De-dollarization: Capital Flight Threatens US Dollar As 2025’s Drop Mirrors 1985 Crisis

US dollar capital flight is intensifying right now as investors are actively shifting their funds away from American assets. This concerning trend also mirrors some historical patterns that were previously seen back in 1985 and again in 2009, which is raising some pretty serious concerns about the dollar’s overall stability and its future role as the world’s reserve currency.

Also Read: Pi Coin Rebounds, But Will It Crash Like Mantra? Experts Weigh In

How US Dollar Capital Flight and De-dollarization Are Impacting the US Dollar in 2025

Capital Outflows Drive Dollar Weakness

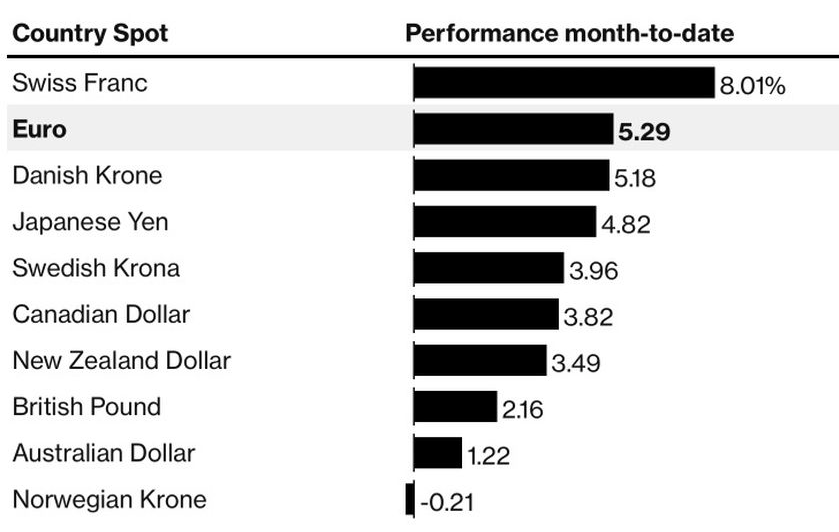

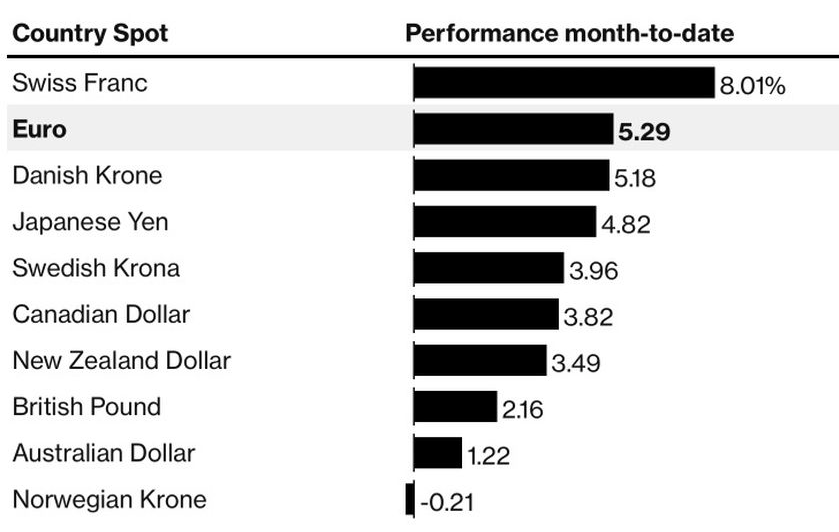

Capital outflows from the US are reaching quite alarming levels at the time of writing. According to a recent analysis from Danske Bank, the US dollar has actually declined at the third fastest pace in history during periods when 10-year debt rates increased by 25 basis points or more. European assets are now, surprisingly enough, outperforming their American counterparts, and German bonds have essentially replaced US Treasuries as the preferred safe-haven investments for many institutional investors.

The ongoing de-dollarization process is definitely gaining momentum as concurrent sell-offs of both US dollars and Treasury bonds indicate potential crisis conditions in American markets. These significant capital outflows are directly weighing on US dollar performance across all major currency pairs, creating additional uncertainty in global markets.

Trump’s Trade Policies Accelerate De-dollarization

The current administration’s trade policies have become an important catalyst for US dollar capital flight in recent months. Despite all the previous rhetoric about other nations taking advantage of America, the United States was actually absorbing global capital through its financial markets for many years.

According to recent reporting from the Wall Street Journal, the White House’s approach to tariffs is primarily focused on preventing China from expanding its economic influence in certain regions.

Also Read: Bitcoin Prediction: AI Sets BTC Price For April 20, 2025

European Markets Gain Despite Trade Tensions

Current market data indicates that European stock indices are indeed outperforming American ones despite the recent tariff-related challenges they’ve faced. This unexpected strength in European markets demonstrates an important lesson – that winning trade wars doesn’t necessarily guarantee currency prosperity. Instead, undermining international trade foundations has apparently reduced investor confidence in US assets, triggering accelerated de-dollarization and increasing US dollar capital flight from traditional safe havens.

Investment Shifts Signal Deeper Changes

The present US dollar capital flight represents something more substantial than just temporary market fluctuations. EUR/USD bears seem unable to push quotes lower at this point, which suggests some potential opportunities for long positions with eventual targets positioned at 1.16 and perhaps even 1.195.

Market volatility has increased substantially as investors continue to reassess risk factors in light of the ongoing de-dollarization trends across multiple economies. Investors now seriously question the traditional view of the US dollar as the ultimate safe haven, creating numerous challenges for portfolio management during this complicated period of currency realignment and adjustment.

Also Read: Amazon Set to Accept $XRP Payments—Ripple Price Predicted to Reach $2.10 by April 2025

As US dollar capital flight continues to develop and evolve, both institutional and retail investors must adapt their strategies to navigate the changing landscape of global finance and the apparently accelerating pace of de-dollarization in international markets.

Read More

SUI Declines 3% as $144M Token Unlock Spurs Selloff

De-dollarization: Capital Flight Threatens US Dollar As 2025’s Drop Mirrors 1985 Crisis

US dollar capital flight is intensifying right now as investors are actively shifting their funds away from American assets. This concerning trend also mirrors some historical patterns that were previously seen back in 1985 and again in 2009, which is raising some pretty serious concerns about the dollar’s overall stability and its future role as the world’s reserve currency.

Also Read: Pi Coin Rebounds, But Will It Crash Like Mantra? Experts Weigh In

How US Dollar Capital Flight and De-dollarization Are Impacting the US Dollar in 2025

Capital Outflows Drive Dollar Weakness

Capital outflows from the US are reaching quite alarming levels at the time of writing. According to a recent analysis from Danske Bank, the US dollar has actually declined at the third fastest pace in history during periods when 10-year debt rates increased by 25 basis points or more. European assets are now, surprisingly enough, outperforming their American counterparts, and German bonds have essentially replaced US Treasuries as the preferred safe-haven investments for many institutional investors.

The ongoing de-dollarization process is definitely gaining momentum as concurrent sell-offs of both US dollars and Treasury bonds indicate potential crisis conditions in American markets. These significant capital outflows are directly weighing on US dollar performance across all major currency pairs, creating additional uncertainty in global markets.

Trump’s Trade Policies Accelerate De-dollarization

The current administration’s trade policies have become an important catalyst for US dollar capital flight in recent months. Despite all the previous rhetoric about other nations taking advantage of America, the United States was actually absorbing global capital through its financial markets for many years.

According to recent reporting from the Wall Street Journal, the White House’s approach to tariffs is primarily focused on preventing China from expanding its economic influence in certain regions.

Also Read: Bitcoin Prediction: AI Sets BTC Price For April 20, 2025

European Markets Gain Despite Trade Tensions

Current market data indicates that European stock indices are indeed outperforming American ones despite the recent tariff-related challenges they’ve faced. This unexpected strength in European markets demonstrates an important lesson – that winning trade wars doesn’t necessarily guarantee currency prosperity. Instead, undermining international trade foundations has apparently reduced investor confidence in US assets, triggering accelerated de-dollarization and increasing US dollar capital flight from traditional safe havens.

Investment Shifts Signal Deeper Changes

The present US dollar capital flight represents something more substantial than just temporary market fluctuations. EUR/USD bears seem unable to push quotes lower at this point, which suggests some potential opportunities for long positions with eventual targets positioned at 1.16 and perhaps even 1.195.

Market volatility has increased substantially as investors continue to reassess risk factors in light of the ongoing de-dollarization trends across multiple economies. Investors now seriously question the traditional view of the US dollar as the ultimate safe haven, creating numerous challenges for portfolio management during this complicated period of currency realignment and adjustment.

Also Read: Amazon Set to Accept $XRP Payments—Ripple Price Predicted to Reach $2.10 by April 2025

As US dollar capital flight continues to develop and evolve, both institutional and retail investors must adapt their strategies to navigate the changing landscape of global finance and the apparently accelerating pace of de-dollarization in international markets.

Read More