Breaking: Bitcoin Crash Fueled by Exchanges Dumping Millions in Crypto

Bitcoin Crash Sparks Exchange Dumping Frenzy

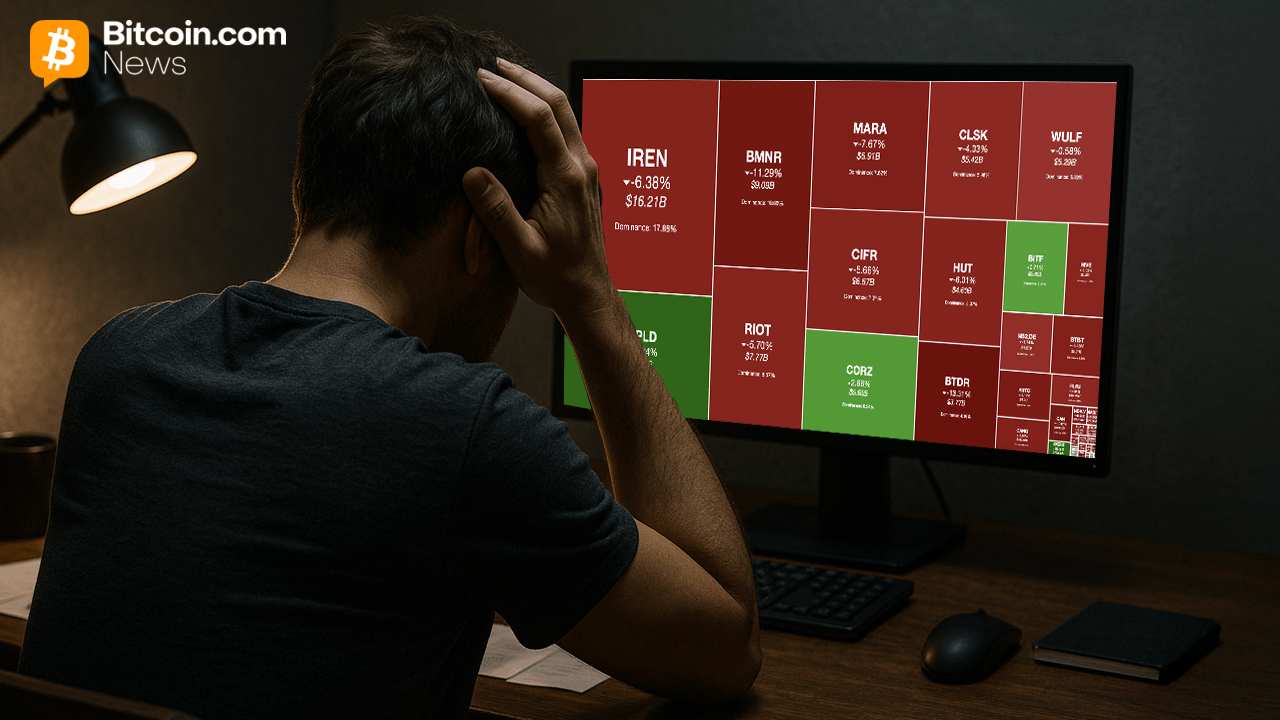

The crypto market shook on October 10, 2025, as $Bitcoin crashed 10% — from $122,000 to $107,000 — after Trump’s 100% tariff threats against China. Key details:

- Over $250B wiped from total market cap, now near $4T.

- Around $250M in hourly liquidations across exchanges.

- @DeFiTracer reported Binance moved 4,000 ETH ($17M) to exchanges like OKX and Kraken in under 10 minutes, sparking fears of coordinated dumping.

Total crypto market cap in USD - TradingView

Ethereum Hit Hard by Exchange Outflows

Ethereum suffered an even steeper drop, plunging 15% from $4,390 to $3,860 on Binance.

- Arkham data revealed rapid ETH outflows from exchanges.

- These transfers suggest exchanges liquidated large long positions.

- Some traders accused Binance and others of manipulation, while on-chain data hints at market makers redistributing liquidity.

- The speed and size of these dumps fueled speculation of deliberate price suppression.

U.S.–China Tensions Amplify Exchange Actions

The bitcoin crash and subsequent exchange dumping are deeply tied to escalating U.S.–China trade tensions. Trump’s tariff hike, announced late Friday, created a “risk-off” environment, prompting exchanges to dump major assets to manage exposure.

Data shows Binance and other platforms moved significant volumes of digital assets, possibly to mitigate losses or capitalize on the panic. This exchange dumping aligns with historical patterns during geopolitical shocks, but the lack of transparency has intensified scrutiny on whether these actions are market-driven or manipulative in the current crypto market turmoil.

Manipulation Claims Target Exchanges

@DeFiTracer called the dumping “pure manipulation”, accusing exchanges of trying to liquidate longs for profit.

- Millions in ETH and other tokens were shifted in minutes.

- So far, no regulatory proof of manipulation has surfaced.

- On-chain data suggests liquidity adjustments during volatility — but traders remain skeptical.

- The debate continues, with calls for greater oversight and transparency.

Future Implications of Exchange Dumping

The $bitcoin crash and exchange dumping have left crypto markets on edge, with Bitcoin and Ethereum hovering near $100,000 and $3,000 support levels. Continued exchange dumping could prolong the bearish trend, especially if U.S.–China trade tensions escalate. Investors are watching for regulatory responses to the alleged manipulation and further exchange moves.

This episode underscores the power of exchanges in shaping crypto market dynamics and the need for transparency. For now, the crypto community braces for more volatility as exchanges remain under the spotlight.

Read More

Bitcoin Flash Crash Confirms a Reset Before the Next Rally...Here's Why

Breaking: Bitcoin Crash Fueled by Exchanges Dumping Millions in Crypto

Bitcoin Crash Sparks Exchange Dumping Frenzy

The crypto market shook on October 10, 2025, as $Bitcoin crashed 10% — from $122,000 to $107,000 — after Trump’s 100% tariff threats against China. Key details:

- Over $250B wiped from total market cap, now near $4T.

- Around $250M in hourly liquidations across exchanges.

- @DeFiTracer reported Binance moved 4,000 ETH ($17M) to exchanges like OKX and Kraken in under 10 minutes, sparking fears of coordinated dumping.

Total crypto market cap in USD - TradingView

Ethereum Hit Hard by Exchange Outflows

Ethereum suffered an even steeper drop, plunging 15% from $4,390 to $3,860 on Binance.

- Arkham data revealed rapid ETH outflows from exchanges.

- These transfers suggest exchanges liquidated large long positions.

- Some traders accused Binance and others of manipulation, while on-chain data hints at market makers redistributing liquidity.

- The speed and size of these dumps fueled speculation of deliberate price suppression.

U.S.–China Tensions Amplify Exchange Actions

The bitcoin crash and subsequent exchange dumping are deeply tied to escalating U.S.–China trade tensions. Trump’s tariff hike, announced late Friday, created a “risk-off” environment, prompting exchanges to dump major assets to manage exposure.

Data shows Binance and other platforms moved significant volumes of digital assets, possibly to mitigate losses or capitalize on the panic. This exchange dumping aligns with historical patterns during geopolitical shocks, but the lack of transparency has intensified scrutiny on whether these actions are market-driven or manipulative in the current crypto market turmoil.

Manipulation Claims Target Exchanges

@DeFiTracer called the dumping “pure manipulation”, accusing exchanges of trying to liquidate longs for profit.

- Millions in ETH and other tokens were shifted in minutes.

- So far, no regulatory proof of manipulation has surfaced.

- On-chain data suggests liquidity adjustments during volatility — but traders remain skeptical.

- The debate continues, with calls for greater oversight and transparency.

Future Implications of Exchange Dumping

The $bitcoin crash and exchange dumping have left crypto markets on edge, with Bitcoin and Ethereum hovering near $100,000 and $3,000 support levels. Continued exchange dumping could prolong the bearish trend, especially if U.S.–China trade tensions escalate. Investors are watching for regulatory responses to the alleged manipulation and further exchange moves.

This episode underscores the power of exchanges in shaping crypto market dynamics and the need for transparency. For now, the crypto community braces for more volatility as exchanges remain under the spotlight.

Read More