Previous Cycles Show Bitcoin Could Hit a New All-time High in 2024 with Trend Extending Into 2025

CCData’s analysis in their July 2 H2 Outlook Report suggests that Bitcoin has yet to display its anticipated parabolic growth this cycle based on past halving cycles, with the current trend potentially extending into 2025.

Bitcoin saw major growth this year, hitting its all-time high (ATH) of $73,737 in March.

It has since experienced a downward correction, with its current price at $60,463. Overall, BTC appreciated 97% over the past year.

There’s Still Room For New All-Time Highs

The report highlights that Bitcoin’s price action “remained largely range-bound” between $72,000 and $59,000 over the three months following the fourth halving on April 19.

However, equity indices, including the SPX and NASDAQ, have recorded all-time highs.

Additionally, there was a recent notable drop in trading activity on centralized exchanges.

These facts resulted in some speculation that the market may have topped this cycle already.

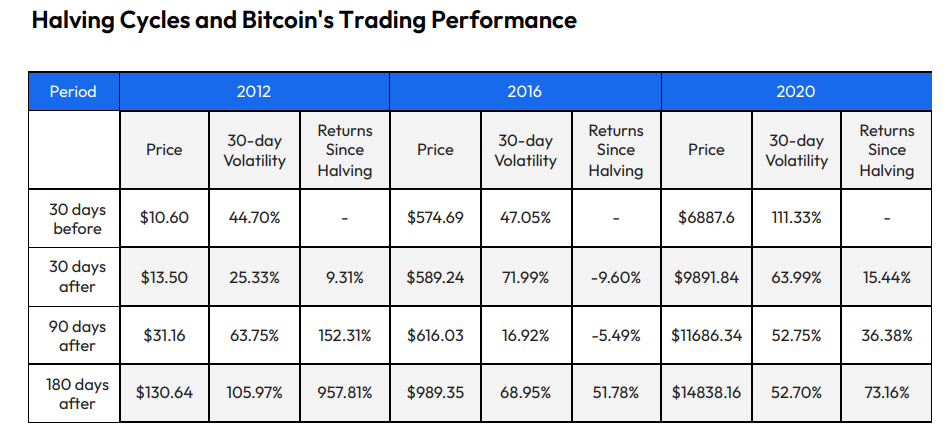

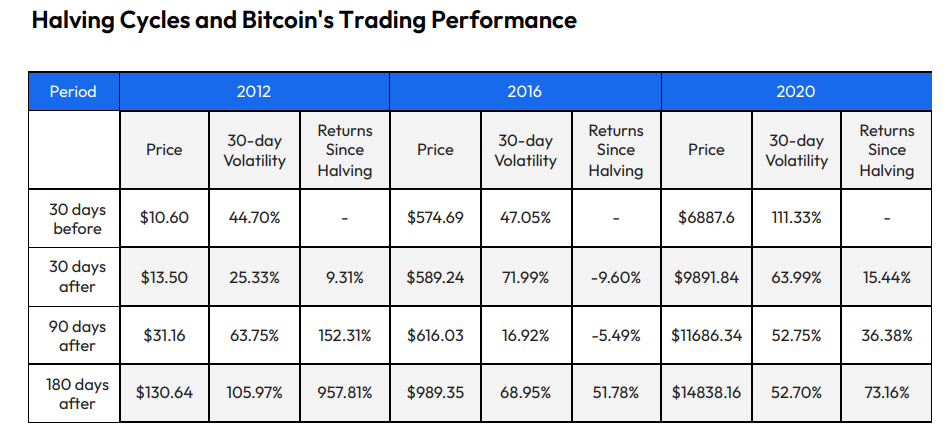

However, CCData offers a different perspective. The researchers found that historical trends have shown that a period of price expansion follows a halving event.

This period can last anywhere from 366 days (as seen in 2014) to 548 days (2021) before producing a cycle top.

Each halving cycle tends to be longer than the last, reflecting the increasing maturity of the asset class and reduced volatility.

CCData observed a similar drop in trading activity on centralized exchanges for nearly two months after the halving event in previous cycles. “This suggests that the current cycle could expand further into 2025,” they said.

Additionally, two out of three previous cycles witnessed positive Bitcoin price returns exceeding 50% within 180 days post-halving, with the 2016 cycle being the exception.

There are also “seasonality effects” to take into account and low trading activity expected in the third quarter. Therefore, more sideways Bitcoin price action is very likely.

The report further emphasizes that “the data and previous trends are strong enough to suggest that any sideways price action is temporary, and we are likely to breach the previous all-time highs once again before the end of the year.”

Extended Cycle and Institutional Influx

According to the report, the first half of 2024 witnessed notable developments within the industry, such as growing institutionalization and maturation.

This is evident in the launch of spot Bitcoin exchange-traded funds (ETFs) in the US, accumulating over $55 billion in net assets as of June.

More capital, liquidity, and demand will follow the launch of Ethereum ETFs in the US and the subsequent approval of ETPs in multiple jurisdictions.

The inflow of institutional capital will further attract retail investors who were previously discouraged to move into the space due to market downturns and collapses of massive companies, such as FTX and Terra.

Additionally, the industry experiences a substantial increase in regulatory clarity and capital injections.

The report highlights that “the recent forays of major entities like Robinhood and Sony into centralized exchanges highlight growing institutional interest, signaling a positive shift as the asset class matures into a viable alternative investment.”

However, the report acknowledges that the significant influence of institutional participants in the crypto industry has changed the previous trends.

For instance, this cycle marks the first time the Bitcoin price surpassed the previous all-time high before the halving. Previous cycles witnessed a concentrated period of Bitcoin price appreciation.

In the four months before the cycle top, BTC made 91.4% and 78.8% of the price expansion in the 2012 and 2016 cycles, respectively, CCData writes.

Then, in 2020, BTC recorded 71.5% of the price increase four months before the initial peak of $63,558. The report concludes that this parabolic expansion is yet to occur in the current cycle.

The post Previous Cycles Show Bitcoin Could Hit a New All-time High in 2024 with Trend Extending Into 2025 appeared first on Cryptonews.

Previous Cycles Show Bitcoin Could Hit a New All-time High in 2024 with Trend Extending Into 2025

CCData’s analysis in their July 2 H2 Outlook Report suggests that Bitcoin has yet to display its anticipated parabolic growth this cycle based on past halving cycles, with the current trend potentially extending into 2025.

Bitcoin saw major growth this year, hitting its all-time high (ATH) of $73,737 in March.

It has since experienced a downward correction, with its current price at $60,463. Overall, BTC appreciated 97% over the past year.

There’s Still Room For New All-Time Highs

The report highlights that Bitcoin’s price action “remained largely range-bound” between $72,000 and $59,000 over the three months following the fourth halving on April 19.

However, equity indices, including the SPX and NASDAQ, have recorded all-time highs.

Additionally, there was a recent notable drop in trading activity on centralized exchanges.

These facts resulted in some speculation that the market may have topped this cycle already.

However, CCData offers a different perspective. The researchers found that historical trends have shown that a period of price expansion follows a halving event.

This period can last anywhere from 366 days (as seen in 2014) to 548 days (2021) before producing a cycle top.

Each halving cycle tends to be longer than the last, reflecting the increasing maturity of the asset class and reduced volatility.

CCData observed a similar drop in trading activity on centralized exchanges for nearly two months after the halving event in previous cycles. “This suggests that the current cycle could expand further into 2025,” they said.

Additionally, two out of three previous cycles witnessed positive Bitcoin price returns exceeding 50% within 180 days post-halving, with the 2016 cycle being the exception.

There are also “seasonality effects” to take into account and low trading activity expected in the third quarter. Therefore, more sideways Bitcoin price action is very likely.

The report further emphasizes that “the data and previous trends are strong enough to suggest that any sideways price action is temporary, and we are likely to breach the previous all-time highs once again before the end of the year.”

Extended Cycle and Institutional Influx

According to the report, the first half of 2024 witnessed notable developments within the industry, such as growing institutionalization and maturation.

This is evident in the launch of spot Bitcoin exchange-traded funds (ETFs) in the US, accumulating over $55 billion in net assets as of June.

More capital, liquidity, and demand will follow the launch of Ethereum ETFs in the US and the subsequent approval of ETPs in multiple jurisdictions.

The inflow of institutional capital will further attract retail investors who were previously discouraged to move into the space due to market downturns and collapses of massive companies, such as FTX and Terra.

Additionally, the industry experiences a substantial increase in regulatory clarity and capital injections.

The report highlights that “the recent forays of major entities like Robinhood and Sony into centralized exchanges highlight growing institutional interest, signaling a positive shift as the asset class matures into a viable alternative investment.”

However, the report acknowledges that the significant influence of institutional participants in the crypto industry has changed the previous trends.

For instance, this cycle marks the first time the Bitcoin price surpassed the previous all-time high before the halving. Previous cycles witnessed a concentrated period of Bitcoin price appreciation.

In the four months before the cycle top, BTC made 91.4% and 78.8% of the price expansion in the 2012 and 2016 cycles, respectively, CCData writes.

Then, in 2020, BTC recorded 71.5% of the price increase four months before the initial peak of $63,558. The report concludes that this parabolic expansion is yet to occur in the current cycle.

The post Previous Cycles Show Bitcoin Could Hit a New All-time High in 2024 with Trend Extending Into 2025 appeared first on Cryptonews.