Coinbase Launches 24/7 XRP & Solana Futures Trading June 13

Coinbase XRP Futures trading becomes available 24/7 starting June 13, 2025, and the exchange is extending continuous trading to XRP news and also Solana futures contracts. This milestone makes Coinbase the first CFTC-regulated derivatives platform in the US to offer round-the-clock access to these popular altcoins, addressing the always-on nature of cryptocurrency markets right now.

Starting June 13, we’re enabling 24×7 trading for $XRP and Solana ( $SOL ) futures, unlocking real-time access to U.S. traders, reflecting the always-on nature of crypto markets.

— Coinbase Institutional(@CoinbaseInsto) May 29, 2025

XRP & Solana Futures Go 24/7—What Coinbase Traders Must Know

Coinbase XRP Futures will join Bitcoin and also Ethereum futures in offering continuous trading, reflecting growing demand for altcoin derivatives. The exchange aims to capture more of the global derivatives flow, which now represents over 75% of total cryptocurrency trading volume according to the firm.

Andy Sears, CEO of Coinbase Financial Markets, had this to say:

“The arrival of 24/7 CFTC-regulated markets is a game-changer for the industry.”

Strong Early Momentum for Coinbase XRP Futures

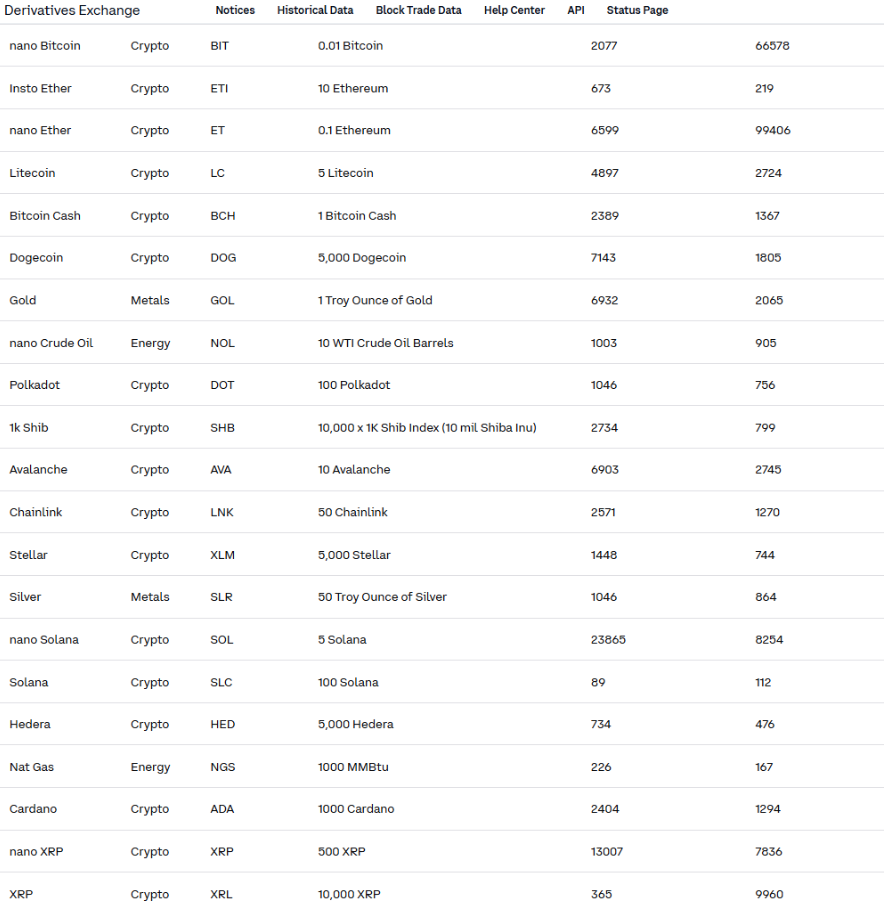

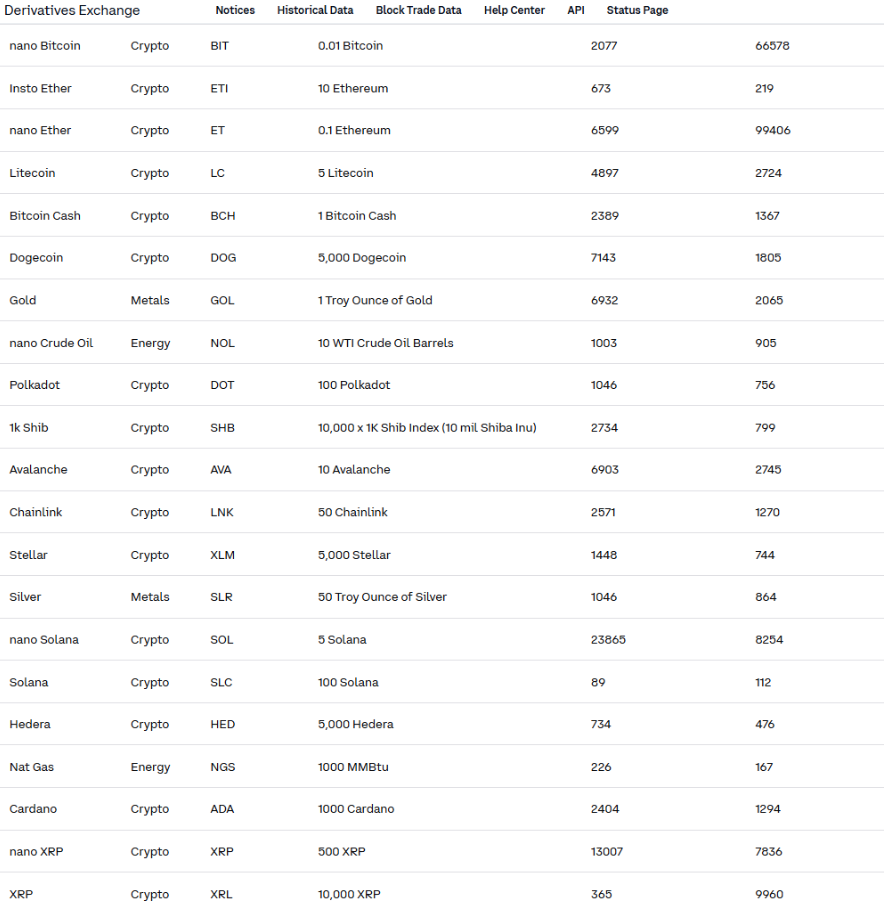

Recent trading data shows impressive traction for both assets right now. Nano Solana futures led all contracts with over 23,000 contracts traded, while XRP futures recorded combined volume exceeding 13,000 across standard and also nano sizes. These Solana futures and XRP price prediction trends suggest strong institutional interest at the time of writing.

The XRP futures contract represents 10,000 XRP per contract, and it’s cash-settled in USD. Trading suspends automatically if XRP fluctuates more than 10% within one hour, providing risk management for volatile cryptocurrency markets.

Also Read: Ripple Price Prediction: $5K in XRP Could Flip Your Future with 580% as ETF Launches

Regulatory Clarity Boosts XRP News Sentiment

The launch comes after Ripple’s SEC settlement, removing regulatory uncertainty that previously impacted XRP price prediction models. Analysts now forecast potential targets ranging from $3 to $21.60, and some are projecting XRP could reach $8 by year-end 2025.

Coinbase introduced Solana futures in February, and then followed by XRP contracts last month. The continuous trading feature addresses gaps between traditional US hours and also global crypto markets, where major price movements often occur during Asian and European sessions.

Market Impact and Future Outlook

The 24/7 Coinbase XRP Futures launch positions the exchange to compete more effectively in global derivatives markets. With cryptocurrency trading happening around the clock, eliminating artificial time constraints enables better price discovery and also liquidity provision right now.

Also Read: Solana Vs. Ethereum: Here’s Why SOL May Dethrone ETH In 2025

This development benefits both institutional and also retail traders seeking exposure to XRP news developments and Solana futures without holding underlying assets. The regulated framework provides confidence for traditional finance participants entering cryptocurrency derivatives markets at the time of writing.

Coinbase Launches 24/7 XRP & Solana Futures Trading June 13

Coinbase XRP Futures trading becomes available 24/7 starting June 13, 2025, and the exchange is extending continuous trading to XRP news and also Solana futures contracts. This milestone makes Coinbase the first CFTC-regulated derivatives platform in the US to offer round-the-clock access to these popular altcoins, addressing the always-on nature of cryptocurrency markets right now.

Starting June 13, we’re enabling 24×7 trading for $XRP and Solana ( $SOL ) futures, unlocking real-time access to U.S. traders, reflecting the always-on nature of crypto markets.

— Coinbase Institutional(@CoinbaseInsto) May 29, 2025

XRP & Solana Futures Go 24/7—What Coinbase Traders Must Know

Coinbase XRP Futures will join Bitcoin and also Ethereum futures in offering continuous trading, reflecting growing demand for altcoin derivatives. The exchange aims to capture more of the global derivatives flow, which now represents over 75% of total cryptocurrency trading volume according to the firm.

Andy Sears, CEO of Coinbase Financial Markets, had this to say:

“The arrival of 24/7 CFTC-regulated markets is a game-changer for the industry.”

Strong Early Momentum for Coinbase XRP Futures

Recent trading data shows impressive traction for both assets right now. Nano Solana futures led all contracts with over 23,000 contracts traded, while XRP futures recorded combined volume exceeding 13,000 across standard and also nano sizes. These Solana futures and XRP price prediction trends suggest strong institutional interest at the time of writing.

The XRP futures contract represents 10,000 XRP per contract, and it’s cash-settled in USD. Trading suspends automatically if XRP fluctuates more than 10% within one hour, providing risk management for volatile cryptocurrency markets.

Also Read: Ripple Price Prediction: $5K in XRP Could Flip Your Future with 580% as ETF Launches

Regulatory Clarity Boosts XRP News Sentiment

The launch comes after Ripple’s SEC settlement, removing regulatory uncertainty that previously impacted XRP price prediction models. Analysts now forecast potential targets ranging from $3 to $21.60, and some are projecting XRP could reach $8 by year-end 2025.

Coinbase introduced Solana futures in February, and then followed by XRP contracts last month. The continuous trading feature addresses gaps between traditional US hours and also global crypto markets, where major price movements often occur during Asian and European sessions.

Market Impact and Future Outlook

The 24/7 Coinbase XRP Futures launch positions the exchange to compete more effectively in global derivatives markets. With cryptocurrency trading happening around the clock, eliminating artificial time constraints enables better price discovery and also liquidity provision right now.

Also Read: Solana Vs. Ethereum: Here’s Why SOL May Dethrone ETH In 2025

This development benefits both institutional and also retail traders seeking exposure to XRP news developments and Solana futures without holding underlying assets. The regulated framework provides confidence for traditional finance participants entering cryptocurrency derivatives markets at the time of writing.