BRICS: Developing Countries Need To Repay China $1.1 Trillion

BRICS member China is now the biggest debt collector in the world as developing countries owe the Communist nation $1.1 trillion. China provided loans to several distressed countries to build ports, roads, railways, and other infrastructure easing the movement of trade. According to the latest reports, China issued loans to over 150 countries and 80% are nations suffering from financial distress.

Also Read: BRICS: Dangers Emerge for Import-Export Sector as US Dollar Rises

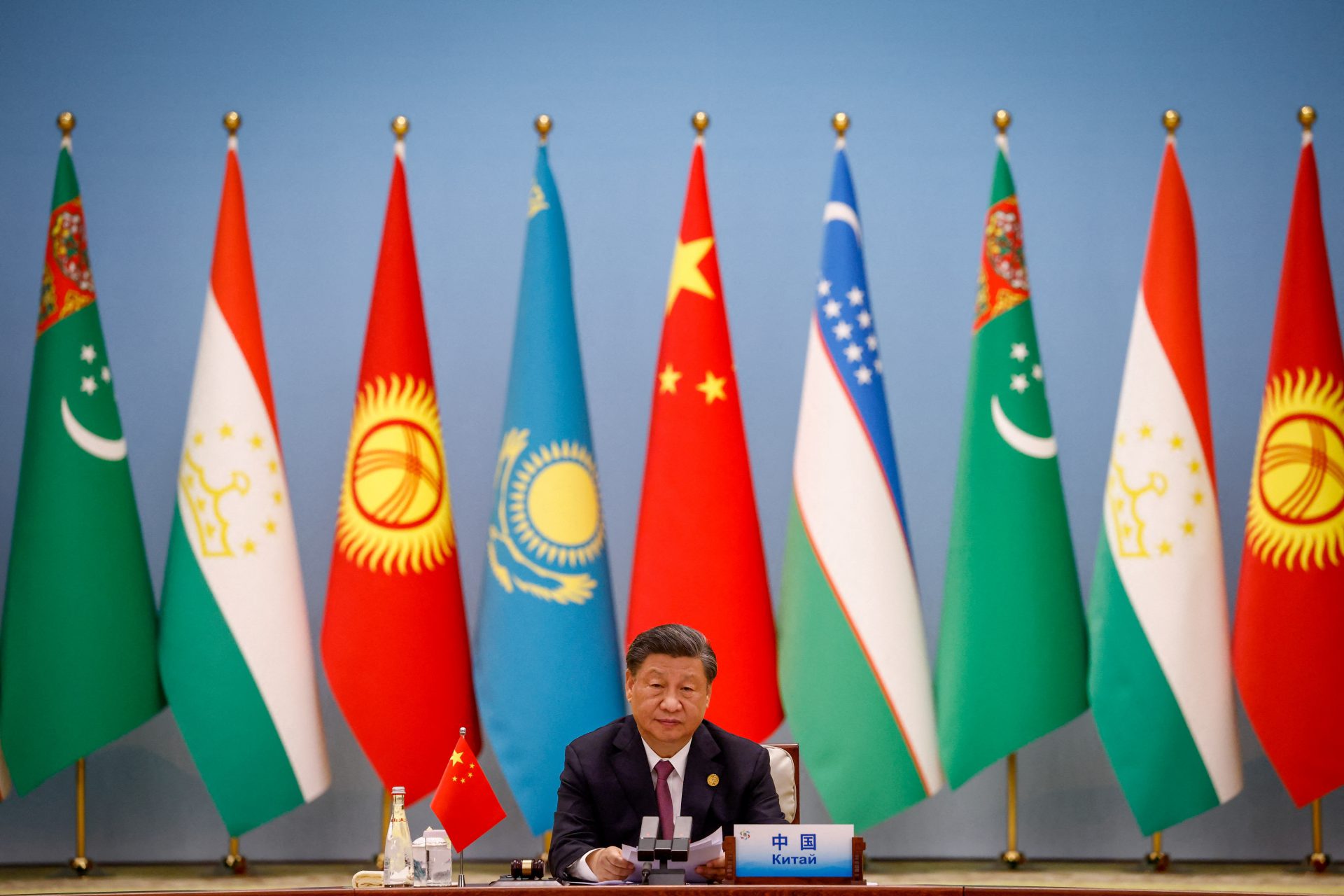

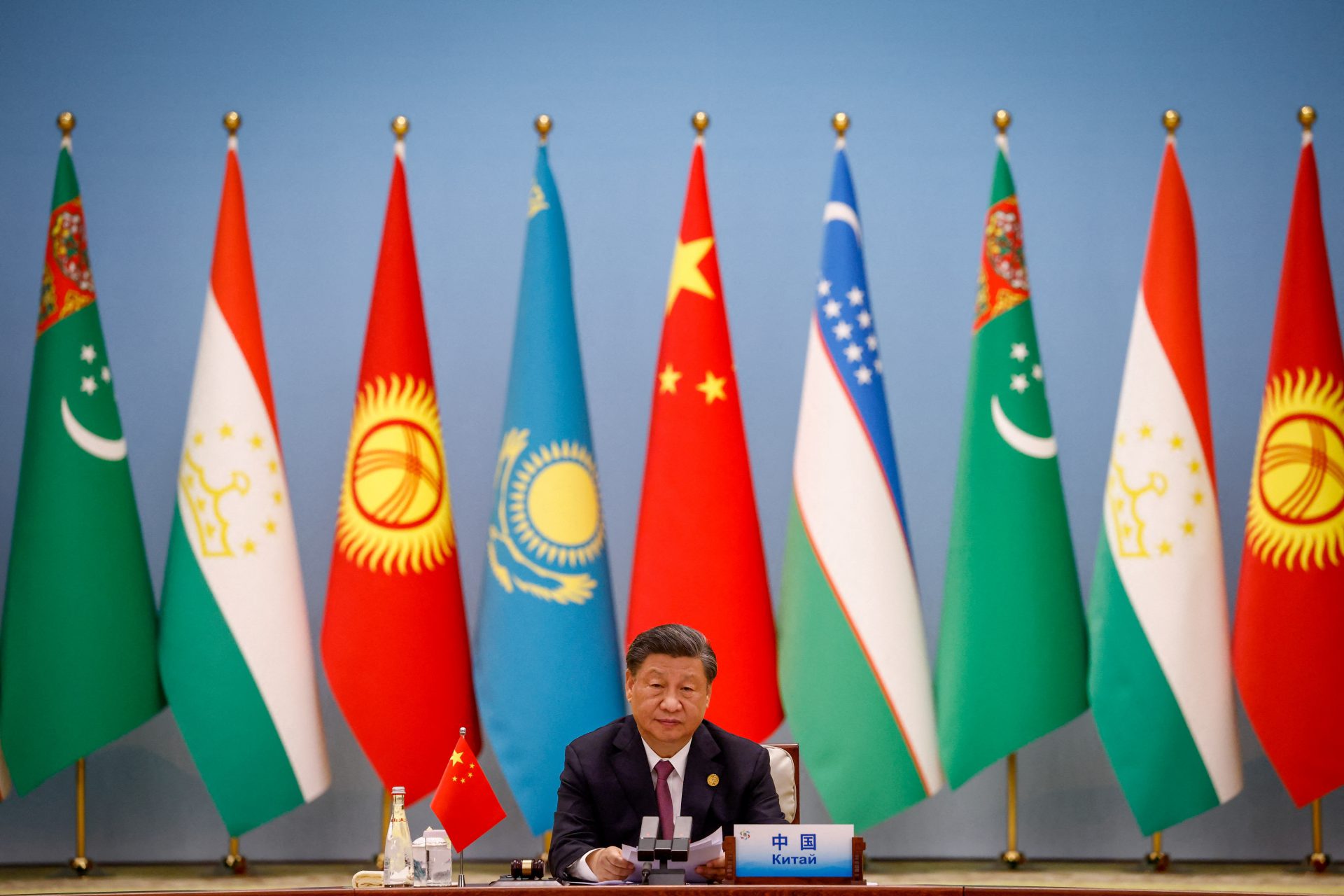

President Xi Jinping unveiled the vast global infrastructure push a decade ago stretching from Angola to Uruguay and Sri Lanka. Chinese loans have reached the majority of countries in Africa, South America, and Asia. The BRICS member China played the role of a crisis manager by lending large sums of money to countries unable to sustain themselves financially.

BRICS: China Taking Advantage of Countries Unable To Repay Loans

Reports highlight that China is now controlling the ports of other countries that are unable to repay the loans. Countries that do not repay China are at risk of seizures, as they’re unable to navigate their economy to safe waters.

Also Read: BRICS Intra-Trade Reaches 37% of The World’s Transactions

The move has met with global scrutiny and condemnation as the Communist nation is taking advantage of the financial crisis. However, BRICS member China has denied that it controls the ports of other countries claiming that it’s not a part of their jurisdiction.

“These cash seizures are mostly being executed in secret and outside the immediate reach of domestic oversight institutions in low- and middle-income countries. The ability to access cash collateral without borrower consent has become a particularly important safeguard in China’s bilateral lending portfolio,” the report read.

Also Read: Indian Man Finds $3 Million US Dollars on Railway Tracks Marked to UNO

BRICS member China is using multiple ways to dominate the global financial sector. From using local currencies for global trade to convincing other nations to ditch the US dollar, the Communist nation remains at the forefront of the change. Read here to know how many sectors in the US will be affected if BRICS stops using the dollar.

Read More

After BRICS, Africa Launches Next-Generation Currency Marketplace PACM

BRICS: Developing Countries Need To Repay China $1.1 Trillion

BRICS member China is now the biggest debt collector in the world as developing countries owe the Communist nation $1.1 trillion. China provided loans to several distressed countries to build ports, roads, railways, and other infrastructure easing the movement of trade. According to the latest reports, China issued loans to over 150 countries and 80% are nations suffering from financial distress.

Also Read: BRICS: Dangers Emerge for Import-Export Sector as US Dollar Rises

President Xi Jinping unveiled the vast global infrastructure push a decade ago stretching from Angola to Uruguay and Sri Lanka. Chinese loans have reached the majority of countries in Africa, South America, and Asia. The BRICS member China played the role of a crisis manager by lending large sums of money to countries unable to sustain themselves financially.

BRICS: China Taking Advantage of Countries Unable To Repay Loans

Reports highlight that China is now controlling the ports of other countries that are unable to repay the loans. Countries that do not repay China are at risk of seizures, as they’re unable to navigate their economy to safe waters.

Also Read: BRICS Intra-Trade Reaches 37% of The World’s Transactions

The move has met with global scrutiny and condemnation as the Communist nation is taking advantage of the financial crisis. However, BRICS member China has denied that it controls the ports of other countries claiming that it’s not a part of their jurisdiction.

“These cash seizures are mostly being executed in secret and outside the immediate reach of domestic oversight institutions in low- and middle-income countries. The ability to access cash collateral without borrower consent has become a particularly important safeguard in China’s bilateral lending portfolio,” the report read.

Also Read: Indian Man Finds $3 Million US Dollars on Railway Tracks Marked to UNO

BRICS member China is using multiple ways to dominate the global financial sector. From using local currencies for global trade to convincing other nations to ditch the US dollar, the Communist nation remains at the forefront of the change. Read here to know how many sectors in the US will be affected if BRICS stops using the dollar.

Read More