America’s Labor Weakness: Why U.S. Jobs Data Could Spark a 2025 Crypto Bull Run

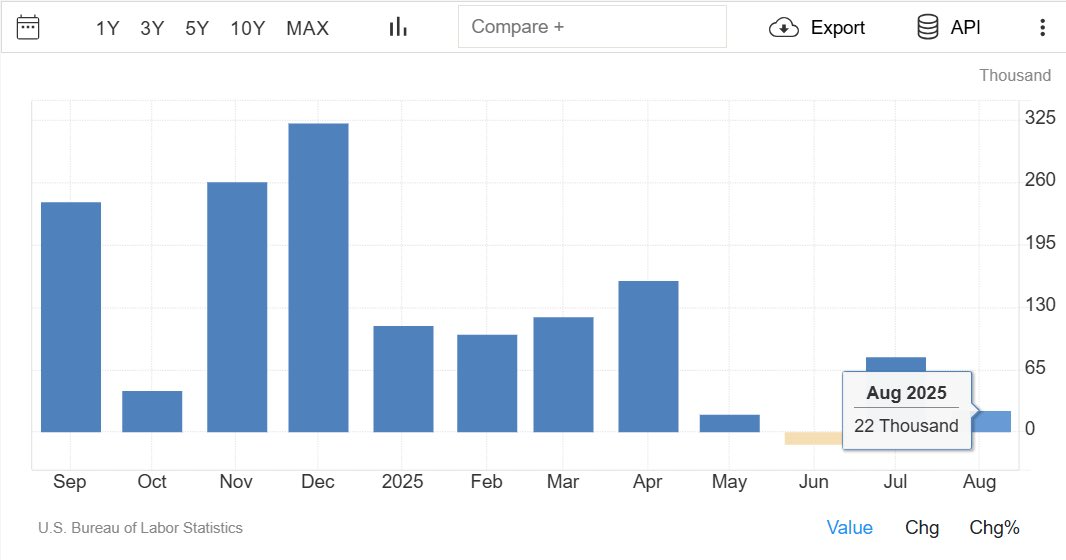

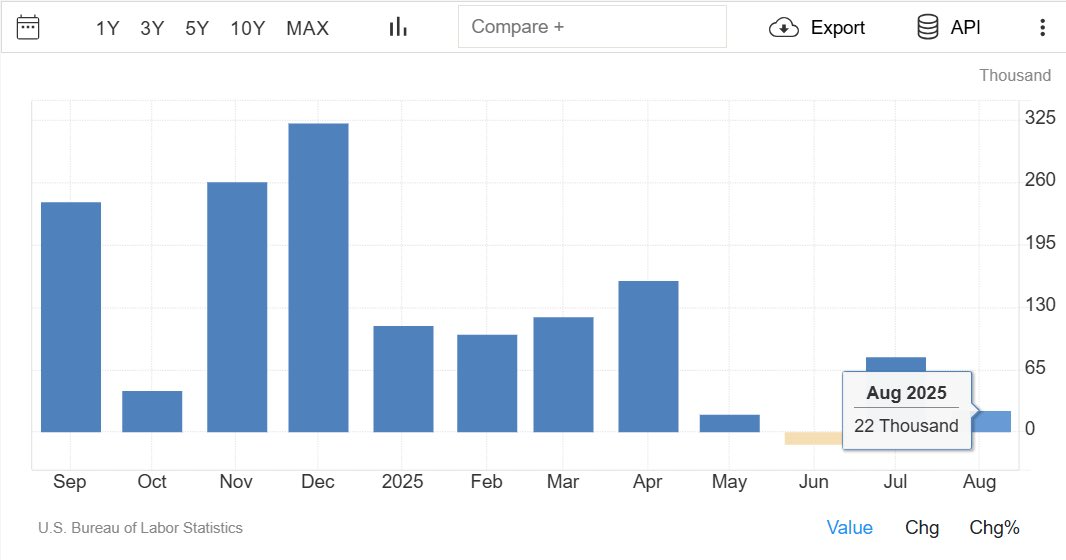

The U.S. economy just flashed its most troubling signal in years. The August jobs report showed the unemployment rate climbing to 4.3%, the highest level since late 2021. Non-farm payrolls rose by just 22,000 jobs, a fraction of the 75,000 expected.

In a detailed analysis on X, Bull Theory points to a labor market losing its footing. For Wall Street, it suggests the business cycle has entered a softening phase. And for the Federal Reserve, it fundamentally alters the policy outlook: with inflation cooling and employment weakening, the case for rate cuts in 2025 is now undeniable.

The shift has already been priced into financial markets. Fed funds futures show a 100% probability of a September cut, with expectations for at least three reductions in 2025.

Beyond the immediate economic risks, this pivot has profound implications for asset markets. Stocks, bonds, and currencies will all react, but crypto may be positioned as the biggest winner of the next liquidity wave.

Labor Market Under Pressure

The details of the August jobs report reveal slowing momentum across the U.S. economy:

- Unemployment: Rising to 4.3%, marking a four-year high.

- Hiring…

The post America’s Labor Weakness: Why U.S. Jobs Data Could Spark a 2025 Crypto Bull Run appeared first on Coin Edition.

Read More

UK and US to Boost Cross-Border Crypto Access With New Agreement

America’s Labor Weakness: Why U.S. Jobs Data Could Spark a 2025 Crypto Bull Run

The U.S. economy just flashed its most troubling signal in years. The August jobs report showed the unemployment rate climbing to 4.3%, the highest level since late 2021. Non-farm payrolls rose by just 22,000 jobs, a fraction of the 75,000 expected.

In a detailed analysis on X, Bull Theory points to a labor market losing its footing. For Wall Street, it suggests the business cycle has entered a softening phase. And for the Federal Reserve, it fundamentally alters the policy outlook: with inflation cooling and employment weakening, the case for rate cuts in 2025 is now undeniable.

The shift has already been priced into financial markets. Fed funds futures show a 100% probability of a September cut, with expectations for at least three reductions in 2025.

Beyond the immediate economic risks, this pivot has profound implications for asset markets. Stocks, bonds, and currencies will all react, but crypto may be positioned as the biggest winner of the next liquidity wave.

Labor Market Under Pressure

The details of the August jobs report reveal slowing momentum across the U.S. economy:

- Unemployment: Rising to 4.3%, marking a four-year high.

- Hiring…

The post America’s Labor Weakness: Why U.S. Jobs Data Could Spark a 2025 Crypto Bull Run appeared first on Coin Edition.

Read More