Chainlink vs XRP Ledger: Which Has the Bigger Future in Crypto?

- Chainlink provides neutral infrastructure for tokenization and cross-chain data, while XRPL focuses on payments and native asset issuance.

- Institutions like JPMorgan, SWIFT, and DTCC are testing Chainlink, while Ripple is driving XRPL adoption with payments, funds, and stablecoins.

- XRPL has a narrower path due to competition, but Chainlink could scale across the entire tokenization space, giving it broader upside.

In crypto, two names keep coming up in conversations about institutional adoption and tokenization — Chainlink and the XRP Ledger (XRPL). They sit in the same conversation but play very different roles. The big debate now is whether Chainlink can eventually become more important than XRPL, or if both will simply carve out their own space.

Chainlink vs XRP Ledger: Different Roles in Blockchain

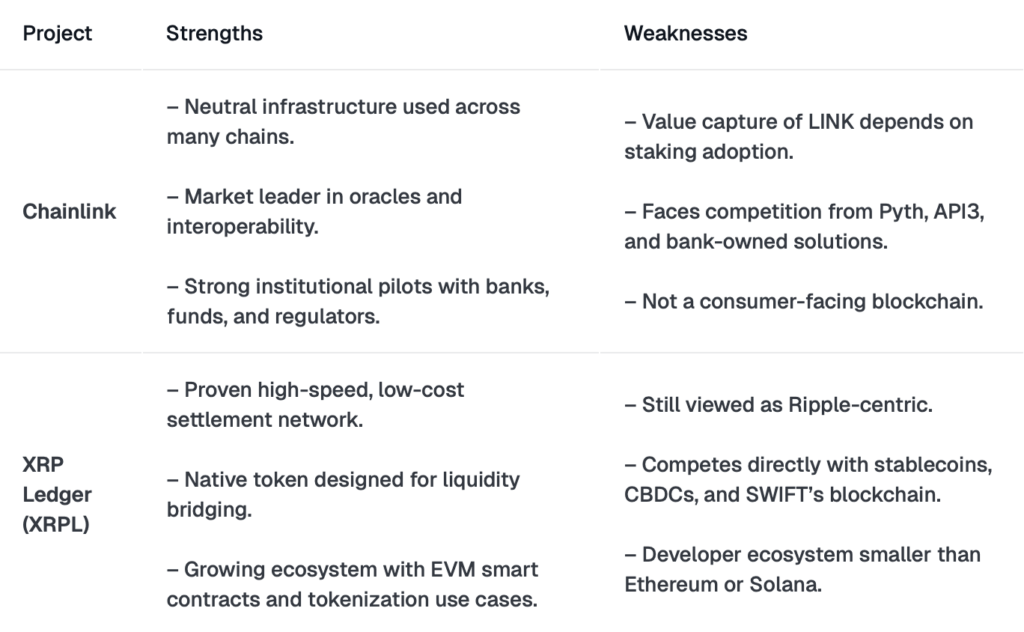

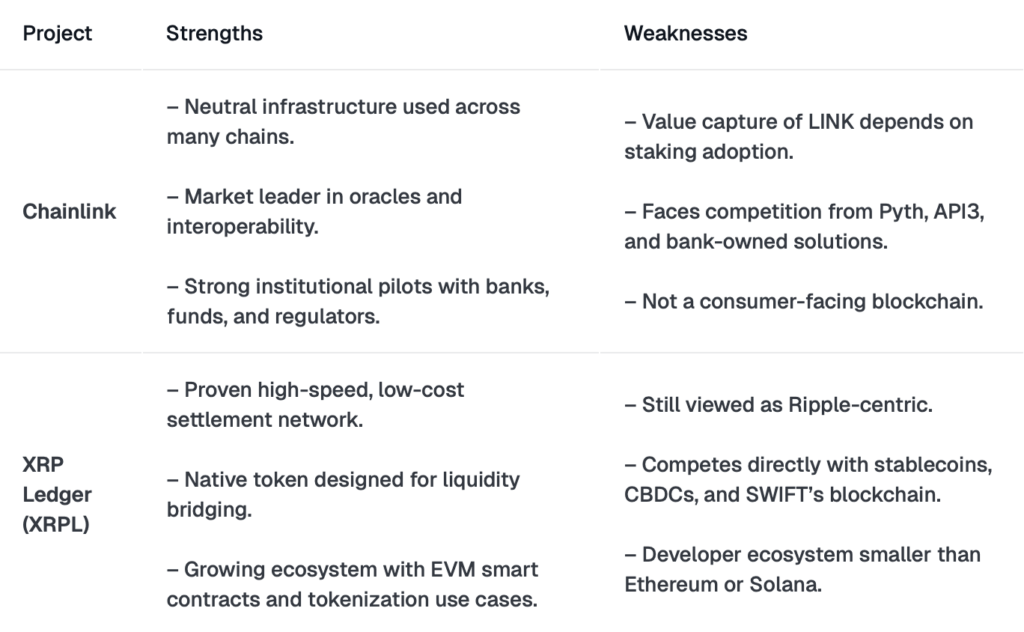

Chainlink isn’t even a blockchain. It’s an oracle and interoperability network — basically the middleware that pipes outside data into blockchains. Think fund valuations, economic reports, or compliance feeds being sent straight into smart contracts. Its Cross-Chain Interoperability Protocol (CCIP) also helps assets move between different chains.

XRPL, on the other hand, is a full-blown Layer-1 blockchain built for payments and tokenization. It uses XRP as its native asset, offering fast settlement and almost no fees. Tokens, stablecoins, and even CBDCs can be issued directly on its ledger. It’s practical and payment-focused, but not as neutral as Chainlink since its history is tied to Ripple.

Institutional Adoption of Chainlink and XRPL

Chainlink has leaned into being infrastructure-first. It’s been running pilots with giants like JPMorgan, DTCC, and SWIFT to bring fund data and cross-chain settlement into the real world. Even the U.S. Department of Commerce has tapped Chainlink to publish official stats on-chain. That gives it credibility as a “standard” that sits across blockchains.

XRPL’s institutional story looks a little different. Ripple has teamed up with Franklin Templeton and DBS for tokenized money market funds on XRPL. In Japan, SBI Ripple Asia is using it for payments and NFTs. Ripple’s RLUSD stablecoin also lives natively on XRPL, giving the ledger more utility in settlement and liquidity.

Tokenization, DeFi Growth, and Regulation Risks

When it comes to tokenization, Chainlink is the layer that makes sure everything works across blockchains — pricing, compliance, data feeds. Value flows back into LINK through staking and usage fees.

XRPL handles tokenization directly on its ledger, with developers issuing stablecoins, NFTs, and DeFi assets. Its new EVM sidechain opens the door for Ethereum-style apps, and its TVL has already passed $120M. But XRP’s history with the SEC lawsuit shows how regulatory risk has shaped its narrative, even after clarity was achieved. Chainlink doesn’t face the same pressure because it’s not issuing assets, just providing data infrastructure.

Future Outlook for Chainlink and XRP Ledger

At the end of the day, Chainlink won’t “replace” XRPL. They’re built for different purposes. XRPL will likely stay relevant in payment corridors and liquidity use cases, especially where speed and cost are key. But competition from stablecoins, CBDCs, and even SWIFT limits how much it can grow.

Chainlink, by contrast, has the chance to scale across the entire tokenization industry. If it cements itself as the neutral standard for data and cross-chain connections, it becomes harder to dislodge than any single blockchain. That’s why many analysts argue its upside with institutions is bigger.

Final Take: Chainlink or XRPL for the Future of Crypto?

Chainlink will never be the next XRPL — it’s not a payments blockchain and doesn’t aim to be. But it could surpass XRPL in institutional relevance by becoming the glue that holds tokenization together. XRPL still matters, especially in payments and liquidity, but Chainlink’s role as infrastructure gives it a much wider ceiling.

The post Chainlink vs XRP Ledger: Which Has the Bigger Future in Crypto? first appeared on BlockNews.

Chainlink vs XRP Ledger: Which Has the Bigger Future in Crypto?

- Chainlink provides neutral infrastructure for tokenization and cross-chain data, while XRPL focuses on payments and native asset issuance.

- Institutions like JPMorgan, SWIFT, and DTCC are testing Chainlink, while Ripple is driving XRPL adoption with payments, funds, and stablecoins.

- XRPL has a narrower path due to competition, but Chainlink could scale across the entire tokenization space, giving it broader upside.

In crypto, two names keep coming up in conversations about institutional adoption and tokenization — Chainlink and the XRP Ledger (XRPL). They sit in the same conversation but play very different roles. The big debate now is whether Chainlink can eventually become more important than XRPL, or if both will simply carve out their own space.

Chainlink vs XRP Ledger: Different Roles in Blockchain

Chainlink isn’t even a blockchain. It’s an oracle and interoperability network — basically the middleware that pipes outside data into blockchains. Think fund valuations, economic reports, or compliance feeds being sent straight into smart contracts. Its Cross-Chain Interoperability Protocol (CCIP) also helps assets move between different chains.

XRPL, on the other hand, is a full-blown Layer-1 blockchain built for payments and tokenization. It uses XRP as its native asset, offering fast settlement and almost no fees. Tokens, stablecoins, and even CBDCs can be issued directly on its ledger. It’s practical and payment-focused, but not as neutral as Chainlink since its history is tied to Ripple.

Institutional Adoption of Chainlink and XRPL

Chainlink has leaned into being infrastructure-first. It’s been running pilots with giants like JPMorgan, DTCC, and SWIFT to bring fund data and cross-chain settlement into the real world. Even the U.S. Department of Commerce has tapped Chainlink to publish official stats on-chain. That gives it credibility as a “standard” that sits across blockchains.

XRPL’s institutional story looks a little different. Ripple has teamed up with Franklin Templeton and DBS for tokenized money market funds on XRPL. In Japan, SBI Ripple Asia is using it for payments and NFTs. Ripple’s RLUSD stablecoin also lives natively on XRPL, giving the ledger more utility in settlement and liquidity.

Tokenization, DeFi Growth, and Regulation Risks

When it comes to tokenization, Chainlink is the layer that makes sure everything works across blockchains — pricing, compliance, data feeds. Value flows back into LINK through staking and usage fees.

XRPL handles tokenization directly on its ledger, with developers issuing stablecoins, NFTs, and DeFi assets. Its new EVM sidechain opens the door for Ethereum-style apps, and its TVL has already passed $120M. But XRP’s history with the SEC lawsuit shows how regulatory risk has shaped its narrative, even after clarity was achieved. Chainlink doesn’t face the same pressure because it’s not issuing assets, just providing data infrastructure.

Future Outlook for Chainlink and XRP Ledger

At the end of the day, Chainlink won’t “replace” XRPL. They’re built for different purposes. XRPL will likely stay relevant in payment corridors and liquidity use cases, especially where speed and cost are key. But competition from stablecoins, CBDCs, and even SWIFT limits how much it can grow.

Chainlink, by contrast, has the chance to scale across the entire tokenization industry. If it cements itself as the neutral standard for data and cross-chain connections, it becomes harder to dislodge than any single blockchain. That’s why many analysts argue its upside with institutions is bigger.

Final Take: Chainlink or XRPL for the Future of Crypto?

Chainlink will never be the next XRPL — it’s not a payments blockchain and doesn’t aim to be. But it could surpass XRPL in institutional relevance by becoming the glue that holds tokenization together. XRPL still matters, especially in payments and liquidity, but Chainlink’s role as infrastructure gives it a much wider ceiling.

The post Chainlink vs XRP Ledger: Which Has the Bigger Future in Crypto? first appeared on BlockNews.