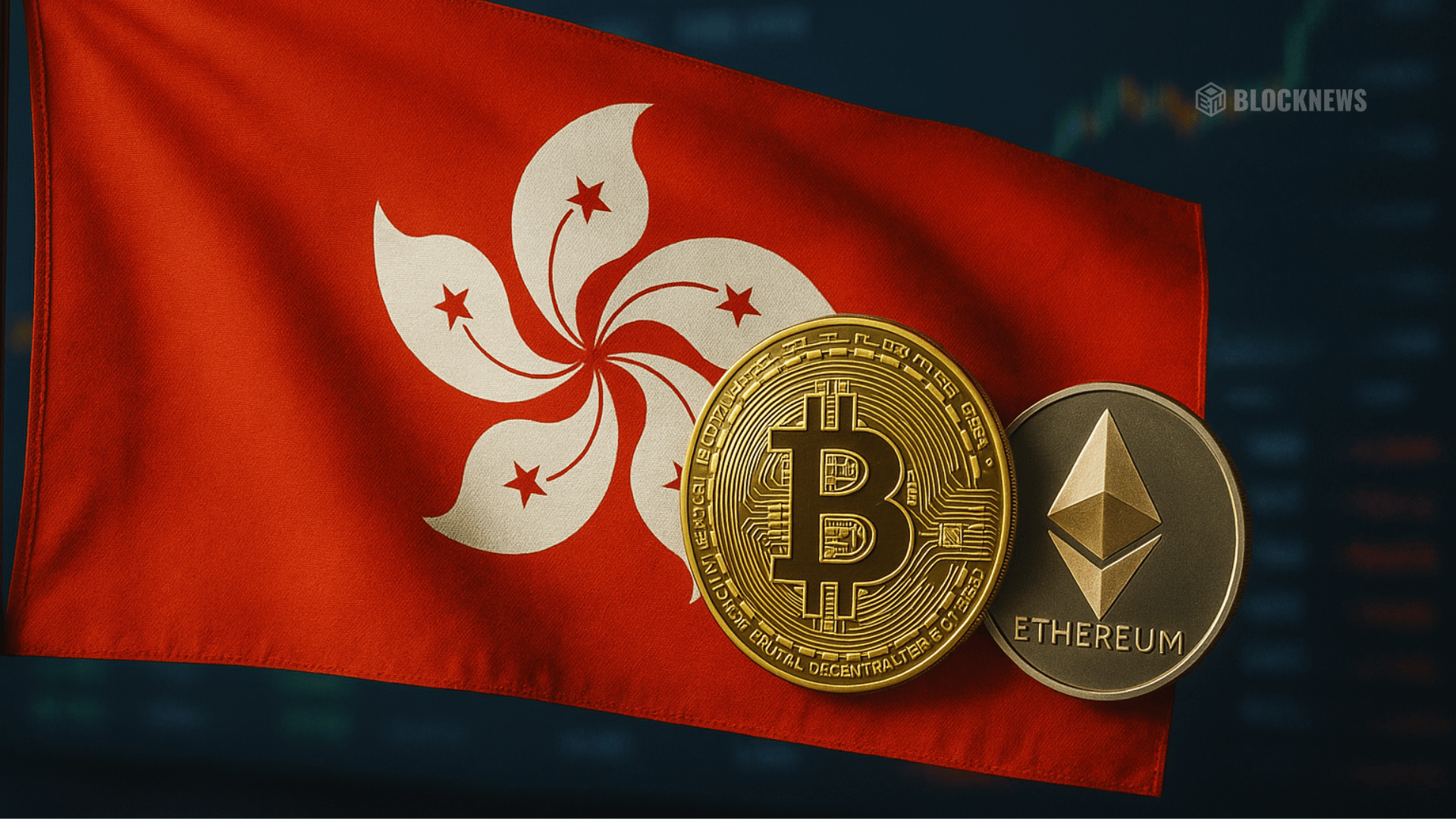

- HKMA proposes easing capital requirements for banks holding select crypto assets.

- Permissionless blockchain tokens may qualify if issuers meet strict risk controls.

- The move strengthens Hong Kong’s role as a global crypto hub while China maintains its ban.

The Hong Kong Monetary Authority (HKMA) has introduced draft guidance that could significantly ease capital requirements for banks holding crypto assets, according to a report from Caixin. The proposal marks another step in Hong Kong’s bid to position itself as a global crypto hub. The draft, known as module CRP-1, was circulated to the local banking sector and lays out how crypto should be classified under the Basel Committee’s global banking standards, set to take effect in early 2026.

Lower Requirements for Permissionless Blockchains

Under the draft, certain crypto assets built on permissionless blockchains could qualify for reduced capital requirements—provided their issuers adopt effective risk management and mitigation strategies. This framework reflects a shift from blanket risk treatment toward a more nuanced approach that considers governance and safeguards implemented by token issuers.

Strengthening Hong Kong’s Position as a Crypto Hub

The proposal aligns with Hong Kong’s broader push to attract crypto businesses through a licensing regime for exchanges and stablecoin issuers. By contrast, mainland China continues to enforce its ban on crypto trading and mining. The HKMA’s softer stance could help the city build on its role as a regulated yet innovation-friendly center for digital finance.

Regulatory Developments in Parallel

In August, the Securities and Futures Commission (SFC) rolled out updated rules requiring licensed crypto platforms to tighten custody measures for client assets. Together, these initiatives suggest Hong Kong is aiming to balance stricter investor protections with flexible capital treatment for banks, paving the way for greater institutional involvement in crypto markets.

The post Hong Kong Proposes Softer Capital Rules for Banks Holding Crypto: Here Is What It Means first appeared on BlockNews.

Read More

The Hong Kong Monetary Authority released a draft “CRP-1 Classification of Crypto Assets” module, part of its Banking Regulatory Policy Manual. It aims to clarify Basel-style capital rules for banks holding compliant crypto assets (including stablecoins), with implementation…

The Hong Kong Monetary Authority released a draft “CRP-1 Classification of Crypto Assets” module, part of its Banking Regulatory Policy Manual. It aims to clarify Basel-style capital rules for banks holding compliant crypto assets (including stablecoins), with implementation…