XRP Faces Bearish Pressure as $2.74 Support Gets Tested

- XRP risks a bearish breakdown if it closes below the $2.74 swing low, with downside targets near $2.40.

- Market sentiment looks weak: open interest is falling, OBV trends lower, and RSI slipped under neutral levels.

- Historical data shows September has rarely delivered strong gains for XRP, making a rebound to $5 unlikely before Q4 2025.

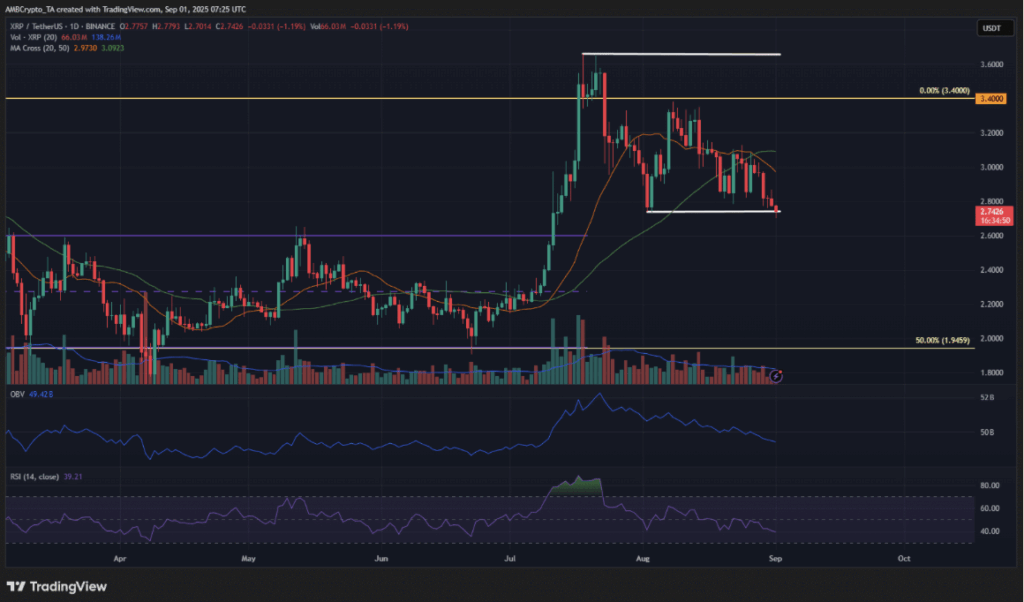

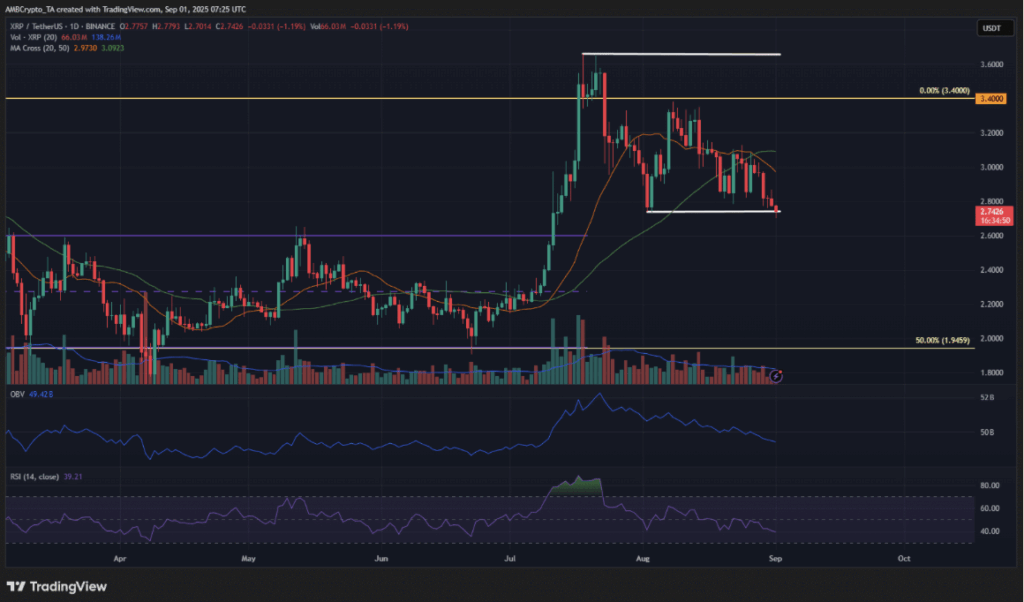

Ripple’s XRP is sitting on shaky ground, with price action circling dangerously close to the $2.74 swing low. If the daily session closes below this level, it would mark a bearish structural shift on the 1-day chart – basically a red flag that the next trend could tilt downward.

Market Sentiment Tilts Bearish

Data from Coinalyze paints a mixed picture. Funding rates stayed positive, but open interest slid lower alongside falling prices over the weekend. That kind of divergence usually signals weak conviction from bulls and a heavier short-term bearish bias. Despite this, XRP is still consolidating near long-term highs, leaving traders torn between expecting a breakdown or a surprise rebound.

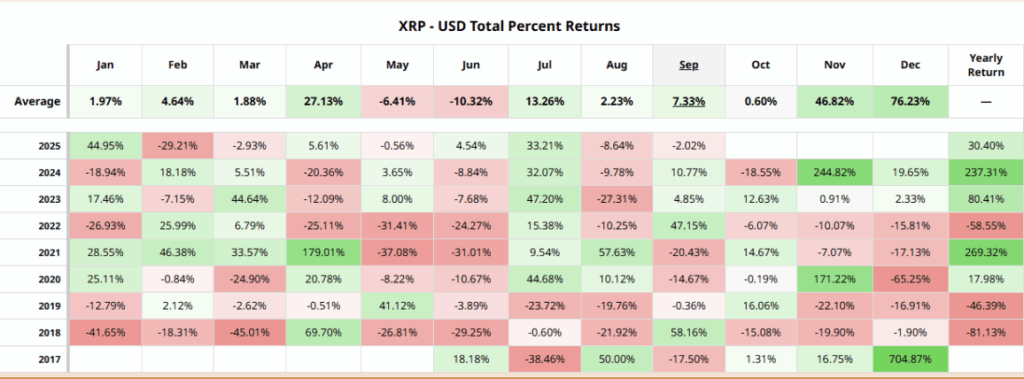

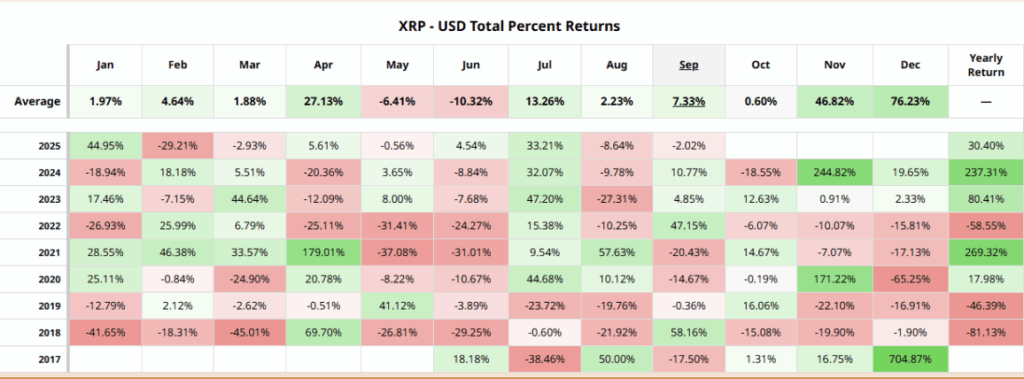

Historical Trends Show September Isn’t Kind

Seasonality doesn’t exactly favor the bulls either. Since 2017, XRP has only managed to post gains of more than 15% in September twice. Compare that to months like January or July, where XRP historically performs better, and it’s clear the odds aren’t in its favor. With Bitcoin expected to retest $100k this month, XRP bulls may find it even harder to stage a meaningful comeback.

Technical Picture Looks Heavy

On the daily chart, trading volume has been thinning out, while the OBV trends lower – clear signs of persistent selling pressure. The RSI also dipped under the neutral 50 zone, showing momentum is slipping away from the buyers. If XRP breaks below $2.74, the next stop could be closer to $2.40 before any meaningful rebound attempt.

Of course, crypto has a way of surprising everyone. A sudden surge in demand or bullish momentum from Bitcoin could flip sentiment quickly. Still, with current signals pointing south, a September rally toward $5 looks less likely. The more realistic timeline for XRP’s next big leg higher may be in Q4 2025.

The post XRP Faces Bearish Pressure as $2.74 Support Gets Tested first appeared on BlockNews.

XRP Faces Bearish Pressure as $2.74 Support Gets Tested

- XRP risks a bearish breakdown if it closes below the $2.74 swing low, with downside targets near $2.40.

- Market sentiment looks weak: open interest is falling, OBV trends lower, and RSI slipped under neutral levels.

- Historical data shows September has rarely delivered strong gains for XRP, making a rebound to $5 unlikely before Q4 2025.

Ripple’s XRP is sitting on shaky ground, with price action circling dangerously close to the $2.74 swing low. If the daily session closes below this level, it would mark a bearish structural shift on the 1-day chart – basically a red flag that the next trend could tilt downward.

Market Sentiment Tilts Bearish

Data from Coinalyze paints a mixed picture. Funding rates stayed positive, but open interest slid lower alongside falling prices over the weekend. That kind of divergence usually signals weak conviction from bulls and a heavier short-term bearish bias. Despite this, XRP is still consolidating near long-term highs, leaving traders torn between expecting a breakdown or a surprise rebound.

Historical Trends Show September Isn’t Kind

Seasonality doesn’t exactly favor the bulls either. Since 2017, XRP has only managed to post gains of more than 15% in September twice. Compare that to months like January or July, where XRP historically performs better, and it’s clear the odds aren’t in its favor. With Bitcoin expected to retest $100k this month, XRP bulls may find it even harder to stage a meaningful comeback.

Technical Picture Looks Heavy

On the daily chart, trading volume has been thinning out, while the OBV trends lower – clear signs of persistent selling pressure. The RSI also dipped under the neutral 50 zone, showing momentum is slipping away from the buyers. If XRP breaks below $2.74, the next stop could be closer to $2.40 before any meaningful rebound attempt.

Of course, crypto has a way of surprising everyone. A sudden surge in demand or bullish momentum from Bitcoin could flip sentiment quickly. Still, with current signals pointing south, a September rally toward $5 looks less likely. The more realistic timeline for XRP’s next big leg higher may be in Q4 2025.

The post XRP Faces Bearish Pressure as $2.74 Support Gets Tested first appeared on BlockNews.