This Is Where Capital Moved During the Latest Crypto Market Correction

- Stablecoin flows shift as Ethereum and BSC gain while Solana sees major outflows.

- TVL drops across top chains; Avalanche and Hyperliquid show rising user activity.

- Bitcoin ETFs gain $1B inflows; whale activity varies with significant ETH and BTC trades.

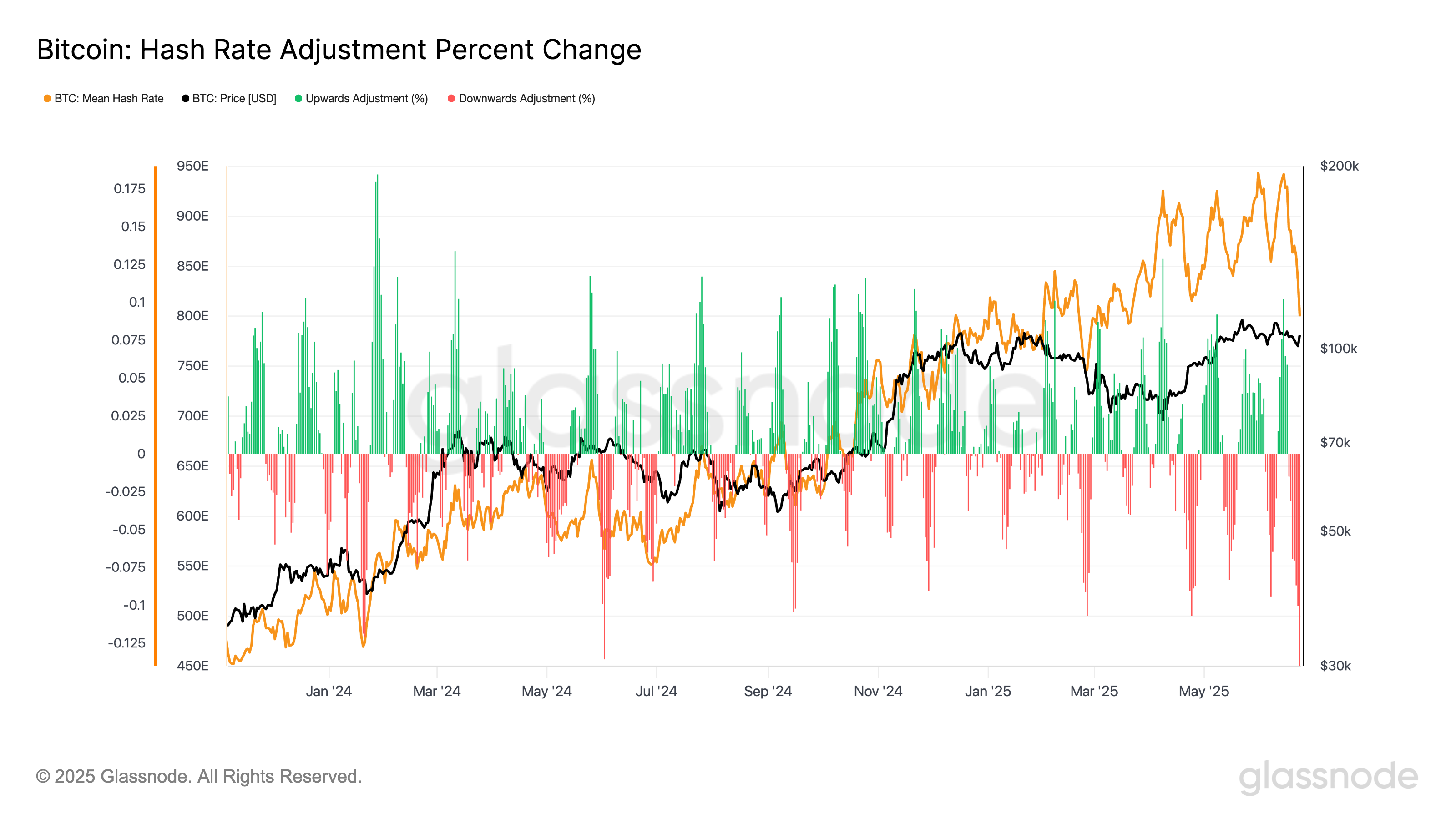

The cryptocurrency market experienced a major decline last week, a move that corresponded with a significant contraction in the total stablecoin supply and a large-scale capital rotation between major blockchain networks. While Bitcoin dipped from its recent highs before recovering, data shows institutional inflows into Bitcoin ETFs remained strong, and large whale investors actively accumulated assets during the sell-off.

The total market capitalization of stablecoins contracted by $339 million during the week, with major shifts observed across the top 15 blockchain ecosystems.

The post This Is Where Capital Moved During the Latest Crypto Market Correction appeared first on Coin Edition.

This Is Where Capital Moved During the Latest Crypto Market Correction

- Stablecoin flows shift as Ethereum and BSC gain while Solana sees major outflows.

- TVL drops across top chains; Avalanche and Hyperliquid show rising user activity.

- Bitcoin ETFs gain $1B inflows; whale activity varies with significant ETH and BTC trades.

The cryptocurrency market experienced a major decline last week, a move that corresponded with a significant contraction in the total stablecoin supply and a large-scale capital rotation between major blockchain networks. While Bitcoin dipped from its recent highs before recovering, data shows institutional inflows into Bitcoin ETFs remained strong, and large whale investors actively accumulated assets during the sell-off.

The total market capitalization of stablecoins contracted by $339 million during the week, with major shifts observed across the top 15 blockchain ecosystems.

The post This Is Where Capital Moved During the Latest Crypto Market Correction appeared first on Coin Edition.

Market Overview

Market Overview