Tether Scales Back Fundraising Plans After Investor Concerns Over $500B Valuation

Share:

- Tether scaled back its fundraising after pushback on a $500B valuation.

- Investor caution remains, despite USDT leading the stablecoin market.

Tether, the world’s largest stablecoin USDT company, is now reconsidering its large fundraising plan. Earlier reports suggested that the company was planning to raise around $20 billion by selling new shares. This plan could move the company’s value to nearly $500 billion. But now talks say that the company may raise $5 billion.

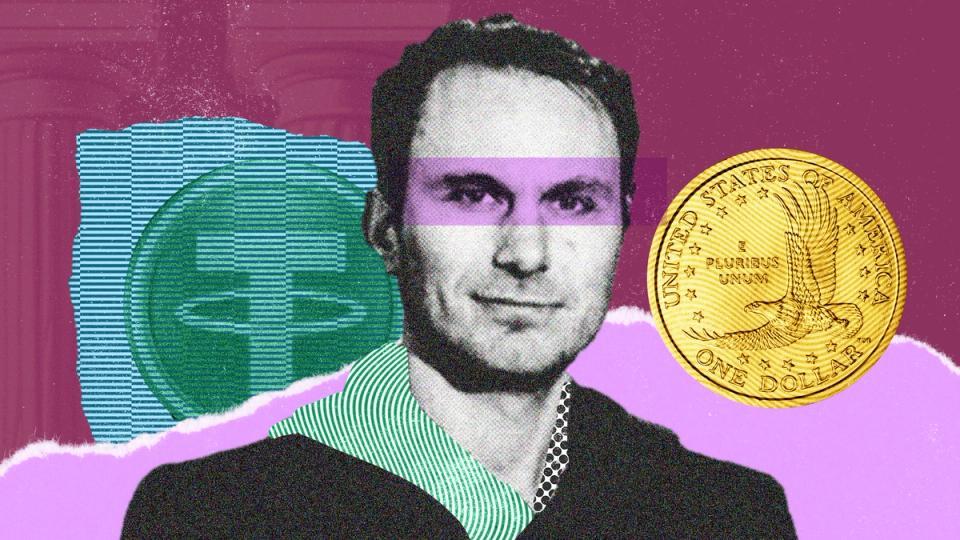

Tether’s CEO clarifies on fundraising expectations

Paolo Ardino, CEO of Tether, says that the larger figure was misunderstood. He explains that Tether never targets $15 to 20 billion; this was the maximum amount Tether was prepared to raise if the demand was stronger. Cantor Fitzgerald, Tether’s advisors are now discussing a much smaller raise of around $5 billion. Still, no financial decisions have been made, and the talks are going on.

The investors are cautious because of regulatory concerns and the recent profit decline. Even though Crypto rules are becoming clear in the U.S., some investors see a legal and compliance risk in Tether. Tethers profits were very much lower when compared to 2024. The investors also have concerns about the reserves.

Tether’s Strong market position

Despite these concerns, Tether continues to generate large cash flows, and USDT remains the largest Stablecoin in the world with a market value of over $185 billion. Tether also increased its gold holding and the CEO Ardoino said these investments earned $8 to $10 billion during the recent gold rally.

Investors’ sentiment is also influenced by recent events, like Rival Stablecoin issuer Circle has completed a successful public listing, and the new U.S. stablecoin laws have improved clarity for the sector. But still, the crypto market remains volatile, and some investors may wait for a broader market recovery and more clarity on Tether’s long term structure.

Highlighted Crypto News:

Read More

Tether Scales Back Fundraising Plans After Investor Concerns Over $500B Valuation

Share:

- Tether scaled back its fundraising after pushback on a $500B valuation.

- Investor caution remains, despite USDT leading the stablecoin market.

Tether, the world’s largest stablecoin USDT company, is now reconsidering its large fundraising plan. Earlier reports suggested that the company was planning to raise around $20 billion by selling new shares. This plan could move the company’s value to nearly $500 billion. But now talks say that the company may raise $5 billion.

Tether’s CEO clarifies on fundraising expectations

Paolo Ardino, CEO of Tether, says that the larger figure was misunderstood. He explains that Tether never targets $15 to 20 billion; this was the maximum amount Tether was prepared to raise if the demand was stronger. Cantor Fitzgerald, Tether’s advisors are now discussing a much smaller raise of around $5 billion. Still, no financial decisions have been made, and the talks are going on.

The investors are cautious because of regulatory concerns and the recent profit decline. Even though Crypto rules are becoming clear in the U.S., some investors see a legal and compliance risk in Tether. Tethers profits were very much lower when compared to 2024. The investors also have concerns about the reserves.

Tether’s Strong market position

Despite these concerns, Tether continues to generate large cash flows, and USDT remains the largest Stablecoin in the world with a market value of over $185 billion. Tether also increased its gold holding and the CEO Ardoino said these investments earned $8 to $10 billion during the recent gold rally.

Investors’ sentiment is also influenced by recent events, like Rival Stablecoin issuer Circle has completed a successful public listing, and the new U.S. stablecoin laws have improved clarity for the sector. But still, the crypto market remains volatile, and some investors may wait for a broader market recovery and more clarity on Tether’s long term structure.

Highlighted Crypto News:

Read More