Over $500M in Longs Wiped Out as Bitcoin Slips Below $116K

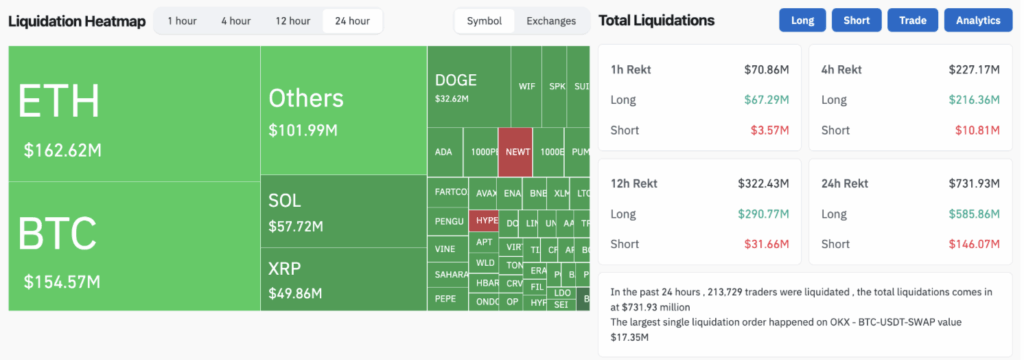

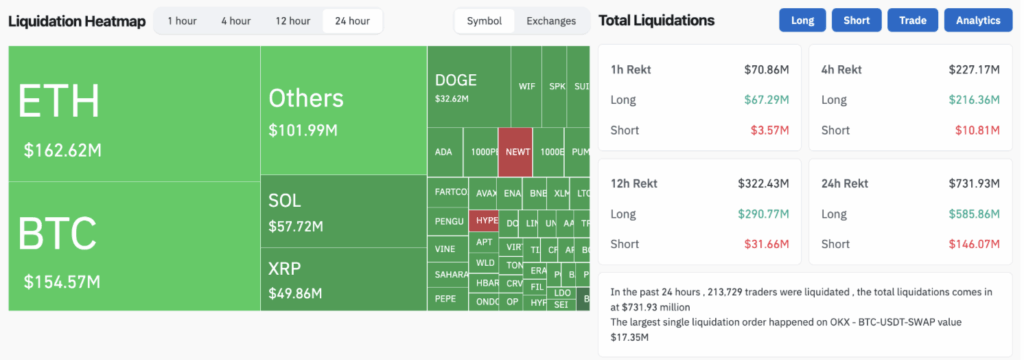

- $585M in long positions were liquidated Friday as Bitcoin dipped below $116K.

- Ethereum and Dogecoin also saw heavy losses, with DOGE down 7%.

- Despite the sell-off, sentiment remains bullish, with Bitcoin’s next target eyed at $136K.

The crypto market got hit with a heavy shake-out on Friday, with more than half a billion dollars in long positions being liquidated. Bitcoin led the drop, sliding under $116,000 after a sharp 2.6% dip.

Data from CoinGlass shows that a total of $585.86 million in longs got wiped out, and Bitcoin accounted for $140 million of that pain as it dropped to $115,356.

“Pure Leverage Flush,” Says Trader

Ethereum didn’t escape the carnage either. It saw $104.76 million in long liquidations as the price fell to $3,598, down 1.3% during the same period. Dogecoin took one of the hardest hits among the top 10 coins, losing 7% in a day and clearing $26 million worth of long positions, per Nansen.

Crypto trader Ash Crypto summed it up in a blunt post on X:

“Many people longed alts after seeing ETH pump hard, so market makers dumped and liquidated the late longs. This dump is a pure leverage flush.”

In total, 213,729 traders were liquidated in the last 24 hours, as the sudden drop wiped out $731.93 million across both long and short positions.

Sentiment Still Bullish Despite Pullback

Bitcoin had just tapped new all-time highs of $123,100 on July 14, so many were expecting the rally to continue. Yet, even with this drop, sentiment hasn’t turned sour. The Crypto Fear & Greed Index still shows “Greed” with a score of 70.

Analysts remain confident in higher prices ahead. Michael Novogratz of Galaxy Digital predicts ETH will soon hit $4,000 — a nearly 10% climb from current levels. Meanwhile, Bitfinex analysts say that if Bitcoin’s momentum returns, its next major target is $136,000.

Short Squeeze Risk Looms

Interestingly, a quick rebound could put shorts in danger. If BTC pushes back to Thursday’s price of $119,500, over $3 billion worth of short positions could be liquidated.

This mix of high leverage, volatile moves, and strong sentiment suggests the next few sessions might be anything but quiet.

The post Over $500M in Longs Wiped Out as Bitcoin Slips Below $116K first appeared on BlockNews.

Over $500M in Longs Wiped Out as Bitcoin Slips Below $116K

- $585M in long positions were liquidated Friday as Bitcoin dipped below $116K.

- Ethereum and Dogecoin also saw heavy losses, with DOGE down 7%.

- Despite the sell-off, sentiment remains bullish, with Bitcoin’s next target eyed at $136K.

The crypto market got hit with a heavy shake-out on Friday, with more than half a billion dollars in long positions being liquidated. Bitcoin led the drop, sliding under $116,000 after a sharp 2.6% dip.

Data from CoinGlass shows that a total of $585.86 million in longs got wiped out, and Bitcoin accounted for $140 million of that pain as it dropped to $115,356.

“Pure Leverage Flush,” Says Trader

Ethereum didn’t escape the carnage either. It saw $104.76 million in long liquidations as the price fell to $3,598, down 1.3% during the same period. Dogecoin took one of the hardest hits among the top 10 coins, losing 7% in a day and clearing $26 million worth of long positions, per Nansen.

Crypto trader Ash Crypto summed it up in a blunt post on X:

“Many people longed alts after seeing ETH pump hard, so market makers dumped and liquidated the late longs. This dump is a pure leverage flush.”

In total, 213,729 traders were liquidated in the last 24 hours, as the sudden drop wiped out $731.93 million across both long and short positions.

Sentiment Still Bullish Despite Pullback

Bitcoin had just tapped new all-time highs of $123,100 on July 14, so many were expecting the rally to continue. Yet, even with this drop, sentiment hasn’t turned sour. The Crypto Fear & Greed Index still shows “Greed” with a score of 70.

Analysts remain confident in higher prices ahead. Michael Novogratz of Galaxy Digital predicts ETH will soon hit $4,000 — a nearly 10% climb from current levels. Meanwhile, Bitfinex analysts say that if Bitcoin’s momentum returns, its next major target is $136,000.

Short Squeeze Risk Looms

Interestingly, a quick rebound could put shorts in danger. If BTC pushes back to Thursday’s price of $119,500, over $3 billion worth of short positions could be liquidated.

This mix of high leverage, volatile moves, and strong sentiment suggests the next few sessions might be anything but quiet.

The post Over $500M in Longs Wiped Out as Bitcoin Slips Below $116K first appeared on BlockNews.