De-Dollarization: How Russia’s Digital Ruble & US Bitcoin Reserves are Shaping Finance

De-dollarization gains momentum as Russia rolls out its digital ruble program. The US dollar keeps its strength through treasury yields and bitcoin reserves. Russia’s largest bank, Sberbank, now tests the digital ruble alongside 29 other banks, reshaping global finance.

Also Read: El Salvador’s Bitcoin Stash Tops 6,000 BTC: A Model for National Crypto Investment?

The Role of Digital Ruble, Bitcoin Reserves, & De-Dollarization in Shaping Global Markets

Russia’s Digital Ruble Program Expands

Russia’s digital ruble pilot now includes 30 banks, with Sberbank and Tinkoff Bank joining recently. “The digital ruble is a digital form of the Russian national currency that the Bank of Russia plans to issue in addition to existing forms of money,” states the Bank of Russia. By July 1, 2025, major banks must offer digital ruble services or pay fines. This de-dollarization project now involves 600 citizens and 30 companies testing actual digital ruble transactions.

US Dollar Maintains Global Dominance Despite De-dollarization Efforts

The dollar index rose 2.3% this month, gaining 6.6% this year, backed by solid bitcoin reserves. Treasury yields hit seven-month peaks, with the 10-year mark at 4.625%. Chris Weston from Pepperstone notes: “Despite paid forecasters almost universally calling for a weaker U.S. dollar in 2024, the greenback looks set to close the year higher against all major currencies.”

Also Read: Ripple: AI Predicts XRPs Price For January 1st 2025

Financial Security and Digital Currency Volatility

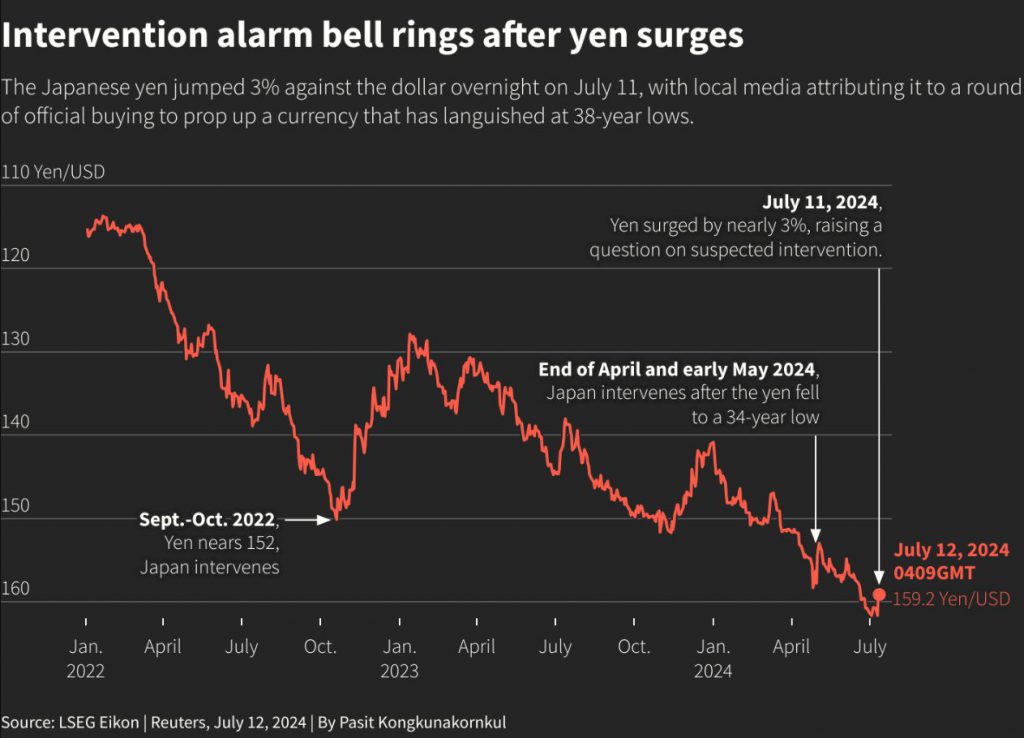

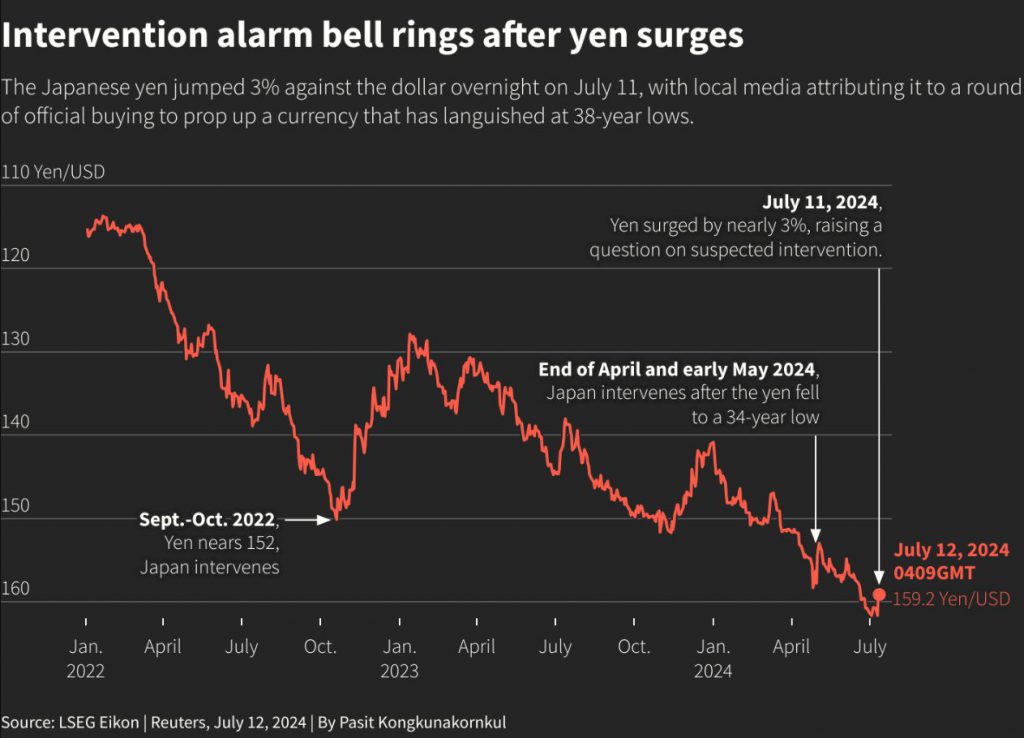

The yen dropped to 157.82 against the dollar, down 10.6% this year amid global de-dollarization shifts. Finance Minister Katsunobu Kato warns they will “take action against excessive currency moves.” The digital ruble aims to boost financial security. The Bank of Russia states: “The ruble will have three forms: cash, non-cash and digital. They are equivalent: one cash ruble is equal to one non-cash ruble, as well as one digital ruble.”

Also Read: Shiba Inu: Can You Turn $1000 Of SHIB Into $1 Million By 2030?

Bitcoin Reserves and Cryptocurrency Volatility in Global Markets

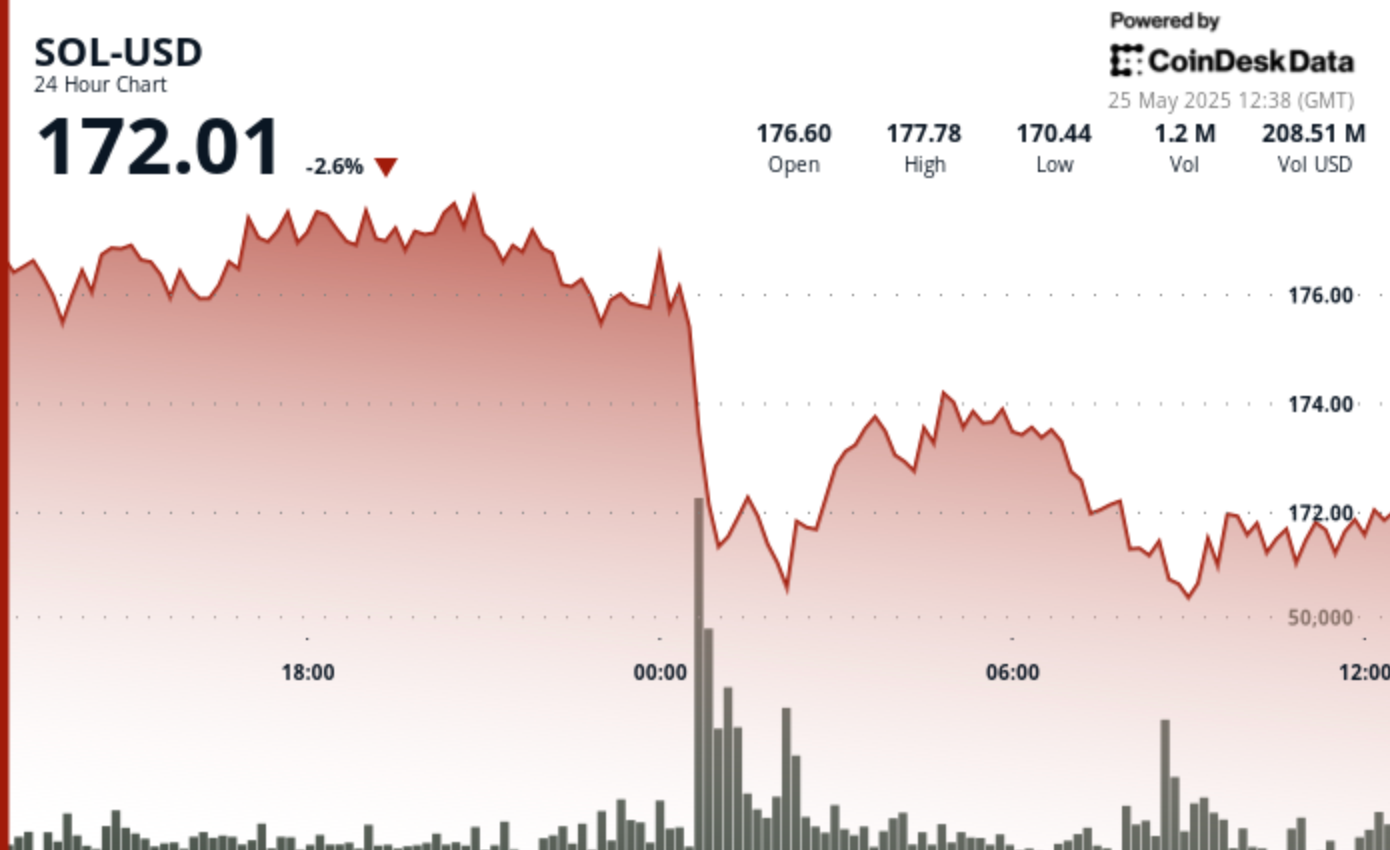

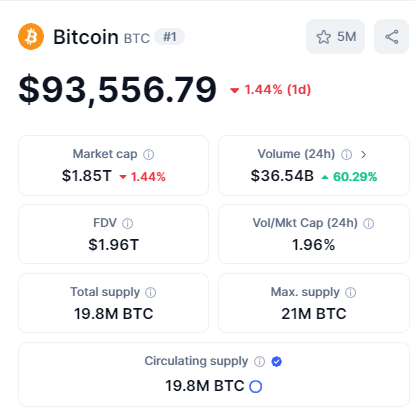

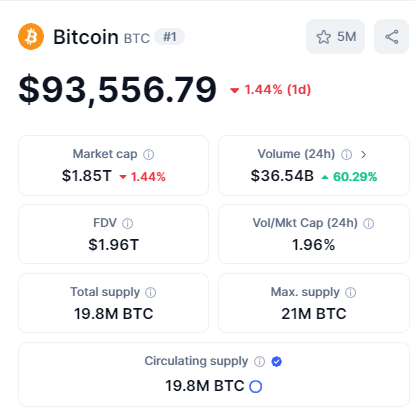

Bitcoin fell from its December 17 high of $108,379.28 to $93,599, showing cryptocurrency volatility during de-dollarization. This affects bitcoin reserves and market stability. Reuters reports that rising Treasury yields support the dollar, hitting a seven-month high and showing links between traditional and digital money.

Future of Global Finance

The digital ruble grows as 17 more banks join the program, marking progress in de-dollarization. The Bank of Russia focuses on modernizing finance while maintaining security. The pilot’s success with bitcoin reserves and banking systems shows how digital options reshape global currency markets.

Also Read: How High Will Bitcoin Rise In January 2025?

Read More

Massachusetts Man Sentenced to 6 Years for Running Unlicensed Bitcoin Business

De-Dollarization: How Russia’s Digital Ruble & US Bitcoin Reserves are Shaping Finance

De-dollarization gains momentum as Russia rolls out its digital ruble program. The US dollar keeps its strength through treasury yields and bitcoin reserves. Russia’s largest bank, Sberbank, now tests the digital ruble alongside 29 other banks, reshaping global finance.

Also Read: El Salvador’s Bitcoin Stash Tops 6,000 BTC: A Model for National Crypto Investment?

The Role of Digital Ruble, Bitcoin Reserves, & De-Dollarization in Shaping Global Markets

Russia’s Digital Ruble Program Expands

Russia’s digital ruble pilot now includes 30 banks, with Sberbank and Tinkoff Bank joining recently. “The digital ruble is a digital form of the Russian national currency that the Bank of Russia plans to issue in addition to existing forms of money,” states the Bank of Russia. By July 1, 2025, major banks must offer digital ruble services or pay fines. This de-dollarization project now involves 600 citizens and 30 companies testing actual digital ruble transactions.

US Dollar Maintains Global Dominance Despite De-dollarization Efforts

The dollar index rose 2.3% this month, gaining 6.6% this year, backed by solid bitcoin reserves. Treasury yields hit seven-month peaks, with the 10-year mark at 4.625%. Chris Weston from Pepperstone notes: “Despite paid forecasters almost universally calling for a weaker U.S. dollar in 2024, the greenback looks set to close the year higher against all major currencies.”

Also Read: Ripple: AI Predicts XRPs Price For January 1st 2025

Financial Security and Digital Currency Volatility

The yen dropped to 157.82 against the dollar, down 10.6% this year amid global de-dollarization shifts. Finance Minister Katsunobu Kato warns they will “take action against excessive currency moves.” The digital ruble aims to boost financial security. The Bank of Russia states: “The ruble will have three forms: cash, non-cash and digital. They are equivalent: one cash ruble is equal to one non-cash ruble, as well as one digital ruble.”

Also Read: Shiba Inu: Can You Turn $1000 Of SHIB Into $1 Million By 2030?

Bitcoin Reserves and Cryptocurrency Volatility in Global Markets

Bitcoin fell from its December 17 high of $108,379.28 to $93,599, showing cryptocurrency volatility during de-dollarization. This affects bitcoin reserves and market stability. Reuters reports that rising Treasury yields support the dollar, hitting a seven-month high and showing links between traditional and digital money.

Future of Global Finance

The digital ruble grows as 17 more banks join the program, marking progress in de-dollarization. The Bank of Russia focuses on modernizing finance while maintaining security. The pilot’s success with bitcoin reserves and banking systems shows how digital options reshape global currency markets.

Also Read: How High Will Bitcoin Rise In January 2025?

Read More