India Rejects Global South’s De-Dollarization Agenda: “Absolutely No Interest”

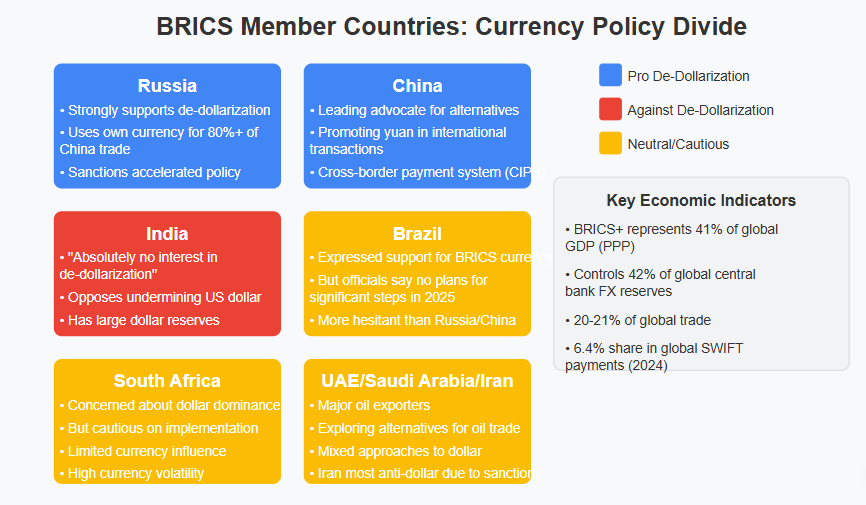

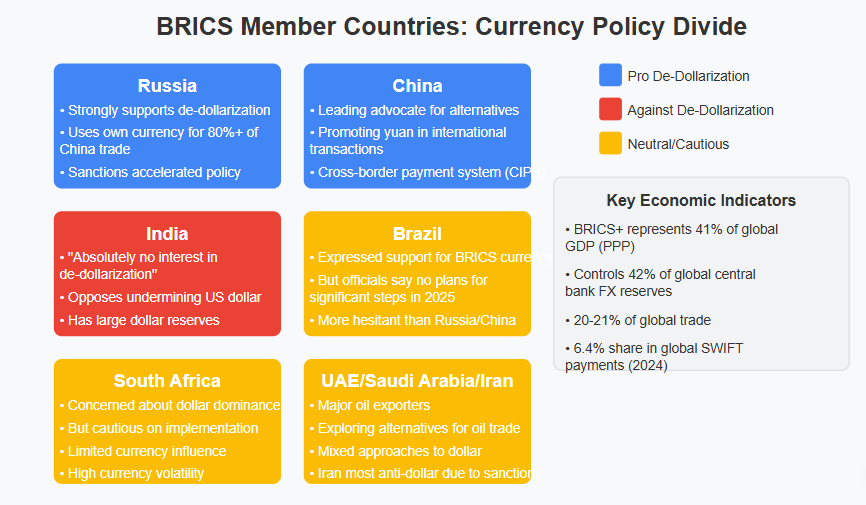

BRICS de-dollarization plans have, at the time of writing, hit a major roadblock as India dollar rejection has become quite apparent. Indian officials have declared, in no uncertain terms, “absolutely no interest” in currency substitution initiatives that would, in any way, undermine the United States dollar position, and this has created some tension within the expanding Global South alliance and also raised questions about the future of the group’s currency plans.

Also Read: Pi Coin Faces 40% Crash Risk: Will $0.70 Hold Through May 25, 2025?

BRICS Currency Plans Stall As Key Member Backs United States Dollar

The ongoing disagreement over BRICS de-dollarization has exposed some growing divisions within the Global South alliance, with Russia and China actively pushing for alternatives while India dollar rejection continues to maintain support for the current United States dollar as the global reserve currency system.

Indian Officials Emphasize Dollar Stability

A high-ranking Indian finance ministry official stated:

“India has absolutely no interest in de-dollarization or in undermining the US dollar in any way.”

This rather direct India dollar rejection comes as other members of the Global South alliance, particularly Russia, have been, for some time now, promoting local currencies for trade settlements and also exploring the possibility of currency substitution systems that could potentially bypass SWIFT.

Russia And China Push For Alternatives

Despite India’s resistance to BRICS de-dollarization, both Russia and China remain determined to advance currency substitution efforts to reduce United States dollar reliance. The Western sanctions against Russia have, in many ways, accelerated this push within the Global South alliance for alternative financial mechanisms.

A Russian economic representative noted:

“The process of de-dollarization is gaining momentum globally.”

Chinese officials have also expressed their support for expanding the use of the yuan in international transactions, with several BRICS members already increasing their yuan reserves in recent months.

Also Read: MetaPlanet Buys $104M in BTC After Bitcoin Closes at $106.5K Weekly High

Implications For Cryptocurrency

The current BRICS de-dollarization division and India dollar rejection may, in fact, boost interest in cryptocurrencies that offer cross-border payment solutions independent of the ongoing geopolitical tensions within the Global South alliance.

An international finance expert explained:

“When major economic powers disagree on fundamental currency policies, it creates market uncertainty.”

Factors Behind India’s Position

India’s United States dollar support reflects, in many respects, its economic priorities and also its concerns about the potential instability that might result from currency substitution efforts away from the established global reserve currency. The country’s rather significant dollar reserves make it somewhat reluctant to support any BRICS de-dollarization initiatives proposed by other Global South alliance members at this point in time.

Also Read: Ripple’s XRP ETF Goes Live: Can Price Hit $2.50 Before June?

Read More

JPMorgan to Allow Clients to Buy Bitcoin, CEO Confirms

India Rejects Global South’s De-Dollarization Agenda: “Absolutely No Interest”

BRICS de-dollarization plans have, at the time of writing, hit a major roadblock as India dollar rejection has become quite apparent. Indian officials have declared, in no uncertain terms, “absolutely no interest” in currency substitution initiatives that would, in any way, undermine the United States dollar position, and this has created some tension within the expanding Global South alliance and also raised questions about the future of the group’s currency plans.

Also Read: Pi Coin Faces 40% Crash Risk: Will $0.70 Hold Through May 25, 2025?

BRICS Currency Plans Stall As Key Member Backs United States Dollar

The ongoing disagreement over BRICS de-dollarization has exposed some growing divisions within the Global South alliance, with Russia and China actively pushing for alternatives while India dollar rejection continues to maintain support for the current United States dollar as the global reserve currency system.

Indian Officials Emphasize Dollar Stability

A high-ranking Indian finance ministry official stated:

“India has absolutely no interest in de-dollarization or in undermining the US dollar in any way.”

This rather direct India dollar rejection comes as other members of the Global South alliance, particularly Russia, have been, for some time now, promoting local currencies for trade settlements and also exploring the possibility of currency substitution systems that could potentially bypass SWIFT.

Russia And China Push For Alternatives

Despite India’s resistance to BRICS de-dollarization, both Russia and China remain determined to advance currency substitution efforts to reduce United States dollar reliance. The Western sanctions against Russia have, in many ways, accelerated this push within the Global South alliance for alternative financial mechanisms.

A Russian economic representative noted:

“The process of de-dollarization is gaining momentum globally.”

Chinese officials have also expressed their support for expanding the use of the yuan in international transactions, with several BRICS members already increasing their yuan reserves in recent months.

Also Read: MetaPlanet Buys $104M in BTC After Bitcoin Closes at $106.5K Weekly High

Implications For Cryptocurrency

The current BRICS de-dollarization division and India dollar rejection may, in fact, boost interest in cryptocurrencies that offer cross-border payment solutions independent of the ongoing geopolitical tensions within the Global South alliance.

An international finance expert explained:

“When major economic powers disagree on fundamental currency policies, it creates market uncertainty.”

Factors Behind India’s Position

India’s United States dollar support reflects, in many respects, its economic priorities and also its concerns about the potential instability that might result from currency substitution efforts away from the established global reserve currency. The country’s rather significant dollar reserves make it somewhat reluctant to support any BRICS de-dollarization initiatives proposed by other Global South alliance members at this point in time.

Also Read: Ripple’s XRP ETF Goes Live: Can Price Hit $2.50 Before June?

Read More