Bitcoin Hits New $123K All-Time High as ETFs Buy 20x More BTC Than Is Mined Daily

- Bitcoin climbs to $123,000 amid rising institutional involvement.

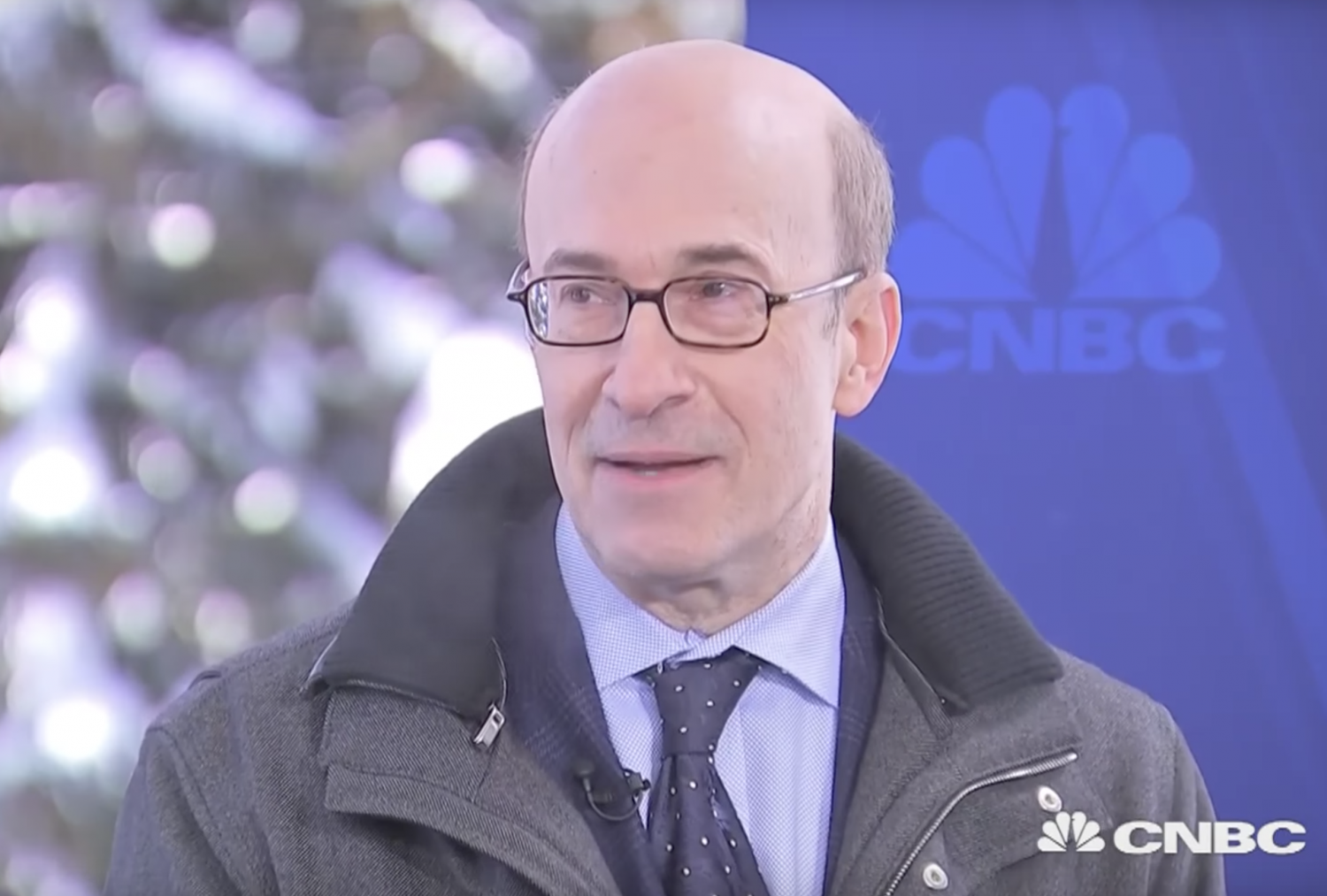

- Mohamed El-Erian cites broader adoption factors behind the rally.

- BlackRock ETF now holds over 700K BTC, surpassing $84B in assets under management.

Bitcoin has established a new peak above $123,000, driven by a combination of institutional interest, supportive regulation, and market momentum. The surge reflects growing investor confidence and a shift toward wider cryptocurrency adoption. Economist Mohamed El-Erian pointed to these converging trends as key drivers.

Institutional and Regulatory Forces Fuel the Rally

Bitcoin surged to a new record high of $123,200 earlier today as large financial institutions continue to deepen their involvement in the crypto market. Investment firms, asset managers, and corporations are increasingly adding Bitcoin to their portfolios, signaling growing trust in the digital asset.

Related: Bitcoin Price Prediction: BTC Hits $122K as ETF Inflows and Geopolitical Risk Drive Breakout

In a statement on X, the president of Queens’ College at the University of Cambridge and chief economic advisor at Allianz, Mohamed A. El-Erian, said Bitcoin’s rise was “prop…

The post Bitcoin Hits New $123K All-Time High as ETFs Buy 20x More BTC Than Is Mined Daily appeared first on Coin Edition.

Bitcoin Hits New $123K All-Time High as ETFs Buy 20x More BTC Than Is Mined Daily

- Bitcoin climbs to $123,000 amid rising institutional involvement.

- Mohamed El-Erian cites broader adoption factors behind the rally.

- BlackRock ETF now holds over 700K BTC, surpassing $84B in assets under management.

Bitcoin has established a new peak above $123,000, driven by a combination of institutional interest, supportive regulation, and market momentum. The surge reflects growing investor confidence and a shift toward wider cryptocurrency adoption. Economist Mohamed El-Erian pointed to these converging trends as key drivers.

Institutional and Regulatory Forces Fuel the Rally

Bitcoin surged to a new record high of $123,200 earlier today as large financial institutions continue to deepen their involvement in the crypto market. Investment firms, asset managers, and corporations are increasingly adding Bitcoin to their portfolios, signaling growing trust in the digital asset.

Related: Bitcoin Price Prediction: BTC Hits $122K as ETF Inflows and Geopolitical Risk Drive Breakout

In a statement on X, the president of Queens’ College at the University of Cambridge and chief economic advisor at Allianz, Mohamed A. El-Erian, said Bitcoin’s rise was “prop…

The post Bitcoin Hits New $123K All-Time High as ETFs Buy 20x More BTC Than Is Mined Daily appeared first on Coin Edition.