CME leads unprecedented growth in Bitcoin ‘cash’ open interest

Quick Take

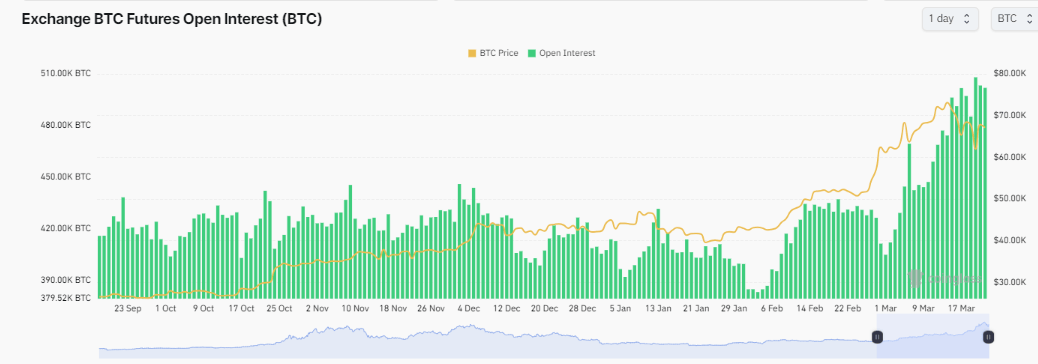

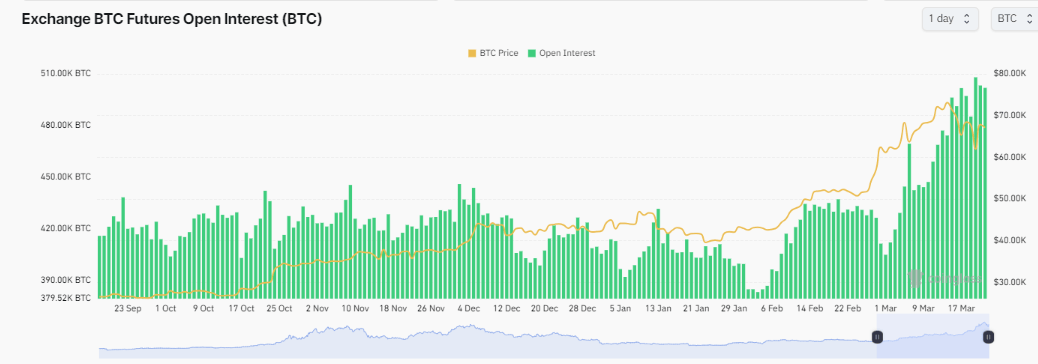

Recent data highlights a notable increase in Bitcoin open interest, reaching 500,000 BTC, despite a minor reduction of about 10,000 BTC during the latest dip from peak levels, according to Coinglass.

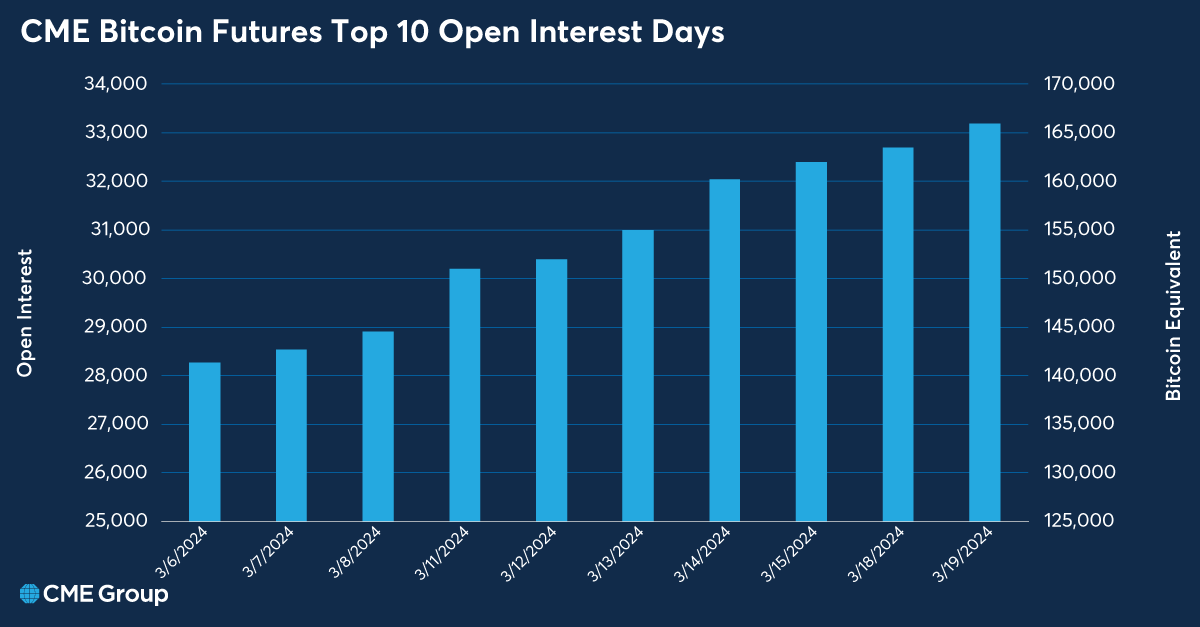

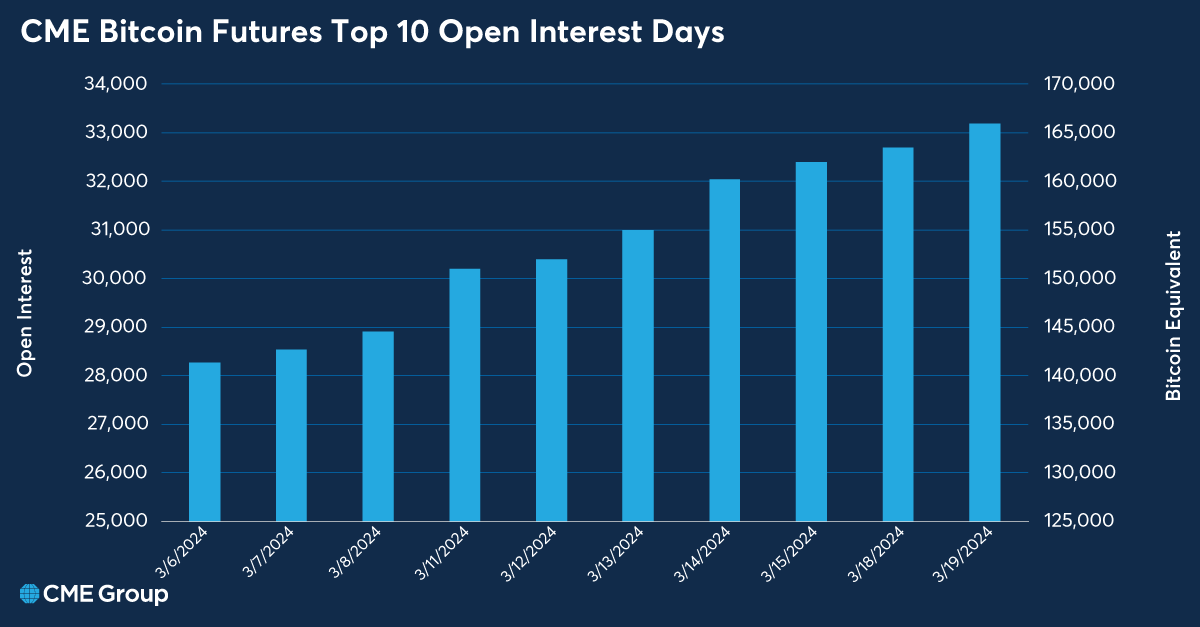

The total open interest has seen a 25% increase since early March, with a notable contribution from trading activities on the CME, an institutional platform. Specifically, the CME Group has experienced a significant upturn in institutional engagement, marking a 20% increase in its open interest since March 5, during a period of ten days of record-breaking growth, according to CME Group.

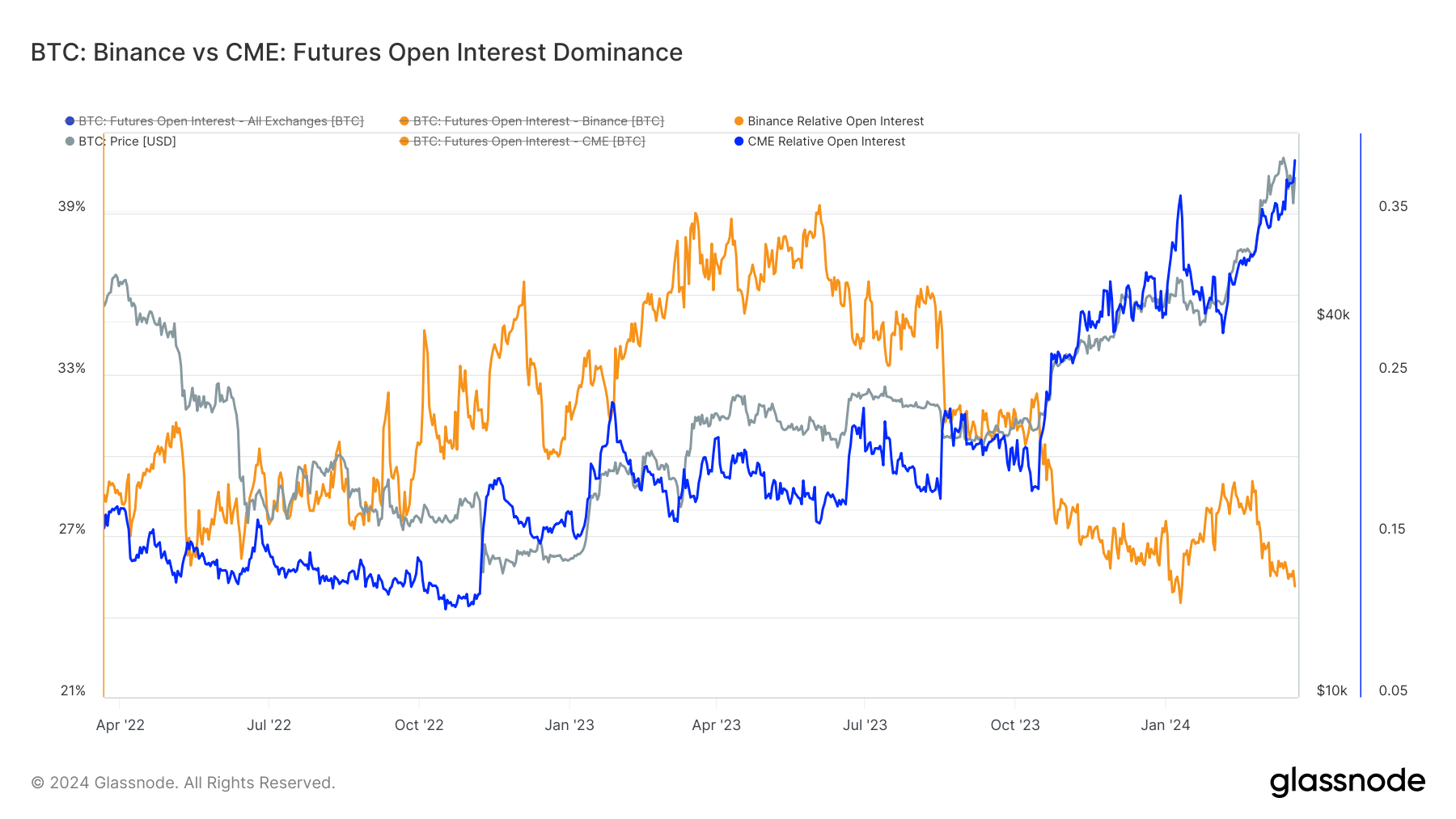

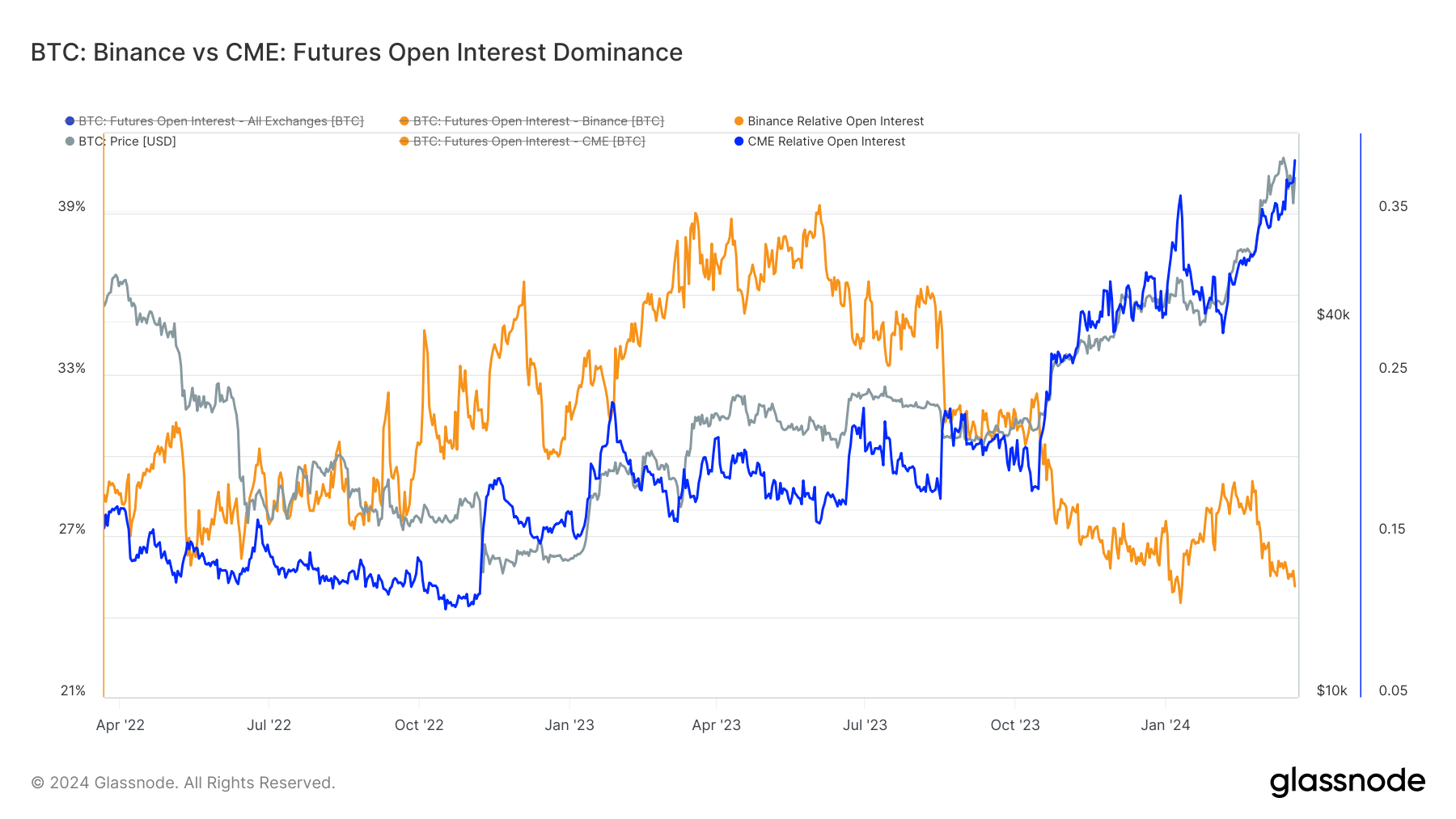

This trend highlights a growing gap between CME, which requires cash margins, and Binance, which uses crypto margins.

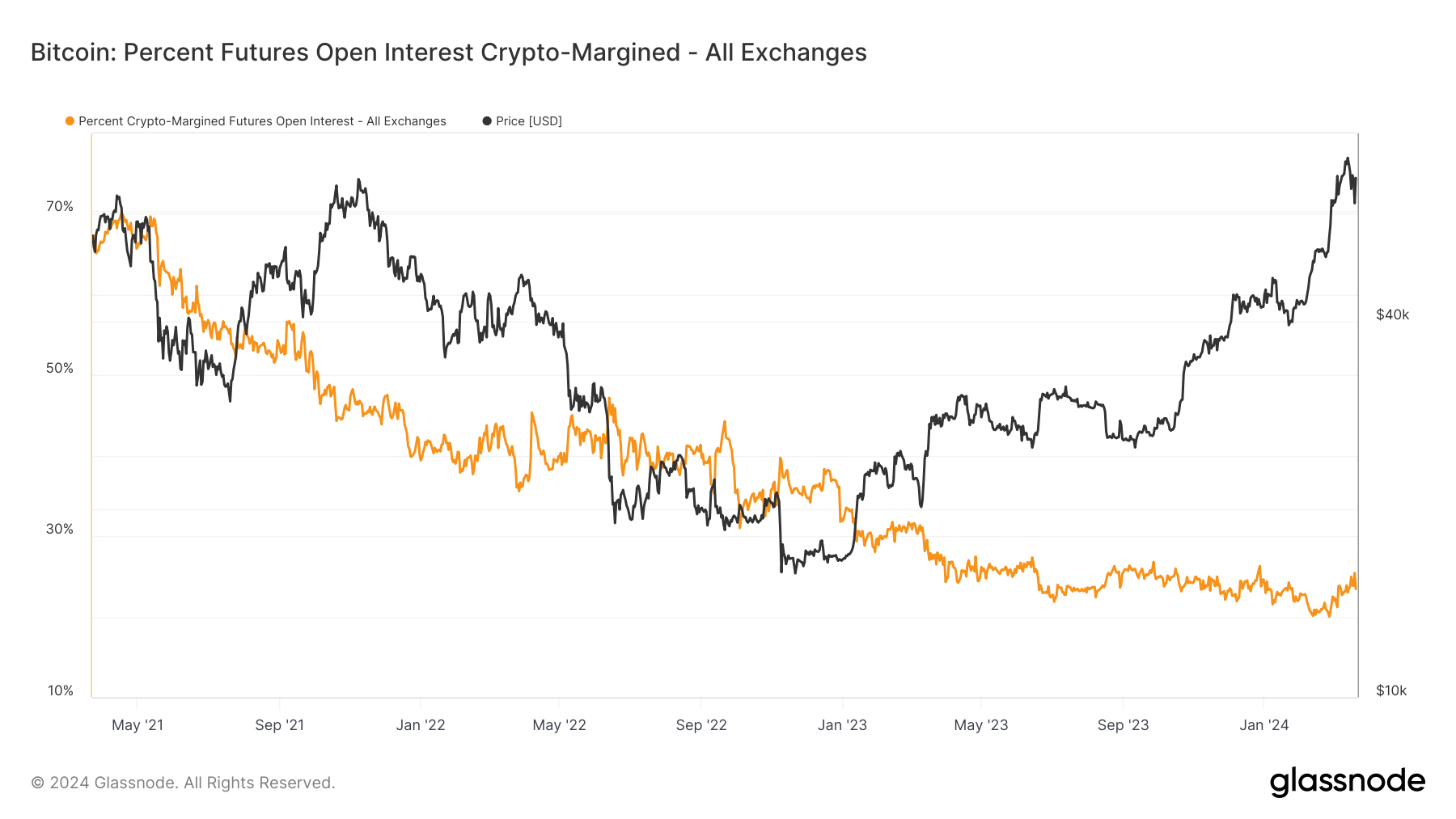

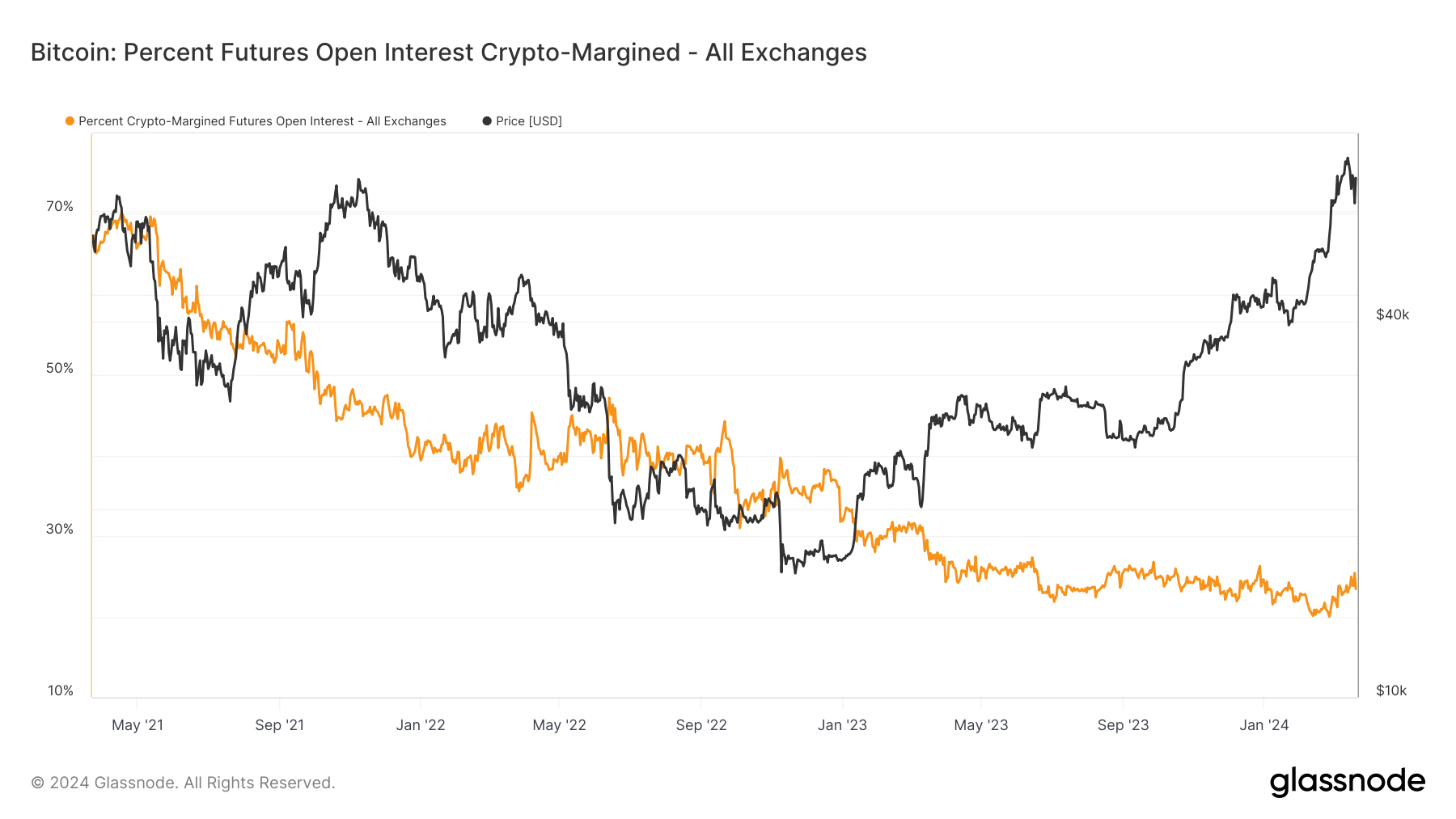

As cash-margined futures on platforms like the CME use stable assets for margins, such as USD, and grow in popularity, they could lead to a calmer Bitcoin market. Cash, a less volatile asset than BTC, continues to be the predominant margin asset.

Currently, crypto margin has fallen to around 20% of all margin accounts, with the remaining 80% being cash margins, according to Glassnode.

The post CME leads unprecedented growth in Bitcoin ‘cash’ open interest appeared first on CryptoSlate.

CME leads unprecedented growth in Bitcoin ‘cash’ open interest

Quick Take

Recent data highlights a notable increase in Bitcoin open interest, reaching 500,000 BTC, despite a minor reduction of about 10,000 BTC during the latest dip from peak levels, according to Coinglass.

The total open interest has seen a 25% increase since early March, with a notable contribution from trading activities on the CME, an institutional platform. Specifically, the CME Group has experienced a significant upturn in institutional engagement, marking a 20% increase in its open interest since March 5, during a period of ten days of record-breaking growth, according to CME Group.

This trend highlights a growing gap between CME, which requires cash margins, and Binance, which uses crypto margins.

As cash-margined futures on platforms like the CME use stable assets for margins, such as USD, and grow in popularity, they could lead to a calmer Bitcoin market. Cash, a less volatile asset than BTC, continues to be the predominant margin asset.

Currently, crypto margin has fallen to around 20% of all margin accounts, with the remaining 80% being cash margins, according to Glassnode.

The post CME leads unprecedented growth in Bitcoin ‘cash’ open interest appeared first on CryptoSlate.