Serum Price Prediction 2023-2032: Is SRM a Good Investment?

Serum Price Prediction 2023-2032

- Serum Price Prediction 2023 – up to $0.074

- Serum Price Prediction 2025 – up to $0.25

- Serum Price Prediction 2028 -up to $0.75

- Serum Price Prediction 2031 – up to $2.44

Undoubtedly, the crypto world is growing unpredictably, with several projects springing up now and then. Interests in new projects have continued to skyrocket as they offer investors more returns on investment. Serum is one such project that offers earning potential and significant use cases for now and the future.

Unfortunately, Serum is dependent on FTX, the network was affected by the chaos. As upgrade authority is held by FTX, security is in jeopardy, leading to protocols like @JupiterExchange and @RaydiumProtocol moving away from Serum. This guide will examine the fundamentals of the Serum protocol, its native token, key features, historical price analysis, and developments. We will also delve into Serum price prediction for 2023 and beyond.

How much is SRM (Serum) worth?

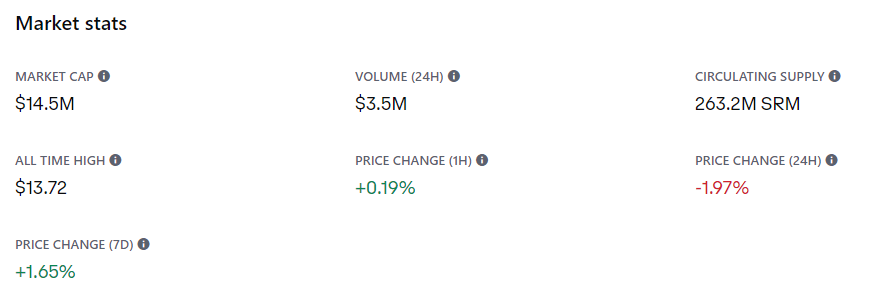

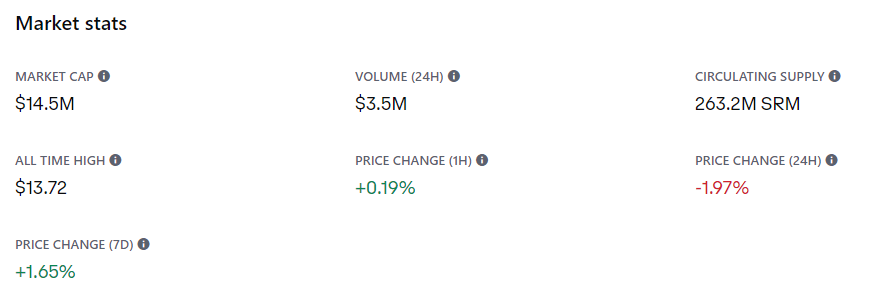

The live Serum price today is $0.054721 USD with a 24-hour trading volume of $3,161,174 USD. Serum is down 0.26% in the last 24 hours. The current CoinMarketCap ranking is #663, with a live market cap of $14,404,880 USD. It has a circulating supply of 263,244,669 SRM coins and a max. supply of 10,161,000,000 SRM coins.

Serum price analysis:$0.0555 barrier halts recent ascend, a buying opportunity?

TL;DR Breakdown

- Serum price analysis shows a negative market sentiment

- SRM failed to break higher above the resistance at $0.0555.

- The immediate support has been established near $0.0539.

The Serum price analysis shows SRM is trading in a bearish market sentiment after attempts to break the $0.0555 barrier failed. SRM coin is trading at $0.05471, down by 0.28% in the last 24 hours, with sellers accumulating strength. The technical analysis of the SRM suggests that the buyers failed to gain momentum and maintain a bullish sentiment above the $0.0555 resistance level. The price is currently trading near the immediate support at $0.0539, which could be tested if no buying strength is seen in the coming days.

The immediate resistance on the upside exists near the $0.0555 level. A break higher above this level could open the doors for a rally towards $0.0600 and above. The MACD indicates bearish momentum, while the RSI is currently trading just below 50 levels, indicating no clear directional bias in the market right now.

If SRM price action fails to close above the $0.0555 resistance level in the near term, it could potentially open doors for a further downside move. The immediate support exists at $0.0539 and below this, the price could drop to the next significant support at $0.0450 levels.

SRM/USD daily chart technical analysis: Consolidation seems to be in progress

The technical analysis of the daily chart shows that SRM price action is trading within a tight range between $0.0539 and $0.0555 levels. The relative strength index seems to be inside the neutral zone, indicating no clear directional bias in the near term. This indicates that consolidation could remain in play for some time before a clear direction is seen.

The moving averages are also indicating a lack of momentum in either direction. The 50-day moving average is currently crossing the 200-day MA, suggesting further rangebound movement in the near term. The Bollinger bands are starting to expand, indicating increasing volatility in the market.

SRM/USD price analysis on a 4-hour chart: SRM trades in a low volatility range

The technical analysis of the 4-hour chart shows SRM price action has been minimum rangebound between the $0.0539 and $0.0555 resistance levels. The RSI is currently trading just above 50 levels, indicating a neutral market sentiment in the near term.

The moving average convergence/divergence indicator has also moved into bearish territory, suggesting further downside pressure on SRM prices in the near term unless buyers can break back above the $0.0555 resistance level.

What to Expect from Serum price analysis

SRM/USD appears to be trading in a low volatility range with no clear direction at the moment. The bears are currently in control of the market and could push the price lower toward $0.0539 if they manage to break below this support level. On the upside, a break above the $0.0555 resistance is needed for buyers to gain traction and move SRM prices higher. If bulls can get back above this level, then there are chances that SRM price action could test the next resistance level at $0.0600 in the coming days.

Serum Price Predictions by Cryptopolitan

As a result, we can expect Serum prices to remain in this range until another trigger event occurs, such as a new partnership announcement or a surge in trading volume. We expect the prices to start surging as per our predictions for 2023 and beyond.

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2023 | $0.067 | $0.069 | $0.074 |

| 2024 | $0.098 | $0.10 | $0.12 |

| 2025 | $0.14 | $0.15 | $0.17 |

| 2026 | $0.20 | $0.21 | $0.25 |

| 2027 | $0.30 | $0.31 | $0.36 |

| 2028 | $0.43 | $0.45 | $0.52 |

| 2029 | $0.62 | $0.64 | $0.75 |

| 2030 | $0.91 | $0.94 | $1.10 |

| 2031 | $1.41 | $1.46 | $1.60 |

| 2032 | $1.99 | $2.06 | $2.44 |

Serum Price Prediction 2023

According to our current Serum price prediction, Serum is expected to surge in price in 2023 and potentially reach a maximum price of $0.074. The average price forecast for 2023 is $0.069 while the minimum price is expected to be $0.067.

Serum Price Prediction 2024

According to the Serum price forecast for 2024, a maximum price target of $0.12 and an average trading price of $0.098 is expected. The minimum forecast is expected to be around $0.10.

Serum Price Prediction 2025

For the year 2025, our Serum price forecast suggests that a maximum price target of $0.17 and an average trading price of $0.15 is expected. The minimum forecast is expected to be around $0.14.

Serum Price Prediction 2026

According to the Serum price forecast for 2026, SRM price might potentially surge to a maximum price of $0.25.Serum coin is expected to trade at an average price of $0.20 and a minimum value of $0.21.

Serum Price Prediction 2027

Our SRM price prediction for 2027 is Serum price to reach the lowest possible level of $0.30. As per our findings, the SRM price could reach the maximum possible level of $0.36 with the average forecast price of $0.31.

Serum Price Prediction 2028

According to the Serum price forecast for 2028, the SRM coin is expected to continue on a bullish sentiment and reach the maximum price of $0.52. The average predicted price is expected to be around $0.45 while the minimum forecasted value is likely to be $0.40.

Serum Price Prediction 2029

According to our Serum SRM price prediction for 2029, Serum is expected to continue surging in price and reach a maximum price of $0.75.The average forecasted value is around $0.64 and the minimum value is expected to be $0.62.

Serum Price Prediction 2030

According to our Serum SRM price prediction for 2030, a maximum value of $1.10 and a minimum trading price of $0.92 is expected to be achieved. The average price forecast is expected to be $0.94.

Serum Price Prediction 2031

According to our Serum SRM price prediction for 2031, a maximum value of $1.60 and an average forecasted trading value of $1.46 is expected to be achieved. The minimum prediction is likely to be around $1.41.

Serum Price Prediction 2032

According to our Serum SRM price prediction for 2032, Serum is expected to continue surging in price and reach a maximum price of $2.44. The average forecasted value is around $2.06 and the minimum value is expected to be $1.99.

Serum Price Prediction by Wallet Investor

Wallet Investor’s serum forecast a bearish outlook for SRM in the short term. The forecast suggests that its price will go down to $0.0688 by November 2023. It also expects SRM to stagnate at this level by June 2024 and could continue declining in the long-term.

Serum Price Prediction by Price Prediction net

Serum’s value is expected to continue to expand, as shortage tends to encourage price rise. The SRM price is expected to reach a maximum level of $0.074 at the end of 2023. In five years, Serum will have a minimum price of $0.36 and a maximum price of $0.30 per SRM. Since Serum is traded on a supply-and-demand basis, its value fluctuates drastically.

Serum Price Prediction by CoinArbitrageBot

In the next 3 years, the highest Serum price could reach is 1.23865 USD and the lowest Serum price could be 0.038382 USD. According to our calculations, at the end of 2024 we expect the Serum price would be around 0.36872 USD while it could easily end up at price level of 0.64673 USD at the end of 2025. When we calculate the Serum near future price prediction at the end of 2028 we surprisingly find out a remarkable value of 0.89627 USD per Serum.

Serum Price Prediction by Market Experts

Market experts, however, remain bullish on SRM and predict that its price will start to see an uptrend soon. According to ”Crypto Vault”, the token is likely to be trading around $1.30 by early 2023, with a possible peak of up to $2.50 later in the year. The experts cite various factors such as the rising demand for decentralized exchanges and have given a technical analysis whereby he expects Serum to surge by over 500x in the next 5 years.

Serum Overview

Serum Price History

Following the completion of the protocol’s phase one deployment, which included issuing both ERC-20 and SPL SRM tokens, listing on major crypto exchanges, and the roll-out of its on-chain DEX, $SRM kicked off on August 11, 2020, with an opening price of $0.1101 (current ATL) and a trading volume of $211,232,756. Over the coming days, SRM went on a bullish run and reached $3.78 on September 1, 2020. The uptrend reversed during the month, and by the end of October 2020, SRM had bottomed at $0.974. SRM closed out the year at $1.04, with a market cap of $52,001,293.

At the turn of the new year, SRM trended with the cryptocurrency market boom of 2021 that saw mainstream assets like BTC and ETH attain new heights. On February 10, $SRM exceeded its previous high and attained a new high of $4.42. The bullish run continued for the next few months, and by May 03, 2021, SRM’s price had gained over 190% to reach $12.89. The bears soon took over, but the token regained momentum to attain its all-time high at $13.72 on September 11. Also, its 24-hour trading volume peaked at $2,347,324,861.

SRM ended 2021 with a significant price drop of over 73% after a massive selling spree. Trading volume also dipped to as low as $76,463,705. The token started in 2022 at $3.42, and its price range has been relatively stable, between $2 to $4.

Today, Serum has a circulating supply of 372,782,297 SRM. The highest recorded Serum price is 11.66 €. And the lowest recorded SRM price is 0.06 €. The price of Serum has risen by 1.65% in the past 7 days. The price declined by 1.97% in the last 24 hours. In just the past hour, the price grew by 0.19%. The current price is $0.0552 per SRM. Serum is 99.60% below the all-time high of $13.72.

The current circulating supply is 263,244,669 SRM.

Recent News on Serum

More About the Serum Network

What is Serum?

Serum is a decentralized exchange (DEX) that provides decentralized financing with high speed and cheap transaction fees (DeFi). The Network is the first and only high-performance DEX built on a completely on-chain central limit order book and matching engine. Ecosystem partners may use Serum’s on-chain order book to distribute liquidity and fuel their trading functionalities for institutional and retail customers.

Users and developers are constrained by high gas prices and delayed transactions due to the popularity of DeFi and the expansion of DEXes on Ethereum. Serum intends to address these conventional DeFi difficulties and centralization, inadequate capital efficiency, and liquidity segmentation.

The Serum token (SRM) offers its holders’ protocol governance privileges, staking incentives, trading fee reductions, and fee revenues.

This open-source project is backed by the Serum Foundation and co-founded by FTX CEO and Solana contributor Sam Bankman–Fried. The Serum protocol was launched in July 2020 and is poised to unveil trustless cross-chain trading.

The platform’s primary aim is to bring the convenience and speed of centralized crypto exchanges to Decentralized Finance(DeFi) space without compromising transparency and security. It is entirely permissionless, built on the high-performing Solana blockchain, and interoperable with the Ethereum blockchain.

Serum Native Token

The governance token of the Serum protocol is $SRM, and it is built natively as an SPL token on the Solana mainnet, although with an ERC-20 version on the ETH blockchain. While most of the features of the Serum protocol are perceived as immutable, parameters like future fees may be subject to change via $SRM token governance votes.

$SRM has a maximum supply of 10 billion tokens, of which approximately 10% was circulated at launch. The circulating supply of $SRM is set to increase by 15% every year. In addition, 90% of the total SRM tokens are intended for long-term lock-ups or hold to ensure the longevity of the Serum project. They are locking up 1 million SRM tokens for users as MegaSerum (MSRM) tokens.

$SRM can be used as network fees or staked to earn rewards. Serum (SRM) token holders can get up to 50% discount on trading fees, while MSRM holders can earn up to 60% discount. All trading fees from Serum’s Decentralized Exchange will be vested into the $SRM burn and buyback program.

The distribution of SRM is projected as follows:

- 27% – Collaborator and Partner Fund

- 20% – Advisors and Team

- 27% – Incentive Fund for the Serum Ecosystem

- 4% – Auction Purchasers and Locked Seed

- 22% – Project Contributors

Serum Key Features

Unlike most Ethereum-based decentralized exchanges, Serum leverages the high performance of Solana to offer users a traditional order book. But users don’t trade directly on Serum – it’s just a contract that sits on the Solana blockchain.

- Cross-Chain Swaps

The current DeFi landscape raises interoperability concerns, with users struggling to execute cross-chain token swaps. The Serum protocol offers cross-chain support, thereby securely facilitating decentralized, trustless, and efficient transactions between different chains. For instance, users can directly and seamlessly trade assets between Solana, BTC, and ERC-20. The chain interoperability feature of the Serum protocol also means that existing DeFi projects can access its features regardless of their base blockchain. Despite being built natively on Solana, Serum can be entirely usable from Ethereum.

- Automated On-Chain Order Book

Serum offers an automated limit order book that grants users the ability to take control of their trading by specifying order price sizes and choosing trade direction. The order books offered by the Serum protocol are implementable between tokens due to the project’s cross-chain support. Also, Serum’s on-chain order books are wholly programmatic and feature BTC and ETH order books. The Serum protocol supersedes other DEXs because it includes significant optimizations that facilitate cheaper and faster order matching, even between 3rd-party users.

- SRM Token

$SRM is the native token of the Serum protocol, and it can be staked to optimize the network’s performance.

- Solana Integration

Compared to previous blockchains iterations, Solana is substantially faster and less expensive. Integrating Solana with Serum provides the latter with speed, lower costs, and a user experience similar to centralized exchanges while remaining non-custodial and trustless. Also, the Solana integration elevates Serum’s ETH interoperability.

Order books work out of the box, not just for spot markets but all these kinds of exotic derivatives as well. You don’t need to change the underlying mechanics needed for the order book to support these.”

- Custom Contracts

The Serum protocol allows users to initiate custom crypto contracts and execute P2P leveraged trading on the fully decentralized and non-custodial Serum DEX assets. These contracts include cross-chain physically settled contracts. They can be tokenized and moved across the blockchain.

- SerumBTC

The Serum ecosystem allows users to create a permissionless and truly decentralized BTC token on the Solana and Ethereum blockchain.

- SerumUSD

SerumUSD is a decentralized stablecoin on the Serum protocol, and it offers a model for establishing a decentralized stablecoin with no failure point.

Serum Latest Developments

Atrix Protocol Devnet Launch

Atrix is an Automated Market Maker (AMM) built on Solana that uses Serum’s order book to allow for permissionless liquidity pools and farm creation. In August, the Atrix team is celebrating the release of their Devnet launch. The permissionless interface allows users to swap, add liquidity directly on Serum, and easily create liquidity mining farms.

SRM listed on BitMEX!

The SRMUSDT Perpetual Swap contract went live at 04:00 UTC on 24 August and is now available to trade on BitMEX. Market traders post margin in XBT and earn or lose XBT as the SRM/USDT rate changes.

Symmetry Serum

In August, Symmetry became the default swap for the Serum Decentralized Exchange. The Symmetry team had worked tirelessly to deliver the product over the past few months.

Conclusion

The Serum protocol is a hybrid of decentralized and traditional finance, leveraging the strengths of each. Based on the Solana blockchain system, it offers cheap and fast transactions compared to its counterparts. The Serum order book is a significant selling point owing to its high liquidity and ability to accommodate complex orders like derivatives and future contracts. Serum has also partnered with big players in the blockchain space.

The crypto has, however, been on a bearish trend this year and is reportedly the second-largest holding of the now troubled three arrows capital. The firm is facing insolvency following several liquidations of its holdings.

Serum is currently selling at a discount, but we expect the crypto to begin recovering in 2023. Holding the Serum token (SRM) over an extended period could be an excellent investment, given the Serum’s predictions, features, and enormous prospects. However, these forecasts are not always the most significant aspect of purchasing.

Various factors influence investment decisions, including fundamental & technical analysis and other market variables. Ultimately, it’s an excellent option to do your research and not rely solely on price forecasts to establish your opinion.

Serum Price Prediction 2023-2032: Is SRM a Good Investment?

Serum Price Prediction 2023-2032

- Serum Price Prediction 2023 – up to $0.074

- Serum Price Prediction 2025 – up to $0.25

- Serum Price Prediction 2028 -up to $0.75

- Serum Price Prediction 2031 – up to $2.44

Undoubtedly, the crypto world is growing unpredictably, with several projects springing up now and then. Interests in new projects have continued to skyrocket as they offer investors more returns on investment. Serum is one such project that offers earning potential and significant use cases for now and the future.

Unfortunately, Serum is dependent on FTX, the network was affected by the chaos. As upgrade authority is held by FTX, security is in jeopardy, leading to protocols like @JupiterExchange and @RaydiumProtocol moving away from Serum. This guide will examine the fundamentals of the Serum protocol, its native token, key features, historical price analysis, and developments. We will also delve into Serum price prediction for 2023 and beyond.

How much is SRM (Serum) worth?

The live Serum price today is $0.054721 USD with a 24-hour trading volume of $3,161,174 USD. Serum is down 0.26% in the last 24 hours. The current CoinMarketCap ranking is #663, with a live market cap of $14,404,880 USD. It has a circulating supply of 263,244,669 SRM coins and a max. supply of 10,161,000,000 SRM coins.

Serum price analysis:$0.0555 barrier halts recent ascend, a buying opportunity?

TL;DR Breakdown

- Serum price analysis shows a negative market sentiment

- SRM failed to break higher above the resistance at $0.0555.

- The immediate support has been established near $0.0539.

The Serum price analysis shows SRM is trading in a bearish market sentiment after attempts to break the $0.0555 barrier failed. SRM coin is trading at $0.05471, down by 0.28% in the last 24 hours, with sellers accumulating strength. The technical analysis of the SRM suggests that the buyers failed to gain momentum and maintain a bullish sentiment above the $0.0555 resistance level. The price is currently trading near the immediate support at $0.0539, which could be tested if no buying strength is seen in the coming days.

The immediate resistance on the upside exists near the $0.0555 level. A break higher above this level could open the doors for a rally towards $0.0600 and above. The MACD indicates bearish momentum, while the RSI is currently trading just below 50 levels, indicating no clear directional bias in the market right now.

If SRM price action fails to close above the $0.0555 resistance level in the near term, it could potentially open doors for a further downside move. The immediate support exists at $0.0539 and below this, the price could drop to the next significant support at $0.0450 levels.

SRM/USD daily chart technical analysis: Consolidation seems to be in progress

The technical analysis of the daily chart shows that SRM price action is trading within a tight range between $0.0539 and $0.0555 levels. The relative strength index seems to be inside the neutral zone, indicating no clear directional bias in the near term. This indicates that consolidation could remain in play for some time before a clear direction is seen.

The moving averages are also indicating a lack of momentum in either direction. The 50-day moving average is currently crossing the 200-day MA, suggesting further rangebound movement in the near term. The Bollinger bands are starting to expand, indicating increasing volatility in the market.

SRM/USD price analysis on a 4-hour chart: SRM trades in a low volatility range

The technical analysis of the 4-hour chart shows SRM price action has been minimum rangebound between the $0.0539 and $0.0555 resistance levels. The RSI is currently trading just above 50 levels, indicating a neutral market sentiment in the near term.

The moving average convergence/divergence indicator has also moved into bearish territory, suggesting further downside pressure on SRM prices in the near term unless buyers can break back above the $0.0555 resistance level.

What to Expect from Serum price analysis

SRM/USD appears to be trading in a low volatility range with no clear direction at the moment. The bears are currently in control of the market and could push the price lower toward $0.0539 if they manage to break below this support level. On the upside, a break above the $0.0555 resistance is needed for buyers to gain traction and move SRM prices higher. If bulls can get back above this level, then there are chances that SRM price action could test the next resistance level at $0.0600 in the coming days.

Serum Price Predictions by Cryptopolitan

As a result, we can expect Serum prices to remain in this range until another trigger event occurs, such as a new partnership announcement or a surge in trading volume. We expect the prices to start surging as per our predictions for 2023 and beyond.

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2023 | $0.067 | $0.069 | $0.074 |

| 2024 | $0.098 | $0.10 | $0.12 |

| 2025 | $0.14 | $0.15 | $0.17 |

| 2026 | $0.20 | $0.21 | $0.25 |

| 2027 | $0.30 | $0.31 | $0.36 |

| 2028 | $0.43 | $0.45 | $0.52 |

| 2029 | $0.62 | $0.64 | $0.75 |

| 2030 | $0.91 | $0.94 | $1.10 |

| 2031 | $1.41 | $1.46 | $1.60 |

| 2032 | $1.99 | $2.06 | $2.44 |

Serum Price Prediction 2023

According to our current Serum price prediction, Serum is expected to surge in price in 2023 and potentially reach a maximum price of $0.074. The average price forecast for 2023 is $0.069 while the minimum price is expected to be $0.067.

Serum Price Prediction 2024

According to the Serum price forecast for 2024, a maximum price target of $0.12 and an average trading price of $0.098 is expected. The minimum forecast is expected to be around $0.10.

Serum Price Prediction 2025

For the year 2025, our Serum price forecast suggests that a maximum price target of $0.17 and an average trading price of $0.15 is expected. The minimum forecast is expected to be around $0.14.

Serum Price Prediction 2026

According to the Serum price forecast for 2026, SRM price might potentially surge to a maximum price of $0.25.Serum coin is expected to trade at an average price of $0.20 and a minimum value of $0.21.

Serum Price Prediction 2027

Our SRM price prediction for 2027 is Serum price to reach the lowest possible level of $0.30. As per our findings, the SRM price could reach the maximum possible level of $0.36 with the average forecast price of $0.31.

Serum Price Prediction 2028

According to the Serum price forecast for 2028, the SRM coin is expected to continue on a bullish sentiment and reach the maximum price of $0.52. The average predicted price is expected to be around $0.45 while the minimum forecasted value is likely to be $0.40.

Serum Price Prediction 2029

According to our Serum SRM price prediction for 2029, Serum is expected to continue surging in price and reach a maximum price of $0.75.The average forecasted value is around $0.64 and the minimum value is expected to be $0.62.

Serum Price Prediction 2030

According to our Serum SRM price prediction for 2030, a maximum value of $1.10 and a minimum trading price of $0.92 is expected to be achieved. The average price forecast is expected to be $0.94.

Serum Price Prediction 2031

According to our Serum SRM price prediction for 2031, a maximum value of $1.60 and an average forecasted trading value of $1.46 is expected to be achieved. The minimum prediction is likely to be around $1.41.

Serum Price Prediction 2032

According to our Serum SRM price prediction for 2032, Serum is expected to continue surging in price and reach a maximum price of $2.44. The average forecasted value is around $2.06 and the minimum value is expected to be $1.99.

Serum Price Prediction by Wallet Investor

Wallet Investor’s serum forecast a bearish outlook for SRM in the short term. The forecast suggests that its price will go down to $0.0688 by November 2023. It also expects SRM to stagnate at this level by June 2024 and could continue declining in the long-term.

Serum Price Prediction by Price Prediction net

Serum’s value is expected to continue to expand, as shortage tends to encourage price rise. The SRM price is expected to reach a maximum level of $0.074 at the end of 2023. In five years, Serum will have a minimum price of $0.36 and a maximum price of $0.30 per SRM. Since Serum is traded on a supply-and-demand basis, its value fluctuates drastically.

Serum Price Prediction by CoinArbitrageBot

In the next 3 years, the highest Serum price could reach is 1.23865 USD and the lowest Serum price could be 0.038382 USD. According to our calculations, at the end of 2024 we expect the Serum price would be around 0.36872 USD while it could easily end up at price level of 0.64673 USD at the end of 2025. When we calculate the Serum near future price prediction at the end of 2028 we surprisingly find out a remarkable value of 0.89627 USD per Serum.

Serum Price Prediction by Market Experts

Market experts, however, remain bullish on SRM and predict that its price will start to see an uptrend soon. According to ”Crypto Vault”, the token is likely to be trading around $1.30 by early 2023, with a possible peak of up to $2.50 later in the year. The experts cite various factors such as the rising demand for decentralized exchanges and have given a technical analysis whereby he expects Serum to surge by over 500x in the next 5 years.

Serum Overview

Serum Price History

Following the completion of the protocol’s phase one deployment, which included issuing both ERC-20 and SPL SRM tokens, listing on major crypto exchanges, and the roll-out of its on-chain DEX, $SRM kicked off on August 11, 2020, with an opening price of $0.1101 (current ATL) and a trading volume of $211,232,756. Over the coming days, SRM went on a bullish run and reached $3.78 on September 1, 2020. The uptrend reversed during the month, and by the end of October 2020, SRM had bottomed at $0.974. SRM closed out the year at $1.04, with a market cap of $52,001,293.

At the turn of the new year, SRM trended with the cryptocurrency market boom of 2021 that saw mainstream assets like BTC and ETH attain new heights. On February 10, $SRM exceeded its previous high and attained a new high of $4.42. The bullish run continued for the next few months, and by May 03, 2021, SRM’s price had gained over 190% to reach $12.89. The bears soon took over, but the token regained momentum to attain its all-time high at $13.72 on September 11. Also, its 24-hour trading volume peaked at $2,347,324,861.

SRM ended 2021 with a significant price drop of over 73% after a massive selling spree. Trading volume also dipped to as low as $76,463,705. The token started in 2022 at $3.42, and its price range has been relatively stable, between $2 to $4.

Today, Serum has a circulating supply of 372,782,297 SRM. The highest recorded Serum price is 11.66 €. And the lowest recorded SRM price is 0.06 €. The price of Serum has risen by 1.65% in the past 7 days. The price declined by 1.97% in the last 24 hours. In just the past hour, the price grew by 0.19%. The current price is $0.0552 per SRM. Serum is 99.60% below the all-time high of $13.72.

The current circulating supply is 263,244,669 SRM.

Recent News on Serum

More About the Serum Network

What is Serum?

Serum is a decentralized exchange (DEX) that provides decentralized financing with high speed and cheap transaction fees (DeFi). The Network is the first and only high-performance DEX built on a completely on-chain central limit order book and matching engine. Ecosystem partners may use Serum’s on-chain order book to distribute liquidity and fuel their trading functionalities for institutional and retail customers.

Users and developers are constrained by high gas prices and delayed transactions due to the popularity of DeFi and the expansion of DEXes on Ethereum. Serum intends to address these conventional DeFi difficulties and centralization, inadequate capital efficiency, and liquidity segmentation.

The Serum token (SRM) offers its holders’ protocol governance privileges, staking incentives, trading fee reductions, and fee revenues.

This open-source project is backed by the Serum Foundation and co-founded by FTX CEO and Solana contributor Sam Bankman–Fried. The Serum protocol was launched in July 2020 and is poised to unveil trustless cross-chain trading.

The platform’s primary aim is to bring the convenience and speed of centralized crypto exchanges to Decentralized Finance(DeFi) space without compromising transparency and security. It is entirely permissionless, built on the high-performing Solana blockchain, and interoperable with the Ethereum blockchain.

Serum Native Token

The governance token of the Serum protocol is $SRM, and it is built natively as an SPL token on the Solana mainnet, although with an ERC-20 version on the ETH blockchain. While most of the features of the Serum protocol are perceived as immutable, parameters like future fees may be subject to change via $SRM token governance votes.

$SRM has a maximum supply of 10 billion tokens, of which approximately 10% was circulated at launch. The circulating supply of $SRM is set to increase by 15% every year. In addition, 90% of the total SRM tokens are intended for long-term lock-ups or hold to ensure the longevity of the Serum project. They are locking up 1 million SRM tokens for users as MegaSerum (MSRM) tokens.

$SRM can be used as network fees or staked to earn rewards. Serum (SRM) token holders can get up to 50% discount on trading fees, while MSRM holders can earn up to 60% discount. All trading fees from Serum’s Decentralized Exchange will be vested into the $SRM burn and buyback program.

The distribution of SRM is projected as follows:

- 27% – Collaborator and Partner Fund

- 20% – Advisors and Team

- 27% – Incentive Fund for the Serum Ecosystem

- 4% – Auction Purchasers and Locked Seed

- 22% – Project Contributors

Serum Key Features

Unlike most Ethereum-based decentralized exchanges, Serum leverages the high performance of Solana to offer users a traditional order book. But users don’t trade directly on Serum – it’s just a contract that sits on the Solana blockchain.

- Cross-Chain Swaps

The current DeFi landscape raises interoperability concerns, with users struggling to execute cross-chain token swaps. The Serum protocol offers cross-chain support, thereby securely facilitating decentralized, trustless, and efficient transactions between different chains. For instance, users can directly and seamlessly trade assets between Solana, BTC, and ERC-20. The chain interoperability feature of the Serum protocol also means that existing DeFi projects can access its features regardless of their base blockchain. Despite being built natively on Solana, Serum can be entirely usable from Ethereum.

- Automated On-Chain Order Book

Serum offers an automated limit order book that grants users the ability to take control of their trading by specifying order price sizes and choosing trade direction. The order books offered by the Serum protocol are implementable between tokens due to the project’s cross-chain support. Also, Serum’s on-chain order books are wholly programmatic and feature BTC and ETH order books. The Serum protocol supersedes other DEXs because it includes significant optimizations that facilitate cheaper and faster order matching, even between 3rd-party users.

- SRM Token

$SRM is the native token of the Serum protocol, and it can be staked to optimize the network’s performance.

- Solana Integration

Compared to previous blockchains iterations, Solana is substantially faster and less expensive. Integrating Solana with Serum provides the latter with speed, lower costs, and a user experience similar to centralized exchanges while remaining non-custodial and trustless. Also, the Solana integration elevates Serum’s ETH interoperability.

Order books work out of the box, not just for spot markets but all these kinds of exotic derivatives as well. You don’t need to change the underlying mechanics needed for the order book to support these.”

- Custom Contracts

The Serum protocol allows users to initiate custom crypto contracts and execute P2P leveraged trading on the fully decentralized and non-custodial Serum DEX assets. These contracts include cross-chain physically settled contracts. They can be tokenized and moved across the blockchain.

- SerumBTC

The Serum ecosystem allows users to create a permissionless and truly decentralized BTC token on the Solana and Ethereum blockchain.

- SerumUSD

SerumUSD is a decentralized stablecoin on the Serum protocol, and it offers a model for establishing a decentralized stablecoin with no failure point.

Serum Latest Developments

Atrix Protocol Devnet Launch

Atrix is an Automated Market Maker (AMM) built on Solana that uses Serum’s order book to allow for permissionless liquidity pools and farm creation. In August, the Atrix team is celebrating the release of their Devnet launch. The permissionless interface allows users to swap, add liquidity directly on Serum, and easily create liquidity mining farms.

SRM listed on BitMEX!

The SRMUSDT Perpetual Swap contract went live at 04:00 UTC on 24 August and is now available to trade on BitMEX. Market traders post margin in XBT and earn or lose XBT as the SRM/USDT rate changes.

Symmetry Serum

In August, Symmetry became the default swap for the Serum Decentralized Exchange. The Symmetry team had worked tirelessly to deliver the product over the past few months.

Conclusion

The Serum protocol is a hybrid of decentralized and traditional finance, leveraging the strengths of each. Based on the Solana blockchain system, it offers cheap and fast transactions compared to its counterparts. The Serum order book is a significant selling point owing to its high liquidity and ability to accommodate complex orders like derivatives and future contracts. Serum has also partnered with big players in the blockchain space.

The crypto has, however, been on a bearish trend this year and is reportedly the second-largest holding of the now troubled three arrows capital. The firm is facing insolvency following several liquidations of its holdings.

Serum is currently selling at a discount, but we expect the crypto to begin recovering in 2023. Holding the Serum token (SRM) over an extended period could be an excellent investment, given the Serum’s predictions, features, and enormous prospects. However, these forecasts are not always the most significant aspect of purchasing.

Various factors influence investment decisions, including fundamental & technical analysis and other market variables. Ultimately, it’s an excellent option to do your research and not rely solely on price forecasts to establish your opinion.