Lucid Stock Price Prediction

Share:

- Lucid Group Inc: An Introduction

- Lucid Group’s Start and Functions

- Historical Development

- Lucid Stock Price Prediction: Price History

- Lucid Stock Price Prediction: Price Analysis

- Lucid Stock Price Prediction

- Lucid Stock Price Prediction 2024

- Lucid Stock Price Prediction 2025

- Lucid Stock Price Prediction 2030

- Conclusion

- FAQ

Lucid Group Inc: An Introduction

The industry of electric vehicles (EVs) is witnessing the latest developments with time. The exclusive advancements in the EV market bringing about a huge revolution. The transformation toward electric mobility plays the role of an environmental imperative. The increasing demand for electric vehicles has developed an industry for entities that have a specialization in manufacturing and developing exclusive EV motors.

Among the respective platforms, Lucid Group has a significant position. The company, which is based in California, is redefining the market of electric vehicles. It was established back in the year 2017. The EV company has a crucial objective of developing electric cars with more efficiency, and luxuriousness, and is more maintainable in comparison with conventional gasoline-driven vehicles.

Lucid is getting a lot of fame within the news headlines with exclusive technology. Nonetheless, it has also witnessed an elevated selling strain recently. As a result of this, investors have been worrying about the future performance of the platform and its potential to carry out further progress. Below is an overview of the start of the platform as well as its operations.

Lucid Group’s Start and Functions

Back in 2007, Lucid Group Inc was established in California’s Newark. In recent times, on the 30th of October in 2021, the platform began offering Dream Edition versions to the initial group of nearly five hundred and twenty reservation holders. Lucid Motors has a considerable position within the electric vehicle market and it is at present playing the role of a driver within the sector of the latest EV products.

The flagship product of Lucid is Lucid Air. It is an all-electric luxury vehicle that is considered to offer a mileage of more than 500 miles with a single charge. The car is categorized as a technological marvel that features a highly effective electric motor. The vehicle has a power density of up to 14.4 kilowatts in each kilogram. The battery pack of the Lucid Air is manufactured in collaboration with LG Chem. It is additionally the biggest in the market and it has a capacity of nearly 113 kWh.

Nonetheless, the Lucid Air is not only a green vehicle with a long range. In addition to this, it is a luxurious vehicle having rivals such as Mercedes-Benz, BMW, and Tesla. The interior of the car is elegant, well-designed, and spacious, offering premium materials as well as state-of-art technology. It is a vehicle that is not just preferred by environmentally mindful drivers but additionally appeals to those who seek performance and luxury simultaneously.

Apart from that, Lucid Motors has disclosed its role as the entity that supplies the front electric motors for the present Gen3 Formula E racing vehicles. The motorsport drive division, which takes into account the gearbox, differential, inverter, and motor, is considered to have a strong output of approximately 350 kW. In this way, the present performance and future development signify an optimistic trend for the stock value of LCID.

Historical Development

Along with the spotlight on sustainable and renewable power, Lucid Motors has a dominant position within the luxury vehicle market. The platform was first established under the title Atieva back in 2007. That was the time when the company’s chief target was to develop electric vehicle powertrains and batteries to facilitate automakers.

Peter Rawlinson, the CTO, and CEO of the platform had formerly played the role of the Chief Engineer and VP of Engineering at Tesla for the Model S. On the other hand, the Vice President named Derek Jenkins had formerly offered services at Mazda North American Operations as Head of Design. Lucid remained successful in receiving investments from well-known entities like JAFCO, Venrock, Mitsui, and Tsing Capital.

Back in 2016’s October, the firm underwent a rebranding and changed its title to Lucid Motors. Moreover, it declared a strategy to manufacture an efficiently working luxury car driven wholly by electricity. After that, on the 29th of November of the same year, state and firm officials disclosed the strategy to create a manufacturing plant of Lucid in Arizona-based Casa Grande for up to $700M worth.

The project was predicted to employ nearly 2,000 workers by 2020’s mid. At the start, the factor had the target of manufacturing up to 20,000 vehicles per annum. Following that, the respective plans extended to several approximately 130,000 cars every year. It happened in 2017 when the platform had intended to innovate and started manufacturing by 2019’s beginning. However, the initial vehicles were not ready in the assembly line till the 28th of September in 2021.

In that month, the platform began manufacturing its initial all-electric Air vehicle at the Arizona plant. Moreover, it also started offering the respective vehicles to the consumers at the end of the next month. While the firm had initially made a strategy to develop 20,000 cars, in the year 2022, it had the compulsion to revise the outlook thereof because of supply chain-related problems.

In this way, its estimate was decreased to the range between 12,000 and 14,000 cars on the 28th of February in the same year. Nevertheless, the production outlook saw a further decrease to a range between 6,000 and 7,000 vehicles. This was witnessed at a time when the company released its financial results covering the year’s 2nd quarter on the 3rd of August. Although the company went through several challenges, it remained effective to develop 7,180 cars during the whole of 2022.

Lucid Stock Price Prediction: Price History

Lucid, after being launched in 2007 under the name Atieva, first emphasized manufacturing electric powertrains and batteries. Nonetheless, the company witnessed considerable evolution over time. In this respect, in 2016’s October, Atieva shifted its interest to developing a separate all-electric luxury vehicle offering high performance. Hence, it rebranded as Lucid Motors.

In the 2021’s July, the company recompensed a worth of up to 11,000 in terms of reservation for Lucid Air. In the year 2018, the Public Investment Fund (PIF) of Saudi Arabia invested more than $1B in the platform to offer funds for the development of the platform, its testing, as well as to begin manufacturing Lucid Air. Apart from that, another purpose of that investment was to establish a manufacturing facility in Arizona.

Furthermore, the investment also focused on launching Lucid’s retail strategy within North American jurisdiction. The business started manufacturing the Arizona facility in 2019’s December. On the 22nd of February in 2021, Churchill Capital Corp IV – which is known as a special purpose acquisition company (SPAC) – and Lucid Motors expressed the intention for a merger.

The transaction contained an injection of up to $2.1B worth from CCIV. Additionally, a $2.5B worth was offered in private investment in public equity (PIPE) valued at a discount for marketing at $15 per share, placing the value of the entity at $24 billion. On the 23rd of July in 2021, the shareholders of Lucid voted to authorize the merger. In this respect, the delisting of CCIV stock from the New York Stock Exchange (NYSE) took place.

On the NYSE, CCIV had been trading since 2020’s July. On the 26th of July in 2021, the merged entity Lucid got listed on Nasdaq with LCID as its ticker symbol for stock. On the other hand, LCIDW was its ticker symbol for warrants. The historical stock data brings to the front that LCID stock started trading within the market at up to $25.24 per share.

Following that, it obtained a 19.71% increase and reached an interday high value of up to $20.03 per share. The initial trading of Lucid Motors stock ended at a per-share price of $26.83. This figure was approximately 10.64% increased than its opening price. Then, the stock price kept on witnessing significant growth in the next weeks. Subsequently, on the 8th of November, the stock price touched $53.80.

Nevertheless, the stock market performance of LCID witnessed volatility in the following months. In December 2021, LCID’s stock price fell to $27.25 for each share. This was due to the problems dealing with the price chain. As a result, Lucid Air’s production was influenced. The stock price remained fluctuating throughout the initial half of the year 2022. In the meantime, the stock reached a decreased price level of $6.3 for each share on the 25th of December last year.

Although Lucid witnessed such rises and falls in its stock price history, its performance indicates that the growth projections of the platform are positive toward turning into a prominent player within the EV industry. The platform’s commitment to minimizing the environmental effect while manufacturing luxury electric cars has increased investor interest in addition to assisting in enhancing the stock price. Although the stocks might see some volatility in the upcoming time, LCID’s historical price movement points toward a promising future.

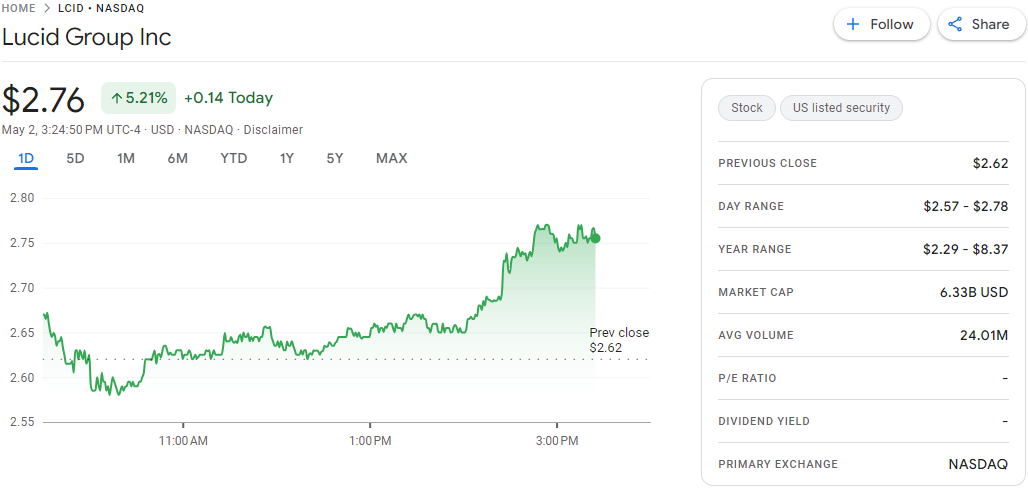

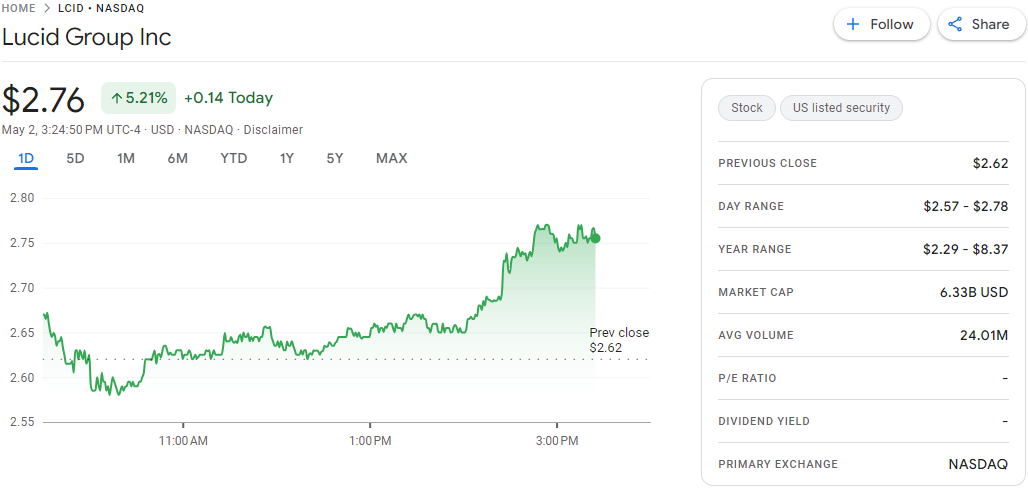

Lucid Stock Price Prediction: Price Analysis

The stock market has been seeing great progress and adoption in recent times. The automotive industry has also witnessed a huge rise simultaneously. Lucid Motors, a giant player in this industry, experienced remarkable price performance in its stock history. The fundamental analysis of the Lucid stock points out that the current per-share price is standing at $7.04. In the recent 24 hours, the high stock price per share was nearly $7.1778.

Additionally, the low price level in the meantime was approximately $6.89. The current market capitalization of the LCID stock is placed at 12,887,197,073. Moreover, the LCID stock’s latest 24-hour trading volume is nearly $14,059,385. Along with this, data analysis also indicates that the 52-week high price level of the LCID stock was $21.78 at present. Lucid Motors fundamental analysis brings to the front that its stock price has the potential to jump forward in line with its historical performance.

The technical analysis brings to the front that this level is up to 209% increased than the present price. On the contrary, the 52-week low price was almost $6.09. This price level is almost 13.5% decreased than the present share price. The average price of one Lucid stock is nearly 12.60. Lucid stock’s one-year target is standing at $10.00.

LCID stock’s share volume is currently standing at 6,890. The earnings per share are negative at almost $-1.44. On the other hand, forward earnings per share for the next year are standing at the -4.48 spot. Lucid Motors technical analysis signifies that the next years will see huge growth in its stock prices as the platform’s immersive nature and its exclusive developments will drive more adoption and price rise.

Lucid Stock Price Prediction

Keeping in view the market indicators, stock price volatility, and financial models, the Lucid stock price is anticipated to reap huge profits in the upcoming time. In line with the aforementioned historical data, market sentiment analysis, and artificial intelligence-driven predictive analytics, market trends are going to be optimistic. Particularly, Lucid Motors stock forecast points toward substantial price increases in the next years.

Lucid Stock Price Prediction 2024

Lucid Motors stock analysis has clarified the potential outlook of the platform’s stock in the future. Lucid Motors share price prediction says that its stock price will reach nearly $13.76 during this year. The figure is double the present price, displaying an optimistic outlook.

Lucid Stock Price Prediction 2025

Lucid Motors financial performance has been seeing ups and downs in recent years. Nonetheless, at present, lucid Motors stock market trends are positive. Lucid Motors stock volatility can play a crucial role in its future performance. However, Lucid Motors stock growth potential is enormous. In this way, the potential price of Lucid stock will be nearly $19.16. This shows Lucid Motors investment opportunities.

Lucid Stock Price Prediction 2030

Lucid Motors risk assessment specifies that investors can consider Lucid stock for long-term investment. Adequate Lucid Motors stock trading strategies can be helpful over time as the industry is witnessing recovery. Based on Lucid Motors stock market analysis, Lucid Motors stock valuation will go through a huge jump by the year 2030. In this way, Lucid Motors investment outlook will also improve to a great extent. Lucid Motors earnings projections bring to the front that LCID stock price will reach $41.36 by 2030.

Conclusion

The above-mentioned statistics, analytics, as well as forecasts specify that long-term investors can consider Lucid stock as an option for their investment. According to Lucid Motors investment outlook, the investors should adopt proper investment strategies and risk assessment. Nonetheless, people unwilling to take risky investment steps should avoid this.

FAQ

What is Lucid Group Inc, and when was it established?

Lucid Group Inc is a company that specializes in manufacturing and developing electric vehicles (EVs), with a focus on luxury, efficiency, and sustainability. The company was originally founded as Atieva in 2007 and rebranded to Lucid Motors in 2016.

What is Lucid’s flagship product, and what are its main features?

Lucid’s flagship product is the Lucid Air, an all-electric luxury vehicle that boasts a range of over 500 miles on a single charge. It features a highly efficient electric motor and a large battery pack of approximately 113 kWh, developed in collaboration with LG Chem.

How does Lucid Air compare with its competitors?

The Lucid Air competes with other luxury vehicles from brands like Mercedes-Benz, BMW, and Tesla. It stands out with its elegant, spacious interior that includes premium materials and advanced technology, appealing to both environmentally conscious drivers and those seeking performance and luxury.

What significant milestone did Lucid achieve in 2021?

In 2021, Lucid began deliveries of its Dream Edition versions to the initial group of around 520 reservation holders. This marked a significant milestone as it began the transition from development to commercial availability.

Where are Lucid vehicles manufactured?

Lucid vehicles are manufactured in a facility in Casa Grande, Arizona. The company initially planned to produce up to 20,000 vehicles annually, with ambitions to increase this to around 130,000 vehicles per year.

Has Lucid been involved in any significant financial transactions?

Yes, in 2021, Lucid Motors merged with Churchill Capital Corp IV, a special purpose acquisition company (SPAC), which led to Lucid being listed on Nasdaq under the ticker symbol LCID. This transaction significantly boosted their financial position and market presence.

What challenges has Lucid faced in its production?

Lucid has encountered challenges related to the supply chain, which affected its production targets. Initially aiming to produce between 12,000 and 14,000 cars in 2022, these targets were adjusted down to between 6,000 and 7,000 vehicles due to these issues.

What does the future hold for Lucid Motors according to stock price predictions?

Lucid Motors’ stock price predictions are optimistic, with projections suggesting significant price increases in the coming years. By 2030, the stock price is expected to reach around $41.36, reflecting the company’s growth potential and its position within the evolving EV market.

MORE:

Rivian Stock Price Prediction 2030

Amazon Stock Price Prediction 2030

Meta Stock Price Prediction

SoFi Stock Price Prediction

Rivian Stock Price Prediction

Coinbase Stock Price Prediction

Lucid Stock Price Prediction

Share:

- Lucid Group Inc: An Introduction

- Lucid Group’s Start and Functions

- Historical Development

- Lucid Stock Price Prediction: Price History

- Lucid Stock Price Prediction: Price Analysis

- Lucid Stock Price Prediction

- Lucid Stock Price Prediction 2024

- Lucid Stock Price Prediction 2025

- Lucid Stock Price Prediction 2030

- Conclusion

- FAQ

Lucid Group Inc: An Introduction

The industry of electric vehicles (EVs) is witnessing the latest developments with time. The exclusive advancements in the EV market bringing about a huge revolution. The transformation toward electric mobility plays the role of an environmental imperative. The increasing demand for electric vehicles has developed an industry for entities that have a specialization in manufacturing and developing exclusive EV motors.

Among the respective platforms, Lucid Group has a significant position. The company, which is based in California, is redefining the market of electric vehicles. It was established back in the year 2017. The EV company has a crucial objective of developing electric cars with more efficiency, and luxuriousness, and is more maintainable in comparison with conventional gasoline-driven vehicles.

Lucid is getting a lot of fame within the news headlines with exclusive technology. Nonetheless, it has also witnessed an elevated selling strain recently. As a result of this, investors have been worrying about the future performance of the platform and its potential to carry out further progress. Below is an overview of the start of the platform as well as its operations.

Lucid Group’s Start and Functions

Back in 2007, Lucid Group Inc was established in California’s Newark. In recent times, on the 30th of October in 2021, the platform began offering Dream Edition versions to the initial group of nearly five hundred and twenty reservation holders. Lucid Motors has a considerable position within the electric vehicle market and it is at present playing the role of a driver within the sector of the latest EV products.

The flagship product of Lucid is Lucid Air. It is an all-electric luxury vehicle that is considered to offer a mileage of more than 500 miles with a single charge. The car is categorized as a technological marvel that features a highly effective electric motor. The vehicle has a power density of up to 14.4 kilowatts in each kilogram. The battery pack of the Lucid Air is manufactured in collaboration with LG Chem. It is additionally the biggest in the market and it has a capacity of nearly 113 kWh.

Nonetheless, the Lucid Air is not only a green vehicle with a long range. In addition to this, it is a luxurious vehicle having rivals such as Mercedes-Benz, BMW, and Tesla. The interior of the car is elegant, well-designed, and spacious, offering premium materials as well as state-of-art technology. It is a vehicle that is not just preferred by environmentally mindful drivers but additionally appeals to those who seek performance and luxury simultaneously.

Apart from that, Lucid Motors has disclosed its role as the entity that supplies the front electric motors for the present Gen3 Formula E racing vehicles. The motorsport drive division, which takes into account the gearbox, differential, inverter, and motor, is considered to have a strong output of approximately 350 kW. In this way, the present performance and future development signify an optimistic trend for the stock value of LCID.

Historical Development

Along with the spotlight on sustainable and renewable power, Lucid Motors has a dominant position within the luxury vehicle market. The platform was first established under the title Atieva back in 2007. That was the time when the company’s chief target was to develop electric vehicle powertrains and batteries to facilitate automakers.

Peter Rawlinson, the CTO, and CEO of the platform had formerly played the role of the Chief Engineer and VP of Engineering at Tesla for the Model S. On the other hand, the Vice President named Derek Jenkins had formerly offered services at Mazda North American Operations as Head of Design. Lucid remained successful in receiving investments from well-known entities like JAFCO, Venrock, Mitsui, and Tsing Capital.

Back in 2016’s October, the firm underwent a rebranding and changed its title to Lucid Motors. Moreover, it declared a strategy to manufacture an efficiently working luxury car driven wholly by electricity. After that, on the 29th of November of the same year, state and firm officials disclosed the strategy to create a manufacturing plant of Lucid in Arizona-based Casa Grande for up to $700M worth.

The project was predicted to employ nearly 2,000 workers by 2020’s mid. At the start, the factor had the target of manufacturing up to 20,000 vehicles per annum. Following that, the respective plans extended to several approximately 130,000 cars every year. It happened in 2017 when the platform had intended to innovate and started manufacturing by 2019’s beginning. However, the initial vehicles were not ready in the assembly line till the 28th of September in 2021.

In that month, the platform began manufacturing its initial all-electric Air vehicle at the Arizona plant. Moreover, it also started offering the respective vehicles to the consumers at the end of the next month. While the firm had initially made a strategy to develop 20,000 cars, in the year 2022, it had the compulsion to revise the outlook thereof because of supply chain-related problems.

In this way, its estimate was decreased to the range between 12,000 and 14,000 cars on the 28th of February in the same year. Nevertheless, the production outlook saw a further decrease to a range between 6,000 and 7,000 vehicles. This was witnessed at a time when the company released its financial results covering the year’s 2nd quarter on the 3rd of August. Although the company went through several challenges, it remained effective to develop 7,180 cars during the whole of 2022.

Lucid Stock Price Prediction: Price History

Lucid, after being launched in 2007 under the name Atieva, first emphasized manufacturing electric powertrains and batteries. Nonetheless, the company witnessed considerable evolution over time. In this respect, in 2016’s October, Atieva shifted its interest to developing a separate all-electric luxury vehicle offering high performance. Hence, it rebranded as Lucid Motors.

In the 2021’s July, the company recompensed a worth of up to 11,000 in terms of reservation for Lucid Air. In the year 2018, the Public Investment Fund (PIF) of Saudi Arabia invested more than $1B in the platform to offer funds for the development of the platform, its testing, as well as to begin manufacturing Lucid Air. Apart from that, another purpose of that investment was to establish a manufacturing facility in Arizona.

Furthermore, the investment also focused on launching Lucid’s retail strategy within North American jurisdiction. The business started manufacturing the Arizona facility in 2019’s December. On the 22nd of February in 2021, Churchill Capital Corp IV – which is known as a special purpose acquisition company (SPAC) – and Lucid Motors expressed the intention for a merger.

The transaction contained an injection of up to $2.1B worth from CCIV. Additionally, a $2.5B worth was offered in private investment in public equity (PIPE) valued at a discount for marketing at $15 per share, placing the value of the entity at $24 billion. On the 23rd of July in 2021, the shareholders of Lucid voted to authorize the merger. In this respect, the delisting of CCIV stock from the New York Stock Exchange (NYSE) took place.

On the NYSE, CCIV had been trading since 2020’s July. On the 26th of July in 2021, the merged entity Lucid got listed on Nasdaq with LCID as its ticker symbol for stock. On the other hand, LCIDW was its ticker symbol for warrants. The historical stock data brings to the front that LCID stock started trading within the market at up to $25.24 per share.

Following that, it obtained a 19.71% increase and reached an interday high value of up to $20.03 per share. The initial trading of Lucid Motors stock ended at a per-share price of $26.83. This figure was approximately 10.64% increased than its opening price. Then, the stock price kept on witnessing significant growth in the next weeks. Subsequently, on the 8th of November, the stock price touched $53.80.

Nevertheless, the stock market performance of LCID witnessed volatility in the following months. In December 2021, LCID’s stock price fell to $27.25 for each share. This was due to the problems dealing with the price chain. As a result, Lucid Air’s production was influenced. The stock price remained fluctuating throughout the initial half of the year 2022. In the meantime, the stock reached a decreased price level of $6.3 for each share on the 25th of December last year.

Although Lucid witnessed such rises and falls in its stock price history, its performance indicates that the growth projections of the platform are positive toward turning into a prominent player within the EV industry. The platform’s commitment to minimizing the environmental effect while manufacturing luxury electric cars has increased investor interest in addition to assisting in enhancing the stock price. Although the stocks might see some volatility in the upcoming time, LCID’s historical price movement points toward a promising future.

Lucid Stock Price Prediction: Price Analysis

The stock market has been seeing great progress and adoption in recent times. The automotive industry has also witnessed a huge rise simultaneously. Lucid Motors, a giant player in this industry, experienced remarkable price performance in its stock history. The fundamental analysis of the Lucid stock points out that the current per-share price is standing at $7.04. In the recent 24 hours, the high stock price per share was nearly $7.1778.

Additionally, the low price level in the meantime was approximately $6.89. The current market capitalization of the LCID stock is placed at 12,887,197,073. Moreover, the LCID stock’s latest 24-hour trading volume is nearly $14,059,385. Along with this, data analysis also indicates that the 52-week high price level of the LCID stock was $21.78 at present. Lucid Motors fundamental analysis brings to the front that its stock price has the potential to jump forward in line with its historical performance.

The technical analysis brings to the front that this level is up to 209% increased than the present price. On the contrary, the 52-week low price was almost $6.09. This price level is almost 13.5% decreased than the present share price. The average price of one Lucid stock is nearly 12.60. Lucid stock’s one-year target is standing at $10.00.

LCID stock’s share volume is currently standing at 6,890. The earnings per share are negative at almost $-1.44. On the other hand, forward earnings per share for the next year are standing at the -4.48 spot. Lucid Motors technical analysis signifies that the next years will see huge growth in its stock prices as the platform’s immersive nature and its exclusive developments will drive more adoption and price rise.

Lucid Stock Price Prediction

Keeping in view the market indicators, stock price volatility, and financial models, the Lucid stock price is anticipated to reap huge profits in the upcoming time. In line with the aforementioned historical data, market sentiment analysis, and artificial intelligence-driven predictive analytics, market trends are going to be optimistic. Particularly, Lucid Motors stock forecast points toward substantial price increases in the next years.

Lucid Stock Price Prediction 2024

Lucid Motors stock analysis has clarified the potential outlook of the platform’s stock in the future. Lucid Motors share price prediction says that its stock price will reach nearly $13.76 during this year. The figure is double the present price, displaying an optimistic outlook.

Lucid Stock Price Prediction 2025

Lucid Motors financial performance has been seeing ups and downs in recent years. Nonetheless, at present, lucid Motors stock market trends are positive. Lucid Motors stock volatility can play a crucial role in its future performance. However, Lucid Motors stock growth potential is enormous. In this way, the potential price of Lucid stock will be nearly $19.16. This shows Lucid Motors investment opportunities.

Lucid Stock Price Prediction 2030

Lucid Motors risk assessment specifies that investors can consider Lucid stock for long-term investment. Adequate Lucid Motors stock trading strategies can be helpful over time as the industry is witnessing recovery. Based on Lucid Motors stock market analysis, Lucid Motors stock valuation will go through a huge jump by the year 2030. In this way, Lucid Motors investment outlook will also improve to a great extent. Lucid Motors earnings projections bring to the front that LCID stock price will reach $41.36 by 2030.

Conclusion

The above-mentioned statistics, analytics, as well as forecasts specify that long-term investors can consider Lucid stock as an option for their investment. According to Lucid Motors investment outlook, the investors should adopt proper investment strategies and risk assessment. Nonetheless, people unwilling to take risky investment steps should avoid this.

FAQ

What is Lucid Group Inc, and when was it established?

Lucid Group Inc is a company that specializes in manufacturing and developing electric vehicles (EVs), with a focus on luxury, efficiency, and sustainability. The company was originally founded as Atieva in 2007 and rebranded to Lucid Motors in 2016.

What is Lucid’s flagship product, and what are its main features?

Lucid’s flagship product is the Lucid Air, an all-electric luxury vehicle that boasts a range of over 500 miles on a single charge. It features a highly efficient electric motor and a large battery pack of approximately 113 kWh, developed in collaboration with LG Chem.

How does Lucid Air compare with its competitors?

The Lucid Air competes with other luxury vehicles from brands like Mercedes-Benz, BMW, and Tesla. It stands out with its elegant, spacious interior that includes premium materials and advanced technology, appealing to both environmentally conscious drivers and those seeking performance and luxury.

What significant milestone did Lucid achieve in 2021?

In 2021, Lucid began deliveries of its Dream Edition versions to the initial group of around 520 reservation holders. This marked a significant milestone as it began the transition from development to commercial availability.

Where are Lucid vehicles manufactured?

Lucid vehicles are manufactured in a facility in Casa Grande, Arizona. The company initially planned to produce up to 20,000 vehicles annually, with ambitions to increase this to around 130,000 vehicles per year.

Has Lucid been involved in any significant financial transactions?

Yes, in 2021, Lucid Motors merged with Churchill Capital Corp IV, a special purpose acquisition company (SPAC), which led to Lucid being listed on Nasdaq under the ticker symbol LCID. This transaction significantly boosted their financial position and market presence.

What challenges has Lucid faced in its production?

Lucid has encountered challenges related to the supply chain, which affected its production targets. Initially aiming to produce between 12,000 and 14,000 cars in 2022, these targets were adjusted down to between 6,000 and 7,000 vehicles due to these issues.

What does the future hold for Lucid Motors according to stock price predictions?

Lucid Motors’ stock price predictions are optimistic, with projections suggesting significant price increases in the coming years. By 2030, the stock price is expected to reach around $41.36, reflecting the company’s growth potential and its position within the evolving EV market.

MORE:

Rivian Stock Price Prediction 2030

Amazon Stock Price Prediction 2030

Meta Stock Price Prediction

SoFi Stock Price Prediction

Rivian Stock Price Prediction

Coinbase Stock Price Prediction