De-Dollarization: China Dumps $23 Billion Worth of US Dollars

Share:

China is making big moves to advance the de-dollarization agenda and is dumping billions of US dollars and Treasuries. The Xi Jinping administration is fighting tooth and nail against Trump’s tariffs by imposing equal tariffs on the US. The Communist nation raised tariffs to 125% on Friday in the latest escalation of the ongoing trade wars. The reciprocal tariffs went from 84% to 125%, and Beijing made it clear that they won’t go any higher.

Also Read: De-Dollarization: Elon Musk Warns On The Future Of The US Dollar

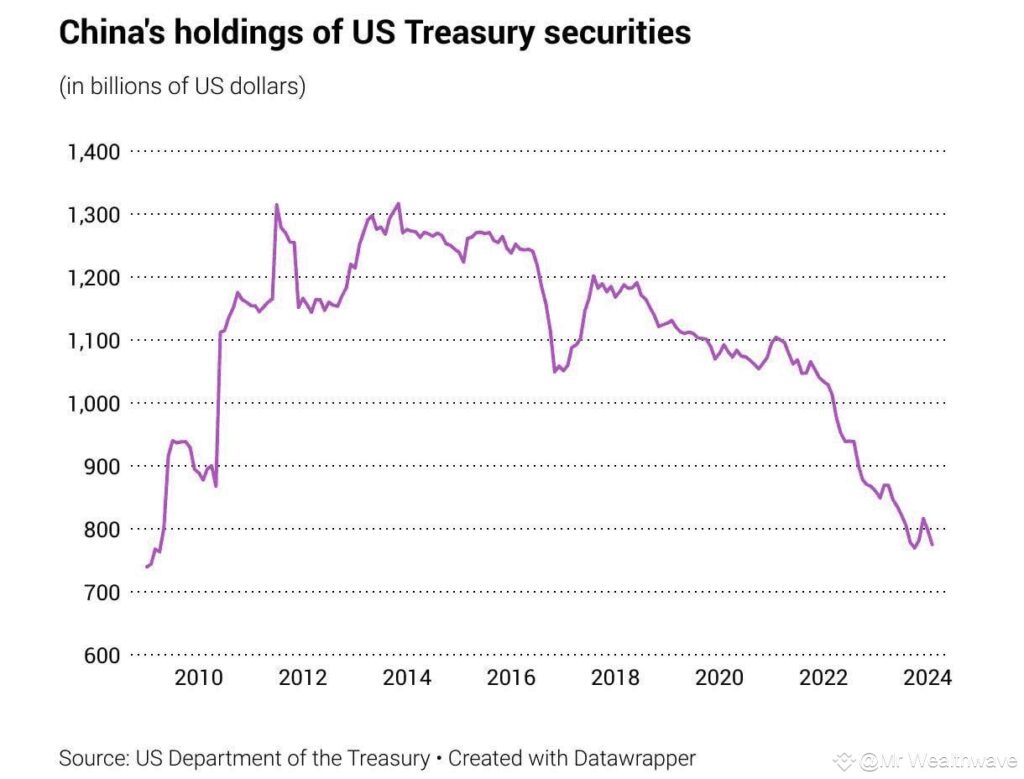

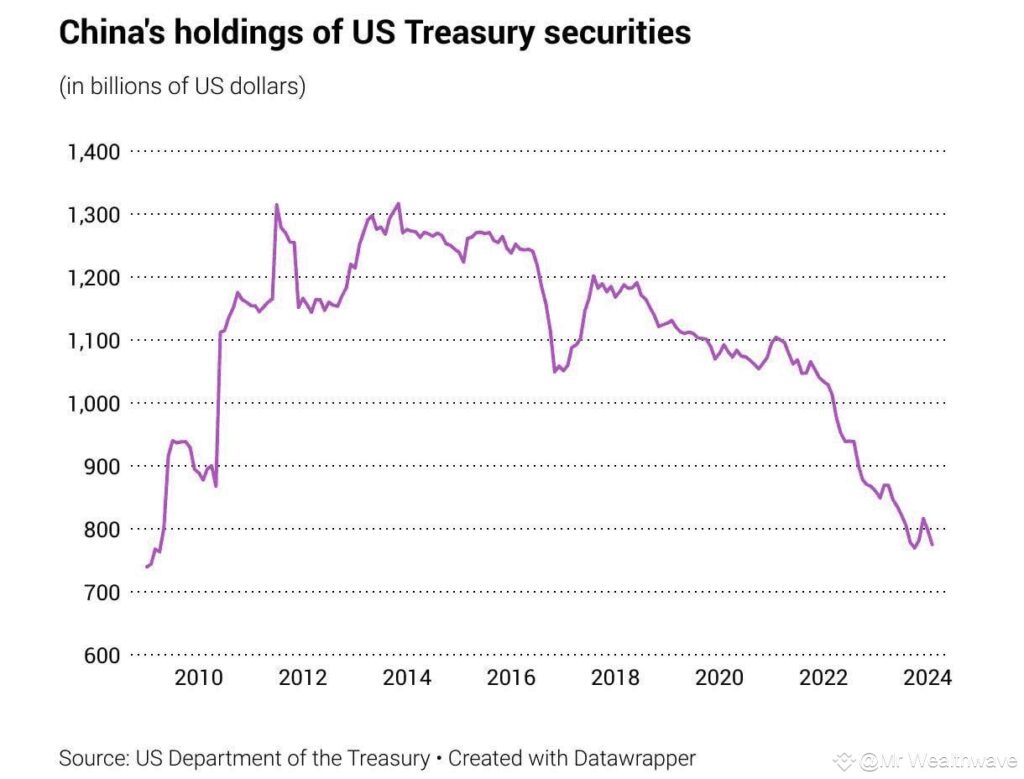

The latest data indicates that China has dumped $22.7 billion worth of US dollars and Treasury bonds and is consistently decreasing its holdings. The government is slowly yet steadily getting rid of all US debts and remaining free from market fluctuations stemming from the American economy. The dumping of the US dollars and Treasury bonds furthers the de-dollarization agenda making the US economy feel the heat.

Also Read: De-Dollarization: BitMEX’s Arthur Hayes Predicts The Future Of The US Dollar

The de-dollarization chart from the Treasury Department shows that China’s holdings of US bonds and dollars are rapidly decreasing. The holdings touched a peak of $1,350 billion in 2012-13 and are now at the $750-800 billion mark in 2024. That’s a massive reduction of close to 40% to 45% in the last 13 years. The holdings are now at their lowest point since 2009 indicating that the power of the greenback is dwindling.

China Ensures De-Dollarization Is Advancing Rapidly

Not just China, no developing country wants to maintain its economy at the mercy of the US dollars and Treasuries. The weaponization of the US dollars and Treasuries from the White House has led to the de-dollarization agenda gaining steam. Developing countries are now looking to protect and safeguard their respective local economies from the weaponization of the White House. Therefore, emerging economies are now steadily diversifying their central bank reserves with gold and ending reliance on the US dollar.

Also Read: De-Dollarization: The Numbers Wall Street Doesn’t Want You to See About USD Abandonment

Read More

De-Dollarization: China Dumps $23 Billion Worth of US Dollars

Share:

China is making big moves to advance the de-dollarization agenda and is dumping billions of US dollars and Treasuries. The Xi Jinping administration is fighting tooth and nail against Trump’s tariffs by imposing equal tariffs on the US. The Communist nation raised tariffs to 125% on Friday in the latest escalation of the ongoing trade wars. The reciprocal tariffs went from 84% to 125%, and Beijing made it clear that they won’t go any higher.

Also Read: De-Dollarization: Elon Musk Warns On The Future Of The US Dollar

The latest data indicates that China has dumped $22.7 billion worth of US dollars and Treasury bonds and is consistently decreasing its holdings. The government is slowly yet steadily getting rid of all US debts and remaining free from market fluctuations stemming from the American economy. The dumping of the US dollars and Treasury bonds furthers the de-dollarization agenda making the US economy feel the heat.

Also Read: De-Dollarization: BitMEX’s Arthur Hayes Predicts The Future Of The US Dollar

The de-dollarization chart from the Treasury Department shows that China’s holdings of US bonds and dollars are rapidly decreasing. The holdings touched a peak of $1,350 billion in 2012-13 and are now at the $750-800 billion mark in 2024. That’s a massive reduction of close to 40% to 45% in the last 13 years. The holdings are now at their lowest point since 2009 indicating that the power of the greenback is dwindling.

China Ensures De-Dollarization Is Advancing Rapidly

Not just China, no developing country wants to maintain its economy at the mercy of the US dollars and Treasuries. The weaponization of the US dollars and Treasuries from the White House has led to the de-dollarization agenda gaining steam. Developing countries are now looking to protect and safeguard their respective local economies from the weaponization of the White House. Therefore, emerging economies are now steadily diversifying their central bank reserves with gold and ending reliance on the US dollar.

Also Read: De-Dollarization: The Numbers Wall Street Doesn’t Want You to See About USD Abandonment

Read More