TRON Network Hits New Heights as USDT Supply Reaches $71 Billion

- TRON now hosts $71 billion in USDT, closing gap with Ethereum’s $74.5 billion.

- Network surpasses 2.66 million long-term holding addresses.

- TRON facilitates 29% of all stablecoin transactions globally.

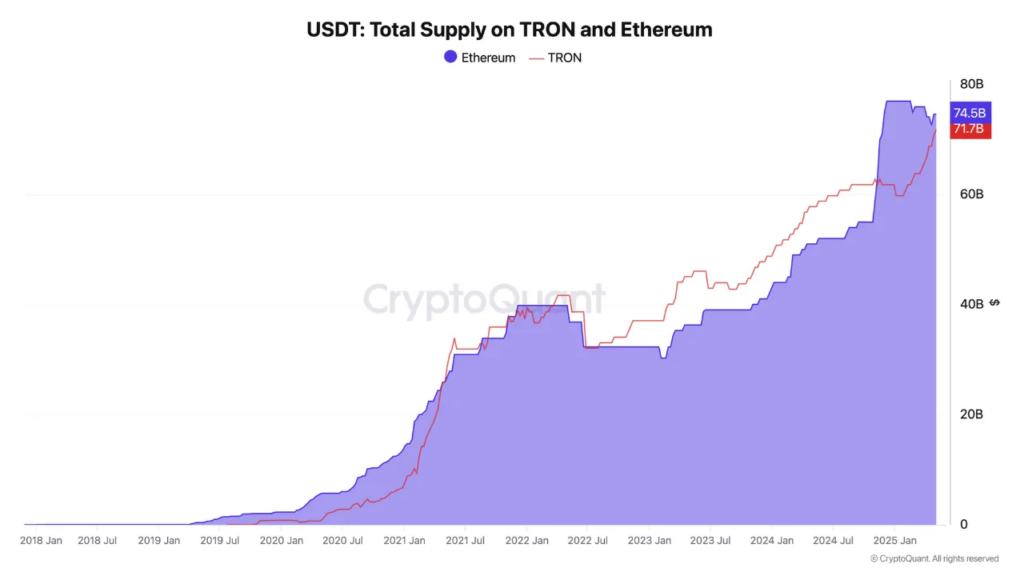

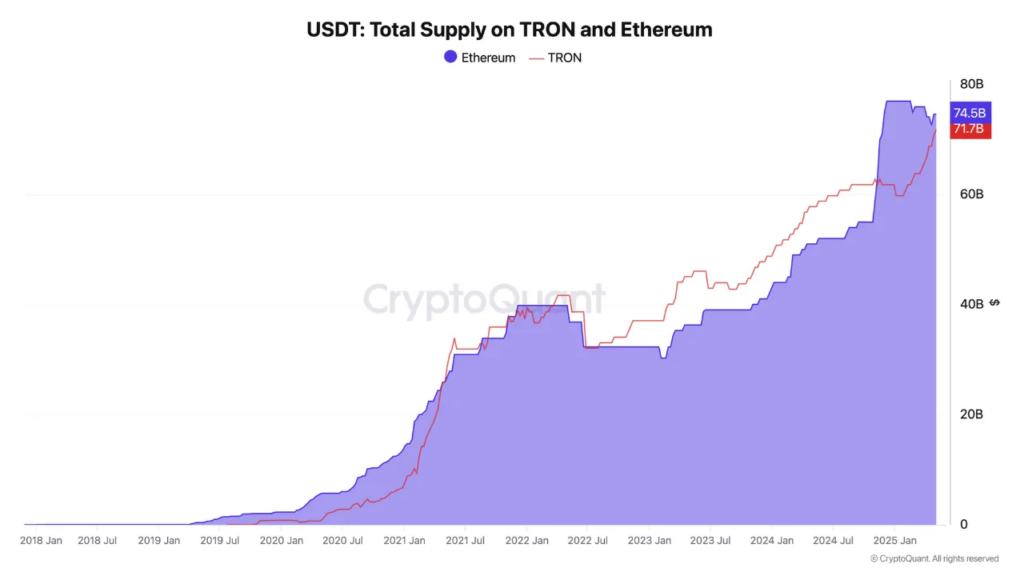

The TRON network has achieved a key milestone in the stablecoin sector as the amount of USDT (Tether) circulating on its blockchain reached a new all-time high of $71 billion. This growth positions TRON just $3.5 billion behind Ethereum, which currently hosts $74.5 billion in USDT, according to the latest data from CryptoQuant.

The increasing USDT supply on TRON has followed a steady upward trajectory over recent years, narrowing the gap with Ethereum in terms of stablecoin usage. When considering the total stablecoin market capitalization of $242 billion, TRON now facilitates smooth transactions for nearly 29% of all stablecoin value globally and 47% of USDT’s total market capitalization of $149 billion.

“This milestone cements TRON’s position as one of the major blockchains in the DeFi space,” analyst Darkfost noted in response to these figures.

TRON secures leading position in active user engagement

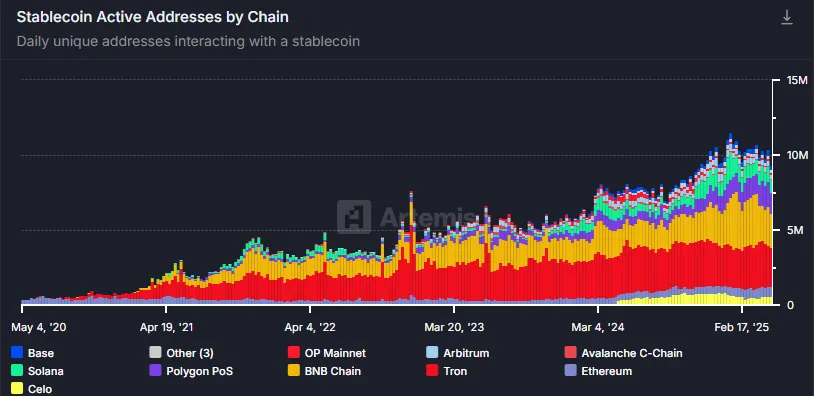

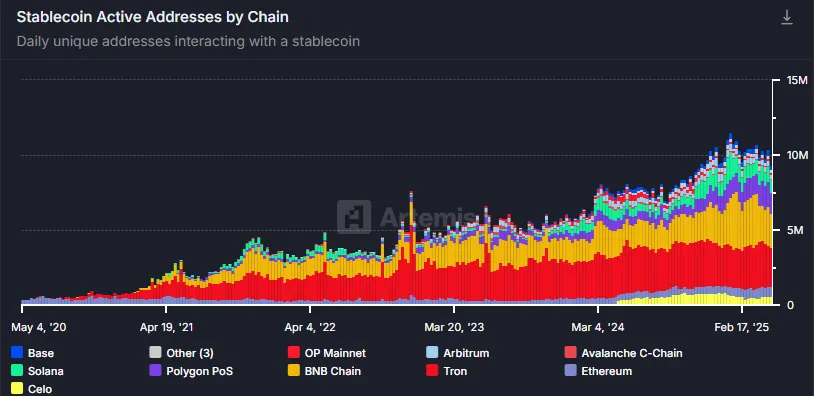

Beyond raw transaction volume, TRON has secured a leading position in active user engagement. According to data from Artemis, TRON is the most prevalent blockchain in their analysis, accounting for 28% of all active stablecoin wallet addresses. This high level of activity has made TRON the top chain in terms of fee revenue from stablecoin transactions.

The network’s growth comes at a time when experts predict significant expansion in the stablecoin sector. In addition to the growth in USDT circulation, TRON has experienced increased token holder commitment. Based on CryptoQuant, 2.66 million TRX addresses have held their tokens for more than one year without selling them.

These wallets hold balances of more than 10 TRX, which indicates retail investors have the willingness to hold TRON for long periods of time despite having limited capital.

Analyst Crazzyblockk interprets this number as a sign of user commitment and long-term stickiness, keeping in mind that “augmented long-term holding is sometimes aligned with stronger beliefs in the underlying network and liquidity resilience.”

But this growth tale comes with strings attached. the network’s activity is, in the view of some analysts, dependent on USDT trades. Dune Analytics data indicate that although more than 3 million TRX wallets are active on a typical day, the majority of them only trade in USDT.

TRON Network Hits New Heights as USDT Supply Reaches $71 Billion

- TRON now hosts $71 billion in USDT, closing gap with Ethereum’s $74.5 billion.

- Network surpasses 2.66 million long-term holding addresses.

- TRON facilitates 29% of all stablecoin transactions globally.

The TRON network has achieved a key milestone in the stablecoin sector as the amount of USDT (Tether) circulating on its blockchain reached a new all-time high of $71 billion. This growth positions TRON just $3.5 billion behind Ethereum, which currently hosts $74.5 billion in USDT, according to the latest data from CryptoQuant.

The increasing USDT supply on TRON has followed a steady upward trajectory over recent years, narrowing the gap with Ethereum in terms of stablecoin usage. When considering the total stablecoin market capitalization of $242 billion, TRON now facilitates smooth transactions for nearly 29% of all stablecoin value globally and 47% of USDT’s total market capitalization of $149 billion.

“This milestone cements TRON’s position as one of the major blockchains in the DeFi space,” analyst Darkfost noted in response to these figures.

TRON secures leading position in active user engagement

Beyond raw transaction volume, TRON has secured a leading position in active user engagement. According to data from Artemis, TRON is the most prevalent blockchain in their analysis, accounting for 28% of all active stablecoin wallet addresses. This high level of activity has made TRON the top chain in terms of fee revenue from stablecoin transactions.

The network’s growth comes at a time when experts predict significant expansion in the stablecoin sector. In addition to the growth in USDT circulation, TRON has experienced increased token holder commitment. Based on CryptoQuant, 2.66 million TRX addresses have held their tokens for more than one year without selling them.

These wallets hold balances of more than 10 TRX, which indicates retail investors have the willingness to hold TRON for long periods of time despite having limited capital.

Analyst Crazzyblockk interprets this number as a sign of user commitment and long-term stickiness, keeping in mind that “augmented long-term holding is sometimes aligned with stronger beliefs in the underlying network and liquidity resilience.”

But this growth tale comes with strings attached. the network’s activity is, in the view of some analysts, dependent on USDT trades. Dune Analytics data indicate that although more than 3 million TRX wallets are active on a typical day, the majority of them only trade in USDT.